- Home

- »

- Next Generation Technologies

- »

-

Autonomous Farm Equipment Market Size Report, 2030GVR Report cover

![Autonomous Farm Equipment Market Size, Share & Trends Report]()

Autonomous Farm Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tractors, Harvesting Equipment, Irrigation Equipment), By Automation, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-341-4

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Farm Equipment Market Summary

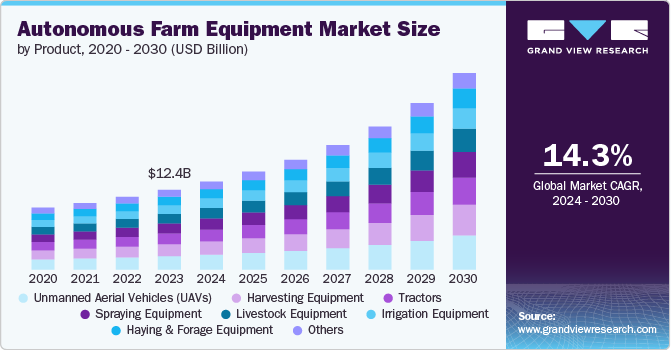

The global autonomous farm equipment market size was valued at USD 12.45 billion in 2023 and is expected to reach USD 30.65 billion by 2030, growing at a CAGR of 14.3% from 2024 to 2030. The growth of the market is driven by labor shortages in the farming sector, and an aging rural workforce, which are compelling farmers to seek automated solutions to maintain and enhance productivity.

Key Market Trends & Insights

- North America maintained a notable 34.7% revenue share in the global industry in 2023.

- By product, Unmanned Aerial Vehicles (UAVs) dominated the target market and accounted for the largest revenue share of 16.9% in 2023.

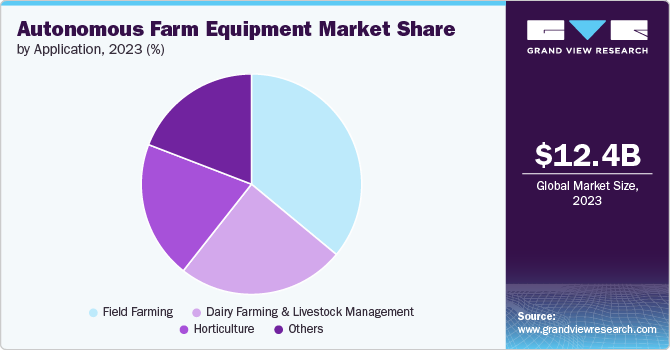

- By application, the field farming segment held the largest market share of 36.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.45 Billion

- 2030 Projected Market Size: USD 30.65 Billion

- CAGR (2024-2030): 14.3%

- North America: Largest market in 2023

This shift is further propelled by the rapid evolution of artificial intelligence, machine learning, and sensor technologies, which are dramatically improving the capabilities and reliability of autonomous equipment.

Technological advancements are enabling a transition to precision agriculture practices, allowing farmers to optimize resource utilization, reduce waste, and increase crop yields. The integration of GPS guidance systems, computer vision, and advanced analytics enables autonomous equipment to perform tasks with unprecedented accuracy and efficiency. This precision not only improves productivity but also addresses growing concerns about sustainable farming practices and environmental stewardship.

Market growth is influenced by several interconnected parameters. Government initiatives promoting smart farming practices are providing both financial incentives and regulatory frameworks that encourage adoption. Simultaneously, the global imperative to increase food production to meet the demands of a growing population is putting pressure on the agricultural sector to innovate. Economic factors, such as farm income levels and access to financing, play a crucial role in determining the pace of adoption, particularly given the significant initial investment required for autonomous equipment.

The market's expansion is also closely tied to developments in supporting infrastructure. The rollout of high-speed rural internet connectivity and the integration of autonomous systems with existing farm management software are critical enablers of widespread adoption. As these supporting technologies mature, they create a more favorable ecosystem for autonomous farm equipment to operate effectively.

