- Home

- »

- Homecare & Decor

- »

-

Automotive Sun Visor Market Size, Industry Report, 2030GVR Report cover

![Automotive Sun Visor Market Size, Share & Trends Report]()

Automotive Sun Visor Market Size, Share & Trends Analysis Report By Vehicle (Passenger, Commercial), By Material (Fabric, Vinyl), By Component (Conventional, LCD), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-486-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Automotive Sun Visor Market Size & Trends

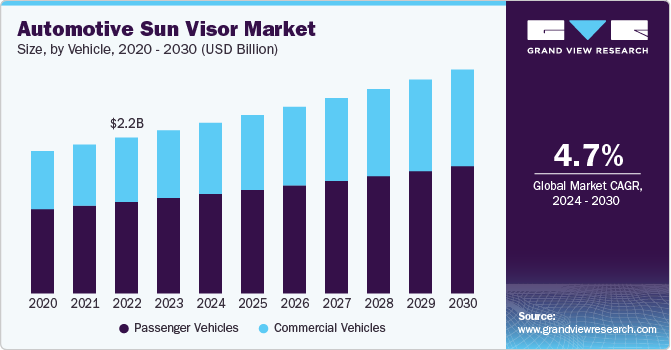

The global automotive sun visor market size was estimated at USD 2.35 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030. One of the primary drivers of the market is the consistent growth in vehicle production and sales globally. As more vehicles are manufactured, the demand for essential components like sun visors naturally increases. The automotive sector is particularly booming in emerging markets, where rising disposable incomes and urbanization are leading to higher vehicle ownership rates. This trend is evident in regions such as Asia-Pacific, where countries like China and India are witnessing rapid growth in automobile production, further boosting the demand for sun visors across various vehicle segments.

Another critical factor influencing the market is the implementation of stricter safety regulations by governments worldwide. Regulatory bodies are increasingly mandating high-quality sun visors that effectively reduce glare and enhance driver visibility to mitigate accident risks. As a result, automotive manufacturers are compelled to integrate advanced sun visor solutions into their vehicles to comply with these safety standards. This regulatory push not only drives demand but also encourages innovation in sun visor designs, leading to the development of more effective and multifunctional products.

Consumer preferences have shifted towards vehicles that offer enhanced comfort and convenience features. Modern sun visors have evolved from basic fold-down shades to multifunctional components equipped with features such as vanity mirrors, integrated lighting, and adjustable tints. This evolution caters to consumer demands for improved driving experience and aesthetic appeal within vehicle interiors. As consumers increasingly prioritize comfort in their vehicle choices, the demand for high-quality sun visors that offer both functionality and style continue to rise.

The integration of smart technologies into automotive components is another significant driver of the sun visor market. Innovations such as LCD sun visors that allow for adjustable tint levels controlled electronically are gaining popularity, particularly in luxury vehicles. These advanced features not only enhance user experience but also align with consumer expectations for modern technological solutions in their vehicles. As manufacturers invest in R&D to develop smarter sun visor options, this segment is expected to see substantial growth, further expanding the overall market.

The increasing adoption of electric vehicles presents new opportunities for the market. As EVs often feature modern designs and advanced technology, there is a growing demand for customized sun visors that complement these vehicles' aesthetics and functionalities. The emphasis on energy efficiency and innovative designs in the EV sector encourages manufacturers to create specialized sun visors that cater to this burgeoning market segment. This trend not only supports the growth of the sun visor market but also aligns with broader sustainability goals within the automotive industry.

Regional dynamics significantly influence the market growth trajectory. The Asia-Pacific region is anticipated to dominate this market due to its robust automotive industry and high vehicle production rates. Countries like China, India, and Japan are pivotal players driving demand through increased automobile manufacturing and consumer preferences for high-quality interiors. Meanwhile, regions such as North America and Europe are also seeing growth driven by premium vehicle sales and stringent safety regulations. Understanding these regional trends allows manufacturers to tailor their offerings effectively and capitalize on emerging opportunities across different markets.

The market faces several challenges that impact its growth and development. One of the primary challenges in the automotive sun visor market is the volatility in raw material prices. Sun visors are typically made from materials such as vinyl, fabric, and various plastics, which are subject to price fluctuations due to global supply chain dynamics, geopolitical tensions, and environmental regulations. For instance, recent conflicts, such as the war in Ukraine, have disrupted access to essential materials like steel and aluminum, leading to increased costs for manufacturers. These rising costs can squeeze profit margins and may result in higher prices for consumers, potentially affecting demand.

