Automotive Simulation Software Market Size, Share & Trends Analysis Report By Solution (Software, Service), By Deployment (On-premise, Cloud-based), By Application, By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-245-8

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global automotive simulation software market size was estimated at USD 5,316.8 million in 2023 and is projected to grow at a CAGR of 14.9% from 2024 to 2030. In the automotive industry, simulation software stands as a significant tool, creating virtual real-time environments to assess the applicability and efficiency of various products and processes. The automotive software market is growing due to the increasing adoption of electric vehicles (EVs), driving demand for advanced simulation software, coupled with continuous technological advancements and innovations that enhance product development processes, and the imperative role of simulation software in meeting stringent regulatory standards and conducting comprehensive testing in the automotive industry.

The market is growing significantly, primarily driven by the compelling advantages it offers, including a substantial reduction in production expenditures and lower training costs. These software solutions play a crucial role in aiding automotive companies to identify and refine ideal vehicle prototypes, particularly in the context of reducing CO2 emissions. By virtually testing and optimizing different aspects of vehicle design and functionality, automotive simulation software enables manufacturers to enhance product development efficiency and mitigate risks associated with traditional prototyping methods. The widespread adoption of simulation tools in the automotive sector not only streamlines the production process but also contributes to the overall sustainability goals of the industry by fostering the development of eco-friendly and fuel-efficient vehicles.

Traditionally, manufacturers faced significant costs in prototyping automotive products, utilizing complex mechanisms in mechanical engineering simulation software. Despite having prototypes, the probability of failures remained high, resulting in additional expenses for research and development (R&D) to mitigate product failures. The substantial expenditures on prototypes and addressing faults in existing products contributed to elevated pre and post-production costs. In response to these challenges, the adoption of simulation software in the automotive industry has gained prominence, effectively minimizing the need for extensive manual testing of multiple prototypes and subsequently reducing the risk of product failures. This trend is prompting automotive companies to invest in advanced simulation tools.

Automotive manufacturers worldwide are strategically investing in the development of AI-related technologies to navigate the challenges of a Volatile, Uncertain, Complex, and Ambiguous (VUCA) environment. In response to this, virtual testing techniques are gaining prominence, enabling the observation of AI-enabled devices' behavior in real-time scenarios. The adoption of virtual testing methods significantly enhances the efficiency of product development processes while concurrently reducing associated costs.

The automotive simulation market is experiencing robust growth, driven by the proliferation of autonomous vehicles and Electric Vehicles (EVs). Manufacturers leverage simulation tools to rigorously test the efficiency and effectiveness of these vehicles in real-world situations, ensuring adherence to industry standards and regulations. For instance, Tesla Motors faced the challenge of efficiently engineering an electric vehicle from scratch. To overcome this, the company turned to Dassault Systèmes (DS) software solutions, utilizing Version 6 (V6) PLM as its sole platform for collaborative design. By leveraging DS technology, Tesla successfully eliminated data boundaries, reduced lead times, and minimized costs in developing their second vehicle, the Model S, after establishing themselves as an innovator with the electric Roadster.

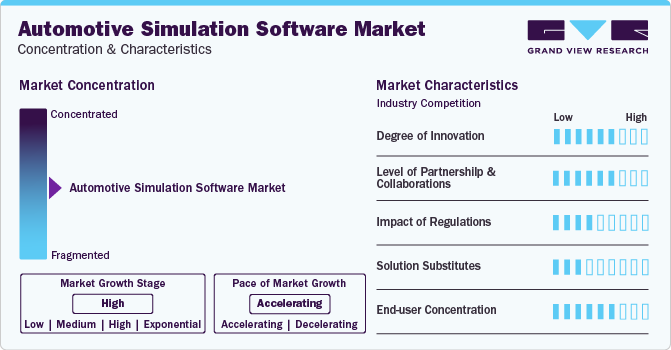

Market Concentration & Characteristics

The market exhibits a high degree of innovation driven by the rapid evolution of automotive technologies. Continuous advancements in simulation algorithms, computational capabilities, and artificial intelligence contribute to the industry's dynamic landscape. Innovations focus on enhancing the accuracy and realism of simulations, allowing for more precise analysis of vehicle behavior in various scenarios. The integration of virtual reality and augmented reality technologies into simulation tools further enhances the immersive testing experience. In addition, the development of simulation software for emerging technologies such as autonomous driving and electric vehicles showcases the industry's commitment to staying at the forefront of innovation. Collaborations between automotive manufacturers, software developers, and research institutions play a crucial role in fostering a environment of innovation, enabling the creation of cutting-edge solutions in the market.

