- Home

- »

- Next Generation Technologies

- »

-

Automotive Robotics Market Size And Share Report, 2030GVR Report cover

![Automotive Robotics Market Size, Share & Trends Report]()

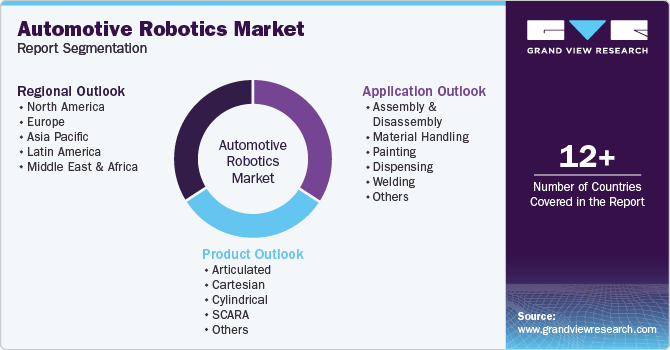

Automotive Robotics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Articulated, Cartesian, Cylindrical, SCARA, Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-212-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Robotics Market Summary

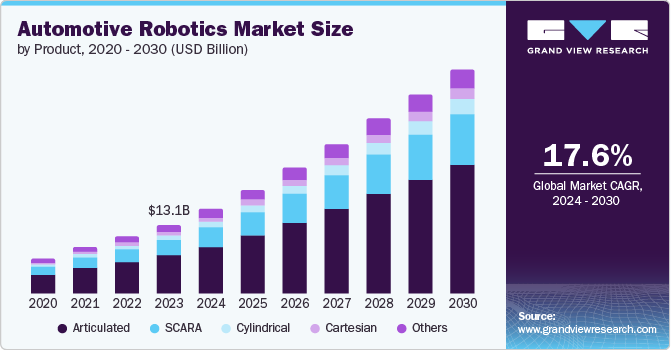

The global automotive robotics market size was valued at USD 13.06 billion in 2023 and is expected to reach USD 42.27 billion by 2030, growing at a CAGR of 17.6% from 2024 to 2030. As the demand for automobiles continues to increase, manufacturers are under pressure to enhance their production efficiency and output.

Key Market Trends & Insights

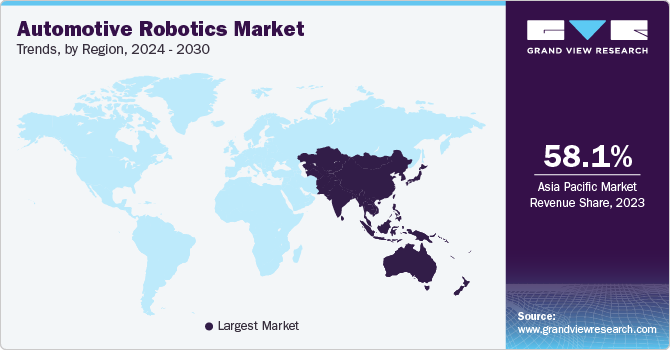

- The Asia Pacific automotive robotics market accounted for the largest market revenue share of 58.1% in 2023.

- The U.S. automotive robotics market is expected to grow rapidly in the coming years.

- By product, the articulated segment dominated the market and accounted for a share of 55.9% in 2023.

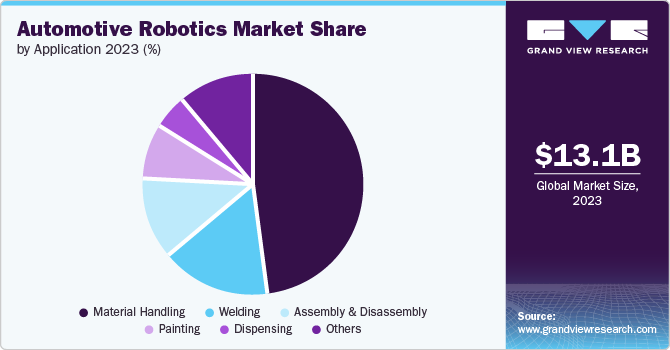

- By application, the material handling sector accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 13.06 Billion

