Automotive Timing Belt Market Size, Share & Trends Analysis Report By Type (Dry Belt, Belt-in-Oil), By Distribution Channel (OEM, Aftermarket), By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-423-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Automotive Timing Belt Market Size & Trends

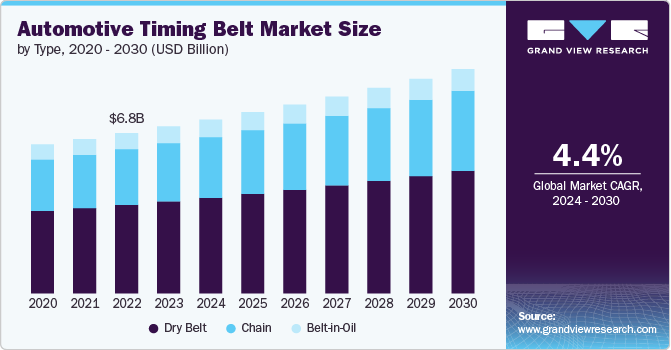

The global automotive timing belt market size was estimated at USD 7.1 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The global automotive timing belt industry is experiencing growth primarily due to the increasing production of vehicles and the rising adoption of direct injection engines. As automotive manufacturers strive to enhance engine performance and efficiency, timing belts play a crucial role in synchronizing engine components, which is essential for optimal functionality.

Moreover, the aftermarket segment is also contributing to market growth, as an expanding vehicle population and increased average miles driven per vehicle lead to a higher frequency of timing belt replacements. This trend underscores the importance of timing belts in vehicle maintenance and repair, solidifying their role in the automotive ecosystem.

Drivers, Opportunities & Restraints

Stricter emission regulations are pushing manufacturers to develop engines that meet higher environmental standards, often leading to the integration of advanced timing belt systems. These regulations compel automotive OEMs to invest in innovative technologies that improve fuel efficiency and reduce emissions, thereby increasing the demand for timing belts.

The rise of Electric vehicles (EVs) poses a restraint to the automotive timing belt market as they do not use timing belts in their powertrains. While hybrid vehicles may still use timing belts in their internal combustion engines, the growing shift toward fully electric vehicles reduces the overall demand for timing belts in the automotive sector.

Innovations in materials, such as the development of high-performance synthetic compounds, enhance the durability and reliability of timing belts, an avenue that can potentially increase their adoption. Improved designs that offer better efficiency and reduced noise can also attract both manufacturers and consumers

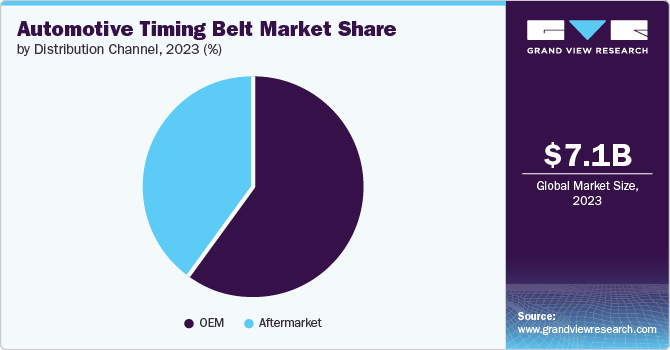

Distribution Channel Insights

“The demand for the aftermarket segment is expected to grow at a rapid CAGR of 4.6% from 2024 to 2030 in terms of revenue”

The OEM segment led the market with the largest revenue share of 60.1% in 2023. In the OEM distribution channel, the growth in automotive production drives demand for timing belts, as manufacturers need reliable components for new vehicles. The integration of the latest technologies and innovations in OEM components also attracts vehicle manufacturers who seek advanced, high-performance parts for their new models.

The aftermarket segment benefits from increased vehicle maintenance and repair needs. As vehicles age, the demand for replacement timing belts grows, driven by routine maintenance and repair requirements. Additionally, the expanding vehicle fleet boosts the need for replacement parts in the aftermarket sector.

Type Insights

“The chain segment is expected to grow at a notable CAGR of 4.7% from 2024 to 2030 in terms of revenue”

The dry belt segment dominated the market with the largest revenue share of 55% in 2023. The segment is driven by its cost-effectiveness and simplicity. Dry belts are typically less expensive to produce and install, making them an attractive choice for both manufacturers and consumers looking for budget-friendly options. Their straightforward design and reliable performance across various engine types further contribute to their popularity.

The chain segment accounted for a 34.9% market share in 2023. For timing chains, durability and longevity are key drivers. Timing chains are known for their extended service life compared to timing belts, making them suitable for high-performance and high-mileage vehicles. Additionally, their low maintenance requirements appeal to users seeking long-term reliability and reduced upkeep costs.

Vehicle Type Insights

“The growth of the light commercial vehicle segment is expected to grow at a significant CAGR of 4.9% from 2024 to 2030 in terms of revenue”

The passenger vehicles segment accounted for the largest revenue share of 65.1% in 2023, driven by high production volumes, both in OEM and aftermarket channels. Additionally, technological advancements in passenger vehicles lead to increased adoption of specialized timing belts that enhance engine performance and efficiency.

In the light commercial vehicle segment, economic growth and the rise in small business activities boost the demand for these vehicles, which in turn drives the need for timing belts. Regular maintenance schedules for light commercial vehicles also contribute to the need for replacement parts in the aftermarket.

