Automotive Refinish Coating Market Size, Share & Trends Analysis Report By Resin (Acrylic, Alkyd, Polyurethane, Others), By Technology, By Product, By Vehicle Age, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-950-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Automotive Refinish Coating Market Trends

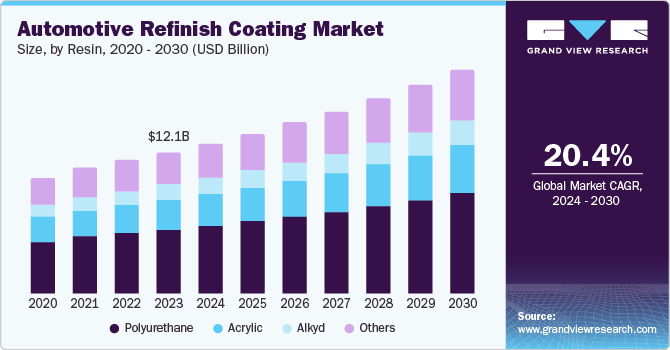

The global automotive refinished coating market size was valued at USD 12.10 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The ownership of vehicles is increasing, leading to a higher demand for repair and refinishing services due to accidents, wear and tear, and cosmetic enhancements. Moreover, the growing trend of customizing and personalizing vehicles has contributed to market growth as consumers seek unique vehicle appearances. It has significantly increased demand for a wide range of colors, finishes, and effects, driving advancements in refinish coating formulations.

The rising average age of the worldwide vehicle population is driving the market. Old vehicles are more prone to damage and require frequent repairs and repainting. This aspect is especially notable in regions with established automobile markets, such as North America and Europe. Furthermore, the increasing focus on the visual appeal of vehicles and the desire to maintain their appearance has led to an increased need for high-quality refinish coatings. Consumers are willing to spend money on refurbishing their vehicles to improve their look with customization.

Stringent environmental regulations have been crucial in shaping the automotive refinish coating market. The focus on reducing volatile organic compounds (VOCs) emissions has driven the development of water-borne coatings. While these coatings have gained traction, ongoing technological advancements are further propelling the market.

Resin Insights

The polyurethane segment dominated the market and accounted for a revenue share of 44.9% in 2023. Polyurethane resins offer exceptional flexibility, durability, chemical and abrasion resistance, and outstanding gloss retention. It also displays exceptional adherence to different surfaces, ensuring long-lasting finishes. Additionally, polyurethane coatings offer superior protection against UV rays and environmental factors, making them perfect for safeguarding the exteriors of vehicles. These characteristics have led to their extensive use in different regions, contributing to their dominant market share.

The acrylic segment is expected to register the fastest CAGR during the forecast period. Acrylic resins exhibit superior color preservation and shine, improving vehicles' overall visual appeal. The increasing focus on environmentally friendly formulas has also played a major role in the sector's expansion, as acrylic resins are expected to produce water-based coatings with a lesser environmental impact. Additionally, progress in acrylic resin technology has enhanced performance and flexibility, broadening their potential uses in the automotive refinish industry.

Technology Insights

The solvent-borne segment dominated the market in 2023. Solvent-borne coatings offer exceptional durability, adhesion, and resistance to environmental factors, resulting in high-quality finishes. These coatings are highly effective in providing excellent shine, color richness, and overall aesthetic appeal, which are crucial for the automotive industry. Solvent-borne coatings are preferred for their rapid drying times, easy application, and ability to achieve desired finishes efficiently. Additionally, the existing infrastructure and expertise in handling solvent-borne coatings within the automotive refinish industry contribute to their sustained dominance.

The water-borne segment is expected to register the fastest CAGR during the forecast period. Due to strict environmental regulations in Europe and North America, the automotive industry uses more environmentally friendly coatings. Water-based coatings have reduced volatile organic compound (VOC) emissions and align perfectly with these sustainability guidelines. Moreover, progress in water-based technology has resulted in notable enhancements in performance, such as faster drying times, improved durability, and superior color-matching abilities. Furthermore, the rising expenses of raw ingredients for solvent-based coatings are causing water-based alternatives to become more financially appealing. These factors are driving the growth of the water-based sector in the automotive refinish coating industry.

