- Home

- »

- Advanced Interior Materials

- »

-

Automotive Steel Wheels Market Size & Share Report, 2030GVR Report cover

![Automotive Steel Wheels Market Size, Share & Trends Report]()

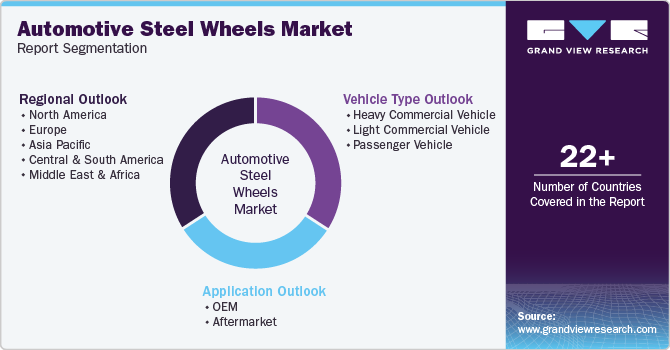

Automotive Steel Wheels Market Size, Share & Trends Analysis Report By Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, Passenger Vehicle), By Application (OEM, Aftermarket), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-432-3

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Automotive Steel Wheels Market Trends

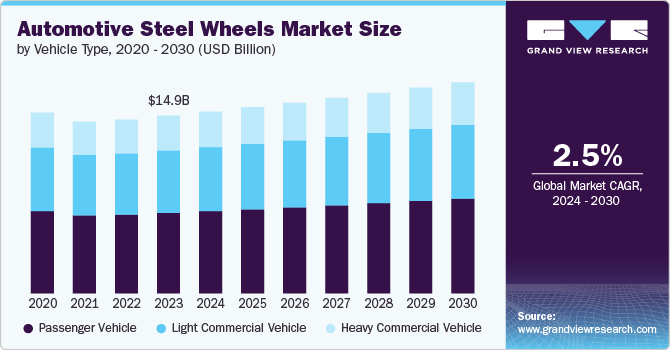

The global automotive steel wheels market size was estimated at USD 14.94 billion in 2023 and is forecasted to grow at a CAGR of 2.5% from 2024 to 2030. Global automotive steel wheels market is primarily driven by cost-effectiveness. Steel wheels are more affordable to produce compared to alloy wheels, making them a popular choice in markets where price sensitivity is a significant factor. The well-established manufacturing processes allow for large-scale production at lower costs, which appeals to both budget-conscious consumers and automakers focused on economy models. This affordability is especially crucial in developing economies where consumers prioritize initial purchase costs.

The growth of this automotive industry is having a direct and significant impact on this demand for automotive steel wheels. As global automotive market expands, driven by increased vehicle production, especially in emerging economies, the need for reliable and cost-effective components such as steel wheels is rising. This is particularly true in regions such as Asia Pacific, where rapid urbanization and industrialization are fueling demand for both passenger and commercial vehicles. As more vehicles are manufactured, industry demand for steel wheels, known for their affordability and durability, increases in parallel.

Durability and strength also play a critical role in driving industry demand for steel wheels. Known for their robustness, steel wheels can withstand harsh driving conditions, including rough terrains and heavy loads, making them ideal for both passenger and commercial vehicles. Their resistance to damage and longer lifespan under stress makes them a preferred choice in environments where reliability is essential, particularly in heavy-duty applications.

In addition, the growing demand in emerging markets significantly boosts global automotive steel wheels market. Regions such as Asia Pacific and Latin America are experiencing rapid growth in vehicle production and sales. The economic advantages of steel wheels, combined with their durability, make them particularly well-suited for these expanding markets, where there is a rising need for cost-effective, reliable automotive components.

Another critical aspect is the focus on economy and compact segments within the automotive industry. These vehicle segments are typically more price-sensitive, making steel wheels an attractive option for manufacturers aiming to keep production costs low while meeting consumer demand. Steel wheels offer a balance between cost, performance, and durability, which is particularly important in markets where consumers prioritize affordability. As automakers continue to expand their offerings in the economy segment to cater to a broader customer base, the demand for steel wheels is expected to grow correspondingly.

