- Home

- »

- Automotive & Transportation

- »

-

Automotive Transmission Market Size, Industry Report, 2030GVR Report cover

![Automotive Transmission Market Size, Share & Trends Report]()

Automotive Transmission Market (2025 - 2030) Size, Share & Trends Analysis Report By Transmission (Manual, Automatic), By Fuel (Gasoline, Diesel, Others), By Vehicle (Passenger Cars, LCVs, HCVs), By Region, And Segment Forecasts

- Report ID: 978-1-68038-978-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Transmission Market Summary

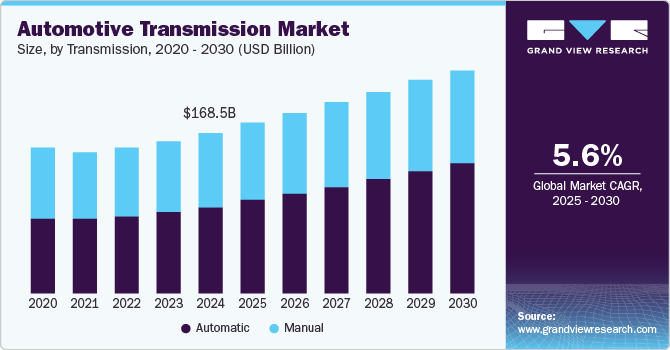

The global automotive transmission market size was valued at USD 168.50 billion in 2024 and is projected to reach USD 234.87 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. This growth is attributable to advancements in automotive transmission technology, which include developing efficient and sophisticated systems such as Dual-Clutch Transmissions (DCT) and Continuously Variable Transmissions (CVT).

Key Market Trends & Insights

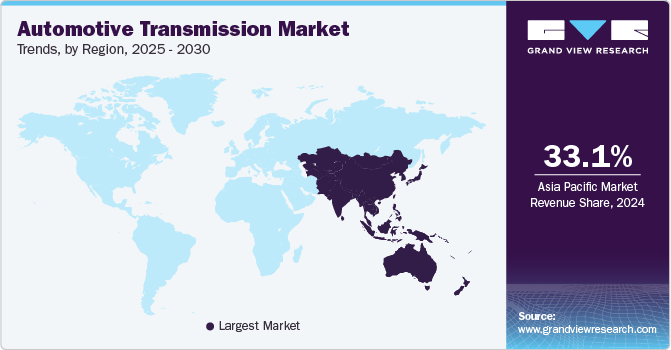

- The Asia Pacific automotive transmission market held the largest revenue share of 33.1% in 2024.

- India is anticipated to experience the fastest growth in the automotive transmission market.

- Based on transmission, the automatic segment led the market with a revenue share of 53.8% in 2024.

- Based on fuel, the gasoline segment dominated the market with a revenue share of 60.29% in 2024.

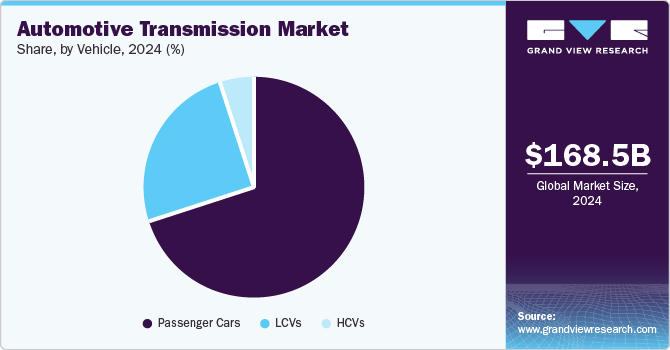

- Based on vehicle,the passenger cars segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 168.50 Billion

- 2030 Projected Market Size: USD 234.87 Billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

These innovations enhance vehicle performance, fuel efficiency, and driving comfort, making modern vehicles more appealing to consumers. In addition, the increasing implementation of stringent emission regulations worldwide compels manufacturers to adopt advanced transmission technologies that can help reduce greenhouse gas emissions while maintaining optimal engine performance.

Another significant factor influencing the automotive transmission market is consumers' rising demand for automatic transmissions. With increasing urbanization and busy lifestyles, drivers prefer convenient, easy-to-use vehicles, especially in crowded cities. Automatic transmissions provide smoother gear shifts and eliminate the need for manual gear changes, making them more attractive to a broader audience. This trend is particularly evident in emerging markets where rising disposable incomes enable more consumers to purchase passenger vehicles equipped with automatic transmission systems.

Consequently, manufacturers focus on producing more automatic transmissions to meet this growing demand. Furthermore, the expansion of electric and hybrid vehicles is reshaping the automotive transmission landscape. As automakers shift toward electrification to comply with environmental standards and cater to changing consumer preferences, there is a notable increase in the development of specialized transmission systems designed for electric powertrains. These systems are essential for optimizing energy efficiency and performance in electric vehicles (EVs) and hybrids. The growing popularity of EVs and advancements in battery technology are expected to drive substantial growth in the automotive transmission industry as manufacturers seek innovative solutions that enhance vehicle capabilities while addressing sustainability concerns.