Regional Insights

“India to witness fastest market growth at 6.7% CAGR”

North America automotive timing belt market experiences significant growth due to high vehicle ownership rates and a strong aftermarket sector focused on maintenance and repairs. Technological advancements in engine systems and the emphasis on quality and performance drive demand for specialized timing belts. The rise of hybrid vehicles also contributes to steady demand in this region.

Asia Pacific Automotive Timing Belt Market Trends

The automotive timing belt market in Asia Pacific sees growth in the automotive timing belt market driven by rapid economic development and industrialization, leading to increased vehicle production and a growing fleet. The expanding aftermarket services due to rising vehicle ownership and government support for the automotive sector further boost demand. Additionally, the growth of mid-range and premium vehicle segments increases the need for advanced timing belts.

China automotive timing belt market is estimated to grow at 7.8% over the forecast period. China's commitment to achieving carbon neutrality by 2060 and its participation in international agreements like the Paris Agreement signal a long-term strategy to address environmental challenges. This commitment is likely to drive investments in green technologies and remediation practices, as the country seeks to balance economic growth with environmental sustainability.

Europe Automotive Timing Belt Market Trends

The automotive timing belt market in Europe benefits from stringent regulatory standards that promote high-performance vehicle components, including advanced timing belts. The presence of major automotive manufacturers and a robust aftermarket industry support market growth.

Key Automotive Timing Belt Company Insights

Some of the key players operating in the automotive timing belt market include ENTACT and WSP among others.

-

ContiTech Deutschland GmbH, a part of Continental AG, is engaged in the manufacture of automotive timing belts, audio and display technologies, tires, and other products. The company is based in Germany and has a robust global presence with operations in over 40 countries.

-

BorgWarner Inc. is a company involved in the production of automotive components such as timing belts, battery systems, electric drive motors, ignition technologies, and others. The company has a strong global footprint with a presence in Asia, North America, South America, and Europe.

Key Automotive Timing Belt Companies:

The following are the leading companies in the automotive timing belt market. These companies collectively hold the largest market share and dictate industry trends.

- ContiTech Deutschland GmbH

- BorgWarner Inc.

- Schaeffler Technologies AG & Co. KG

- SKF

- NTN Group

- AISIN CORPORATION

- TSUBAKIMOTO CHAIN CO

- JK Fenner

- The Goodyear Tire & Rubber Company

- Gates Corporation

- Dayco Incorporated

- Ningbo GUL TZ Rubber Belt Co., Ltd.

- Toyopower

- BGA (BRITISH GASKETS LIMITED)

- L.G.Balakrishnan & Bros Ltd.

Recent Developments

-

In February 2023, ContiTech Deutschland GmbH announced the introduction of a new generation of polyurethane (PU) timing belts under the Synchromotion name, part of their Truly Endless product line. The polyurethane cover enhances power transmission efficiency compared to other materials. Synchromotion offers eleven profile options, ranging from 1,500 to 14,500 mm in length and up to 100 mm in width.

-

PIX Transmissions Ltd. announced the launch of its PIX-X’tremePro-XTC, a carbon-corded timing belt and an Aramid-corded timing belt called PIX-X’tremePro-XTA especially designed for E-scooters, E-motorcycles, and E-bicycles. They feature specially woven nylon fabric teeth to ensure a silent operation and the extension of product life.

Automotive Timing Belt Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.4 billion |

|

Revenue forecast in 2030 |

USD 9.6 billion |

|

Growth Rate |

CAGR of 4.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, vehicle type, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Country Scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, and UAE |

|

Key companies profiled |

ContiTech Deutschland GmbH; BorgWarner Inc.; Schaeffler Technologies AG & Co. KG; SKF; NTN Group; AISIN CORPORATION; TSUBAKIMOTO CHAIN CO; JK Fenner; The Goodyear Tire & Rubber Company; Gates Corporation; Dayco Incorporated; Ningbo GUL TZ Rubber Belt Co. Ltd.; Toyopower; BGA (BRITISH GASKETS LIMITED); L.G.Balakrishnan & Bros Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Timing Belt Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive timing belt market report based on type, distribution channel, vehicle type, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dry Belt

-

Chain

-

Belt-in-Oil

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Vehicle Type (Revenue, USD Billion, 2018 - 2030)

-

Passenger Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive timing belt market size was estimated at USD 7.1 billion in 2023 and is expected to reach USD 9.6 billion in 2024.

b. The global automotive timing belt market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 9.6 billion by 2030.

b. The OEM segment dominated the market in 2023 accounting for 60.1% of the market share in 2023 driven by increase in the volume of automotive production and technological innovation.

b. Some of the key players operating in the automotive timing belt market include ContiTech Deutschland GmbH, BorgWarner Inc., Schaeffler Technologies AG & Co. KG, SKF, NTN Group, AISIN CORPORATION, TSUBAKIMOTO CHAIN CO, JK Fenner, The Goodyear Tire & Rubber Company, Gates Corporation, Dayco Incorporated, Ningbo GUL TZ Rubber Belt Co., Ltd., Toyopower, BGA (BRITISH GASKETS LIMITED), and L.G.Balakrishnan & Bros Ltd.

b. The Automotive Timing Belt market is driven by advancements in technology, increasing production and sale of automotives, regulatory pressure on safety across various nations, and increase in aftermarket sales.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."