- 2030 Projected Market Size: USD 42.27 Billion

- CAGR (2024-2030): 17.6%

- Asia Pacific: Largest market in 2023

Automotive robots are crucial in streamlining manufacturing processes, improving precision, and increasing overall productivity, thereby supporting the growing vehicle production rates. The rise of electric and autonomous vehicles is propelling the growth of the automotive robotics market. With the shift towards electric vehicles, there is a need for advanced manufacturing processes that can accommodate the unique requirements of electric vehicle production. The International Energy Agency (IEA) predicts that by 2030, 250 million electric vehicles will be in use worldwide to decrease environmental pollution. Similarly, developing autonomous vehicles requires highly sophisticated manufacturing techniques, which can be efficiently achieved by implementing robotics. As a result, the demand for robotics in the automotive sector is rising to support the production of these next-generation vehicles.

The ongoing technological advancements in robotics, including the integration of artificial intelligence, machine learning, and advanced sensors, are expanding the capabilities of automotive robots. These innovations enable robots to perform more complex tasks with greater precision and adaptability, further driving the growth of the automotive robotics market as manufacturers seek to leverage these cutting-edge technologies to stay competitive in the industry.

Product Insights

The articulated segment dominated the market and accounted for a share of 55.9% in 2023. With their multi-jointed arms and dexterity, articulated robots are essential for performing complex tasks such as welding, assembly, and painting with high precision. As automotive manufacturers strive to produce vehicles that meet stringent quality standards, articulated robots offer the flexibility and accuracy required to handle intricate processes and ensure consistent product quality. This demand for precision in automotive production not only enhances the efficiency of manufacturing operations but also leads to reduced defects and increased vehicle reliability, which fuels the growth of the articulated robotics market.

Selective Compliance Assembly Robot Arm (SCARA) is anticipated to grow significantly at a CAGR of 17.9% over the forecast period. SCARA robots are renowned for their high-speed and precise operations, making them ideal for assembly, pick-and-place operations, and part transfer in automotive manufacturing. As the automotive industry continues to evolve with the need for faster production cycles to meet global demand, SCARA robots offer the perfect solution due to their high-speed capabilities and compact design. This drive for efficiency in production lines fuels the growth of the SCARA automotive robotics market as manufacturers seek to optimize their processes and reduce time-to-market for new vehicle models.

Application Insights

The material handling sector accounted for the largest market revenue share in 2023. As automotive manufacturers expand production lines and introduce more diverse vehicle models, the need for efficient and scalable material handling solutions becomes paramount. Robotics play a crucial role in automating parts transportation, sorting, and storage tasks, which are essential for maintaining smooth and efficient production workflows. The complexity of modern automotive manufacturing requires advanced robotic systems to manage large volumes of parts and components, ensuring timely delivery to assembly lines and preventing bottlenecks. This demand for sophisticated material handling solutions directly fuels the growth of the automotive robotics market.

The painting segment is anticipated to grow significantly over the forecast period. Automating the painting process with robots helps manufacturers achieve higher production speeds and consistency than manual painting methods. Robotic systems can operate continuously, reduce cycle times, and perform repetitive tasks with high precision, which leads to increased throughput and lower costs per unit. Manufacturers can streamline operations, reduce labor costs, and improve overall production efficiency by automating the painting process.

Regional Insights

The North America automotive robotics market is anticipated to witness significant growth over the forecast period. North America has a robust robotics ecosystem that includes top industry players, renowned research organizations, and highly skilled workers. This environment promotes working together, exchanging knowledge, and inventing new robotics technology, accelerating the progress and acceptance of cutting-edge robotic solutions for car manufacturing. This area boasts a robust automotive sector, with large car manufacturers and suppliers running manufacturing plants throughout the region. The requirement for automation and robotics in car manufacturing arises from enhancing productivity, quality, and competitiveness amidst global market challenges.

U.S. Automotive Robotics Market Trends

The U.S. automotive robotics market is expected to grow rapidly in the coming years. The U.S. automotive sector’s focus on modernizing production lines with state-of-the-art robotics solutions reflects a broader trend towards advanced manufacturing processes that leverage robotics to achieve superior operational outcomes. This drive towards technological advancement and efficiency is a significant factor propelling the growth of the automotive robotics market in the U.S.

