Automotive Wiring Harness Market Size, Share & Trends Analysis Report By Vehicle, By Component (Electric Wires, Connectors, Terminals), By Application, By Electric Vehicle, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-191-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Automotive Wiring Harness Market Trends

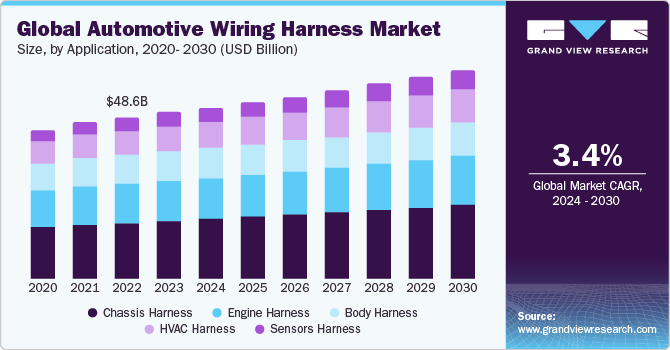

The global automotive wiring harness market size was estimated at USD 50.09 billion in 2023 and is projected to grow at a CAGR of 3.4% from 2024 to 2030. The surge in electric vehicle (EV) adoption, bolstered by consistent government incentives for both manufacturers and consumers, is a key driver propelling demand for the EV segment. This, in turn, is fueling market growth.

Rising integration of advanced technologies such as vehicle-to-vehicle communication, self-healing for electric vehicles, smart battery systems, and smart braking & safety systems, among others, is attributed to drive the market growth. In line with these advancements, the introduction of autonomous and semi-autonomous vehicles, which have a high dependency on components such as low-latency communication devices, sensors, cameras, and radar, will increase the demand for automotive wiring harnesses within the automotive manufacturing industry, thereby offering numerous growth opportunities to the global market. Moreover, the increasing use of optical fiber for producing wiring harnesses is expected to create new opportunities for market players.

The rising consensus pertaining to security and safety while driving is fueling the demand for driver-assisting technologies such as adaptive cruise control, blind spot detection, adaptive front light, and lane departure warning systems. In addition, vehicle manufacturers are obliged to comply with stringent safety norms introduced by authorities worldwide and are expected to support the market growth. For instance, in July 2022, the European Union introduced new safety measures to reduce commute-related injuries and fatalities by applying general safety regulations. The regulation sets the legal framework for the EU's approval of fully driverless and automated vehicles and introduces advanced driver assistance technologies for passenger and commercial vehicles.

The deployment of cables or wire harnesses is anticipated to gain traction owing to its incorporation into multimedia and security systems. To enhance the driving experience, features including ambient lighting systems, cooled cup holders, voice recognition systems, heated steering wheels and seats, infotainment, and power steering functions have gained prominence. A wiring harness is necessary for the data, signal, and power transfer in electronic equipment which enables these functions. Wiring harness bundles are put in automobiles with these circuits to ensure that various features operate without interruption. Thus, the market growth is due to its application in automotive industry.

The demand for automotive wiring harnesses is increasing owing to the connected car ecosystem, new laws, electrification, growing preference for 48V high voltage capacity, and an increase in comfort and safety features in automobiles. Throttle control, steering, and braking are essential vehicle activities that the electronic control unit (ECU) aids. Throughout the sensors, actuators, and ECU, the wiring harness facilitates the transmission of signals, power, and data. The development of electronic and electrical features in vehicles further exacerbates the need for wiring harnesses. Governments in North America, Europe, and Asia-Pacific are advocating for an increase in the integration of ADAS systems, telematics, and low-emission engines such as China VI, Euro VI, and BSIII to BSIV electronics engines. These engines increase the application of sensors. radar, telematics, and communication devices. Thus, the growing need for connectivity and data transmission in automobiles is anticipated to propel market growth within the forecast period.

The strong emphasis market players are putting on ensuring sustainable manufacturing operations is emerging as a notable trend. Market players are delving into the realm of eco-friendly materials and sustainable manufacturing processes as part of the efforts to mitigate the environmental impact of their operations. As such, market players are increasingly seeking sustainable alternatives to conventional materials and methods. Eco-friendly practices, such as using recycled plastics, biodegradable polymers, and eco-friendly metals, and advancements in manufacturing processes, such as energy-efficient production techniques and waste mitigation strategies, are also being pursued to reduce the carbon footprint of the automotive wiring harness manufacturing processes.

