Autonomous Aircraft Market Size, Share & Trends Analysis Report By Technology (Increasingly Autonomous, Fully Autonomous), By End Use (Commercial Aircraft, Cargo Aircraft, Medical Services, Others), By Region, And Segment Forecasts, 2024 - 2035

- Report ID: GVR-4-68040-360-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Autonomous Aircraft Market Size & Trends

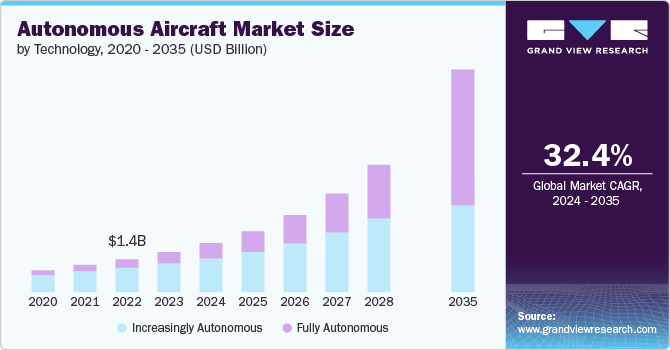

The global autonomous aircraft market size was estimated at USD 1.75 billion in 2023 and is projected to grow at a CAGR of 32.40% from 2024 to 2035. The market growth is driven by several key factors such as reduced operational costs, minimized human error, and increasing trend of urban air mobility, among others. Advancements in terms of aircraft hardware and software technologies are enabling manufacturers to develop sophisticated l systems to cater to the increasing demand for autonomous aircraft for government, military, and civilian applications globally.

Autonomous aircraft, also known as unmanned aerial vehicles (UAVs) or drones, have evolved from their military origins to become integral to commercial, industrial, and civilian applications. This evolution is primarily fueled by advancements in technology, regulatory frameworks, and expanding applications across various sectors. Technological advancements play a crucial role in driving the growth of autonomous aircraft. Innovations in artificial intelligence, machine learning, and sensor technologies have significantly enhanced the capabilities of UAVs. These advancements enable autonomous aircraft to perform complex tasks with high precision, reliability, and safety, which were previously challenging or impossible with traditional piloted aircraft.

Regulatory frameworks are another critical driver of market growth. Governments worldwide are increasingly establishing guidelines and regulations to integrate autonomous aircraft into the airspace safely. As regulatory bodies gain confidence in the safety and reliability of autonomous systems, they are opening up more opportunities for commercial applications. These regulations provide clarity and stability, encouraging investment and innovation in the autonomous aircraft sector.

Moreover, the expanding range of applications for autonomous aircraft is creating new opportunities for growth. For instance, in agriculture, drones equipped with sensors and imaging technologies enable farmers to monitor crops, optimize irrigation, and assess soil conditions more efficiently than traditional methods. In logistics, autonomous delivery drones promise faster and more cost-effective transportation of goods, particularly in remote or hard-to-reach areas.

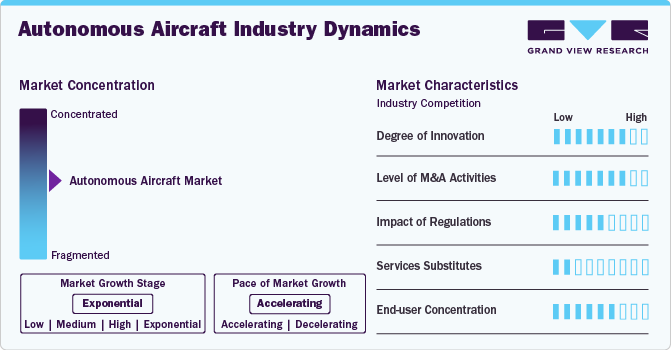

Industry Dynamics

The market growth stage is exponential and the pace of growth is accelerating. Rapid advancements in artificial intelligence, sensor technologies, and communication systems are driving the development of more capable and reliable autonomous aircraft. These innovations enable enhanced autonomy, safety, and operational efficiency, appealing to a broader range of applications and industries.

The market for autonomous aircraft is seeing an increasing number of merger and acquisition (M&A) activities by the leading players underlying a dynamic industry landscape. Mergers and acquisitions enable companies to form strategic partnerships, combining complementary strengths in technology, regulatory compliance, and market access to accelerate innovation and market penetration.