In addition to new vehicle production, the replacement market also plays a significant role in driving the demand for automotive steel wheels. Vehicles that operate in tough conditions, such as those used in rural areas or for commercial purposes, often require more frequent wheel replacements. The robust nature of steel wheels makes them a preferred choice for such applications, further contributing to the growing demand. As the global automotive fleet expands, the aftermarket for replacement parts, including wheels, is also expected to grow, reinforcing their importance in the automotive industry.

Vehicle Type Insights

Based on vehicle type, this market is segmented into heavy commercial vehicle, light commercial vehicle, and passenger vehicles. Among these, passenger vehicles dominated this market with a revenue share of 45.3% in 2023 and is further expected to grow at a significant rate over forecast period. The rising demand for passenger vehicles is a key factor driving the growth of global automotive wheels market. As economies develop and urbanization increases, particularly in emerging markets such as China and India, more people are gaining access to higher disposable incomes. This has led to a surge in car ownership, particularly among the expanding middle class, who often prioritize affordability and durability when purchasing vehicles. Steel wheels, being more cost-effective and robust compared to alloy wheels, are the preferred choice for many manufacturers targeting these markets.

In addition, automotive industry is seeing a significant increase in the production of economy and compact cars, which are particularly popular among first-time buyers and those looking for affordable transportation options. These vehicles typically come equipped with steel wheels as a standard feature, due to their lower production cost and reliability. As the demand for passenger vehicles continues to grow, particularly in regions where cost is a critical factor, the demand for steel wheels rises correspondingly. This trend is expected to sustain the growth of the automotive wheels market as more consumers enter the car market, particularly in developing regions.

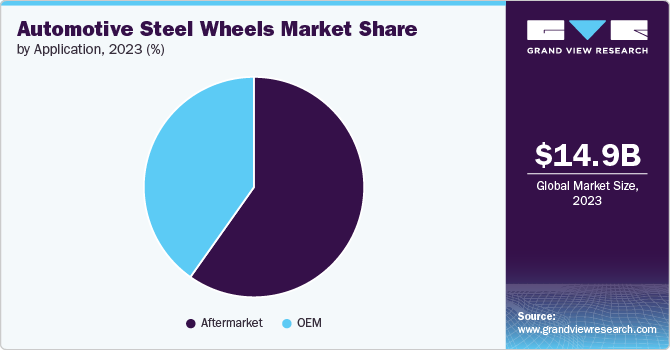

Application Insights

On the basis of application, aftermarket application accounted for the major industry share of 59.8% in 2023 and is further expected to grow at a significant rate over forecast period. One of the primary reasons for this is the need for replacement due to wear and tear. Steel wheels are commonly used in vehicles that operate under challenging conditions, such as rough roads or harsh weather, where they endure significant stress.

Over time, even these durable wheels can suffer damage or degradation, leading to a consistent demand for replacements. This need is particularly strong in regions with poor road infrastructure or where vehicles are used for heavy-duty purposes, ensuring a steady flow of aftermarket sales.

Regional Insights

Asia Pacific dominated this market with a revenue share of 47.5% in 2023. The demand for automotive steel wheels is growing in the Asia Pacific region largely due to rapid urbanization and economic expansion. Countries such as China and India are seeing significant economic growth, which has led to the rise of a larger middle class with increasing disposable income. This economic shift is driving higher vehicle sales, particularly in the budget and economy segments, where steel wheels are commonly used due to their cost-effectiveness and durability. As more people in these countries can afford to buy cars, the demand for affordable and reliable components such as steel wheels continues to rise.

Europe Automotive Steel Wheels Market Trends

Europe has a significant number of older vehicles on the road, creating a strong demand for replacement parts. As these vehicles age, the need for cost-effective replacements such as metal wheels increases. Europe's emphasis on sustainability and recycling aligns with the use of steel wheels, as they are fully recyclable. This environmental consideration supports the ongoing demand for steel wheels in the European market.

