- Home

- »

- Next Generation Technologies

- »

-

Automotive Smart Antenna Market, Industry Report, 2030GVR Report cover

![Automotive Smart Antenna Market Size, Share & Trends Report]()

Automotive Smart Antenna Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle (Passenger Vehicles, Commercial Vehicles), By Propulsion (Electric, Non-Electric), By Sales Channel (OEM), By Frequency (High, Very High), By Region And Segment Forecasts

- Report ID: GVR-4-68040-337-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Smart Antenna Market Summary

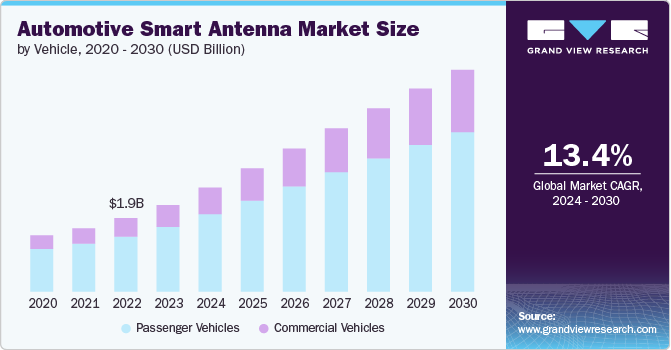

The global automotive smart antenna market size was estimated at USD 2,787.3 million in 2024 and is projected to reach USD 5,944.2 million by 2030, growing at a CAGR of 12.3% from 2025 to 2030. This growth is largely driven by increasing consumer demand for advanced vehicles that feature state-of-the-art navigation systems, infotainment capabilities, and connectivity options that necessitate robust antenna systems.

Key Market Trends & Insights

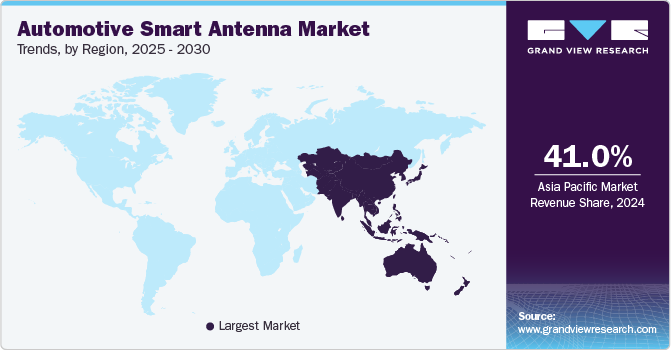

- The Asia-Pacific automotive smart antenna market dominated the market with a share of over 41% in 2024.

- The U.S. automotive smart antenna market is expected to grow at a CAGR of over 10% from 2025 to 2030.

- Based on propulsion, the non-electric segment accounted for the largest market share in 2024.

- Based on sales channel, the OEM segment accounted for the largest market share in 2024.

- Based on frequency, the ultra-high frequency segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,787.3 Million

- 2030 Projected Market Size: USD 5,944.2 Million

- CAGR (2025-2030): 12.3%

- Asia Pacific: Largest market in 2024

The effectiveness of smart antennas in enabling seamless integration of GPS navigation, Wi-Fi hotspots, Bluetooth, satellite radio, and cellular communication enhance overall vehicle connectivity, further propelling market expansion.

The implementation of stringent regulatory standards that require the inclusion of connectivity features in vehicles is expected to drive the automotive smart antenna industry in the coming years. These regulations aim to improve road safety, emissions monitoring, and emergency response capabilities. Smart antennas facilitate compliance with these mandates by supporting essential communication functions such as eCall in the EU and ERA-GLONASS in Russia. As automotive manufacturers strive to meet safety and emissions standards, smart antennas play a crucial role in ensuring effective communication between vehicles, infrastructure, and other road users, thereby enhancing operational efficiency and vehicle safety.

Additionally, the growing technology integration, including capabilities such as GPS navigation, cellular communication, satellite radio reception, Wi-Fi connectivity, and vehicle-to-everything (V2X) communication, is expected to drive the automotive smart antenna industry in coming years. By reducing the complexity and footprint of antenna systems within vehicles, these advancements enhance overall efficiency and performance.