Market Concentration & Characteristics

The industry growth stage is medium, and pace is moderate. The integration of smart technologies into wiring harness systems is gaining significant traction in a progressive shift that involves the incorporation of sensors and advanced communication protocols to enable real-time data transmission and diagnostics.

The automotive wiring harness industry is characterized by a high level of partnerships, collaborations, and agreements activity by the companies. These activities can help manufacturers to enter new markets or expand their presence in existing ones. Furthermore, collaboration helps the manufacturers to spread out risks associated with product development, market fluctuations, or regulatory changes. By diversifying their partnerships, manufacturers can reduce their dependencies on any single partner or market.

Various standards related to the production and use of electrical and electronic components being published by global standards organizations are allowing market players to standardize their products, ensuring their products are universally compatible. The IPC, a member-driven organization considered a premier authority in setting industry standards, providing training, disseminating industry intelligence, and advocating for public policy, released the IPC/WHMA A-620E-2022 standard.

The threat of substitutes for automotive wiring harnesses is low. While there are some alternatives to automotive wiring harnesses, such as cable assembly and wiring looms, these do not provide the same level of safety as automotive wiring harnesses. Despite the potential substitutes, the degree of threat to the wiring harness market is relatively low now. Moreover, advancements in automotive wiring harness technologies are leading to the development of more compact, simpler, and cost-effective wiring harnesses, which go beyond what current substitutes can provide.

The cost of switching is low for buyers in the market. However, design limitations and the availability of fewer potential substitutes restrict buyers from shifting to other companies. The price competition among existing automotive wiring harness manufacturers is low because automotive manufacturers have tie-ups with wiring harness manufacturers and other component manufacturers and suppliers.

Component Insights

Based on component, the terminal segment led the market with the largest market revenue share of 41.71% in 2023. Increasing emphasis on safety and reliability in automotive electrical systems, driving the demand for terminals with enhanced thermal management and vibration resistance. The automotive industry is witnessing a significant shift towards incorporating advanced connectivity features such as crimples terminals, quick-connect terminals, and waterproof terminals within wiring harnesses. The growing complexity of vehicles drives this trends, the rise of electric vehicles (EVs) and hybrids, and a heightened focus on reliability and durability.

The connector segment is anticipated to register at the fastest CAGR from 2024 to 2030. The development of connected and autonomous vehicles requires sophisticated wiring systems to support communications between various vehicle components and external networks. Connectors are essential for enabling data transfer between sensors, controllers, and other electronic components in these vehicles. Furthermore, a shift towards modular connector design with interchangeable components to streamline assembly processes and accommodate future vehicle architectures is anticipated to drive the demand for the connectors in the market.

Application Insights

Based on application, the chassis harness segment led the market with the largest revenue share of 34.64% in 2023. The regulatory mandates for vehicle safety, consumer demand for enhanced driving dynamics and safety features, and technological advancements in chassis control systems are driving the demand for chassis wiring segment. Wiring harnesses for chassis applications are evolving to support the increasing electrification and connectivity of chassis components, as well as integration of advanced safety and driver assistance systems.

The sensors harness segment is expected to exhibit at the fastest CAGR from 2024 to 2030. Including numerous sensors for systems such as illumination, battery system, speed systems, infotainment systems, and ADAS. Moreover, the development and integration of advanced sensors are expected to play a crucial role in the evolution of automotive technology, especially as vehicles increasingly feature a variety of safety solutions. For instance, in May 2022, Continental AG, an automotive manufacturer, announced the expansion of its extensive sensor portfolio by introducing two new sensors for electric vehicles, namely Battery Impact Detection (BID) and Current Sensor Module (CSM). The new sensors would focus on safeguarding the batteries of electrified vehicles. Moreover, advancements in sensor technologies, such as LiDAR and RADAR for autonomous driving, are driving the demand for sophisticated wiring harnesses capable of supporting complex sensor networks.

Electric Vehicle Insights

Based on electric vehicle, the battery electric vehicle (BEV) segment led the market with the largest revenue share of 65.78% in 2023. Consumer preferences are evolving, with a growing interest in sustainable and futuristic transportation. The appeal of cutting-edge technology and the lower operational costs associated with BEVs are particularly making BEVs attractive to consumers. As technologies advance, they are expected to contribute toward positive feedback, fostering greater consumer confidence in BEVs. Furthermore, advances in battery technology have helped reduce charging times, increase driving ranges, and enhance overall performance, addressing some of the consumers’ initial concerns regarding EVs.

