Automotive Smart Display Market Size, Share & Trends Analysis Report By Display Size (Less than 5'', 5''-10'', Greater than 10''), By Display Technology, By Application (Digital Instrument Cluster, Center Stack), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-299-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global automotive smart display market size was estimated at USD 11.39 billion in 2022 and is projected to grow a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The increasing demand for advanced functions, including navigation, multimedia systems, driver assistance, and connected car features, and the improving driver-to-vehicle communication are anticipated to boost the use of smart displays in the automotive sector. Furthermore, growing demand for enhanced safety, comfort, and convenience in automobiles, especially in developing and mature economies, is also anticipated to propel the automotive smart display industry growth over the forecast period. The rise in the demand for autonomous and semi-autonomous vehicle technology and the growth of the high-end and luxury car segments, especially in emerging markets, are also expected to offer growth avenues for the automotive smart display market over the forecast period.

The use of smart displays for automotive applications is growing at a rapid pace. The automotive smart display industry relies on the demand trends in the automobile industry, the progress toward developing autonomous vehicles, technological advancements in cockpit electronics, and buyer preferences. Moreover, smart displays play an essential role in making critical driver assistance functions available on a single-touchscreen platform. In January 2023, an audio electronics company Harman International Industries introduced announced the launch of six advanced cockpit technologies Ready Care, Ready Display, Ready on Demand, Ready Upgrade, Ready Vision, Sound Vibration Sensor + External Microphone. This launch is expected to enhance safety for passengers and drivers.

Technologies such as gesture control systems, advanced infotainment systems, head-up displays, telematics, central controllers, and steering-mounted controls are increasingly being used in passenger vehicles for safety, comfort, luxury, and security benefits. The governments of several countries across the globe are implementing regulations pertaining to vehicle safety and security. For instance, the document by National Highway Traffic Safety Administration (NHTSA) states that vehicles and equipment manufacturers should review and enhance the vehicle cybersecurity system on a primary priority basis. This has prompted the demand for electronic devices, including smart displays, across the globe.

The in-vehicle infotainment systems and electronic components play a significant role, particularly for commuters, mobile workers, excursionists, and travelers. The cockpit electronics technology trends and innovations help enhance the driver and passenger experience in vehicles. Trends such as the increasing size, number, and quality of displays in cockpit electronics are on the rise creating avenues for industry growth. Further, the integration of voice recognition, AI-enhanced agent, and natural-language processing to enhance autonomous vehicle experience & driver monitoring systems are a few technologies chased by tier-1 suppliers & automotive OEMs. For instance, in March 2023, automotive manufacturing company General Motors Company announced its plan for utilizing ChatGPT in vehicles in collaboration with Microsoft Corporation. The chatbot is expected to be used for displaying vehicle features among other uses.

The usage and acceptance of Google’s Android Auto and Apple’s CarPlay standards is increasing, a trend expected to continue as technology advances. Moreover, the growing popularity of displays that use 3D, multiple layers, auto-stereoscopic, prismatic, Diffractive Lightfield Backlighting (DLB), and other depth-conveying technologies is expected to gain traction over the forecast period, creating opportunities for market growth. For instance, the Honda E urban Electric Vehicle (EV) features a 32-inch-wide console display with three separate displays underneath a seamless top layer.

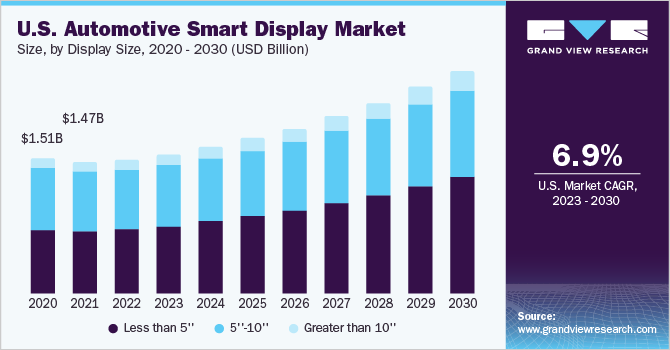

Display Size Insights

The less than 5” display size segment accounted for the largest revenue share of over 45% in 2022. The use of less than 5" smart displays is expected to gain traction in line with the growing preference for features, such as navigation, multimedia support, driving assistance, and driver-to-vehicle communication. Furthermore, as vehicles become more compact and advanced, there is a growing need for displays that take up less space and provide more information. Smaller smart displays are an efficient solution to this problem as they can fit in tight spaces while still providing a range of features and information.