North America Automotive Steel Wheels Market Trends

In North America, the demand for automotive steel wheels is driven by trends in vehicle preferences and cost considerations. This region's growing preference for trucks and SUVs, which require durable components to handle heavy loads and rugged performance, boosts the demand for this product. These wheels are well-suited for the heavy-duty requirements of such vehicles.

Key Automotive Steel Wheels Company Insights

Some of the key players operating in the market include Central Motor Wheel of America, Inc. and Carlstar Group LLC

-

Carlstar Group LLC, headquarterd in the U.S., is a global supplier of specialty tires and wheels serving the agricultural, industrial, lawn & garden, powersports, and high-speed trailer markets. This company employs over 3,400 associates in 17 facilities located in four countries.

-

Central Motor Wheel of America, Inc. , headquartered in Paris, France, was founded in 1986 and is involved in manufacturing and provision of high quality and innovative automotive wheels. Some of the major product categories catered by this player include steel wheels and aluminum wheels.

Steel Strips Wheels Ltd is one of the emerging participants in this market.

- Steel Strips Wheels Ltd is an emerging Wheel Manufacturing industry, with plants all over India. This company design & manufactured automotive steel wheels & alloy wheels and is among the major supplier to Indian & Global Automobile Manufacturers. This company caters to steel wheels for two and three wheelers, passenger cars, multi utility vehicles, tractors, trucks & OTR vehicles.

Key Automotive Steel Wheels Companies:

The following are the leading companies in the automotive steel wheels market. These companies collectively hold the largest market share and dictate industry trends.

- THE CARLSTAR GROUP, LLC.

- Automotive Wheels Ltd

- Central Motor Wheel of America, Inc.

- ALCAR WHEELS GMBH

- TOPY AMERICA, INC.

- CLN Coils Lamiere Nastri SpA

- Klassic Wheels Limited Accuride Corporation

- Steel Strips Group

- MAXION Wheels

- Thyssenkrupp AG

- U.S. WHEEL CORP.

Recent Developments

-

In September 2021, Maxion Wheels announced newest truck steel wheels plant with partner Inci Holding, is ready to open in Turkey. This initiative has a combined investments of about USD 150 million from 2021 through 2025, over the next few years, and further enhance Maxion Wheels’ existing globally leading steel wheel portfolio, while extending its reach to commercial vehicle applications where aluminum is the preferred solution.

Automotive Steel Wheels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.29 billion

Revenue forecast in 2030

USD 17.75 billion

Growth rate

CAGR of 2.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, application, region

Regional scope

North America, Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

THE CARLSTAR GROUP, LLC.; Automotive Wheels Ltd; Central Motor Wheel of America, Inc.; ALCAR WHEELS GMBH; TOPY AMERICA, INC.; CLN Coils Lamiere Nastri SpA; Klassic Wheels Limited Accuride Corporation; Steel Strips Group; MAXION Wheels; Thyssenkrupp AG; U.S. WHEEL CORP.

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Steel Wheels Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global automotive steel wheels market on the basis of vehicle type, application, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy Commercial Vehicle

-

Light Commercial Vehicle

-

Passenger Vehicle

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global automotive steel market size was estimated at USD 14.94 billion in 2023 and is expected to reach USD 15.29 billion in 2024.

b. The global automotive steel wheels market is expected to grow at a compound annual growth rate (CAGR) of 2.5% from 2024 to 2030 to reach USD 17.75 billion by 2030.

b. Passenger vehicles accounted for the largest revenue share of over 45.3% in 2023. This is attributed to the growing disposable income in the developing countries.

b. Some key players operating in the automotive steel wheels market include THE CARLSTAR GROUP, LLC., Automotive Wheels Ltd, Central Motor Wheel of America, Inc., ALCAR WHEELS GMBH, TOPY AMERICA, INC., CLN Coils Lamiere Nastri SpA, Klassic Wheels Limited Accuride Corporation, Steel Strips Group, MAXION Wheels, Thyssenkrupp AG and U.S. WHEEL CORP.

b. The key factors that are driving the market growth is the growing demand for passenger vehicles among middle income population groups.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."