The plug-in hybrid electric vehicle (PHEV) segment is anticipated to register at a considerable CAGR during the forecast period. Growing electrification of public transportation and the rising adoption of hybrid vehicles by public fleet operators in the market are driving the demand for PHEVs. At the same time, tax incentives, rebates, and subsidies are also being offered to electrify the existing vehicle fleet. For instance, the City of Jonesboro in Arkansas is set to receive funding of around USD 878,584 for the acquisition of hybrid buses, aiming to replace older diesel buses and enhance air quality within the city. Also, under the U.S. government's Clean School Bus program, the U.S. Environmental Protection Agency (EPA) is expected to cover up to 100% of the expenses associated with transitioning from the existing school buses to zero-emission alternatives. This coverage includes costs associated with the vehicle and the charging infrastructure. All such initiatives bode well for the market growth of the wiring harness within PHEV segment.

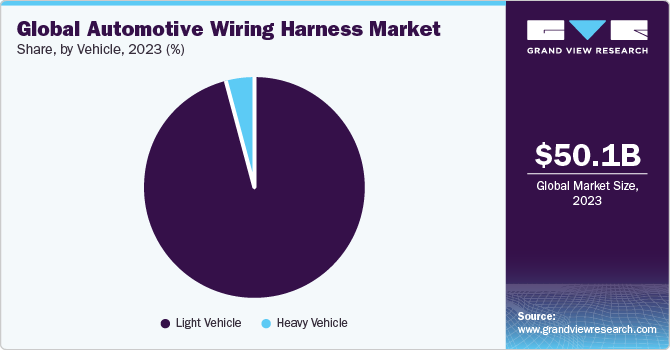

Vehicle Insights

Based on vehicle, the light vehicles segment led the market with the largest revenue share of 95.81% in 2023.Light vehicles such as utility vans, SUVs, or trucks are now equipped with systems such as GPS, advanced infotainment systems, smart lights, and panoramic roofs, even with sensors for temperature control and tire pressure. The integration of such technologies and equipment in light vehicles is helping in redefine comfort and functionality while traveling as consumers are now considering advanced functions and driving experience while buying a vehicle. The wiring harness in these vehicles is expected to increase in proportion while maintaining an optimum vehicle weight. Thus, the rising functions in the vehicle will positively impact the demand for wiring harnesses in light vehicles.

The heavy vehicles segment is expected to register at a considerable CAGR over the forecast period. The increasing focus of governments and regulatory bodies on road safety demand for safety systems in heavy commercial vehicles is increasing the need for ADAS. The increasing number of accidents of heavy vehicles on the road due to their size and weight, and ADAS technologies can help to reduce the risk of accidents and improve safety is anticipated to drive the demand for wiring harnesses. Moreover, the increasing adoption of automation and connectivity technologies in the transportation industry is driving the demand for wiring harnesses in heavy vehicles.

Regional Insights

The automotive wiring harness market in North America is expected to register at a considerable CAGR from 2024 to 2030. As the automotive industry continues to evolve, the growing demand for advanced wiring harnesses is playing a crucial role in driving the market growth. The push toward autonomous vehicles and the electrification of mobility are presenting a significant opportunity for innovation and investment in automotive wiring harness solutions. At this juncture, the incumbents of the North America market can achieve significant growth over the forecast period by focusing on high-speed data transmission, electromagnetic shielding, and thermal management.

U.S. Automotive Wiring Harness Market Trends

The automotive wiring harness market in the U.S. is expected to grow at the fastest CAGR of 2.1% from 2024 to 2030. The growing adoption of autonomous vehicles and the increasing emphasis on vehicle electrification is anticipated to spur substantial investments in advanced wiring harness technologies. These advancements encompass innovations in areas such as high-speed data transmission, electromagnetic shielding, and thermal management to accommodate the intricate electrical systems of vehicles. As the automotive sector continues to evolve, there is likely to be a notable rise in demand for cutting-edge wiring harness solutions capable of meeting the changing requirements of vehicle electrification and connectivity.

Asia Pacific Automotive Wiring Harness Market Trends

Asia Pacific dominated the automotive wiring harness market with a revenue share of 45.8% in 2023. The dynamic nature of the automotive industry in the Asia Pacific is opening ample opportunities for the manufacturers of automotive wiring harnesses to capitalize on the advances in technology and shifting consumer preferences. As such, market players are focusing on innovation and product differentiation to cater to the evolving market demands effectively. The subsequent emphasis on innovation is driving investments in research and development aimed at enhancing the performance, efficiency, and reliability of automotive wiring harness solutions.

