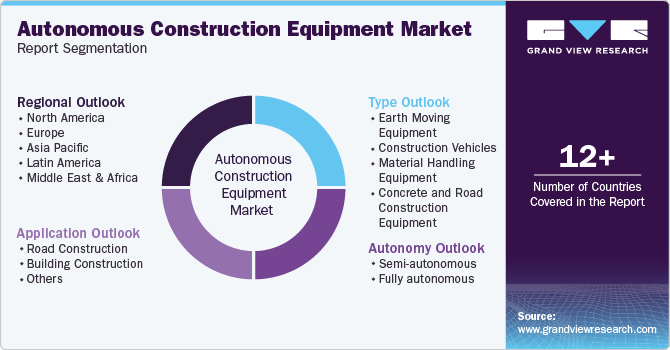

Autonomous Construction Equipment Market Size, Share & Trends Analysis Report By Autonomy (semi-autonomous, fully autonomous), By Type, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-452-7

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global autonomous construction equipment market size was estimated at USD 12.72 billion in 2023 and is expected to grow at a CAGR of 9.6% from 2024 to 2030.The surge in infrastructure development projects is a major driving force behind the market growth. As governments and private entities embark on ambitious infrastructure initiatives, such as building highways, bridges, and urban transit systems, the demand for efficient and precise construction technologies increases. Autonomous construction equipment offers a solution to meet the high demands of these large-scale projects by improving productivity, reducing construction timelines, and enhancing the accuracy of complex tasks.

The rapid advancements in artificial intelligence (AI) and machine learning are revolutionizing the autonomous construction equipment market. Modern AI algorithms enhance the ability of construction machinery to perform complex tasks with high precision and efficiency. Developments in sensor technology and real-time data processing further improve the accuracy and reliability of autonomous systems. Innovations such as advanced imaging and LiDAR systems are enabling machines to navigate and interact with their environment more effectively. These technological breakthroughs are driving increased adoption and investment in autonomous construction equipment.

Safety concerns are a major driving force behind the adoption of autonomous construction equipment. By reducing the need for human operators in hazardous environments, autonomous machinery helps mitigate risks associated with construction sites. Enhanced safety features, such as collision avoidance and real-time monitoring, are becoming standard in modern autonomous equipment. These improvements not only protect workers but also minimize the likelihood of costly accidents and project delays. As safety regulations become more stringent, the demand for autonomous solutions that enhance site safety is expected to grow.

The construction industry is facing a significant shortage of skilled labor, prompting a shift towards automation to maintain productivity. Autonomous construction equipment offers a viable solution to this challenge by performing tasks that would otherwise require a large workforce. The integration of robotics and automation helps alleviate the dependency on manual labor, addressing the issue of labor shortages effectively. Companies are investing in autonomous technologies to streamline operations and ensure projects are completed on time despite the limited availability of skilled workers. This trend is likely to drive continued growth in the autonomous equipment sector.

Cost efficiency is a critical factor driving the adoption of autonomous construction equipment. While the initial investment in autonomous machinery can be high, the long-term savings in labor costs and operational expenses are substantial. Autonomous systems can operate around the clock without breaks, leading to increased productivity and faster project completion times. Additionally, reduced human error and improved precision contribute to lower material wastage and rework costs. As construction companies seek to optimize their budgets, the financial benefits of autonomous equipment become increasingly compelling.

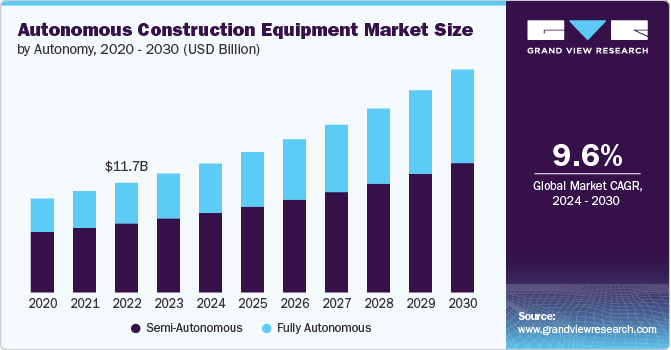

Autonomy Insights

The semi-autonomous segment led the market and accounted for 62.5% of the global revenue in 2023. The growing emphasis on improving construction efficiency and safety is driving the adoption of semi-autonomous construction equipment. These systems enhance productivity by integrating advanced automation features while allowing operators to maintain control over critical tasks. The trend towards semi-autonomous equipment is fueled by the need for a transitional solution that bridges traditional manual operations and fully automated systems. By combining automation with human oversight, semi-autonomous machinery addresses the complexities of construction environments and adapts to varied project requirements.

