Automotive Rain Sensor Market Size, Share & Trends Analysis Report by Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Sales Channel (OEM, Aftermarket), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-306-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Automotive Rain Sensor Market Trends

The global automotive rain sensor market size was estimated at USD 5.03 billion in 2023 and is expected to grow at a CAGR of 7.7% from 2024 to 2030. The increasing demand for vehicles, advancements in sensor technology, and comfort and convenience features in vehicles are driving the market growth. With the growth of the automotive industry, the demand for advanced features like rain sensors in newer vehicles has increased.

The increasing demand for advanced driver assistance systems (ADAS) adds to the growing demand for rain sensors. Rain sensors are an integral part of ADAS and contribute to safer driving by automatically controlling the windshield wipers in response to rain. Various governments are implementing regulations that mandate the inclusion of advanced safety features in vehicles. In November 2023, the Ministry of Road Transport and Highway of India announced plans to make autonomous driving assistance system functions mandatory in new vehicles. With new and improved highway infrastructure and increasing road traffic, the government plans to make the installation of autonomous driving assistance systems mandatory.

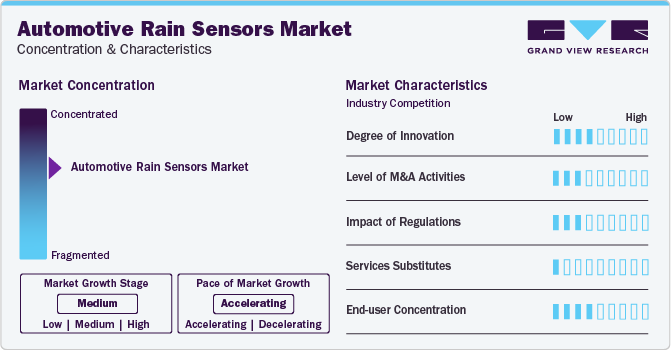

Market Characteristics & Concentration

The automotive rain sensors market has been significantly consolidated owing to several key players dominating the market. The industry growth stage is medium, and the growth pace is accelerating. The industry's degree of innovation is high as automotive companies invest heavily in new product development to match the industry competition, introducing new features such as radar-based cruise control, park assist, automatic rain sensors, and blind spot monitoring systems. The increasing consumer demand for vehicles with enhanced safety, greater comfort, and convenience features significantly influences the automotive rain sensor industry. The growing awareness and preference for automated systems capable of adjusting to environmental changes increases the demand for vehicles outfitted with rain sensors.

The industry's impact on regulations is high. Many governments mandate the use of advanced driving assistance systems in vehicles for enhanced safety. Organizations such as NCAP and EuroNCAP conduct automobile safety tests and set safety standards. These organizations promote advanced safety features such as rain sensors and lane-keeping assistance to make driving safer.

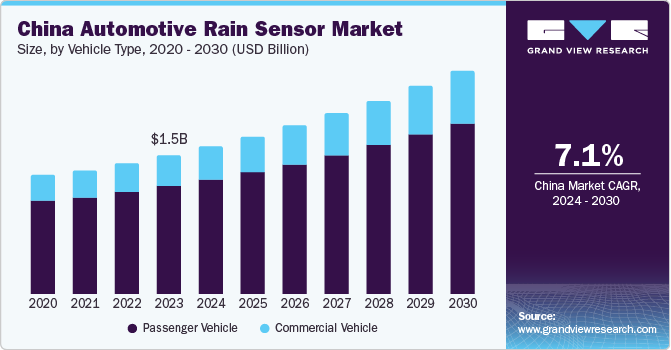

Vehicle Type Insights

The passenger vehicle segment held the largest market share of 77.3% in 2023. Increasing population, rise in disposable income, and advancements in vehicle technology features such as autonomous driving assistance systems are the key factors driving the demand for passenger vehicles. With the rise in disposable incomes, the consumer demand for vehicles with comfort and convenience features such as automatic climate control, panoramic sunroof, 360° parking camera, automatic headlights, and rain-sensing wipers has increased.

