- Home

- »

- Automotive & Transportation

- »

-

Automotive Wheels Aftermarket Industry Size Report, 2030GVR Report cover

![Automotive Wheels Aftermarket Industry Size, Share & Trends Report]()

Automotive Wheels Aftermarket Industry Size, Share & Trends Analysis Report By Vehicle Type (Passenger, Commercial), By Material (Alloy, Steel), By Rim Size, By Coating Type, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-843-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

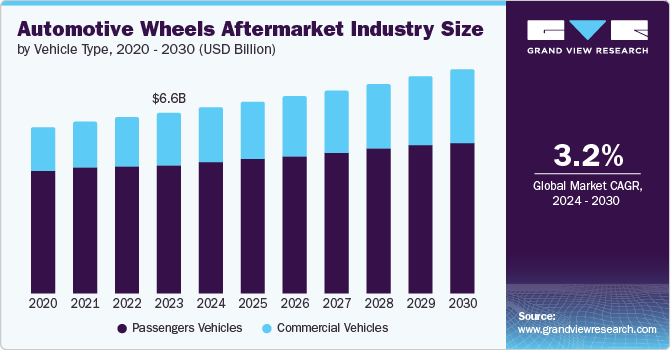

The global automotive wheel aftermarket industry size was valued at USD 6.56 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030. The automotive wheels aftermarket plays a vital role in the automotive industry as it offers vehicle owners a broad alternative for customization with performance enhancement. In the past few years, essential innovations in the automotive wheels aftermarket have evolved the industry. These improvements include enhancements in wheel design, manufacturing procedures, and materials.

The technical innovations in materials and manufacturing methods support manufacturers in including the latest wheel features and designs. The market is implementing new design tools, such as high-strength alloys or other steel materials, to attract customers and comply with contemporary competition. Various automotive accessories or components manufacturing companies invest in improving manufacturing services, resulting in significant market growth during the forecast period.

In addition, consumers are increasingly seeking to personalize their vehicles with unique wheel designs, materials, and finishes, expected to drive the market growth. Furthermore, developing lightweight, high-performance, and aesthetically appealing wheels, such as those made from alloy and carbon fiber, further fuels market growth. The growth of the used car market creates opportunities for aftermarket wheel sales as buyers seek to customize their vehicles.

Moreover, the increasing sales of passenger vehicles and the shifting consumer trends generate a higher demand for performance-based cars. Wheels play an important role in vehicle performance assessment, and it is anticipated that the market is likely to gain an advantage from the rising adoption of electric vehicles (EVs).

Vehicle Type Insights

The passenger vehicle dominated the market and accounted for the largest revenue share of 71.2% in 2023. This growth is attributed to the increased demand by enthusiasts for several passenger vehicles, increased spending power, and shifting trends. In addition, the market is expected to be driven by the higher number of vehicles on the road worldwide due to the increasing population. Furthermore, developing economies in some countries result in increased demand for passenger vehicles, thereby fueling the segment growth.

Commercial vehicles are expected to grow at a CAGR of 5.1% over the projected years. This growth is driven by strength, durability, heavy-duty wheels, and the need to indulge in these properties, mainly in the commercial vehicle segment, as they run for business purposes. Therefore, the requirement for rough and sturdy wheels for undertaking heavy weights and loads in daily commercial uses by trailers, buses, or trucks has greater demand worldwide, which is expected to drive the segment growth in the market.

Material Type Insights

The alloy type led the market with the largest revenue share of 45.0% in 2023. The growth is attributed to its properties, such as being anticorrosive, robust, and light in weight. Wheels made from alloys are also adopted in racing cars for their best-built qualities and for emitting or letting the heat away from tires and brakes. Many companies have increased their R&D and investments in manufacturing and set up plants for alloy wheel manufacturing, which is expected to boost the segment growth over the forecast years.

Aluminum type is expected to grow at a CAGR of 4.9% over the projected years. These wheels are widely adopted in light-duty vehicles and are prevalent in developed countries. In addition, the market is expected to grow with the increasing utility of various material types in dynamic environments. Furthermore, automotive manufacturers are focused on implementing advanced lightweight materials for automotive parts, which is expected to further drive the segment growth.

Rim Size Insights

13 - 19 rim size dominated the market with a significant revenue share of 38.4% in 2023. Wheel rims are essential for improving the driving experience; for instance, lightweight wheel rims improve the vehicle's power-to-weight ratio, enhance driving quality and overall performance, and increase the utilization of designed wheels with suitable size, resulting in market expansion.