The fully autonomous segment is expected to register significant growth from 2024 to 2030. The push towards fully autonomous construction equipment is being accelerated by the demand for increased operational efficiency and reduced labor costs. Technological advancements in AI, machine learning, and sensor technologies are making fully autonomous systems more viable and cost-effective. The drive towards full automation is also influenced by the need for enhanced safety and precision in complex construction tasks, minimizing human error and optimizing workflow. As construction projects become more ambitious and technologically advanced, fully autonomous equipment offers a compelling solution to meet these evolving needs.

Type Insights

The earth moving equipment segment accounted for the largest revenue share in 2023. The rapid growth in infrastructure and urban development projects is significantly driving the adoption of autonomous earth moving equipment. These machines, including excavators, bulldozers, and loaders, are essential for large-scale excavation and site preparation tasks. The trend towards automation in earth moving equipment is fueled by the need for increased efficiency, precision, and safety on construction sites. By reducing the reliance on manual labor and minimizing operational errors, autonomous earth moving equipment enhances overall productivity. As construction projects become more complex and expansive, the demand for advanced earth moving machinery continues to rise.

The construction vehicles segment is expected to grow significantly from 2024 to 2030. The demand for autonomous construction vehicles is surging as companies seek to optimize material handling and logistics on construction sites. Vehicles such as dump trucks and haulers are critical for transporting materials and equipment, and their automation promises to improve operational efficiency and reduce costs. The trend towards autonomous construction vehicles is driven by the need for enhanced safety, reduced labor requirements, and continuous operation in challenging environments. Innovations in autonomous vehicle technology enable these machines to navigate and operate with greater precision and reliability.

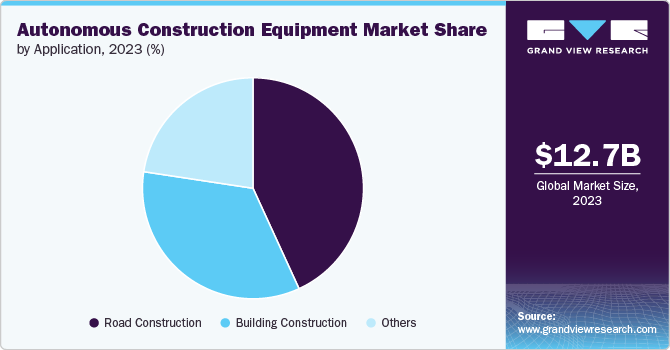

Application Insights

The road construction segment accounted for the largest revenue share in 2023. The increasing investment in infrastructure development is driving the adoption of autonomous equipment in road construction. The need for high precision and efficiency in paving, grading, and compaction tasks is pushing companies to integrate advanced automation technologies. Autonomous road construction equipment offers significant advantages, such as reduced labor costs, enhanced safety, and faster project completion. The demand for improved road quality and the ability to handle large-scale projects efficiently further fuel the trend towards automation.

The building construction segment is expected to grow significantly from 2024 to 2030. The shift towards automation in building construction is being driven by the need for greater efficiency and precision in diverse construction tasks. Autonomous equipment is increasingly used for site preparation, material handling, and structural work, addressing the complexities of modern building projects. The trend towards automation in building construction is also influenced by the growing demand for reduced labor costs and enhanced safety on job sites. As urbanization accelerates and construction projects become more ambitious, the integration of autonomous technology helps streamline operations and improve overall productivity.

Regional Insights

North America autonomous construction equipment market dominated the global market and accounted for 36.24% in 2023. The region's increasing investments in infrastructure development and technological advancements drive the demand for autonomous machinery. North America's focus on improving construction efficiency and safety through automation is a key factor contributing to the market's expansion. The presence of leading construction firms and innovation hubs in the U.S. and Canada further supports the growth of autonomous equipment. As the region continues to prioritize smart construction solutions and sustainability, the adoption of autonomous construction technologies is expected to accelerate.