The commercial vehicle segment is expected to grow at the fastest CAGR over the forecast period. The increasing demand for enhanced safety features is anticipated to drive the growth of the commercial vehicle segment. With increasing industrialization, e-commerce, infrastructure development, and the growing need for transportation of goods, commercial vehicle sales have significantly increased. The rain sensors help improve road visibility by automatically turning on wipers during rain or snow. In May 2023, the Volkswagen commercial vehicle announced the launch of Amarok in the UK It is a new-generation pickup truck with a payload capacity of 1.19 tons. The new truck features advanced safety features such as lane keep assist, automatic rain-sensing wipers, and autonomous emergency braking.

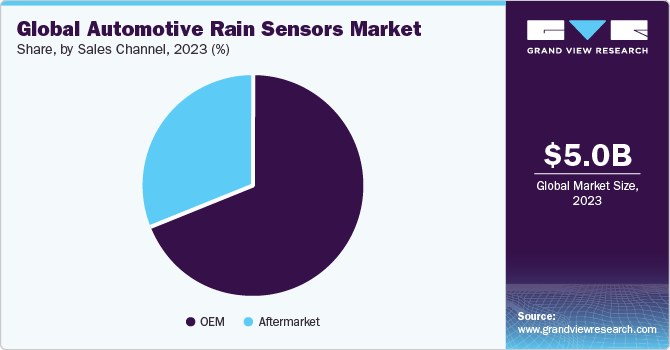

Sales Channel Insights

The OEM segment led the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR over the forecast period. The increasing production of vehicles, technological advancements, and consumer demand for improved safety features are driving the segment's growth.

The aftermarket segment is expected to grow at the fastest CAGR over the forecast period. Aftermarket manufacturers and suppliers witnessed a growing demand for rain sensors from automobile manufacturers. This demand is attributed to factors, such as increasing consumer awareness of safety features and the cost-effectiveness associated with rain sensor repairs. Aftermarket rain sensors are cost-effective over OEM sensors as they cost less to repair or replace in case of damage or malfunction.

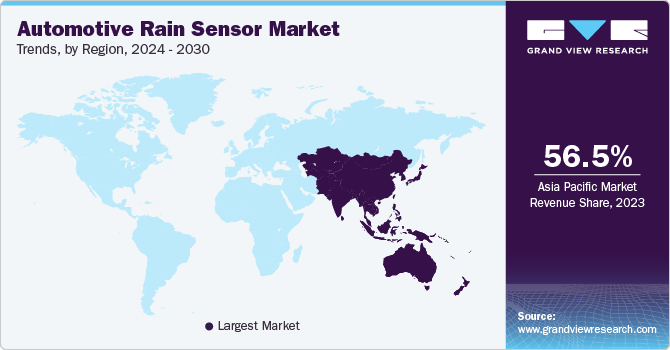

Regional Insights

The North America automotive rain sensor market is expected to grow at the fastest CAGR over the forecast period. The increasing technological advancements in autonomous driving are expected to drive the market's growth in the region.

U.S. Automotive Rain Sensor Market Trends

The automotive rain sensor market of the U.S. held the largest revenue share in 2023. The growing demand for advanced and comfortable features such as ADAS, parking assistance systems, automatic headlights, and rain-sensing wipers is expected to drive the market growth. Automobile manufacturers like Tesla, Ford, and Cadilac offer rain sensors and other advanced driver assistance features to enhance safety and driver comfort. In December 2023, Ford Motor Company announced the launch of the E transit Van company's first electric van for the commercial market. The van offers a range of 126 miles on a single charge and has advanced features such as connected vehicle technology, rain-sensing wipers, blind-spot assist, and lane departure warning.

Asia Pacific Automotive Rain Sensor Market Trends

The Asia Pacific automotive rain sensor market held the largest market share of 56.5% in 2023. The region has the largest automobile market, with China and India dominating sales. The growing population, rising disposable incomes among individuals, and increasing demand for advanced safety features are driving the growth of automotive rain sensors in the region.

The automotive rain sensor market of China accounted for a market share of 52.3% in 2023. The increasing demand for electric vehicles drives the growth of automotive rain sensors in China. BYD, an electric vehicle manufacturer in China, recorded 3 million new energy vehicle sales. The increasing demand for sustainable transport and reducing carbon emissions are key factors for the rise in electric vehicle sales. New vehicles are increasingly adopting advanced technology, such as autonomous driving, automatic headlights, and rain-sensing wipers.