Transmission Insights

The automatic segment of the automotive transmission industry dominated the market in 2024, with a revenue share of 53.8%. This dominance can be attributed to the growing consumer preference for automatic transmissions due to their ease of use and convenience, especially in urban driving conditions. As more drivers seek comfort and efficiency, manufacturers increasingly focus on developing advanced automatic transmission technologies. In addition, integrating smart technologies in automatic systems will likely enhance performance and appeal to tech-savvy consumers. This trend is expected to continue, further reinforcing the dominance of the automatic segment in the market.

The manual segment of the automotive transmission industry is anticipated to experience a significant CAGR during the forecast period. This growth is attributable to the continued popularity of manual transmissions among driving enthusiasts who value control and engagement while driving. In addition, manual transmissions are often more cost-effective and can provide better fuel efficiency in certain applications. As a result, manufacturers continue to produce manual options to cater to this dedicated market segment. Despite the rise of automatics, the manual segment remains relevant due to its unique advantages and loyal customer base.

Fuel Insights

The gasoline segment dominated the market, with a revenue share of 60.29%. This growth can be attributed to the increasing adoption of gasoline-powered vehicles, which remain popular due to their affordability and widespread availability. This dominance in the fuel market is further reinforced by its easy availability and well-established infrastructure. In addition, the growing demand for personal transportation, particularly in emerging economies, is expected to sustain this segment's growth. As consumers prioritize convenience and cost-effectiveness, gasoline is preferable in vehicles worldwide.

The diesel segment is anticipated to experience a significant CAGR during the forecast period. This growth is attributable to the increasing reliance on Diesel engines in heavy-duty vehicles and industrial applications, where high power output and fuel efficiency are critical. The automotive transmission industry benefits from this trend, as manufacturers continue to develop advanced Diesel transmission systems designed to enhance performance and reduce emissions. Moreover, the expansion of transportation infrastructure, particularly in emerging markets, further drives the demand for Diesel fuel. With businesses prioritizing efficiency and durability, the Diesel segment is expected to remain a substantial component of the transportation landscape.

Vehicle Insights

The passenger cars segment held the largest market share in 2024 within the automotive transmission industry. This growth is driven by the ongoing advancements in automotive technology, particularly in transmission systems that enhance vehicle performance and comfort. The popularity of automatic transmissions, including CVTs and DCTs, has contributed to this dominance, as consumers increasingly favor these options for their efficiency and ease of use. Furthermore, passenger cars represent the largest category in production and sales volume, leading to a higher demand for automotive transmissions than other vehicle segments. As the automotive market continues to evolve, the passenger car segment is expected to maintain its leading position throughout the forecast period.

The HCVs segment is anticipated to experience the fastest CAGR during the forecast period. This growth is attributable to the increasing demand for HCVs due to rising global manufacturing and infrastructure development activities. As economies expand, there is a greater need for efficient transportation solutions to support logistics and supply chains. In addition, advancements in automotive transmission technology, particularly in automatic- and automated-manual transmissions, are enhancing the performance and fuel efficiency of HCVs. This trend is expected to attract more investments and innovations within the automotive transmission industry, further propelling the growth of the HCV segment.

Regional Insights

The North America automotive transmission market is expected to grow significantly over the forecast period. This growth is attributable to the increasing adoption of electrified systems, particularly hybrid vehicles, as consumers prioritize fuel efficiency and reduced emissions. The strong preference for automatic transmissions further supports market expansion, bolstered by advancements in DCT and CVT technologies. In addition, regulatory pressures to meet fuel economy standards are prompting manufacturers to innovate their transmission systems. North America is set to remain a key player in the global automotive transmission landscape.

U.S. Automotive Transmission Market Trends

The U.S. automotive transmission market dominated the regional market in 2024. This growth can be attributed to the high demand for automatic transmissions, as most Americans prefer vehicles equipped with these systems. The passenger vehicle segment is expected to be a significant contributor, accounting for a substantial market share due to the increasing sales of electric and hybrid vehicles. In addition, advancements in transmission technology are enhancing fuel efficiency and performance, further supporting market expansion. As the automotive industry evolves, the U.S. market is expected to experience steady growth in the coming years.

Europe Automotive Transmission Market Trends

The Europe automotive transmission market is expected to grow significantly in 2024. This growth is attributable to technological advancements and increasing demand for efficient transmission systems. In addition, Germany's strong automotive manufacturing sector further thrives on market expansion. The region is also witnessing a shift toward EVs, prompting manufacturers to innovate and adapt their transmission technologies. Furthermore, government regulations aimed at reducing emissions influence the types of transmissions offered in the market. As consumer preferences evolve, the European automotive transmission landscape is set to transform significantly in the coming years.