The greater than 10” smart display segment is projected to register the highest CAGR of 10.7% from 2023 to 2030. The greater than 10" displays in automobiles allow all functions, including the instrument cluster and the central stack system, to be accessed via a single screen. OEMs, such as LG Display, are developing pillar-to-pillar displays stretching across the entire dashboard to include the instrument cluster display, co-driver display, and central information display onto a single screen and facilitate improved visibility. Similarly, Stellantis North America, an automobile manufacturer, announced the launch of infotainment technologies in the North American region.

Display Technology Insights

The TFT-LCD display segment accounted for the largest share of over 50% of the overall market in 2022. LCD and TFT LCDs are commonly used in display applications as they meet durability and temperature standards. Depending on the range of temperature required for the function of the display, manufacturers use a combination of TFT and LCD in a vehicle. The basic instrument cluster, center stack touchscreen display, and rear-seat entertainment touchscreen display are equipped with LCD panels. Advanced applications are equipped with TFT-LCD owing to its enhanced visual quality.

The OLED display segment is expected to register a compound annual growth rate exceeding 11.7% from 2022 to 2030. Passenger cars with OLED displays are being showcased at various automotive exhibitions; however, the penetration rate is low compared to the LCDs in the consumer models. Moreover, OLED automotive smart display systems are expected to witness faster adoption in comparison to other display technologies over the forecast period. Most of the upcoming vehicles are equipped with OLED displays.

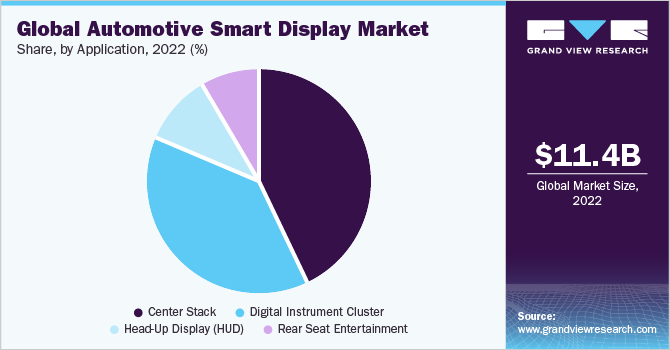

Application Insights

The center stack display segment accounted for the largest share of around 40.0% of the market in 2022. Center stack displays are infotainment systems that offer a range of interactive features such as navigation, music, cabin temperature controls, and other information. Advancements in the field of self-driving and connected cars are expected to propel the demand for center stack displays in vehicles. Additionally, several vehicle OEMs are aiming at offering advanced center stack display solutions in mid-segment and economical vehicle variants, thereby driving segment growth.

The Head-Up Display (HUD) segment is projected to register a compound annual growth rate of over 10.2% over the forecast period. Advances in display technologies and the growing prices of head-up displays are expected to play a vital role in driving the growth of the segment. The head-up display projects information about road signs, speed, speed limit, and turn-by-turn navigation along with other driver alerts directly within the driver’s line of sight, thereby reducing the chances of driver distraction. Head-up displays are often TFT-LCD displays, which are backlit by a white LED.