The target market experiences a high level of partnerships and collaborations due to the complex nature of technology integration and the diverse expertise required for comprehensive solutions. Automotive manufacturers often collaborate with specialized simulation software providers to leverage their domain knowledge and technological advancements. These partnerships facilitate the seamless integration of simulation tools into the automotive design and testing processes, ensuring a more efficient and accurate development cycle. In addition, collaborations help address the evolving needs of the industry, such as the integration of simulation software with emerging technologies like artificial intelligence and machine learning for enhanced predictive modeling. The high level of partnerships enables continuous innovation and the development of cutting-edge solutions that cater to the dynamic demands of the automotive sector.

The impact of regulations on the market is high, as stringent safety and emission standards drive the demand for advanced testing and simulation tools. Regulatory requirements, such as crash test simulations and fuel efficiency standards, necessitate the use of simulation software for compliance testing, increasing the market's significance. Regulatory bodies mandate rigorous testing procedures, prompting automakers to rely on simulation tools for efficient compliance. The demand for advanced driver assistance systems (ADAS) and autonomous vehicles further intensifies the regulatory focus, elevating the importance of simulation software in ensuring the safety and reliability of these technologies. Consequently, the use of automotive simulation software is high, reflecting its crucial role in helping manufacturers meet and exceed regulatory requirements while accelerating innovation in the automotive industry.

The impact of solution substitutes on the target market is relatively low, given the specialized nature of simulation tools tailored for the automotive industry. While there are some alternatives, such as physical testing and traditional prototyping, these methods are time-consuming, expensive, and lack the efficiency and versatility provided by simulation software. The unique capabilities of simulation tools, including rapid testing of various scenarios and cost-effectiveness, make them irreplaceable in the automotive design and testing processes. Open source simulation software, while gaining traction, still has limited impact due to concerns about reliability and comprehensive features compared to commercial solutions. The automotive industry places a high premium on precision, security, and extensive capabilities, factors where established commercial simulation software often outperforms open-source alternatives. While open-source options can be valuable for specific applications and research, they have not significantly disrupted the dominance of commercial automotive simulation software in the market. Overall, the impact of solution substitutes, including open-source alternatives, remains low in the market.

End user concentration is one of the significant factors in the target market. Major automotive manufacturers and their suppliers are the primary end users of simulation software. These companies, including global players such as Toyota Motor Corporation, BMW AG, and General Motors, heavily rely on simulation tools for vehicle design, testing, and optimization. The concentration is higher among these large enterprises, which invest significantly in advanced simulation technologies to enhance product development processes and ensure regulatory compliance. However, there is also a growing adoption of simulation software among smaller manufacturers and research institutions, contributing to a broader end-user base. Overall, the end-user concentration in the market is high, with a focus on both key market players and emerging players in the automotive sector.

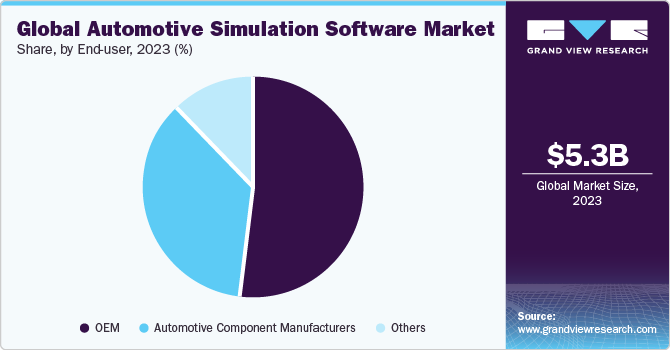

End-user Insights

Based on end-user, the OEMs segment led the market with the largest revenue share of 51.4% in 2023. The high revenue share of the segment is attributable to the increased adoption of simulation software and solutions by OEMs, recognizing the key role of simulation software in optimizing vehicle design and performance. As automotive manufacturers continuously strive for innovation and efficiency, simulation tools have become indispensable in the development of cutting-edge vehicle models. OEMs utilize simulation software extensively for virtual testing, enabling them to identify and rectify potential issues before physical prototyping, thereby reducing development time and costs. Moreover, the increasing complexity of vehicle systems and the integration of emerging technologies like electric vehicles and autonomous driving further drives the demand for simulation software among OEMs. In addition, OEMs' commitment to meeting stringent regulatory standards and enhancing vehicle safety further emphasizes their reliance on simulation tools.

