- Home

- »

- Advanced Interior Materials

- »

-

Automotive Window And Exterior Sealing System Market Report, 2030GVR Report cover

![Automotive Window And Exterior Sealing System Market Size, Share & Trends Report]()

Automotive Window And Exterior Sealing System Market Size, Share & Trends Analysis Report By Component (Roof Ditch Molding Seals, Door Seals, Glass Run Channel Seals), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-372-4

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

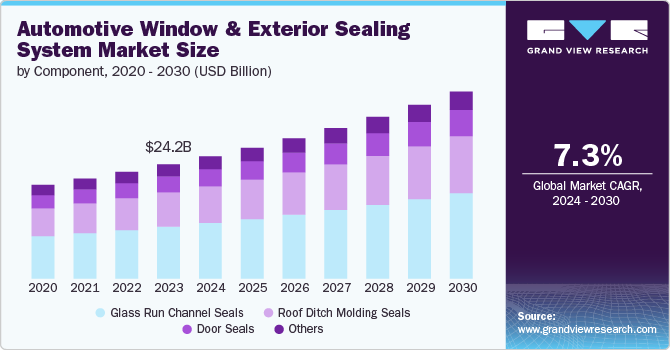

The global automotive window and exterior sealing system market size was estimated at USD 24.16 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. This growth is attributed to the rising sales and production of vehicles, stringent environmental regulations, and heightened consumer expectations for safety and comfort. In addition, advances in technology are driving the improvement of more effective and durable sealing solutions, while the growing usage of electric vehicles is expected to introduce new sealing requirements, thereby fueling the market growth.

Economic growth, rising disposable incomes, and a focus on reducing cabin noise and vibration further fuel the market's expansion. As manufacturers and consumers alike prioritize performance, efficiency, and aesthetics, the demand for sophisticated sealing systems is set to rise accordingly.

Growing advancements in technology are poised to significantly fuel global market growth by enhancing the performance, durability, and efficiency of these components. Innovations such as the development of advanced materials-like lightweight, high-strength polymers and eco-friendly compounds-improve the sealing effectiveness against water, dust, and noise while contributing to overall vehicle aerodynamics and fuel efficiency.

Major players in the industry are actively pursuing a range of strategies, including investing heavily in research and development to create innovative sealing solutions that improve performance, durability, and environmental sustainability. They are also enhancing their product portfolios with advanced materials such as thermoplastic elastomers and recycled materials to meet evolving regulatory and consumer requirements. In addition, strategic partnerships and collaborations with automotive manufacturers enable these players to integrate their technologies early in the design process.

Component Insights

Based on component, the market is segmented into roof ditch molding seals, door seals, glass run channel seals, others. Among these, glass run channel seals dominated the market with a revenue share of 48.4% in 2023 and is further expected to grow at a significant rate over forecast period. Glass run channels are necessary for providing a safe and smooth interface between the vehicle’s window and the door frame, which helps to reduce vibration, road noise, and water ingress. As consumers are increasingly prioritizing a quieter and more refined driving experience, the need for high-quality run channel seals that offer superior noise insulation and weather protection is expected to increase further. Moreover, the advancements in design and materials, aimed at advancing durability and thermal efficiency, is expected to contribute to the growing demand for these components.

Demand for roof ditch molding seals for automotive window and exterior sealing system manufacturing is expected to grow at a fastest rate over the period of 2024-2030. The trend towards smoother vehicle designs and the incorporation of panoramic sunroofs increases the requirements for advanced roof ditch molding seals that provides improved performance and aesthetics. The growing consumer emphasis on vehicle longevity and premium features, combined with stricter regulatory standards for water management and vehicle safety, further predicted to fuel the market’s demand.

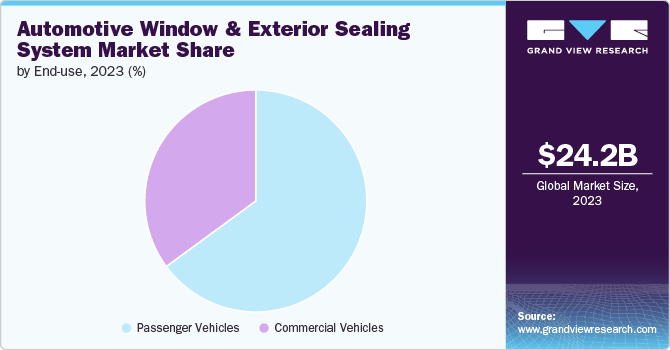

End-use Insights

Based on end-use, automotive window and exterior sealing system market is segmented into commercial vehicles and passenger vehicles. Commercial vehicles end use accounted for the largest revenue share of 64.9% in 2023. This is due to the growing requirements for durability, safety, and comfort in these vehicles. Commercial vehicles, including buses, trucks, and vans, operate in diverse environments, requiring strong sealing solutions that can withstand extreme weather conditions, prevent leaks, and reduce noise and vibration. Moreover, the growing e-commerce and logistics demand is expected to increase in the number of commercial vehicles on the road, further fueling the market growth.

The passenger vehicles segment is anticipated to grow at the fastest CAGR over the forecast period. This growth is attributed to increasing consumer preferences for better comfort, safety, and vehicle performance. Modern passenger vehicles are designed with a focus on reducing cabin noise, improving climate control, and providing better protection against water and dust ingress. Furthermore, growing environmental regulations and the push for improved fuel efficiency is likely to drive the adoption of sealing technologies which can enhance aerodynamics and reduce drag. These factors are expected to fuel the demand for the segment growth over the forecast period.