However, the market faces several challenges that moderate its growth trajectory. High initial costs remain a significant barrier for many farmers, particularly smaller operations. Concerns about data security and privacy, especially regarding the collection and use of farm-specific data, need to be addressed to build trust among potential adopters. Additionally, the need for comprehensive farmer education and training programs to effectively utilize these advanced systems presents both a challenge and an opportunity for market players.

The regulatory landscape surrounding autonomous vehicles in agriculture is still evolving, creating uncertainty that can impact market development. As policymakers work to establish clear guidelines, this regulatory clarity will likely accelerate market growth. Technological hurdles, such as improving battery life for electric autonomous equipment, enhancing GPS accuracy in challenging environments, and refining obstacle detection systems, continue to be areas of focus for industry innovation.

Product Insights

Unmanned Aerial Vehicles (UAVs) dominated the target market and accounted for the largest revenue share of 16.9% in 2023. UAVs offer flexibility and efficiency in agricultural operations, particularly for monitoring and data collection. Their ability to cover large areas quickly and access difficult terrain makes them invaluable for precision agriculture practices. UAVs equipped with advanced sensors and imaging technologies provide farmers with high-resolution data on crop health, soil conditions, and pest infestations, enabling targeted interventions and resource optimization. The relatively lower initial investment compared to larger autonomous ground vehicles has accelerated UAV adoption across various farm sizes.

Additionally, the rapid technological advancements in drone capabilities, including longer flight times, improved payload capacity, and enhanced data processing, have expanded their utility in agriculture. The regulatory environment for UAVs in agriculture has also become more favorable in many regions, further driving adoption. Lastly, the scalability of UAV solutions, from small farms to large agricultural operations, has contributed to their widespread acceptance and market dominance within the autonomous farm equipment sector.

Automation Insights

The fully autonomous segment is expected to register the fastest CAGR of 14.7% from 2024 to 2030. The growth can be attributed to the advancements in artificial intelligence, machine learning, and sensor technologies have significantly enhanced the capabilities of fully autonomous systems, enabling them to perform complex agricultural tasks with minimal human intervention. This increased sophistication addresses labor shortages in the agricultural sector while improving operational efficiency and productivity. The potential for 24/7 operation of fully autonomous equipment maximizes farm output and resource utilization.

Additionally, these systems offer unparalleled precision in tasks such as planting, fertilizing, and harvesting, leading to optimized crop yields and reduced input costs. The integration of fully autonomous equipment with farm management software and IoT devices creates comprehensive, data-driven agricultural ecosystems, further driving adoption. As regulatory frameworks evolve to accommodate autonomous vehicles in agriculture, market barriers are diminishing. Moreover, the long-term cost-effectiveness of fully autonomous systems, despite higher initial investments, is becoming increasingly apparent in large-scale farming operations.

Application Insights

The field farming segment held the largest market share of 36.0% in 2023 and is expected to maintain its dominance from 2024 to 2030. Field crops represent the largest portion of global agricultural production, necessitating extensive mechanization and automation to meet growing food demands. The vast scale of field farming operations provides a compelling economic case for autonomous equipment adoption, as the potential for efficiency gains and cost savings is significantly amplified. Autonomous technologies in field farming, such as self-driving tractors, automated harvesters, and precision planting systems, have reached a higher level of maturity compared to other agricultural sectors, making them more reliable and attractive to farmers. The relatively uniform and predictable nature of field environments, compared to orchards or livestock farms, facilitates easier implementation and operation of autonomous systems. Additionally, field farming faces acute labor shortages in many regions, driving the need for automated solutions. The integration of autonomous equipment with precision agriculture practices in field farming has demonstrated tangible benefits in resource optimization, yield improvement, and environmental sustainability, further cementing its market dominance.

Building on its established dominance, the field farming segment continues to attract significant investment and innovation from both established agricultural equipment manufacturers and technology startups. This influx of capital and expertise is accelerating the development of more sophisticated and specialized autonomous solutions tailored to field farming operations. The segment's growth is further bolstered by increasing government support for smart farming initiatives, particularly in regions facing food security challenges or environmental pressures. As autonomous field farming equipment becomes more interconnected and data-driven, it is enabling new business models such as Farming-as-a-Service (FaaS) and precision agriculture consulting, expanding the segment's economic footprint.