Product Insights

Basecoat accounted for the largest revenue share in 2023. Consumers seek unique and distinctive looks for their cars, which has created a massive demand for various basecoat colors and finishes. Regions such as North America and Europe, known for their well-established automotive aftermarket traditions, have seen a notable increase in the use of basecoat for custom paint projects. Furthermore, the increasing demand for metallic, pearl, and other special effect coatings, which need a base coat to achieve the best color and depth, is expected to drive the growth of this segment. The Asia Pacific area has a growing middle class and higher disposable incomes, leading to a greater need for basecoat products due to consumers choosing more fashionable and customized vehicles.

Topcoat is expected to register a significant CAGR during the forecast period. The growing consumer preference for high-quality finishes and the ever-increasing demand for strong, long-lasting coatings have driven the sector's expansion. In regions such as North America, the focus on the look of vehicles and the frequent harsh weather have created a need for topcoats that provide excellent defense against UV rays, scratches, and corrosion. In the Asia Pacific region, the growing urban population and higher ownership of cars have caused a sharp increase in the need for refinish coatings, particularly topcoats, to maintain the vehicles' original appearance. Furthermore, the automotive aftermarket's emphasis on customization and personalization has led to opportunities for innovative topcoat formulations, contributing to the segment's growth.

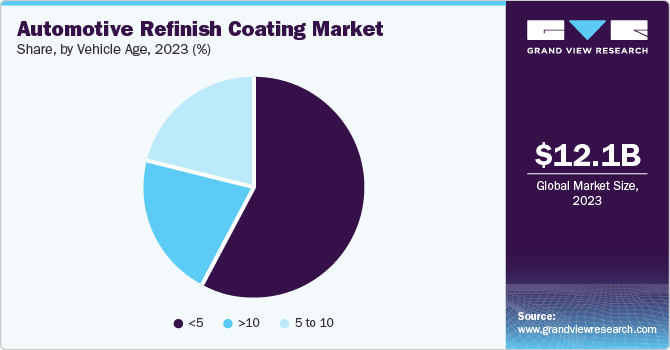

Vehicle Age Insights

The <5 age segment dominated the market in 2023 The popularity of personalization and customization in vehicles is on the rise, especially among newer car owners who wish to alter their vehicle's appearance to suit their preferences or to preserve its resale value following accidents. The increasing traffic volume and the elevated risk of vehicular damage, which are anticipated to contribute to the growth of this market segment, are fueling this trend.

The 5-10 years sector is projected to grow at the fastest CAGR over the forecast period. The segment is expected to experience a significant rise due to the need for regular maintenance and repairs. Due to surface rust, color loss, scratches, and cracks, old vehicles require painting and refinishing coatings. Additionally, the increasing enthusiasm of young people to restore old cars through applying coatings and replacing equipment is further expected to propel the market in the coming years.

Regional Insights

North America automotive refinish coatingmarket is anticipated to witness significant growth. The presence of major automotive manufacturers and a well-established aftermarket infrastructure in North America region is contributing to the market's expansion. Moreover, the increasing frequency of accidents and the prevalence of harsh weather conditions require regular vehicle repairs and repainting, further propelling the market.

U.S. Automotive Refinish Coating Market Trends

The U.S. automotive refinish coating market is expected to grow rapidly in the coming years due to the country's vast vehicle fleet. A substantial portion is reaching its prime repair and refinish age, which requires a consistent demand for refinish coatings. Moreover, the increasing trend for customization and personalization among U.S. customers further drives the market.

Asia Pacific Automotive Refinish Coating Market Trends

Asia Pacific dominated the market with a revenue share of 44.2% in 2023. This is attributed to the thriving automotive industry, particularly in countries such as China and India. The rising disposable income is fueling demand for personal vehicles and increasing demand for repair and refinishing services. Moreover, the region's growing urbanization and expansion of roadways contribute to a higher incidence of accidents, boosting the demand for refinish coatings. Large existing vehicle fleets in countries like China and India also drive the market, as older vehicles require regular maintenance and repainting. Additionally, the region's focus on cost-effective solutions and the availability of skilled workers make it a desirable production hub for automotive refinish coatings, further contributing to market growth.