The automotive wiring harness market in China accounted for a 62.0% revenue share of the Asia Pacific in 2023. Market players in the wiring harness market are strategically enhancing their presence in China by acquiring significant shares of domestic wire harness manufacturers. For instance, in March 2024 , Komax Holding AG, a prominent players of automated wire processing industry acquired a majority stake of 56% in Suzhou Hosver Automation Technology Co., Ltd, known for its expertise in high-voltage cables for electric and hybrid vehicles. This acquisition would enable Komax Group to swiftly adapt to evolving local demands in the dynamic Chinese market.

The India automotive wiring harness market is expected to grow at the fastest CAGR of 4.2% from 2024 to 2030. Major players in the Indian automotive industry are prioritizing partnerships and collaborations with local wiring harness manufacturers. For example, in February 2023, Hero Electric joined forces with Dhoot Transmission, a wiring harness manufacturer based in Aurangabad, Maharashtra, India to source wiring harnesses for its electric two-wheelers. The wiring harnesses provided by Dhoot Transmission would ensure efficient power transmission with minimal losses from the battery to the wheel while guaranteeing that the materials remain durable over years of operation.

The automotive wiring harness market in Japan is driving demand owing to the leading players in the Japanese wiring harness market are actively looking to broaden their business presence in emerging economies across the globe to enhance their competitiveness within the industry.

Europe Automotive Wiring Harness Market Trends

The automotive wiring harness market in Europe is anticipated to reach at USD 13.00 billion in 2023. The region is expected to see a rise in the demand for high-voltage harness wires as the region witnessed a consistent rise in electric vehicle sales. The sales of EV vehicles are further propelling market growth, owing to subsidies provided by the EU and respective governments of European countries. The EV sales are anticipated to positively affect the wiring harness sales.

The UK automotive wiring harness market accounted for an 8.9% revenue share of the Europe in 2023. Technology solution providers in the UK are increasingly directing their efforts toward automating the manufacturing of automotive wire harnesses. This strategic shift reflects the industry's acknowledgment of the potential benefits such as improved efficiency and cost reduction through automation.

The automotive wiring harness market in Germany is expected to register at a considerable CAGR over the forecast period. The rapid shift of Germany’s automotive industry toward electrification has increased the significance of electromagnetic shielding in wiring harness design, which is driving the country’s wiring harness market.

Middle East & Africa Automotive Wiring Harness Market Trends

The automotive wiring harness market in the Middle East and Africa (MEA) region is anticipated to reach USD 2.86 billion by 2030. The aggressive adoption of automation and other advanced technologies in manufacturing in line with the broader trend of Industry 4.0 is driving the market growth of the Middle East and Africa. The integration of smart technologies in manufacturing automotive wiring harnesses can help create more agile and responsive supply chains.

The Saudi Arabia automotive wiring harness market is driven by increase in demand for vehicles and consequently the wiring harness that connect their electrical systems. Furthermore, the demand for advanced features such as driver-assistance systems, in-vehicle infotainment, and comfort controls in on the rise in Saudi Arabia. These features rely heavily on complex wiring harness for data transmission and power supply.

Key Automotive Wiring Harness Company Insights

Some of the key companies operating in the market include Sumitomo Electric Industries, Ltd., YAZAKI Corporation, LEONI AG, Aptiv PLC, and Furukawa Electric Co., Ltd.

-

Sumitomo Electric Industries, Ltd. prioritizes research and development, offering cutting-edge solutions like lightweight aluminum harnesses and high voltage wiring for electric vehicles. Additionally, the company has a global presence with a wide network of manufacturing facilities, allowing them to efficiently serve the needs of automotive manufactures globally

-

Furukawa Electric Co., Ltd. has comprehensive range of wiring harness, including those for conventional vehicles, electric vehicles, and hybrid vehicles, caters to the diverse needs of automotive manufacturers

Kromberg & Schubert GmbH Cable & Wire, Lear Corporation, Tianhai Auto Electronics Group Co., Ltd., and Spark Minda are some of the emerging companies in the global market.

-

Lear Corporation engaged provides automotive technology to enhance in-vehicle experiences for consumers worldwide. The company supplies key seat components; complete seat systems; complete electrical connection and distribution systems; and high-voltage power distribution products, including electronic controllers, low-voltage power distribution products, battery disconnect units, and other electronic products, to all the major automotive manufacturers

-

Tianhai Auto Electronics Group Co., Ltd. designs and manufactures connection systems, electronic transmission systems, low-carbon intellectual solutions, and intelligent control systems. The company is committed to designing and manufacturing high-speed and low- and high-voltage wire harnesses for intelligent connected vehicles

Key Automotive Wiring Harness Companies:

The following are the leading companies in the automotive wiring harness market. These companies collectively hold the largest market share and dictate industry trends.