The automotive component manufacturer segment is expected to grow at the fastest CAGR of 15.6% over the forecast period. This growth is attributed to the adoption of simulation software by automotive component manufacturers and the significance of simulation tools in refining the design and functionality of individual automotive parts. As vehicle systems become more intricate, automotive component manufacturers leverage simulation software to ensure the optimal performance and compatibility of their products within the broader automotive ecosystem. Furthermore, the need for precision and efficiency in component manufacturing processes prompts these manufacturers to adopt simulation technologies for virtual testing and validation. In addition, advancements in simulation software cater specifically to the intricate requirements of component design, attracting automotive part manufacturers seeking specialized solutions. Furthermore, the emphasis on cost-effective and streamlined production processes, along with the demand for high-quality components, has fueled the adoption of simulation tools among automotive component manufacturers.

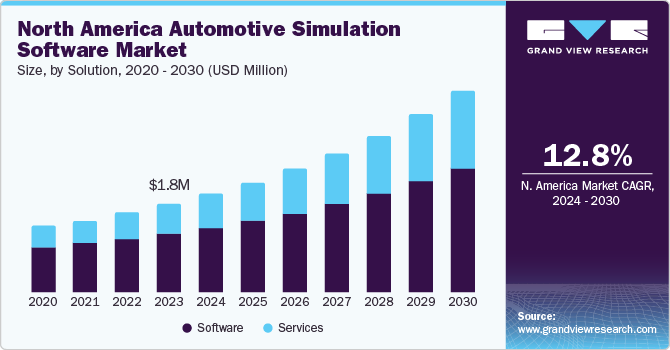

Solution Insights

Based on solution, the software segment held the market with the largest revenue share of 66.13% in 2023. The automotive simulation software is essential for creating virtual environments and conducting complex simulations in the automotive industry. The advancements in software capabilities, such as improved algorithms and realistic modeling, have significantly enhanced the accuracy and efficiency of automotive simulations. The growing complexity of vehicle systems and the integration of emerging technologies like autonomous driving and electric vehicles necessitate sophisticated software solutions. In addition, software updates and customization options provided by vendors contribute to the segment's dominance, allowing manufacturers to adapt to evolving industry needs. Furthermore, the increasing demand for virtual testing and prototyping to reduce development costs and time further amplifies the significance of the software segment in the market.

The service segment is expected to grow at the fastest CAGR of 16.9% over the forecast period. The growth of the segment can be attributed to its integral role in providing customized solutions and support services to address the unique needs of automotive manufacturers. With the increasing complexity of simulation software applications, companies are seeking specialized services for implementation, training, and ongoing maintenance, contributing to the rapid growth of the service segment. In addition, as the automotive industry undergoes constant technological advancements, service providers play a significant role in ensuring seamless integration, upgradation, and troubleshooting, further fueling the demand for service-oriented solutions.

Deployment Insights

Based on deployment, the on-premise segment led the market with the largest revenue share of 63.60% in 2023, primarily attributed to its early adoption within the automotive industry. On-premise deployment, a conventional method involving the installation of software directly at the user's location, has succeeded due to its ability to uphold data confidentiality and security. This approach aligns well with companies prioritizing the protection of their sensitive data, offering a robust defense against potential cyber threats. The steadfast growth of the on-premise segment is linked to its provision of a secure and confidential environment, making it the preferred choice for many automotive entities in the landscape of simulation software deployment.

The cloud-based segment is expected to grow at the fastest CAGR of 17% over the forecast period. The growth of this segment can be attributed to the increasing adoption of cloud-based solutions, which has gained traction as automotive companies seek enhanced flexibility, scalability, and accessibility in their simulation processes. Cloud deployment enables seamless collaboration and real-time access to simulation data from diverse locations, promoting agility and efficiency in product development. In addition, the cost-effectiveness of cloud-based solutions, as they eliminate the need for extensive on-premise infrastructure, has fueled their popularity, contributing significantly to the segment's growth.