Consumer expectations for automotive components are continually rising, particularly regarding comfort, aesthetics, and functionality. Modern drivers expect sun visors to offer more than just basic sun protection; they desire features such as integrated lighting, vanity mirrors, and even smart functionalities like auto-dimming capabilities. Meeting these expectations while maintaining affordability poses a significant challenge for manufacturers who must balance innovation with cost-effectiveness.

Vehicle Insights

Passenger vehicle sun visor was the largest product category for the market with revenue of USD 1.06 billion in 2023. The market for passenger cars is primarily driven by the increasing emphasis on safety and comfort. Sun visors play a crucial role in mitigating glare from sunlight, which can significantly impair driver visibility and lead to accidents. As vehicle manufacturers focus on enhancing safety features, the demand for effective sun visors has risen. Modern sun visors are designed not only to block sunlight but also to protect occupants from harmful ultraviolet (UV) rays, thus contributing to overall health and safety during travel. The growing awareness of these safety benefits among consumers further propels the demand for high-quality sun visors in passenger vehicles.

Another significant driver is the rising consumer expectations for vehicle aesthetics and functionality. Today's consumers are looking for more than just basic components; they desire products that enhance their driving experience. This trend has led manufacturers to innovate and incorporate features such as integrated mirrors, lighting, and adjustable designs in sun visors. These enhancements not only improve usability but also align with the modern interior design of vehicles, making sun visors a critical component in achieving a cohesive and appealing cabin environment. The focus on aesthetics is particularly pronounced in the luxury vehicle segment, where consumers expect premium materials and advanced functionalities.

Lastly, the growing production of passenger vehicles globally is a fundamental driver of the sun visor market. As countries, particularly in the Asia-Pacific region, ramp up automobile manufacturing to meet rising consumer demand, the need for essential components like sun visors increases correspondingly. The expansion of the middle class in emerging economies leads to higher vehicle ownership rates, further boosting the market. Additionally, as manufacturers strive to meet stricter safety regulations and consumer preferences for comfort and design, investments in sun visor technology and innovation are likely to continue growing, ensuring that this component remains integral to modern passenger vehicles.

Demand for sun visor in commercial vehicles is expected to grow at a CAGR of 5.2% from 2024 to 2030. Commercial drivers often spend long hours on the road, making glare reduction a critical factor in enhancing visibility and minimizing distractions. Sun visors serve as essential components that help mitigate the sun's glare, which can lead to accidents. With the rising awareness of safety standards and regulations, manufacturers are compelled to integrate effective sun visor solutions into their commercial vehicles, ensuring that they meet both regulatory requirements and the practical needs of drivers. This focus on safety not only protects drivers but also contributes to the overall efficiency of commercial operations by reducing the likelihood of accidents caused by impaired visibility.

Another important driver is the growing demand for advanced features and technology in commercial vehicles. As industry evolves, there is a noticeable shift towards incorporating innovative technologies that enhance functionality and user experience. For instance, advancements such as LCD sun visors that can adjust tint levels electronically are becoming more appealing to fleet operators looking to improve driver comfort and reduce fatigue during long hauls. Additionally, features like integrated mirrors and ergonomic designs are increasingly being favored in commercial vehicle interiors. This trend reflects a broader movement towards modernizing commercial vehicles, where sun visors play a crucial role in ensuring that drivers have access to tools that enhance their overall driving experience while maintaining safety standards.

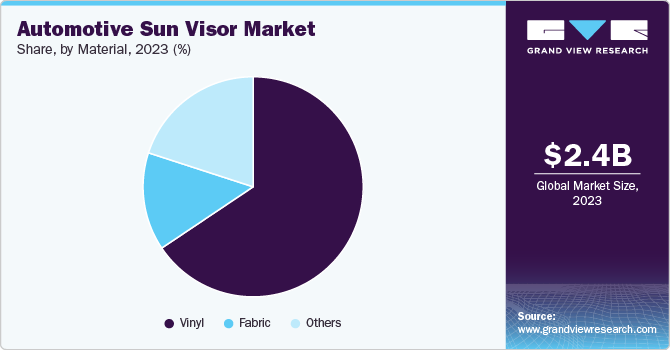

Material Insights

Vinyl was the preferred packaging form for automotive sun visors and accounted for a market share of over 60% in 2023. One of the primary drivers for the increasing popularity of vinyl sun visors is their cost-effectiveness compared to fabric alternatives. Vinyl materials are generally less expensive to produce and install, making them an attractive option for manufacturers looking to maintain competitive pricing in a cost-sensitive market. This affordability appeals not only to manufacturers but also to consumers who are often budget-conscious, particularly in the mid-range vehicle segment. As the demand for economical automotive solutions continues to rise, vinyl sun visors are positioned as a practical choice that meets both quality and price expectations.