Furthermore, the rise of 5G technology is significantly boosting the demand for smart antennas that can support higher data speeds and lower latency. Smart antennas designed for 5G compatibility enable advanced applications like real-time HD video streaming, augmented reality navigation, and cloud-based services within vehicles. Such technological innovations are expected to create substantial growth opportunities for the automotive smart antenna industry in the coming years.

Moreover, companies are strategically focusing on expanding their presence in emerging automotive markets to ensure early adoption of their products by major vehicle manufacturers. They are heavily investing in innovation and enhancing antenna architectures to provide extensive usability for end users. Recognizing the untapped potential of telematics, key players are introducing innovative technologies and telematics applications to attract vehicle manufacturers for component contracts on next-generation vehicles. Such strategies by key companies are expected to drive market growth in the coming years.

Vehicle Insights

The passenger vehicles segment accounted for the largest market share of over 68% in 2024. This dominance is driven by the rising consumer preference for cars equipped with advanced navigation systems, infotainment features, and connectivity options that depend heavily on robust antenna systems. The demand for antennas that seamlessly integrate with smartphones, internet services, and satellite radio to enhance the driving experience is a key factor driving growth in this segment.

The commercial vehicles segment is expected to witness the fastest CAGR of 13% from 2025 to 2030. Trucks and vans used in logistics and transportation increasingly depend on advanced communication systems for effective fleet management. Antennas play a vital role in enabling real-time tracking, monitoring vehicle status, and optimizing routes, thereby improving operational efficiency and reducing costs. The rising need among fleet operators to upgrade or replace antennas in their commercial vehicles for better connectivity and enhanced data transmission presents lucrative opportunities for the automotive smart antenna industry.

Propulsion Insights

The non-electric segment accounted for the largest market share in 2024. Non-electric vehicles typically have a lower initial purchase price compared to electric vehicles, making them more accessible to a wider range of consumers, particularly in regions where electric vehicle infrastructure and incentives are still developing. Additionally, gasoline and diesel fueling stations are widely available globally, providing convenience for consumers concerned about range limitations or the availability of charging stations for electric vehicles. This strong preference for non-electric propulsion among many consumers is driving growth in this segment.

The electric segment is expected to witness the fastest CAGR from 2025 to 2030, owing to several factors, including heightened environmental awareness, technological advancements, economic advantages, and shifting consumer preferences. Moreover, the rising popularity of electric vehicles necessitates sophisticated communication systems for navigation, telematics, and charging infrastructure. This trend is expected to boost the demand for smart antennas significantly, driving growth in this segment in the coming years.

Sales Channel Insights

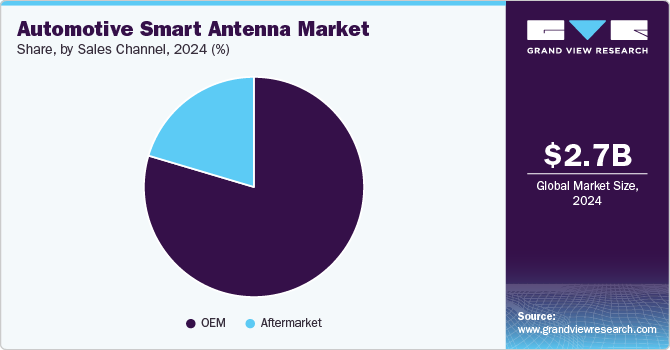

The OEM segment accounted for the largest market share in 2024, primarily owing to the growing consumer preference for this sales channel. OEMs comply with industry standards and implement rigorous quality control measures to ensure that their automotive antennas meet essential performance benchmarks. Additionally, they invest in research and development to enhance antenna technology continually, ensuring their products remain at the forefront of performance and functionality. These factors significantly contribute to the growth of this segment.

The aftermarket segment is expected to witness a significant CAGR from 2025 to 2030, as it offers a diverse selection of automotive antennas, including different types, functionalities, and brands. This variety allows consumers to choose antennas that best suit their preferences and vehicle requirements. Besides, aftermarket antennas cater to older vehicle models that may not have integrated antennas or may benefit from upgraded antenna technologies not available at the time of vehicle manufacture. Such advantages offered by the aftermarket drive segmental growth.

Frequency Insights

The ultra-high frequency segment accounted for the largest market share in 2024, driven by the increasing demand for modern vehicles equipped with advanced infotainment systems that require reliable and high-speed data transmission. These antennas play a vital role in vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication, enhancing road safety and facilitating effective traffic management. Additionally, ultra-high frequency antennas support a variety of applications, including digital audio broadcasting (DAB), satellite radio, and in-car internet services, leading to a significant rise in demand and promoting growth in this segment.