Regional Insights

North America autonomous farm equipment market maintained a notable 34.7% revenue share in the global industry in 2023. This is due to a combination of technological leadership, favorable economic conditions, and structural factors in its agricultural sector. The region's advanced technological ecosystem, with strong research and development capabilities in robotics, AI, and precision agriculture, has fostered early adoption and innovation in autonomous farm equipment. Large-scale farming operations, prevalent in North America, provide an ideal testing ground and market for autonomous solutions, as the potential for efficiency gains and cost savings is significant. The region's acute labor shortages in agriculture accelerated the shift toward automation.

Additionally, North American farmers generally have higher capital investment capabilities, enabling them to adopt expensive autonomous technologies. Supportive government policies and funding for agricultural innovation have further stimulated market growth. The region's well-developed infrastructure, including high-speed rural internet connectivity, facilitates the implementation of connected autonomous systems. Moreover, North America's strong culture of entrepreneurship and venture capital investment has spurred the growth of agtech startups, driving competition and innovation in the autonomous farm equipment sector.

U.S. Autonomous Farm Equipment Market Trends

The autonomous farm equipment market in the U.S. is propelled by the country's leadership in AI and machine learning technologies, which enable sophisticated autonomous solutions. Farm consolidation into larger operations has increased the economic viability of high-tech equipment investments. The U.S. market also benefits from strong partnerships between tech companies and traditional agricultural equipment manufacturers, fostering innovation. Additionally, the growing emphasis on sustainable farming practices and the need to optimize resource use in drought-prone regions are driving interest in precision agriculture technologies, including autonomous equipment.

Asia Pacific Autonomous Farm Equipment Market Trends

The autonomous farm equipment market in Asia Pacific is expected to show a significant CAGR of 15.3% over the forecast period. Rapid urbanization and an aging rural population are exacerbating labor shortages in agriculture, driving demand for automated solutions. Governments across the region are implementing supportive policies and providing subsidies to modernize farming practices and boost agricultural productivity, creating a favorable environment for autonomous equipment adoption. The region's diverse agricultural landscape, from small-scale farming to large plantations, is spurring the development of scalable and adaptable autonomous technologies. Significant investments in digital infrastructure, including 5G networks, are enhancing connectivity in rural areas and facilitating the implementation of advanced farming technologies. The presence of emerging economies with large agricultural sectors, such as China and India, offers substantial market potential. These countries are experiencing rapid technological advancement and increasing farm mechanization rates. Additionally, the region's growing focus on precision agriculture to address food security concerns and environmental challenges is accelerating the uptake of autonomous farm equipment. As local manufacturers and tech companies enter the market, they are developing cost-effective solutions tailored to regional needs, further driving market growth in the Asia Pacific region.

Europe Autonomous Farm Equipment Market Trends

The autonomous farm equipment market in Europe is characterized by steady growth driven by a combination of technological innovation and regulatory support. The region's emphasis on sustainable agriculture and precision farming practices has created a receptive environment for autonomous solutions. European farmers, facing labor shortages and pressure to increase productivity while reducing environmental impact, are increasingly turning to autonomous equipment. The market benefits from strong research and development capabilities, particularly in countries like Germany and the Netherlands, which are at the forefront of agricultural technology. EU policies supporting smart farming and digital agriculture have provided a favorable regulatory framework for market expansion. However, the fragmented nature of European agriculture, with varying farm sizes and types across countries, presents both challenges and opportunities for tailored autonomous solutions. The market is also influenced by stringent environmental regulations, driving demand for equipment that can optimize resource use and reduce chemical inputs.

Key Autonomous Farm Equipment Company Insights

Some of the key companies operating in the Autonomous Farm Equipment Market include John Deere (Deere & Company), and CLAAS KGaA mbH, among others.