- China Auto Electronics Group Limited (THB Group)

- Delphi Technologies PLC (Aptiv PLC)

- Furukawa Electric Co., Ltd.

- Kromberg & Schubert GmbH Cable & Wire

- Lear Corporation

- LEONI AG

- PKC Group

- Spark Minda, Ashok Minda Group

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

Recent Developments

-

In April 2024, AVR Global Technologies, Inc., a manufacturer of wire harnesses, custom molded cables, and electronics assemblies, announced its merger with Conner Industrial, a Surface Mount Technology (SMT) PCB and cable manufacturer. The companies would be named AVR Conner Industrial Ltda. The combined proficiency of these companies in SMT, electronics box assembly, and custom wire harness OEM/CM/ODM manufacturing is likely to help manufacturers improve their product efficiency

-

In May 2023, Sumitomo Electric Industries, Ltd. accelerated the development of an automotive optical harness, with commercial samples slated for release in 2026. Leveraging its extensive experience in wire harness technology and optical communication, the company has been looking forward to facilitating the evolution of Connected, Autonomous, Shared & Services, and Electric (CASE) technologies by enabling high-speed, large-capacity communication

-

In April 2023, Sumitomo Corporation, headquartered in Tokyo, secured a license to establish a factory dedicated to manufacturing wiring harnesses for EVs in Egypt, backed by an investment of approximately USD 100 million. Spanning an area of 150,000 square meters within a free zone, the facility is poised to create around 10,000 employment opportunities. Its production capacity is strategically aligned to serve the needs of prominent car manufacturers in Europe and the Middle East, reinforcing the company’s commitment to global market expansion

-

In February 2023, Hero Electric joined forces with Dhoot Transmission, a wiring harness manufacturer based in Aurangabad, Maharashtra, India to source wiring harnesses for its electric two-wheelers. The wiring harnesses provided by Dhoot Transmission would ensure efficient power transmission with minimal losses from the battery to the wheel while guaranteeing that the materials remain durable over years of operation

-

In May 2022, Yazaki North America (YNA) and Aptera Motors announced a collaborative partnership and supply agreement, designating the two companies as an engineering service supplier and a supplier for line prototype and production parts. The agreement envisaged YNA providing specific production parts for Aptera Motors’ HV & LV EE electrical harnesses, including charge ports, connectivity, wiring, and other utilities

Automotive Wiring Harness Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 51.66 billion |

|

Revenue forecast in 2030 |

USD 63.00 billion |

|

Growth rate |

CAGR of 3.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, electric vehicle, vehicle, region. |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa. |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

China Auto Electronics Group Limited (THB Group); Delphi Technologies PLC (Aptiv PLC); Sumitomo Electric Industries, Ltd.; Yazaki Corporation; Leoni AG; Lear Corporation; Furukawa Electric Co., Ltd.;Kromberg & Schubert GmbH Cable & Wire; •Spark Minda, Ashok Minda Group |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Wiring Harness Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive wiring harness market report based on component, application, electric vehicle, vehicle, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Wires

-

Connectors

-

Terminals

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Body Harness

-

Chassis Harness

-

Engine Harness

-

HVAC Harness

-

Sensors Harness

-

-

Electric Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-in Hybrid Electric Vehicle (PHEV)

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Light Vehicle

-

Heavy Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive wiring harness market size was estimated at USD 50.09 billion in 2023 and is expected to reach USD 51.66 billion in 2024.

b. The global automotive wiring harness market is expected to grow at a compound annual growth rate of 3.4% from 2024 to 2030 to reach USD 63.00 billion by 2030.

b. Terminal components dominated the automotive wiring harness market with a share of 41.7% in 2023. This is attributable to rising adoption of advanced vehicle technologies such as self-driving vehicles and connected vehicles that require more connections as compared to conventional variants.

b. Some key players operating in the automotive wiring harness market include Aptiv PLC, Sumitomo Electric Industries, Ltd., Yazaki Corporation, Leoni AG, Lear Corporation, and Furukawa Electric Co., Ltd.

b. Key factors that are driving the market growth include increasing use of electronic devices and components in vehicles to provide enhanced safety features.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."