Asia Pacific Automotive Robotics Market Trends

The Asia Pacific automotive robotics market accounted for the largest market revenue share of 58.1% in 2023. Asia Pacific is home to some of the world’s largest automotive manufacturing hubs such as Tata, Mitsubishi, Nissan, Toyota, etc. The region is experiencing robust growth in automotive production due to increasing domestic and international consumer demand. As automakers scale production to meet this demand, they invest in advanced robotics to improve efficiency, ensure consistent quality, and reduce labor costs.

The China automotive robotics market held a substantial market share in 2023 owing to increasing use of robotics. China is the world's largest automotive market, and domestic and international automakers are investing heavily in expanding their production capacities in the country. This surge in automotive production has created a strong demand for robotics solutions to meet the growing needs of manufacturers. As stated by the International Trade Administration, China is predicted to have 35 million vehicles produced domestically by 2025, making it the leading global market in annual vehicle sales and manufacturing output.

Europe Automotive Robotics Market Trends

The Europe automotive market was identified as a lucrative region in 2023. European automotive manufacturers leverage robotics to enhance productivity, improve operational efficiency, and maintain high product quality. Integrating advanced robotics systems allows for flexible and agile production processes, enabling manufacturers to respond to the automotive industry's rapidly changing consumer demands and market trends.

The UK automotive robotics market is expected to grow rapidly in the coming years. The UK government has invested in advanced manufacturing technologies as part of its broader industrial strategy to boost the nation's manufacturing sector. Initiatives such as the "Made Smarter" program and the "Automotive Transformation Fund" offer substantial financial support for adopting innovative technologies, including robotics.

Key Automotive Robotics Company Insights

Some of the key companies in the automotive robotics market include ABB Ltd, Acieta, LLC., Comau S.p.A., Denso Corporation., Epson America, Inc., FANUC CORPORATION, and Kawasaki Heavy Industries, Ltd. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

ABB Ltd provides car manufacturers with a set of automation solutions. Their industrial robots handle tasks involving heavy lifting, such as welding and moving materials. At the same time, cobots work alongside humans to assist with detailed assembly and quality inspections. ABB Ltd also provides autonomous mobile robots as continual material carriers and software options to enhance robot programming and evaluate manufacturing information.

-

KUKA AG provides a comprehensive range of solutions for automating car manufacturing. Their industrial robots handle welding, material handling, and parts transfer, acting as the physical strength. Collaborative robots ensure safe collaboration with humans during assembly and quality control tasks. KUKA also offers user-friendly software and controllers for the brains, grippers, and other peripheral equipment to customize the entire robotic system for each specific automotive application. This all-encompassing strategy assists car makers in reaching their production speed, quality, and worker safety objectives.

Key Automotive Robotics Companies:

The following are the leading companies in the automotive robotics market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd

- Acieta, LLC.

- Comau S.p.A.

- Denso Corporation.

- Epson America, Inc.

- FANUC CORPORATION

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Neura Robotics GmbH

- Omron Adept Technologies, Inc.

- Stäubli International AG

- Universal Robots A/S.

- Yaskawa Electric Corporation

Recent Developments

-

In December 2023, ABB Ltd partnered with Volvo Cars to provide 1,300 industrial robots to produce its next-generation electric vehicle models. Volvo plans to utilize ABB's latest industrial robots, IRB 6710, 6720, and 6730, for various activities such as spot welding, riveting, dispensing, flow drilling, etc.

Automotive Robotics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.95 billion

Revenue forecast in 2030

USD 42.27 billion

Growth rate

CAGR of 17.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

ABB Ltd, Acieta, LLC., Comau S.p.A., Denso Corporation., Epson America, Inc., FANUC CORPORATION, Kawasaki Heavy Industries, Ltd., KUKA AG, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Neura Robotics GmbH, Omron Adept Technologies, Inc., Stäubli International AG, Universal Robots A/S., Yaskawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive robotics market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Articulated

-

Cartesian

-

Cylindrical

-

SCARA

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Assembly and Disassembly

-

Material handling

-

Painting

-

Dispensing

-

Welding

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Africa

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.