The 21 - and above rim size is expected to grow at a CAGR of 5.9% over the forecast years, owing to its wide use in commercial vehicles, including trucks, trailers, vans, heavy trucks, buses, and concrete mixers.

Coating Type Insights

Powdered coating led the market with the largest revenue share of 69.2% in 2023. Its exceptional strength, scratch and abrasion resistance, durability, anti-corrosion properties, and advantages from its minimum emissions by volatile organic compounds (VOCs) drive the growth. Powder coatings are available in various finishes, including glossy, matte, metallic, smooth, and textured. Further, the constant development of powder coating has enabled a robust presence in the automotive industry.

Furthermore, the liquid coating market is expected to grow at a CAGR of 5.4% over the projected years. The liquid coating offers a wide variety of choices, such as liquid paint, which has a wide range of color choices, including metallic and pearls, which gives the product the customer's flair. It is also available in various specialty coats, including glow-in-the-dark and Teflon, and is suitable for specialty markets such as luxury vehicles, customized vehicles, or transportation.

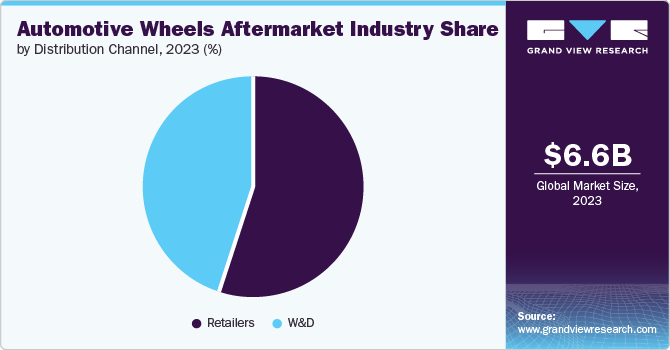

Distribution Channel Insights

Retailers dominated the market and accounted for the largest revenue share of 55.1% in 2023. This growth is attributed to customers relying on retail channels to purchase automotive accessories and parts. Furthermore, the ease of accessibility, availability of various products, and assistance from sales further drive the segment growth. Moreover, countries with developing economies have witnessed growth in purchasing power with increasing incomes, which has also influenced the dominance of this segment for market expansion.

Wholesalers and distributors are expected to grow at a CAGR of 4.5% over the forecast years. They play a significant role in the industry by offering a variety of wheel models to the end customers, such as carbon fiber or aluminum wheels. Furthermore, customers can physically access the items of their choice and seek timely repairs and maintenance to maintain the performance of vehicles.

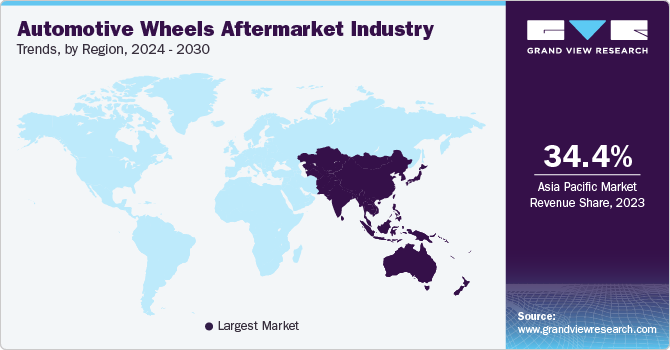

Regional Insights

The North America region automotive wheel aftermarket industry registered a significant revenue share in 2023. This growth is driven by environmental consciousness and a shifting preference for sustainable products, as there is a growing demand for wheels manufactured using eco-friendly techniques. In addition,with the emerging trend for customization and personalization of the market, owners of modern cars desire quality performance and durability in automobiles, which includes customizing their wheels accordingly, thereby driving the growth of the market in the region.

U. S. Automotive Wheels Aftermarket Industry Trends

The automotive wheels aftermarket industry in the U.S. dominated North America and accounted for the largest revenue share of 77.2% in 2023. This growth is attributed to automotive enthusiasts always seeking aftermarket wheels that fulfill their requirements, such as glossy alloy wheels, larger diameter wheels for an eye-catching appearance, or specially designed wheels for off-road experiences. This market's wide variety of designs, finishes, and materials allows vehicle owners to customize, thereby fueling the market expansion.

Asia Pacific Automotive Wheels Aftermarket Industry Trends

The automotive wheel aftermarket industry in Asia Pacific dominated the global market and accounted for the largest revenue share of 34.4% in 2023. This growth is attributed to the availability of skilled labor and technological advances in the automotive industry. In addition, the region's proficiency in precision engineering and innovative manufacturing techniques enables the production of global-standard, high-quality automotive wheels, which is expected to boost the market growth in the region.