Application Insights

Based on application, the designing & development segment led the market with the largest revenue share of 41.3% in 2023. Designing and developing new vehicles involves intricate processes, and simulation software proves valuable in optimizing various aspects of vehicle design before the manufacturing phase. Furthermore, as automotive manufacturers strive for innovation and efficiency, simulation tools are extensively utilized in the initial stages of product development to refine designs and identify potential challenges. Moreover, the growth of the segment is also driven by the need for comprehensive virtual prototyping, enabling manufacturers to enhance vehicle performance, safety, and overall functionality. In addition, the designing & development segment is instrumental in reducing time-to-market by allowing iterative testing and refinement before physical prototypes are produced.

The testing & validation segment is expected to grow at the fastest CAGR of 16.0% over the forecast period. As the automotive industry continues to grow with continuous technological advancements, rigorous testing and validation processes become essential to ensuring the reliability and safety of vehicles. Automotive simulation software plays a significant role in virtual testing scenarios, enabling manufacturers to assess the performance and functionality of vehicles across various conditions and scenarios. Furthermore, the increasing complexity of vehicle systems, especially with the integration of advanced technologies such as autonomous driving and electric propulsion, has elevated the demand for simulation tools in the testing and validation phases. In addition, the need to meet stringent regulatory standards and comply with safety requirements further propels the adoption of simulation software in the testing and validation processes.

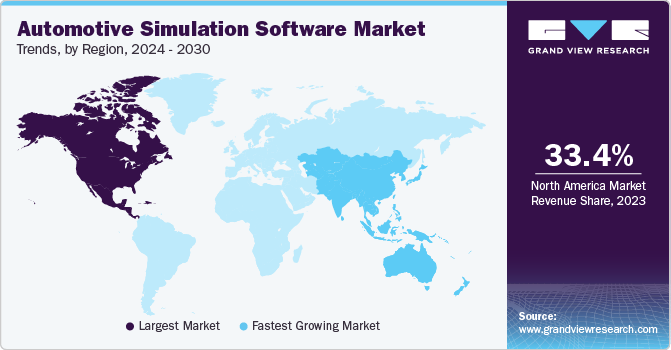

Regional Insights

North America dominated the automotive simulation software market with the largest revenue share of 33.4% in 2023. The growth can be attributable to the presence of major automakers such as General Motors and Ford, which extensively use simulation tools for cost-effective vehicle development. The region's advanced infrastructure and robust network support efficient simulation processes, meeting stringent regulatory requirements for safety and emissions. The strong economy and high disposable income levels in North America enable substantial investments in research and development, fostering the adoption of cutting-edge simulation technologies. Collaborations between automotive and software companies contribute to continuous advancements, reinforcing North America's leadership in the market.

U.S. Automotive Simulation Software Market Trends

The automotive simulation software market in the U.S. accounted with the largest revenue share of 68.2% in 2023 and its growth is attributed to the increasing emphasis on electric and autonomous vehicles, driving the demand for advanced simulation tools to test and validate these technologies comprehensively. The regulatory push for stringent safety standards has further fueled the adoption of simulation software in the U.S. automotive industry. In addition, the efficiency gains and cost savings achieved through virtual testing and prototyping contribute to the market's expansion as U.S. manufacturers strive to stay at the forefront of automotive innovation.

Asia Pacific Automotive Simulation Software Market Trends

The automotive simulation software market in Asia Pacific is anticipated to grow at the fastest CAGR of 16.3% over the forecast period. The region is a major hub for the automotive industry, with countries like China, Japan, and South Korea hosting leading automobile manufacturers such as Toyota, Honda, and Hyundai. These companies leverage simulation software extensively to enhance product development efficiency. For instance, in March 2023, Toyota Motor Corporation announced the development of Version 7 of its THUMS (Total Human Model for Safety) crash test simulation software, specifically tailored to account for changes in people's posture during automated driving. The latest version enhances the modeling of the human body, including men, women, and children, providing more accurate representations of key body parts and predicting the effects of reclined positions or emergency maneuvers on bones, organs, and muscles. Furthermore, the increasing demand for electric vehicles (EVs) in Asia Pacific has led to a surge in the adoption of simulation tools for designing and optimizing electric drivetrains and battery systems.