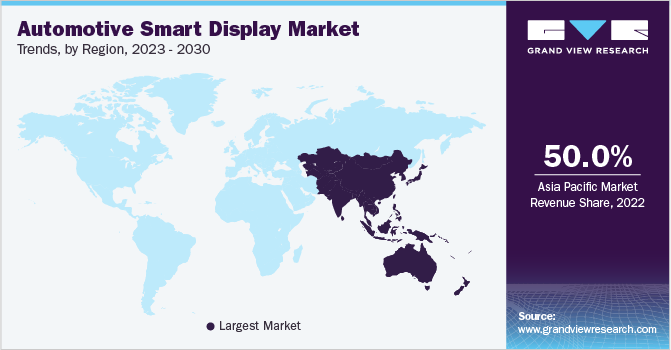

Regional Insights

Asia Pacific accounted for the largest revenue share of over 50% in the overall market in 2022 and is anticipated to retain its dominance, with a compound annual growth rate exceeding 8% over the forecast period of 2023 to 2030. China accounted for around 50% of the passenger vehicle sales in the region. The strategies being pursued by key global automakers toward the electrification of mobility are opening new opportunities for the growth of the market in China. For instance, in November 2022, automotive manufacturing company General Motors Company, during GM China Tech Day 2022 convened in Shanghai, China, announced its progress toward achieving the global vision of zero emissions, zero crashes, and zero congestion. As part of this vision, the company revealed plans to launch over 15 Ultium-based models in China by 2025 to enhance the connectivity and intelligence of electric vehicles.

The European market had a CAGR of 7.6% of the market. The region is a manufacturing hub for prominent automotive OEMs and premium vehicle manufacturers. Production activity in the region has been propelled by investments made by OEMs such as Daimler, Jaguar Land Rover, Volkswagen, BMW, Nissan, and Honda. A majority of premium vehicle manufacturers in the region installed advanced automotive electronics systems in vehicles, which is projected to drive the European market.

Key Companies & Market Share Insights

Key players in the market offer a wide range of automotive smart display components such as digital instrument clusters, digital cockpit systems, center stack displays, rear-seat entertainment systems, and Head-Up Display (HUD) units for passenger cars and commercial vehicles. The companies are focusing on providing technologically driven and advanced products to enhance their product offerings in the market. Companies are undertaking strategic initiatives such as regional expansions, acquisitions, mergers, partnerships, and collaborations to grow in the market.

Moreover, these players are consolidating their market shares by undertaking M&A activities. For instance, in November 2022, Hyundai Mobis Co., an automotive supplier announced the launch of a new display technology that enables the driver to control the display by using gestures on the in-vehicle infotainment systems. The company has been enhancing its infotainment systems in vehicles by using various upgrading its software and hardware capabilities for meeting the requirement of the automotive industry. Some prominent players in the global automotive smart display market include:

-

Alps Alpine Co., Ltd.

-

Continental AG

-

Denso Corporation

-

Hyundai Mobis

-

Nippon Seiki Co., Ltd.

-

Panasonic Corporation

-

Pioneer Corporation

-

Robert Bosch GmbH

-

SAMSUNG (HARMAN International)

-

Visteon Corporation

Automotive Smart Display Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 11.95 billion |

|

Revenue forecast in 2030 |

USD 20.07 billion |

|

Growth rate |

CAGR of 7.7% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

June 2023 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

Display size, display technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; U.K.; Germany; Spain; China; Japan; India; Brazil; Mexico |

|

Key Companies Profiled |

Alps Alpine Co., Ltd.; Continental AG; Denso Corporation; Hyundai Mobis; Nippon Seiki Co., Ltd.; Panasonic Corporation; Pioneer Corporation; Robert Bosch GmbH; SAMSUNG (HARMAN International); Visteon Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Smart Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive smart display market report by display size, display technology, application, and region:

-

Display Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than 5''

-

5''-10''

-

Greater than 10''

-

-

Display Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

LCD

-

TFT-LCD

-

OLED

-

Others

-

-

Application Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Digital Instrument Cluster

-

Center Stack

-

Head-Up Display (HUD)

-

Rear Seat Entertainment

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global automotive smart display market size was estimated at USD 11.39 billion in 2022 and is expected to reach USD 11.95 billion in 2023.

b. The global automotive smart display market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 20.07 billion by 2030.

b. Asia Pacific dominated the automotive smart display market with a share of more than 51.0 % in 2022. This is attributable to increased production and sales of passenger vehicles in the region.

b. Some key players operating in the automotive smart display market include Continental AG, Denso Corporation, Hyundai Mobis, Robert Bosch GmbH, and Visteon Corporation.

b. Key factors that are driving the automotive smart display market growth include increasing demand for advanced functions, including navigation, multimedia system, driver assistance, and connected car features, growing demand for smarter and more complex vehicle displays, and growing demand for enhanced safety, comfort, and convenience, in automobiles.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."