China automotive wheels aftermarket industry led the Asia Pacific market and accounted for a significant revenue share in 2023. This growth is driven by favorable government legal aspects and a growing automotive industry, with the strong presence of the automotive manufacturing sector.

The growth of the automotive wheels aftermarket industry in India is driven by various vehicle models and brands, as enthusiasts seek to customize and enhance the aesthetics and performance of their vehicles. Furthermore, the country's evolving and developing economy, with its extensive automobile manufacturing capabilities, technological advances, and expanding market, also contributes to the growth of the market.

Middle East and Africa Automotive Wheels Aftermarket Industry Trends

The Middle East and Africa automotive wheels aftermarket industry is expected to grow at a CAGR of 3.0% over the forecast years. This growth is attributed to the rising demand for exceptionally light commercial vehicles, which is driving increased tire sales. In addition, advancements in tire technology, such as flat-run and budget-friendly nitrogen-based tires, contribute to market expansion. Furthermore, the growing preference for independent aftermarket brands over original equipment fuels the demand for replacement wheels. The region's economic recovery, with higher oil prices, is expected to boost the automotive aftermarket further, including the wheels segment.

Europe Automotive Wheels Aftermarket Industry Trends

The automotive wheels aftermarket industry in Europe is expected to experience substantial growth over the projected years due to innovations in the development of newer products, which have emerged as a trend attaining the rise in the automotive aftermarket industry. In addition, companies execute and conduct research and focus on introducing newer products into the market.

Germany automotive wheels aftermarket industry is expected to witnesssignificant growth, owing to its expertise and strong presence in the automobile industry. Hence, the large sales of passenger cars propel the automotive aftermarket. Furthermore, it is one of the prominent manufacturers of automotive vehicles, and there is always a high demand for automobiles, contributing to the market for replacement automotive parts.

The automotive wheels aftermarket industry in the UK is expected to be driven by the rise in passenger vehicle demand, the execution of advanced technology while fabricating auto parts, and the digitalization of component delivery facilities. In addition, the growth in customer expenditure and the presence of a well-established industry fuel the development of the overall market.

Key Automotive Wheels Aftermarket Company Insights

Some key automotive wheel aftermarket companies include RONAL GROUP, BORBET, Enkei International, Inc., MAXION Wheels, and AEZ Leichtmetallräder GmbH. Key players invest in advanced material technologies to produce lightweight, durable, and visually appealing wheels. In addition, customization is a key focus for companies, allowing them to cater to evolving consumer preferences for personalization. Furthermore, expanding product portfolios and leveraging strong brand recognition and distribution networks also enable these companies to reach a broader customer base and penetrate new markets.

-

BORBET produces light alloy wheels, including premium, classic, sports, commercial wheels, accessories, and merchandise. The company also offers design facilities.

-

Enkei International, Inc. manufactures wheels, mainly aluminum wheels, for sports models. It is also a wholesale distributor of vehicle supplies, components, accessories, tools, and equipment.

Key Automotive Wheels Aftermarket Companies:

The following are the leading companies in the automotive wheel aftermarket industry. These companies collectively hold the largest market share and dictate industry trends.

- RONAL GROUP

- BORBET

- Enkei International, Inc.

- MAXION Wheels

- AEZ Leichtmetallräder GmbH

- BBS Autotechnik GmbH

- Beyern Wheels

- O.Z. S.p.A.

- CMWheels

- Forgiato

Recent Development

-

In March 2023, RONAL Group produced the first light alloy wheels made of wholly recycled aluminum for BMW Group. In addition, they are working to expand their sustainable resources and grow the proportion of recycled materials in manufacturing operations to minimize the company's ecological footprint.

Automotive Wheels Aftermarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.74 billion

Revenue forecast in 2030

USD 8.14 billion

Growth rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, material, rim size, coating type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

RONAL GROUP; BORBET; Enkei International, Inc.; MAXION Wheels; AEZ Leichtmetallräder GmbH; BBS Autotechnik GmbH; Beyern Wheels; O.Z. S.p.A.; CMWheels; Forgiato

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Wheels Aftermarket Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive wheel aftermarket industry report based on vehicle type, material, rim size, coating type, distribution channel, and region:

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passengers Vehicles

-

Commercial Vehicles

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Alloy

-

Steel

-

Aluminum

-

Others

-

-

Rim Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

13 - 19

-

19 - 21

-

21 & Above

-

-

Coating Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Liquid Coating

-

Powdered Coating

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retailers

-

W&D

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U. S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.