Vinyl sun visors are known for their durability and low maintenance requirements. Unlike fabric visors, which may wear out or stain over time, vinyl is resistant to spills and easier to clean, ensuring that the interior of the vehicle remains visually appealing over its lifespan. This durability translates into a longer product life, reducing the need for frequent replacements. As vehicle owners increasingly prioritize longevity and ease of care in their automotive accessories, the appeal of vinyl sun visors continues to grow, reinforcing their market position. The overall growth in vehicle production, particularly in emerging markets, also contributes significantly to the demand for vinyl sun visors.

As global automobile manufacturing ramps up, driven by rising consumer purchasing power and urbanization trends, the need for essential components like sun visors increases correspondingly. Vinyl's advantages in terms of cost and durability make it a preferred choice among manufacturers aiming to equip a wide range of vehicles efficiently. The anticipated rise in vehicle sales across various segments further supports the sustained demand for vinyl sun visors, solidifying their role in modern automotive design.

The market for alternate sun visors apart from vinyl and fabric is expected to grow at a CAGR of 4.8% from 2024 to 2030. One of the primary reasons for the growth of other sun visor materials, such as recycled plastics and lightweight composites, is the ongoing innovation in materials and design. Manufacturers are increasingly exploring advanced materials that not only enhance the aesthetic appeal of vehicles but also offer improved durability and functionality. For instance, recycled plastics are gaining traction as they align with sustainability goals, allowing manufacturers to reduce their environmental footprint while providing a robust product. These innovative materials can be designed to be lighter, which contributes to overall vehicle efficiency by reducing weight and improving fuel economy. As consumers become more environmentally conscious, the demand for eco-friendly sun visor options is expected to rise.

Technological advancements are also driving the adoption of alternative sun visor materials. The integration of features such as LCD screens and augmented reality (AR) displays within sun visors is becoming increasingly popular, particularly in premium vehicles. These advanced visors can provide real-time information, navigation assistance, and entertainment options, enhancing the overall driving experience. The materials used for these high-tech visors need to meet specific performance criteria, such as transparency, flexibility, and durability, leading manufacturers to explore new options beyond traditional vinyl and fabric. This shift towards smart technology in vehicles is likely to continue propelling the growth of innovative sun visor materials.

As urbanization accelerates and commute times increase, there is a growing demand for sun visors that enhance driver comfort during extended periods on the road. This trend has led to the development of adjustable sun visors made from alternative materials that provide better shading capabilities and reduce glare more effectively than standard options. Features like adjustable extensions or advanced shading technologies are becoming essential for urban commuters who spend significant time in their vehicles. Consequently, manufacturers are responding to this demand by incorporating new materials that improve comfort and usability, thus driving growth in this segment of the sun visor market.

Component Insights

Conventional sun visor was the largest type with a market size of USD 1 billion in 2024. The growth of conventional sun visors in the automotive market is primarily driven by their cost-effectiveness and practicality. Conventional sun visors are typically made from affordable materials such as vinyl and fabric, which makes them an economic choice for manufacturers. As vehicle production continues to rise globally, particularly in emerging markets, the demand for budget-friendly components like sun visors increases. This affordability appeals not only to manufacturers looking to keep costs low but also to consumers who prioritize value in their vehicle purchases. The simplicity and functionality of conventional sun visors further enhance their attractiveness, ensuring they remain a staple in both passenger and commercial vehicles.

Another significant driver for the growth of conventional sun visors is the increasing focus on safety features in vehicles. Sun visors play a crucial role in reducing glare from sunlight, which can impair driver visibility and lead to accidents. As automotive safety regulations become more stringent, manufacturers are compelled to incorporate effective sun visor solutions that meet these requirements. The emphasis on enhancing driver and passenger safety has led to a greater appreciation for conventional sun visors, which provide reliable glare protection without the complexity of advanced technologies. This focus on safety not only drives demand but also encourages manufacturers to innovate within the conventional visor segment.