U.S. Autonomous Construction Equipment Market Trends

The autonomous construction equipment market in the U.S. is anticipated to register significant growth from 2024 to 2030. The country’s strong emphasis on modernizing infrastructure and enhancing construction productivity through automation drives this growth. Established industrial automation infrastructure and significant investments in technology and innovation are pivotal in expanding the market. The U.S. construction industry’s ongoing efforts to integrate advanced autonomous systems for efficiency and safety further boost market prospects.

Asia Pacific Autonomous Construction Equipment Market Trends

The autonomous construction equipment market in Asia Pacific is anticipated to register significant growth from 2024 to 2030. Expansion in construction activities and advancements in smart technology are set to drive significant market growth. The region is experiencing a surge in demand for sophisticated construction machinery, fueled by rapid urbanization and large-scale infrastructure projects across countries like China, Japan, and South Korea. As these economies intensify their focus on digital transformation and smart construction solutions, there is a growing need for advanced automation, real-time monitoring, and precision in construction processes.

Europe Autonomous Construction Equipment Market Trends

The autonomous construction equipment market in Europe is poised for significant growth from 2024 to 2030. The region's stringent regulations on emissions and a strong commitment to sustainable construction practices are driving the adoption of autonomous technologies. European countries, including Germany, France, and the UK, are at the forefront of integrating advanced autonomous systems to enhance construction efficiency and environmental compliance. The push towards innovative solutions in the automotive and industrial sectors, along with the increasing adoption of electric and hybrid construction machinery, fuels the market's growth.

Key Autonomous Construction Equipment Company Insights

Key players operating in the autonomous construction equipment market include Caterpillar, Bobcat Company, CNH Industrial America LLC., Built Robotics.,AB Volvo, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Royal Truck & Equipment, Sany Group, and TOPCON CORPORATION. These companies have capitalized on the growing demand for automated solutions by introducing innovations that improve operational efficiency, reduce labor costs, and enhance safety. Caterpillar, in particular, holds a notable share due to its strong global presence and investment in automation platforms such as Cat Command.

Several construction companies in the market are prioritizing the release of autonomous construction equipment with enhanced features. For instance, in May 2024, Develon showcased its latest Concept-X 2.0 automated construction equipment at the Intermat exhibition in Paris, featuring advancements such as the DX225-CX crawler excavator and DD100-CX dozer with a cabinless design. The upgraded system integrates autonomous driving, blade control via GNSS, and automated 3D grading with a tiltrotator accessory. Concept-X combines AI, ICT, and 5G technologies, utilizing drones for terrain scanning and the X-Center system for real-time equipment control, aiming to improve productivity and reduce costs.

Key Autonomous Construction Equipment Companies:

The following are the leading companies in the autonomous construction equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Bobcat Company

- CNH Industrial America LLC

- Built Robotics

- AB Volvo

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Royal Truck & Equipment

- Sany Group

- TOPCON CORPORATION

Autonomous Construction Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 13.82 billion |

|

Revenue forecast in 2030 |

USD 23.89 billion |

|

Growth rate |

CAGR of 9.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Autonomy, type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Caterpillar; Bobcat Company; CNH Industrial America LLC.; Built Robotics; AB Volvo; Komatsu Ltd.; Hitachi Construction Machinery Co., Ltd.; Royal Truck & Equipment; Sany Group; TOPCON CORPORATION |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Autonomous Construction Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global autonomous construction equipment market report based on autonomy, type, application, and region:

-

Autonomy Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-autonomous

-

Fully autonomous

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Earth Moving Equipment

-

Construction Vehicles

-

Material Handling Equipment

-

Concrete and Road Construction Equipment

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Road Construction

-

Building Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous construction equipment market size was estimated at USD 12.72 billion in 2023 and is expected to reach USD 13.82 billion in 2024.

b. The global autonomous construction equipment market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 23.89 billion by 2030.

b. North America dominated the autonomous construction equipment market with a share of 36.24% in 2023. The region's increasing investments in infrastructure development and technological advancements drive the demand for autonomous machinery.

b. Some key players operating in the autonomous construction equipment market include Caterpillar, Bobcat Company, CNH Industrial America LLC., Built Robotics., AB Volvo, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Royal Truck & Equipment, Sany Group, and TOPCON CORPORATION.

b. Key factors that are driving the market growth include the surge in infrastructure development projects and the rising need to improve productivity, reduce construction timelines, and enhance the accuracy of complex tasks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."