The market is also subject to high regulatory scrutiny and is impacted by its operations and strategic decisions. Regulatory bodies worldwide, such as the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA), impose stringent safety standards for autonomous aircraft operations. These regulations cover aspects like airworthiness, operational procedures, and integration into controlled airspace.

The autonomous aircraft faces moderate to high competition from its counterpart substitutes in the market. This requires specialized technologies such as artificial intelligence, advanced sensors, and robust communication systems that are not readily substituted by conventional human-crewed aircraft or ground-based alternatives.

End user concentration is a significant factor in the autonomous aircraft market. High end user concentration can give significant leverage to large buyers, such as government agencies, major airlines, or large logistics companies. These entities may have substantial bargaining power, influencing pricing, contract terms, and technological requirements from suppliers of autonomous aircraft systems.

Technology Insights

Based on technology, the increasingly autonomous aircraft segment accounted for the largest revenue share of over 70% in 2023. Advancements in artificial intelligence, machine learning, and sensor technology spur the growth. These innovations enable aircraft to perform complex tasks autonomously, such as navigation, obstacle avoidance, and decision-making in various operational scenarios. Autonomous systems promise to enhance safety, efficiency, and operational flexibility in both commercial and military applications. As regulatory frameworks evolve to accommodate autonomous flight, aerospace companies are investing heavily in research and development to capitalize on these technologies, driving the rapid expansion of autonomous capabilities in the aircraft industry.

The fully autonomous aircraft segment is anticipated to grow at the fastest CAGR of nearly 41% from 2024 to 2035. This technology promises to enhance safety, reduce operational costs, and optimize flight routes through advanced artificial intelligence, sensor integration, and robust communication systems. Fully autonomous aircraft have the potential to transform air transportation by increasing reliability, efficiency, and accessibility while reducing the need for human pilots. As regulatory agencies develop frameworks to support fully autonomous operations, aerospace companies are intensifying their efforts to develop and deploy these groundbreaking technologies, driving market growth and innovation.

End Use Insights

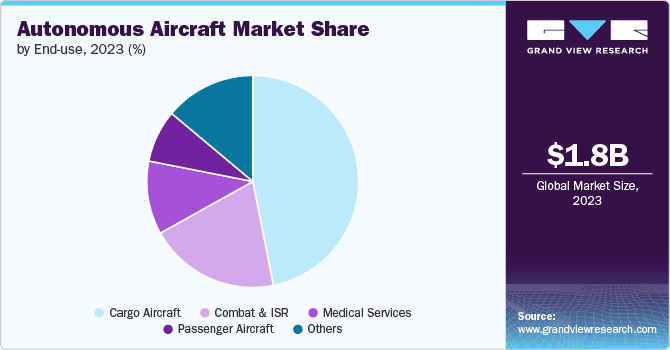

The cargo aircraft segment registered a largest revenue share of the market in 2023. This growth is driven by increasing demand for efficient, cost-effective logistics solutions. Autonomous technology promises to enhance operational efficiency, reduce human error, and lower transportation costs. These aircraft can operate in remote or challenging environments without the need for human pilots, expanding the reach of cargo delivery networks. Companies are investing in autonomous systems to improve delivery speeds and reliability, making them ideal for transporting goods over long distances or in areas with limited infrastructure.

The commercial aircraft segment is expected to grow at a significant CAGR from 2024 to 2035. The growth is due to several key factors. Autonomous technology offers potential benefits such as improved safety, reduced operational costs, and enhanced passenger experience through optimized flight routes and smoother operations. Airlines are increasingly interested in autonomous systems for tasks like taxiing, takeoff, and landing, which can streamline airport operations and reduce delays. Moreover, advancements in artificial intelligence and sensor technology are making autonomous flights more reliable and feasible, driving interest and investment from both established airlines and emerging aviation companies.

Regional Insights

North America accounted for the highest market revenue share of nearly 38% in 2023, driven by robust technological innovation, substantial investments in research and development, and a supportive regulatory environment. Companies like Boeing, Lockheed Martin, and Alphabet's Wing are pioneering advancements in unmanned aerial systems (UAS) for applications ranging from military surveillance to commercial cargo delivery.