Asia Pacific Automotive Transmission Market Trends

The Asia Pacific automotive transmission market held the largest revenue share of 33.1% in 2024. This dominance can be attributed to rapid urbanization, rising disposable incomes, and an expanding middle class, leading to increased vehicle ownership and demand for passenger and commercial vehicles. The region is witnessing a strong preference for automatic transmissions due to traffic congestion and the desire for smoother driving experiences. In addition, stringent government regulations to improve fuel efficiency encourage manufacturers to innovate their transmission systems. Countries such as China, India, and Japan significantly contribute to this market growth, reflecting evolving consumer preferences and a shift toward advanced transmission technologies.

India is anticipated to experience the fastest growth in the automotive transmission market over the forecast period. This surge is attributable to increasing urbanization, rising disposable incomes, and a growing consumer preference for automatic transmission vehicles. The market for automatic transmissions is expected to expand significantly as traffic congestion in urban areas makes these systems more appealing for their convenience and ease of use. In addition, technological advancements and a focus on fuel efficiency encourage automakers to innovate their transmission offerings. Consequently, India is expected to contribute significantly to the automotive transmission market's expansion in the coming years.

Key Automotive Transmission Company Insights

Some key companies in the automotive transmission market are AISIN CORPORATION; Allison Transmission, Inc.; BorgWarner Inc.; and Continental AG. These organizations are focusing on expanding their customer base and gaining a competitive edge in the market. In order to achieve this, key players are actively pursuing several strategic initiatives, such as mergers and acquisitions, as well as forming partnerships with other leading companies.

-

AISIN CORPORATION is renowned for its innovative automotive solutions. The company specializes in manufacturing advanced components, including transmissions, braking systems, and engine parts, catering to both traditional and EVs. AISIN integrates cutting-edge technologies into its products, enhancing vehicle performance, safety, and efficiency. Serving global automakers, the company supports the evolving needs of the automotive industry with a focus on sustainability and reliability.

-

Allison Transmission, Inc. is a leading manufacturer of fully automatic transmissions and hybrid propulsion systems for commercial and military vehicles. The company specializes in producing advanced driveline solutions that enhance vehicle performance, reliability, and efficiency. Serving industries such as construction, transportation, and defense, Allison Transmission integrates innovative technologies to meet the evolving demands of its global customer base.

Key Automotive Transmission Companies:

The following are the leading companies in the automotive transmission market. These companies collectively hold the largest market share and dictate industry trends.

- AISIN CORPORATION

- Allison Transmission, Inc.

- BorgWarner Inc.

- Continental AG

- Eaton

- Magna International Inc.

- GKN Automotive Limited (Dowlais Group plc)

- JATCO Ltd

- Schaeffler AG

- ZF Friedrichshafen AG

Recent Development

-

In October 2024, Schaeffler AG completed the acquisition of Vitesco Technologies Group AG, marking a significant consolidation in the automotive transmission market. This merger aimed to create a leading motion technology company, enhancing Schaeffler's capabilities in powertrain technologies, including advanced transmission systems. The integration is expected to drive innovation and collaboration, positioning the combined entity better to meet the evolving demands of the automotive industry.

-

In June 2023, AISIN CORPORATION announced a USD 200 million investment to establish two new production lines at its North Carolina facility. Scheduled to commence in April 2025, the lines will manufacture 30,000 two-motor hybrid transmissions monthly. This initiative aligns with AISIN's electrification strategy and carbon neutrality objectives, incorporating advanced automation and specialized workforce training.

Automotive Transmission Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 178.58 billion

Revenue forecast in 2030

USD 234.87 billion

Growth Rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD thousand and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transmission, fuel, vehicle, region.

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa

Key companies profiled

AISIN CORPORATION; Allison Transmission, Inc.; BorgWarner Inc.; Continental AG; Eaton; Magna International Inc.; GKN Automotive Limited (Dowlais Group plc); Jatco Ltd.; Schaeffler AG; and ZF Friedrichshafen AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Transmission Market Report Segmentation

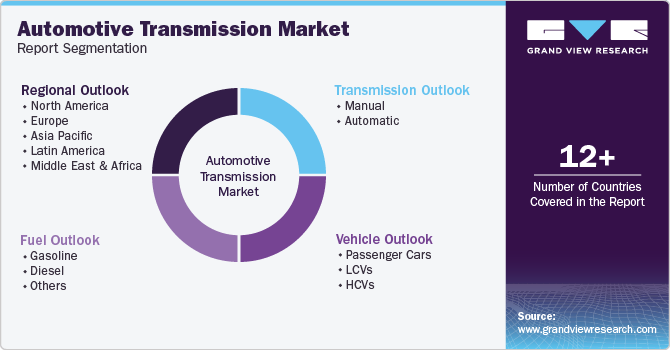

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive transmission market report based on transmission, fuel, vehicle, and region.

-

Transmission Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

Fuel Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Diesel

-

Others

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

LCVs

-

HCVs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.