Regional Insights

North America dominated the automotive window and exterior sealing system market with a revenue share of 25.7% in 2023. Automotive industry in the region is characterized by high vehicle production and a significant presence of major automotive manufacturers and suppliers. Stringent regulatory standards on vehicle emissions and fuel efficiency drive the need.

U.S. Automotive Window And Exterior Sealing System Market Trends

The automotive window and exterior sealing system market in the U.S. is growing at a CAGR of 7.6% over the forecast period. for advanced sealing solutions that enhance aerodynamics and reduce noise and vibration. The increasing consumer preferences for higher vehicle comfort, safety features, and durability contribute to improved demand for modern sealing systems. The growth of electric vehicles in the country further fuels demand for specialized sealing solutions, Moreover, technological advancements and a strong focus on innovation among local automotive companies is further continue to support market growth.

Europe Automotive Window And Exterior Sealing System Market Trends

Europe automotive window and exterior sealing system market is expected to grow at a CAGR of 7.1% from 2024 to 2030. The increasing adoption of electric vehicles (EVs) and autonomous vehicles in Europe requires specialized sealing systems to address new design and performance challenges. The region's focus on sustainability and eco-friendly materials also supports the demand for advanced sealing solutions that align with environmental goals and consumer preferences. Furthermore, the European automotive industry is known for its emphasis on high innovation and standards, which is likely to boosts the demand for cutting-edge sealing technologies that enhance vehicle comfort, safety, and noise insulation over the coming years.

Asia Pacific Automotive Window And Exterior Sealing System Market Trends

The automotive window and exterior sealing system market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. This is owing to the rapid economic development and rising disposable incomes of consumers is predicted to drive higher vehicle sales and production. The region's expanding automotive industry, particularly in countries like China and India, further fuels the need for advanced sealing solutions that enhance vehicle performance, comfort, and safety.

Key Automotive Window And Exterior Sealing System Company Insights

Some of the key players operating in the market include HUTCHINSON and Continental AG.

-

HUTCHINSON was founded in 1953 and headquartered in France. The company is a leader in manufacturing automotive seating systems. It offers a wide range of products including door seals, window seals, and exterior trims, designed to improve vehicle aerodynamics, noise reduction, and weather protection. HUTCHINSON has approximately 40,000 employees spread across 25 countries.

-

Continental AG is a global automotive supplier concentrating in tires, brake systems, and automotive components. The company is renowned for its innovation and technological expertise in developing high-quality sealing solutions that enhance vehicle comfort, safety, and performance. Continental AG has operations in more than 56 countries.

Trelleborg Group and ElringKlinger AG are some of the emerging participants in market.

-

Trelleborg Group is Sweden based manufacturer of engineered polymer solutions. The company is focusing on developing innovative sealing technologies for automotive applications. It provides a range of sealing solutions that enhance vehicle performance, durability, and comfort, including weather strips, window seals, and door seals.

-

ElringKlinger AG is a reliable manufacturer and supplier to the automotive industry. The company has a very diverse product line of plastic housing modules, cylinder-head and specialty gaskets, exhaust gas purification technology, shielding components for engine, exhaust systems and underbody, and fuel cell & battery.

Key Automotive Window And Exterior Sealing System Companies:

The following are the leading companies in the automotive window and exterior sealing system market. These companies collectively hold the largest market share and dictate industry trends.

- HUTCHINSON

- ElringKlinger AG

- Continental AG

- REHAU

- Sika AG

- Trelleborg Group

- Sumitomo Riko Company Limited

- JK Fenner

- Cooper Standard

- Magna International Inc.

Recent Developments

-

In December 2020, Sumitomo Riko Company Limited announced that Toyota Motor Corporation will continue the usage of their fuel cell gaskets in the in the latest fuel cell electric vehicle (FCEV), the "Mirai”. These fuel cell gaskets rubber seal is utilized for improving performance and quality from the previous products. The improvements not only ensure greater comfort and safety but also facilitate more efficient mass production of FCEVs.

Automotive Window And Exterior Sealing System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.85 billion

Revenue forecast in 2030

USD 39.57 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

HUTCHINSON; ElringKlinger AG; Continental AG; REHAU; Sika AG; Trelleborg Group; Sumitomo Riko Company Limited; JK Fenner; Cooper Standard; Magna International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Window And Exterior Sealing System Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive window and exterior sealing system market report based on component, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018-2030)

-

Roof Ditch Molding Seals

-

Door Seals

-

Glass Run Channel Seals

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018-2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive window and exterior sealing system market size was estimated at USD 24.16 billion in 2023 and is expected to reach USD 25.85 billion in 2024.

b. The global automotive window and exterior sealing system market is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030 to reach USD 39.57 billion by 2030.

b. Glass run channels accounted for the largest revenue share of over 45.4% in 2023. Glass run channels are necessary for providing a safe and smooth interface between the vehicle’s window and the door frame, which helps to reduce vibration, road noise, and water ingress. As consumers are increasingly prioritizing a quieter and more refined driving experience, the need for high-quality run channel seals that offer superior noise insulation and weather protection is expected to increase further.

b. Some key players operating in the automotive window and exterior sealing system market include HUTCHINSON, ElringKlinger AG, Continental AG, REHAU, Sika AG, Trelleborg Group, Sumitomo Riko Company Limited, JK Fenner, Cooper Standard, Magna International Inc.

b. The key factors that are driving the market growth are the rising sales and production of vehicles, stringent environmental regulations, and heightened consumer expectations for safety and comfort.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."