U.S. Autonomous Aircraft Market Trends

The autonomous aircraft market in the U.S. is expected to have a notable CAGR of over 30% from 2024 to 2035, propelled by a strong ecosystem of aerospace giants, innovative startups, and government initiatives. Favorable regulatory policies, substantial investments in technology development by companies like Amazon and Alphabet's Wing, and increasing applications in agriculture, infrastructure monitoring, and emergency response drive market expansion.

Asia Pacific Autonomous Aircraft Market Trends

The autonomous aircraft market in Asia Pacific is anticipated to grow at the fastest CAGR of over 35% from 2024 to 2035, owing to increasing defense expenditures, technological advancements, and burgeoning commercial applications. Countries like China, Japan, and India are investing heavily in unmanned systems for military surveillance, border security, and disaster management. Moreover, Asia Pacific's expanding e-commerce sector drives demand for autonomous delivery drones.

The Japan autonomous aircraft market is estimated to grow significantly from 2024 to 2035. Advancements in technology, supportive regulatory frameworks, and applications in disaster response, infrastructure monitoring, and precision agriculture fuel the market. Companies like Mitsubishi Heavy Industries and Yamaha Motor are leading innovators, developing autonomous systems for both commercial and defense purposes.

The autonomous aircraft market in India is estimated to record a notable CAGR from 2024 to 2035, driven by increasing defense expenditures, technological advancements, and applications in agriculture, surveillance, and infrastructure monitoring. The Indian government's initiatives like Digital India and Make in India further promote the development and adoption of uncrewed aerial vehicles (UAVs) for civilian and military applications.

The China autonomous aircraft market had the largest revenue share in 2023. The Chinese government's initiatives to promote uncrewed aerial vehicles (UAVs) for precision agriculture, urban transportation, and public safety applications further accelerate market expansion. Favorable regulatory policies and strategic investments in research and development position China as a key player in the global market.

Europe Autonomous Aircraft Market Trends

The autonomous aircraft market in Europe is anticipated to grow at a CAGR of nearly 32% from 2024 to 2035, propelled by strong aerospace capabilities, supportive regulatory frameworks, and increasing investments in research and development. Countries like Germany, the UK, and France are leading innovators, focusing on applications in defense, environmental monitoring, and urban mobility.

The France autonomous aircraft market accounted for a significant revenue share in 2023. This growth is driven by its aerospace industry leadership, technological innovation, and diverse applications in defense, agriculture, and environmental monitoring. Companies like Dassault Aviation and Thales Group are at the forefront of developing advanced UAV technologies for military surveillance and civilian uses.

The autonomous aircraft market in the UK is estimated to grow at the highest CAGR from 2024 to 2035. The market is propelled by its aerospace expertise, supportive regulatory environment, and strategic investments in research and development. Companies like BAE Systems and Rolls-Royce are advancing UAV technologies for defense, infrastructure inspection, and autonomous cargo transport.

The Germany autonomous aircraft market is estimated to grow at a moderate CAGR from 2024 to 2035. This growth is driven by its robust aerospace industry, technological innovation, and strong regulatory support. Companies like Airbus and DLR (German Aerospace Center) are leading the development of unmanned aerial systems (UAS) for military, commercial, and scientific applications. Germany's focus on sustainability and autonomous technologies in logistics, agriculture, and urban mobility further accelerates market growth.

Middle East & Africa Autonomous Aircraft Market Trends

The autonomous aircraft market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2035. This growth is due to increasing defense expenditures, infrastructure development, and applications in agriculture and security. Countries like Saudi Arabia are investing in UAV technologies for military surveillance, border security, and smart city initiatives.

The autonomous aircraft market in Saudi Arabia accounted for a considerable revenue share in 2023, driven by the kingdom's ambitious Vision 2030 initiative. This initiative aims to diversify the kingdom's economy away from oil dependency. Key drivers include substantial investments in technology and infrastructure, particularly in the defense and security sectors.

Key Autonomous Aircraft Company Insights

Some of the key players operating in the market include The Boeing Company, Northrop Grumman Corporation, and Lockheed Martin Corporation.

-

Lockheed Martin Corporation is advancing in the market through a strategy centered on innovation and strategic partnerships. Leveraging its extensive experience in aerospace and defense, Lockheed Martin is developing advanced autonomous systems tailored for various applications, including military missions and commercial operations. They prioritize investments in advanced technology and research to enhance the performance, reliability, and safety of aircraft.