The very high-frequency segment is expected to register a significant CAGR from 2025 to 2030. VHF antennas are essential for receiving FM radio signals, which continue to be a popular source of information and entertainment for drivers. Furthermore, these antennas enable communication with emergency services, such as emergency broadcast systems and two-way radios used by first responders, thereby enhancing responsiveness and vehicle safety. The growing demand for VHF antennas due to their high usability is contributing to the expansion of this segment.

Regional Insights

North America automotive smart antenna market is expected to grow at the CAGR of 11% from 2025 to 2030, primarily driven by the increasing demand for advanced antenna systems. This demand is fueled by consumers' preferences for vehicles featuring high connectivity levels, sophisticated infotainment systems, and smartphone integration. The region's tech-savvy population is inclined towards smart technologies, further boosting the need for enhanced automotive features. Additionally, North America's robust presence of major technology companies and automakers contributes positively to the market's growth prospects.

U.S. Automotive Smart Antenna Market Trends

The U.S. automotive smart antenna market is expected to grow at a CAGR of over 10% from 2025 to 2030, driven by technological advancements, rising consumer interest in connected cars and infotainment, and the proliferation of electric and autonomous vehicles are driving this growth.

Europe Automotive Smart Antenna Market Trends

Europe automotive smart antenna market is expected to grow at a CAGR of over 11% from 2025 to 2030. In Europe, the rising consumer preference for high-quality infotainment systems and enhanced vehicle safety features drives demand for smart antennas that support multiple communication protocols.

The UK automotive smart antenna market is expected to grow at a significant rate in the coming years. This growth is primarily driven by the rising consumer demand for connected vehicles equipped with advanced infotainment systems and enhanced safety features. The increasing integration of technologies such as 5G, Internet of Things (IoT), and autonomous driving capabilities further fuels the need for high-performance smart antennas that ensure seamless connectivity.

The Germany automotive smart antenna market is characterized by the country's strong automotive industry and its focus on innovation. The market is expected to benefit from the increasing production of electric and autonomous vehicles, which require advanced connectivity solutions for efficient operation.

Asia-Pacific Automotive Smart Antenna Market Trends

Asia-Pacific automotive smart antenna market dominated the market with a share of over 41% in 2024, largely owing to the ongoing expansion of the automotive industry in countries like China, Japan, India, and South Korea. This region is becoming a key hub for automotive manufacturing, supported by increasing production capacities and the presence of numerous global and domestic companies. The demand for connected cars requiring advanced communication systems is expected to present lucrative growth opportunities in the region.

The Japan automotive smart antenna market is gaining traction owing to several key drivers, including the rollout of 5G technology, which enhances connectivity for connected and autonomous vehicles. Growing consumer demand for advanced infotainment systems and smartphone integration is pushing automakers to incorporate smart antennas.

The China automotive smart antenna market is rapidly expanding, driven by the heightened investments in research and development initiatives by both domestic and international automotive and technology firms, fostering innovation in smart antenna technologies.

Key Automotive Smart Antenna Company Insights

Some of the key players operating in the market are DENSO Corporation and Continental AG, among others.

-

DENSO Corporation functions as a mobility supplier, specializing in the development of advanced technologies and components for vehicles. The company has made significant investments in approximately 200 facilities worldwide, focusing on the production of advanced electrification, thermal systems, powertrain components, and mobility electronics. DENSO provides a range of connected driving products and services, including electronic toll collection (ETC) devices, telematics control units (TCUs), and communication devices that facilitate interactions between vehicles and their environments.

-

Continental AG is dedicated to creating technologies and services that promote connected and sustainable mobility. The company delivers efficient, intelligent, safe, and cost-effective solutions across various sectors, including machinery, vehicles, traffic management, and transportation. Its diverse portfolio encompasses innovative display and operating technologies, solutions for assisted and automated driving, audio and camera systems for vehicle interiors, as well as intelligent information and communication solutions tailored for mobility services aimed at commercial vehicle manufacturers.

Schaffner Holding AG, and Ficosa Group are some of the emerging market participants in the automotive smart antenna industry.