The India automotive rain sensor market is anticipated to register the fastest CAGR over the forecast period. Increasing safety awareness is expected to drive the market growth for automotive rain sensors. In January 2024, Tata Motors announced the launch of Punch EV, a compact mid-sized electric SUV with automatic headlights, rain-sensing wiper, and 360° parking camera for enhanced safety.

Europe Automotive Rain Sensor Market Trends

The automotive rain sensor market in Europe is anticipated to grow significantly over the forecast period. The advancements in autonomous driving technologies and increasing focus on driver safety are expected to drive market growth. In March 2024, Euro NCAP announced new guidelines for vehicle manufacturers, urging them to standardize ADAS features in small panel vans for improved safety. The company aims that with this decision, small cargo vans will come equipped with driver assistance systems as standard and will enhance the overall safety of vehicles.

Key Automotive Rain Sensor Company Insights

-

Valeo SA is a French automotive supplier in the rain sensor market. Valeo offers various rain sensor solutions, from traditional optical and ultrasonic sensors to more advanced camera-based systems. Their sensors cater to various vehicle segments, from passenger cars to commercial trucks. Valeo provides additional functionalities beyond essential rain detection, like automatic headlight activation and wiper speed adjustment. This focus on innovation and diverse product offerings positions Valeo as a critical player in the evolving market.

-

Hella GmbH & Co. KGaA is a prominent German automotive parts manufacturer in the rain sensor market. They are known for their expertise in automotive electronics and sensor technology. Hella offers various rain sensor solutions, encompassing optical and ultrasonic technologies. Their sensors cater to multiple vehicles, ensuring compatibility between passenger and commercial vehicles. Beyond core rain detection functionalities, Hella rain sensors can be integrated with other systems for automatic headlight activation and improved visibility in challenging weather conditions. This focus on comprehensive solutions and a commitment to technological innovation solidify Hella's position as a critical player in the global market.

Key Automotive Rain Sensor Companies:

The following are the leading companies in the automotive rain sensor market. These companies collectively hold the largest market share and dictate industry trends.

- HELLA GmbH & Co. KGaA

- MITSUBISHI MOTORS CORPORATION.

- Hamamatsu Photonics K.K.

- Valeo SA

- KOSTAL Automobil Elektrik GmbH & Co. KG

- DENSO ELECTRONICS CORPORATION

- TOYOTA MOTOR CORPORATION.

- General Motors

- Volkswagen Group

- Daimler Truck AG

- BMW AG

Automotive Rain Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.38 billion |

|

Revenue forecast in 2030 |

USD 8.39 billion |

|

Growth rate |

CAGR of 7.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle type, sales channel, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

HELLA GmbH & Co. KGaA; MITSUBISHI MOTORS CORPORATION.; Hamamatsu Photonics K.K.; Valeo SA; KOSTAL Automobil Elektrik GmbH & Co. KG; DENSO ELECTRONICS CORPORATION; TOYOTA MOTOR CORPORATION.; Ford Motor Company; General Motors; Volkswagen Group; Daimler Truck AG.; BMW AG |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Rain Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global automotive rain sensormarket research report based on the vehicle type, sales channel, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive rain sensor market size was estimated at USD 5.03 billion in 2023 and is expected to reach USD 5.38 billion in 2024

b. The global automotive rain sensor market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 8.39 billion by 2030

b. The passenger vehicle segment held the largest market share of 77.3% in 2023. Increasing population, rise in disposable income, and advancements in vehicle technology features such as autonomous driving assistance systems are the key factors driving the demand for passenger vehicles.

b. Some key players operating in the automotive rain sensor market include HELLA GmbH & Co. KGaA, MITSUBISHI MOTORS CORPORATION., Hamamatsu Photonics K.K., Valeo SA, KOSTAL Automobil Elektrik GmbH & Co. KG, DENSO ELECTRONICS CORPORATION, TOYOTA MOTOR CORPORATION., Ford Motor Company, General Motors, Volkswagen Group, Daimler Truck AG., BMW AG

b. The increasing demand for vehicles, advancement in sensor technology and increasing demand for comfort and convenience features in vehicles are driving the market growth. With the growth of the automotive industry, the demand for advanced features like rain sensors in newer vehicles has increased.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."