-

Boeing is expanding its market by focusing on innovation, partnerships, and market diversification. It is leveraging its extensive aerospace expertise to develop advanced autonomous systems for both military and commercial applications. Boeing's strategy includes substantial investments in research and development to enhance autonomous technologies, improve safety, and optimize operational efficiency.

AeroVironment Inc., IAI, and Textron Inc. are some of the emerging market participants in the autonomous aircraft market.

-

AeroVironment Inc. is expanding its market through a strategy focused on innovation and market penetration. They are leveraging their expertise in unmanned systems to develop advanced autonomous aircraft solutions tailored for commercial and defense applications. By investing in research and development, forging strategic partnerships, and enhancing manufacturing capabilities, AeroVironment seeks to capture a larger share of the growing market.

-

Israel Aerospace Industries (IAI) is driving growth in the market by focusing on technological leadership and global partnerships. They are developing innovative unmanned aerial systems (UAS) that cater to both military and civilian sectors, emphasizing reliability, versatility, and operational efficiency. IAI's strategy includes continuous investment in research and development to pioneer next-generation autonomous technologies.

Key Autonomous Aircraft Companies:

The following are the leading companies in the autonomous aircraft market. These companies collectively hold the largest market share and dictate industry trends.

- AeroVironment Inc.

- Airbus SE

- BAE Systems Plc

- Elbit Systems Ltd.

- IAI

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- Saab AB

- Textron Inc.

- The Boeing Company

Recent Developments

-

In May 2024, Northrop Grumman Corporation partnered with DARPA for the ANCILLARY program's Phase 1b, successfully advancing its autonomous VTOL aircraft design. Over ten months, they enhanced modeling fidelity, conducted subsystem testing, and mitigated technical risks. Leveraging expertise in VTOL systems and long-endurance aircraft, Northrop Grumman led a collaborative effort with Leigh Aerosystems and Near Earth Autonomy. This phase brought them closer to developing a flight demonstrator, aiming to deliver an affordable capability to the warfighter community.

-

In January 2022, Wisk Aero, a pioneering Advanced Air Mobility (AAM) company, secured $450 million from The Boeing Company to advance its certified autonomous electric flight capabilities. This substantial investment, combined with previous funding, solidified Wisk's position as a leading player in the AAM sector. The funding accelerated the development of Wisk's 6th generation eVTOL aircraft, aimed at becoming the first certified autonomous, all-electric passenger aircraft in the U.S. It also supported the company's expansion into scale manufacturing and its Go-to-Market initiatives, underlining the strength of its strategic partnership with Boeing.

Autonomous Aircraft Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.15 billion |

|

Revenue forecast in 2035 |

USD 47.16 billion |

|

Growth rate |

CAGR of 32.40% from 2024 to 2035 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2035 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2035 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East and Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Northrop Grumman Corporation; The Boeing Company; Lockheed Martin Corporation; RTX Corporation; Elbit Systems Ltd.; AeroVironment Inc.; Saab AB; BAE Systems Plc; Airbus SE; Textron Inc.; IAI |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Autonomous Aircraft Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Grand View Research has segmented the global autonomous aircraft market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2035)

-

Increasingly Autonomous

-

Fully Autonomous

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2035)

-

Commercial Aircraft

-

Cargo Aircraft

-

Medical Services

-

Combat and ISR

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2035)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous aircraft market size was estimated at USD 1.75 billion in 2023 and is expected to reach USD 2.15 billion in 2024.

b. The global autonomous aircraft market is expected to grow at a compound annual growth rate of 32.41% from 2024 to 2035 to reach USD 47.16 billion by 2035.

b. North America accounted for the highest market revenue share of nearly 38% in 2023, driven by robust technological innovation, substantial investments in research and development, and a supportive regulatory environment. Companies like Boeing, Lockheed Martin, and Alphabet's Wing are pioneering advancements in unmanned aerial systems (UAS).

b. Some key players operating in the autonomous aircraft market include The Boeing Company, Northrop Grumman Corporation, Lockheed Martin Corporation, AeroVironment Inc., IAI, Textron Inc and among others

b. Regulatory frameworks are another critical driver of market growth. Governments worldwide are increasingly establishing guidelines and regulations to integrate autonomous aircraft into the airspace safely.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."