The China automotive simulation software market is growing due to the surging demand for electric vehicles and the advancement of autonomous driving technologies, as evidenced by major Chinese automotive companies such as NIO utilizing simulation tools such as Siemens' Simcenter for comprehensive testing and validation of their electric and autonomous vehicle designs in a virtual environment.

The automotive simulation software market in Japan is growing due to the increasing focus on innovation and safety in the automotive industry, as exemplified by Japanese companies like Toyota Motor Corporation adopting simulation tools such as VEOS, the PC-based simulation platform from dSPACE to enhance the design and testing of advanced driver assistance systems (ADAS) and vehicle dynamics for improved overall performance and safety.

The India automotive simulation software market is growing due to the rising demand for efficient product development and testing processes, as evidenced by Indian automotive companies like Mahindra & Mahindra utilizing simulation tools such as Siemens' Simcenter to enhance vehicle design, optimize performance, and reduce time-to-market for new models.

Europe Automotive Simulation Software Market Trends

The automotive simulation software market in Europe is growing due to the increasing emphasis on vehicle electrification, autonomous driving technologies, and stringent safety standards, with European automotive companies adopting simulation tools to accelerate innovation, reduce development costs, and ensure compliance with regulatory requirements.

The UK automotive simulation software market is growing due to a heightened focus on technological advancements and safety innovations within the automotive sector, highlighted by UK companies such as Jaguar Land Rover utilizing simulation tools like Siemens' Simcenter to enhance vehicle design, optimize performance, and ensure robust testing processes.

The automotive simulation software market in Germany is growing due to the country's strong automotive industry leadership and the increasing demand for advanced driver assistance systems (ADAS) and autonomous vehicle technologies. German companies such as Volkswagen are leveraging simulation tools such as PTV Vissim to enhance the development and testing of innovative features, improving overall vehicle performance and safety in a rapidly evolving automotive landscape.

The France automotive simulation software market accounted for significant growth driven by the increasing emphasis on sustainable and innovative automotive technologies. French companies such as Renault are actively utilizing simulation tools like to optimize vehicle designs, improve fuel efficiency, and accelerate the development of electric and hybrid vehicles, aligning with the global shift towards environmentally friendly transportation solutions.

Middle East & Africa Automotive Simulation Software Market Trends

The automotive simulation software market in the Middle East & Africa (MEA) is expected to at the grow at the significant CAGR during the forecast period, propelled by the region's increasing focus on technological advancements within the automotive sector. As MEA countries strive for economic diversification and development, automotive companies are adopting simulation tools to accelerate innovation, optimize vehicle designs, and enhance safety features. The rising demand for electric vehicles and autonomous driving technologies further contributes to the expansion of the automotive simulation software market in the MEA region.

The Saudi Arabia automotive simulation software market is growing due to the increasing emphasis on advanced driver assistance systems (ADAS) and autonomous vehicle technologies, exemplified by local automotive companies adopting simulation tools such as ANSYS VRXPERIENCE to accelerate the development and testing of innovative vehicle features in a virtual environment.

Key Automotive Simulation Software Company Insights

Some of the key companies operating in the global market include ANSYS, Inc., Dassault Systemes and among others.

-

ANSYS, Inc. is a company specializing in engineering simulation software development and marketing. Using Workbench as its platform for building simulation technologies, the company offers a comprehensive suite of software solutions. These include applications in 3D design, structural analysis, embedded software, electromagnetic field simulation, computational fluid dynamics, semiconductors, systems modeling, and validation. ANSYS serves a diverse range of industries and verticals, including industrial equipment and rotating machinery, automotive, consumer goods, materials & chemical processing, construction, aerospace & defense, and healthcare

-

Dassault Systèmes specializes in providing advanced solutions for the market, offering 3D digital mock-up, 3D design, and product lifecycle management software. The company caters its innovative software products to various industries, including automotive, ensuring comprehensive simulation capabilities for design and product development. Leveraging its expertise, Dassault Systèmes supports automotive companies in achieving efficiency and excellence throughout the product lifecycle

Applied Intuition, Inc., and PTC are some of the emerging market companies in the target market.