Additionally, the growing consumer preference for comfort and convenience has spurred the development of conventional sun visors with enhanced features. Modern consumers expect more from their vehicle interiors, and sun visors have evolved from basic fold-down shades to multifunctional components that may include integrated mirrors, lighting, and adjustable designs. These enhancements cater to the desire for a more enjoyable driving experience while maintaining the core functionality of glare reduction. As manufacturers respond to these changing consumer expectations by improving conventional sun visor designs, this segment is likely to see sustained growth in the automotive market, reinforcing its importance in vehicle interiors.

The LCD sun visor is expected to grow at a CAGR of 5.1% from 2024 to 2030. The growth of LCD sun visors in the automotive market is significantly driven by the increasing demand for advanced safety features. Traditional sun visors often struggle to adequately block glare without obstructing the driver’s view, which can lead to accidents. In contrast, LCD sun visors utilize liquid crystal technology that allows for adjustable tint levels, enabling them to dynamically adapt to changing light conditions. This innovative approach enhances driver’s visibility and comfort by selectively blocking sunlight while maintaining a clear line of sight to the road. As safety regulations become more stringent and consumers prioritize features that enhance driving safety, the adoption of LCD sun visors is expected to grow.

Another key driver for the growth of LCD sun visors is the rising consumer preference for technology and convenience in vehicles. Modern drivers increasingly expect their vehicles to be equipped with smart technologies that improve their overall driving experience. LCD sun visors offer features such as automatic adjustment based on sunlight intensity and integration with vehicle systems for enhanced functionality. For instance, some advanced models incorporate sensors and cameras that detect sunlight and adjust the visor's tint, accordingly, providing a tailored solution to glare reduction. This alignment with consumer expectations for convenience and high-tech features makes LCD sun visors an attractive option for manufacturers looking to differentiate their products in a competitive market.

Additionally, the growing trend toward electric vehicles (EVs) is contributing to the demand for LCD sun visors. As EVs often come equipped with cutting-edge technology and design elements, consumers are more inclined to seek out innovative components that match their vehicle’s modern aesthetic and functionality. LCD sun visors fit well within this context, offering a sleek design while providing enhanced glare protection. The increasing production of EVs worldwide creates fertile ground for the adoption of advanced sun visor technologies, as manufacturers aim to meet the expectations of environmentally conscious consumers who also value innovation in their automotive experiences. As this trend continues, the market for LCD sun visors is likely to expand significantly.

Regional Insights

North America was the largest automotive sun visor market and is expected to account for nearly USD 0.95 billion in 2023. One of the primary drivers for the sun visor market in North America is the steady increase in vehicle production and sales. The region has a well-established automotive industry, with major manufacturers consistently rolling out new models. This growth is not limited to traditional passenger vehicles; it also includes light commercial vehicles (LCVs) and electric vehicles (EVs). As more vehicles are produced, the demand for essential components such as sun visors naturally rises. Additionally, the growing popularity of SUVs and trucks, which often come equipped with advanced features, further propels the market for high-quality sun visors that enhance both comfort and safety.

U.S. Automotive Sun Visor Market Trends

The U.S. sun visor market is expected to reach USD 0.85 billion by 2030. A significant driver is the stringent safety regulations imposed by governments and regulatory bodies in the U.S. These regulations require that vehicles be equipped with effective sun visors to mitigate glare, which is a major cause of accidents. As manufacturers strive to comply with these safety standards, there is an increasing demand for high-quality sun visors that effectively block sunlight and improve driver visibility. The emphasis on safety not only drives demand but also encourages innovation within the sun visor segment, leading to advancements such as LCD visors that offer adjustable tint levels for enhanced glare protection.

Consumer preferences in the U.S. have shifted towards vehicles that offer enhanced comfort and aesthetic appeal. Modern drivers expect more from their vehicle interiors, including multifunctional components like sun visors equipped with features such as integrated mirrors, lighting, and adjustable designs. This trend reflects a broader consumer desire for personalized driving experiences that prioritize comfort and usability. As manufacturers respond to these evolving expectations by improving sun visor designs and incorporating advanced materials, the market for automotive sun visors in the U.S. is likely to continue expanding, driven by both functionality and style.

Asia Pacific Automotive Sun Visor Market Trends

The Asia Pacific sun visor market is expected to grow at a CAGR of 6.5% from 2024 to 2030. One of the main drivers is the rapid urbanization and increasing vehicle production in these countries. As urban populations grow, so does the demand for personal and commercial vehicles. In China, for instance, the automotive industry is booming, with the country being one of the largest car manufacturers globally. This growth is fueled by rising disposable incomes and a growing middle class that seeks personal vehicles for convenience and mobility. The increased vehicle production directly correlates with a higher demand for essential components like sun visors, which enhance driver comfort and safety by reducing glare.