-

John Deere, a leading name in the agricultural machinery sector, has significantly advanced in the autonomous farm equipment market. Renowned for its innovations, John Deere integrates cutting-edge technology into a wide array of products, including autonomous tractors, combines, and precision farming solutions like AutoTrac. These advancements not only enhance operational efficiency and yield but also reduce labor dependency and optimize resource management. With a strong global presence and extensive dealer network with a strong presence in North and South America, Europe, and Asia, John Deere caters to farmers worldwide, offering robust support and training in adopting autonomous technologies. Positioned at the forefront of agricultural innovation, John Deere continues to drive the industry forward with sustainable and technologically advanced solutions for modern farming needs.

Agrobot and Naïo Technologies are some of the emerging market companies in the target market.

-

Agrobot, a robotic solution provider headquartered in Spain, has established itself as one of the emerging leaders in precision agriculture by developing robots equipped with advanced sensors and AI algorithms for strawberry farms. These robots are designed to selectively pick ripe strawberries, improving efficiency and reducing labor costs for farmers. Agrobot's technology not only enhances productivity but also ensures higher quality and sustainability in berry farming practices. The company is actively expanding its presence globally, focusing on markets where strawberry production is prominent, such as North America and Europe. Through innovation and strategic growth, Agrobot continues to shape the future of autonomous harvesting in agriculture.

Key Autonomous Farm Equipment Companies:

The following are the leading companies in the autonomous farm equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Deere & Company

- CNH Industrial

- AGCO Corporation

- Kubota Corporation

- CLAAS KGaA mbH

- Yanmar Co., Ltd.

- Raven Industries

- Naio Technologies

- AgEagle Aerial Systems Inc

- Mahindra & Mahindra

- AGROBOT

Recent Developments

-

In February 2024, John Deere introduced a substantial lineup of new agricultural equipment at the Commodity Classic tradeshow. This includes high-horsepower autonomy-ready tractors, C-Series air carts designed to boost seeding productivity, AI-enabled weed sensing technology on Hagie STS sprayers, and new features in the S7 Series combined. The launch highlights John Deere's dedication to customer-focused solutions and advancing agricultural technology to address changing industry needs.

-

In February 2024, Naïo Technologies and CAMSO partnered to develop agricultural robots with electrically driven tracks, enhancing flotation, accessibility, and flexibility while reducing carbon emissions. Naïo contributes its expertise in autonomy technologies, while CAMSO brings its materials knowledge to create high-performance, soil-respectful products. This collaboration aims to improve productivity, promote decarbonization, and preserve resources and soil.

Autonomous Farm Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.73 billion

Revenue forecast in 2030

USD 30.65 billion

Growth Rate

CAGR of 14.3% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, automation, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Deere & Company; CNH Industrial; AGCO Corporation; Kubota Corporation; CLAAS KGaA mbH; Yanmar Co., Ltd.; Raven Industries; Naio Technologies; AgEagle Aerial Systems Inc; Mahindra & Mahindra; and AGROBOT

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Farm Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global autonomous farm equipment market report based on product, automation, application and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Tractors

-

Harvesting Equipment

-

Irrigation Equipment

-

Livestock Equipment

-

Haying & Forage Equipment

-

Spraying Equipment

-

Unmanned Aerial Vehicles (UAVs)

-

Others

-

-

Automation Outlook (Revenue, USD Million, 2017 - 2030)

-

Partially-autonomous

-

Fully Autonomous

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Field Farming

-

Horticulture

-

Dairy Farming & Livestock Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous farm equipment market size was estimated at USD 12.45 billion in 2023 and is expected to reach USD 13.73 billion in 2024.

b. The global autonomous farm equipment market is expected to grow at a compound annual growth rate of 14.3% from 2024 to 2030 to reach USD 30.65 billion by 2030.

b. North America dominated the autonomous farm equipment market with a share of over 34.7% in 2023. This is attributable to the large farm lands, technological advancement, lack of labor force, and presence of OEM manufacturers.

b. Some key players operating in the autonomous farm equipment market include Deere & Company, CNH Industrial, AGCO Corporation, Kubota Corporation, CLAAS KGaA mbH, Yanmar Co., Ltd., Raven Industries, Naio Technologies, AgEagle Aerial Systems Inc, Mahindra & Mahindra, and AGROBOT.

b. Key factors driving market growth include the growing adoption of labor shortage, advancements in technology, AI and IoT integration, and environmental benefits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.