-

Applied Intuition is a California-based technology company that specializes in creating software for autonomous vehicles. The company's software allows entities in the autonomous automotive industry to develop, test, and deploy their vehicles at scale. The company's software offers a suite of products that focuses on simulation and analytics and delivers sophisticated infrastructure built for scale, enabling automotive industries to test and rapidly accelerate their autonomous vehicle development comprehensively

-

PTC is a prominent provider of cutting-edge technology solutions for the automotive industry, specializing in automotive simulation software. Their offerings enable manufacturers to simulate and validate various facets of vehicle design, emphasizing safety, durability, and efficiency. PTC's comprehensive portfolio also includes product lifecycle management, computer-aided design, and application lifecycle management solutions, contributing to enhanced efficiency and innovation across the automotive product development lifecycle

Key Automotive Simulation Software Companies:

The following are the leading companies in the automotive simulation software market. These companies collectively hold the largest market share and dictate industry trends.

- Altair Engineering, Inc.

- Autodesk Inc.

- ANSYS, Inc.

- PTC

- Dassault Systèmes

- The MathWorks, Inc.

- Rockwell Automation

- Simulations Plus

- ESI Group

- GSE Solutions

- Applied Intuition, Inc.

Recent Developments

-

In February 2024, Dassault Systèmes announced a strategic partnership with BMW Group to develop BMW's future engineering platform, utilizing Dassault Systèmes' 3DEXPERIENCE platform as its core. This collaboration involves over 17,000 BMW employees globally working on a virtual twin of a vehicle, allowing real-time configuration for different model variants. The partnership represents the next phase in their longstanding collaboration, leveraging digital innovation to streamline engineering processes and enhance the development of personalized and sustainable automotive experiences for BMW customers

-

In January 2024, ANSYS, Inc. announced that its AVxcelerate Sensors will be integrated into NVIDIA DRIVE Sim, a scenario-based autonomous vehicle (AV) simulator powered by NVIDIA Omniverse. This collaboration aimed to enhance the development and validation of AV perception systems, incorporating Ansys' physics solvers for camera, lidar, radar, and thermal camera sensors. The integration enables users to access high-fidelity sensor simulation outputs for training and validating perception ADAS/AV systems in a controlled virtual environment, addressing the challenges of testing and validating sensor suites and software in real-world driving scenarios

Automotive Simulation Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6,034.3 million |

|

Revenue forecast in 2030 |

USD 13.90 billion |

|

Growth rate |

CAGR of 14.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, deployment, application, end-user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Mexico; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Altair Engineering, Inc.; Autodesk Inc.; ANSYS, Inc.; PTC; Dassault Systèmes; The MathWorks, Inc.; Rockwell Automation; Simulations Plus; ESI Group; Applied Intuition, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Simulation Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the automotive simulation software market report based on solution, deployment, application, end-user, and region.

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Computer Aided Engineering Simulation Software

-

Electromagnetic Simulation Software

-

Training/Human-in-the-Loop (HITL) Simulation Software

-

ADAS Simulation Software

-

Others

-

-

Services

-

Simulation Development Services

-

Training and Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud-based-based

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Designing & Development

-

Testing & Validation

-

Supply Chain Simulation

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 – 2030)

-

OEM

-

Automotive component manufacturers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive simulation software market size was estimated at USD 5,316.8 million in 2023 and is expected to reach USD 6,034.3 million in 2024.

b. The global automotive simulation software market is expected to grow at a compound annual growth rate of 14.9% from 2024 to 2030 to reach USD 13.90 billion by 2030.

b. North America dominated the automotive simulation software market with a share of 33.4% in 2023. This is attributable to the presence of major automakers such as General Motors and Ford, which extensively use simulation tools for cost-effective vehicle development. The strong economy and high disposable income levels in North America enable substantial investments in research and development, fostering the adoption of cutting-edge simulation technologies.

b. Some key players operating in the automotive simulation software market include Altair Engineering, Inc., Autodesk Inc., ANSYS, Inc., PTC, Dassault Systèmes, The MathWorks, Inc., Rockwell Automation, Simulations Plus, ESI Group, GSE Solutions, and Applied Intuition, Inc.

b. The automotive software market is growing due to the increasing adoption of electric vehicles (EVs), driving demand for advanced simulation software, coupled with continuous technological advancements and innovations that enhance product development processes, and the imperative role of simulation software in meeting stringent regulatory standards and conducting comprehensive testing in the automotive industry.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."