The growing adoption of electric vehicles (EVs) in Asia-Pacific, particularly in China, is also a crucial driver for the sun visor market. The Chinese government actively promotes EV usage through incentives and subsidies, leading to a surge in electric vehicle production. These vehicles often feature modern designs and advanced technologies, creating a demand for high-quality, customizable sun visors that complement their interiors. As manufacturers focus on producing premium automotive components to cater to this evolving market segment, the demand for innovative sun visor solutions that enhance both functionality and aesthetics is expected to rise significantly.

Key Automotive Sun Visor Company Insights

The market is characterized by a diverse landscape of companies that are actively engaged in the design, manufacturing, and Component of sun visors for various vehicle types. This market is witnessing significant growth due to rising consumer demand for enhanced safety features, comfort, and the integration of advanced technologies. Key players in this industry are focusing on innovation and strategic partnerships to maintain competitive advantages and respond to evolving market trends. Several prominent companies dominate the market, including Irvin Automotive Products, Inc., Grupo Antolin, KASAI KOGYO CO., LTD., and IAC Group. These companies are recognized for their extensive product portfolios that include conventional sun visors, LCD visors, and other innovative solutions tailored to meet the needs of both passenger and commercial vehicles.

Key Automotive Sun Visor Companies:

The following are the leading companies in the automotive sun visor market. These companies collectively hold the largest market share and dictate industry trends.

- Irvin Automotive Products, Inc.

- Grupo Antolin

- GUMOTEX

- KASAI KOGYO CO., LTD.

- Atlas Holdings

- FOMPAK

- Hayashi Telempu Corporation

- Benecke-Kaliko AG

- BRACE

- Grios s.r.o.

- BURSA OTOTRIM PANEL SANAYI VE TICARET A.S.

- ContiTech AG

- Magna International Inc.

- ACME Specialty Manufacturing

- Mirror Lite Company, Inc.

Automotive Sun Visor Industry Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.46 billion

Revenue forecast in 2030

USD 3.25 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, Material, Component, Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Saudi Arabia

Key companies profiled

Irvin Automotive Products, Inc.; Grupo Antolin; GUMOTEX; KASAI KOGYO CO., LTD.; Atlas Holdings; FOMPAK; Hayashi Telempu Corporation; Benecke-Kaliko AG; BRACE; Grios s.r.o.; BURSA OTOTRIM PANEL SANAYI VE TICARET A.S.; ContiTech AG; Magna International Inc.; ACME Specialty Manufacturing; Mirror Lite Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Sun Visor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive sun visor market report on the basis of vehicle, material, component, and region.

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fabric

-

Vinyl

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional

-

LCD

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global automotive sun visor market was valued at USD 2.35 billion in 2023 and is expected to reach USD 2.46 billion in 2024.

b. The global automotive sun visor market is expected to grow at a CAGR of 4.7% from 2024 to 2030 to reach USD 3.25 billion by 2030.

b. Passenger vehicle sun visor was the largest product category for the market with revenue of USD 1.06 billion in 2023. The automotive sun visor market for passenger cars is primarily driven by the increasing emphasis on safety and comfort. Sun visors play a crucial role in mitigating glare from sunlight, which can significantly impair driver visibility and lead to accidents.

b. Some key players operating in the automotive sun visor market include Irvin Automotive Products, Inc.; Grupo Antolin; GUMOTEX; KASAI KOGYO CO., LTD.; Atlas Holdings; FOMPAK; Hayashi Telempu Corporation; Benecke-Kaliko AG; BRACE; Grios s.r.o.; BURSA OTOTRIM PANEL SANAYI VE TICARET A.S.; ContiTech AG; Magna International Inc.; ACME Specialty Manufacturing; Mirror Lite Company, Inc.

b. One of the primary drivers of the automotive sun visor market is the consistent growth in vehicle production and sales globally. As more vehicles are manufactured, the demand for essential components like sun visors naturally increases. The automotive sector is particularly booming in emerging markets, where rising disposable incomes and urbanization are leading to higher vehicle ownership rates. This trend is evident in regions such as Asia-Pacific, where countries like China and India are witnessing rapid growth in automobile production, further boosting the demand for sun visors across various vehicle segments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."