-

Schaffner Holding AG serves as a provider of electromagnetic solutions, focusing on delivering services related to electromagnetic compatibility (EMC), power quality, and automotive applications. The company enhances the quality of electricity and ensures the availability of electrical supplies through its innovative solutions. The company’s products are utilized in automotive power electronics, including magnetic components and EMI filters, as well as in electronic immobilizers, keyless entry systems (passive entry/passive go), and tire pressure monitoring systems.

-

Ficosa Group engages in research, development, manufacturing, and marketing of advanced systems that enhance vision, connectivity, safety, and efficiency for the mobility and automotive sectors. The company supplies components to car manufacturers worldwide and operates in 16 countries across North America, Europe, Asia, South America, and Africa.

Key Automotive Smart Antenna Companies:

The following are the leading companies in the automotive smart antenna market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- DENSO Corporation

- HARADA INDUSTRY CO., LTD.

- TE Connectivity Corporation

- Yokowo Co., Ltd.

- HELLA GmbH & Co. KGaA

- Laird Technologies, Inc.

- Schaffner Holding AG

- NXP Semiconductors N.V.

- FICOSA Group

- Robert Bosch GmbH

- Kathrein SE

Recent Developments

-

In January 2024, Ficosa Group collaborated with Indie Semiconductor, a provider of automotive semiconductor solutions, to develop and market automotive camera systems that utilize neural network-based artificial intelligence (AI) processing. This partnership aims to combine Ficosa's expertise in high-volume vision solutions with Indie Semiconductor's proven vision processing technology, enhancing the capabilities of automotive camera systems for improved safety and performance in vehicles.

-

In September 2024, Denso Corporation announced plans to construct a new facility by expanding the existing Zenmyo Plant located in Nishio City, Aichi Prefecture. The total investment for this project is approximately 69 Million yen. The new plant will focus on manufacturing large-scale integrated electronic control units (ECUs) essential for electrification and advanced driver assistance systems (ADAS).

-

In May 2023, TE Connectivity Corporation introduced the ANT-5GW-FPC series of cellular adhesive flexible printed circuit antennas, developed in collaboration with Linx Technologies. These antennas feature an independent dipole internal/embedded design, providing a versatile solution for various applications. The flexible nature and adhesive backing of the antennas facilitate easy installation within RF-transparent enclosures, allowing for effective environmental sealing that protects the antenna from potential damage.

Automotive Smart Antenna Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,333.7 million

Revenue forecast in 2030

USD 5,944.2 million

Growth Rate

CAGR of 12.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, Propulsion, Sales Channel, Frequency

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Continental AG; DENSO Corporation; HARADA INDUSTRY CO., LTD.; TE Connectivity Corporation; Yokowo Co., Ltd.; HELLA GmbH & Co. KGaA; Laird Technologies, Inc.; Schaffner Holding AG; NXP Semiconductors N.V.; FICOSA Group; Robert Bosch GmbH; Kathrein SE.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Automotive Smart Antenna Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive smart antenna market report based on vehicle, propulsion, sales channel, and frequency:

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Non-Electric

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Frequency Outlook (Revenue, USD Million, 2018 - 2030)

-

High

-

Very High

-

Ultra-High

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive smart antenna market size was estimated at USD 2,787.3 million in 2024 and is expected to reach USD 3,333.7 million in 2025.

b. The global automotive smart antenna market is expected to grow at a compound annual growth rate of 12.3% from 2025 to 2030 to reach USD 5,944.2 million by 2030.

b. The passenger vehicles segment held the largest market share of 68% in 2024, owing to increasing consumer inclination for cars equipped with advanced navigation tools, infotainment systems, and connectivity features that largely rely on robust antenna systems.

b. Some key players operating in the automotive smart antenna market include Continental AG; DENSO Corporation; HARADA INDUSTRY CO., LTD.; TE Connectivity Corporation; Yokowo Co., Ltd.; HELLA GmbH & Co. KGaA; Laird Technologies, Inc.; Schaffner Holding AG; NXP Semiconductors N.V.; FICOSA Group; Robert Bosch GmbH; Kathrein SE.

b. Key factors that are driving automotive smart antenna market growth include the increased demand for advanced vehicles equipped with cutting-edge navigation tools, infotainment systems, and connectivity features coupled with stringent regulatory norms mandating the inclusion of connectivity features in vehicles to improve road safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.