China's automotive refinish coating market dominated the Asia Pacific market in 2023. The growth is attributed to its booming automotive sector, which is the biggest in the world. The rapid urbanization and expanding middle class have fueled a surge in car ownership, leading to an increased need for car maintenance and repair services. Moreover, China's extensive road network and increasing traffic congestion increase the frequency of accidents, increasing the demand for refinish coatings. Furthermore, the strong economic expansion in China has boosted the automotive aftermarket, as more customers opt for vehicle customization and personalization, leading to an increased demand for refinishing services. The government's favorable policies towards the automotive industry and a robust domestic manufacturing base further strengthen the market's growth trajectory.

Europe Automotive Refinish Coating Market Trends

Europe's automotive refinish coating market was identified as a lucrative region in 2023 due to its established automotive industry, a sizable number of old vehicles requiring regular repairs, and a significant focus on the appearance of vehicles. The region's established insurance industry and comprehensive claims processes result in a steady need for refinish coatings. Additionally, the increasing demand for specialized coatings and finishes is fueled by the rising popularity of personalized car customization trends. In Europe, strict environmental laws have encouraged the creation of eco-friendly and water-based refinish coatings, which aligns with the region's commitment to sustainability. The existence of major automotive manufacturers and a well-established aftermarket infrastructure also boost the market's growth.

The UK automotive refinish coating market is expected to grow rapidly in the coming years due to the country's rising trend of vehicle customization and personalization, boosting the need for specialized coatings and finishes. Furthermore, the growing emphasis on vehicle restoration and the rise of classic car culture drive demand for high-quality refinish products.

Key Automotive Refinish Coating Company Insights

Some of the key companies in the automotive refinish coating market are BASF SE, Akzo Nobel N.V., PPG Industries, Inc., Axalta Coating Systems, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as research and developments, innovations, technological advancements, mergers and acquisitions, and partnerships with other major companies.

-

BASF is a major player in the chemical sector. It provides a wide selection of high-quality refinish paint brands and associated products. BASF focuses heavily on innovation to create eco-friendly, water-based, and high-solid coatings that cater to the industry's changing demands.

-

Akzo Nobel is a key player in the paints and coatings sector; it provides a diverse range of high-performance refinish products for body shops and repair centers globally. It is well-known for its impressive range of brands and cutting-edge technology; the company offers creative solutions that enhance the appearance and durability of vehicles.

Key Automotive Refinish Coating Companies:

The following are the leading companies in the automotive refinish coating market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Akzo Nobel N.V.

- PPG Industries, Inc.

- Axalta Coating Systems

- Berger Paints India Limited

- Cabot Corporation

- Clariant

- NOROO Paint & Coatings co. Ltd.

- Alsa Refinish and The Alsa Corporation

- The Dow Chemical Company

Recent Developments

-

In April 2024, BASF's Coatings division launched a new range of eco-efficient clearcoats and undercoats for the Asia Pacific refinish market. The products aimed to enhance quality and productivity while significantly reducing CO₂ emissions. The latest products, manufactured using BASF's biomass balance approach, have received approvals from leading automotive OEMs and are designed to help body shops improve efficiency and profitability.

-

In December 2022, BASF introduced car coatings made with renewable raw materials through a certified biomass balance method. BASF's ColorBrite Airspace, Blue ReSource basecoat, launched in China after being certified by REDcert using a biomass balance method. BASF's biomass balance automotive OEM coatings were introduced to Asia for the first time in May 2022, following their official launch in Europe.

Automotive Refinish Coating Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 12.83 billion |

|

Revenue forecast in 2030 |

USD 19.06 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Resin, technology, product, vehicle age, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Belgium, Russia, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia and South Africa |

|

Key companies profiled |

BASF SE; Akzo Nobel N.V.; PPG Industries, Inc.; Axalta Coating Systems; Berger Paints India Limited; Cabot Corporation; Clariant; NOROO Paint & Coatings co. Ltd.; Alsa Refinish and The Alsa Corporation; The Dow Chemical Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Refinish Coating Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive refinish coating market report based on resin, technology, product, vehicle age, and region:

-

Resin Outlook (Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Alkyd

-

Polyurethane

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Solvent-borne

-

Water-borne

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primer

-

Basecoat

-

Topcoat

-

Fillers

-

Others

-

-

Vehicle Age Outlook (Revenue, USD Million, 2018 - 2030)

-

<5

-

5 to 10

-

>10

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."