- Home

- »

- Automotive & Transportation

- »

-

Automotive Radar Market Size, Share & Trends Report, 2030GVR Report cover

![Automotive Radar Market Size, Share & Trends Report]()

Automotive Radar Market (2024 - 2030) Size, Share & Trends Analysis Report By Range (Long Range Radar, Medium & Short Range Radar), By Frequency (2X-GHz, 7X-GHz), By Engine, By Vehicle, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-584-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Radar Market Summary

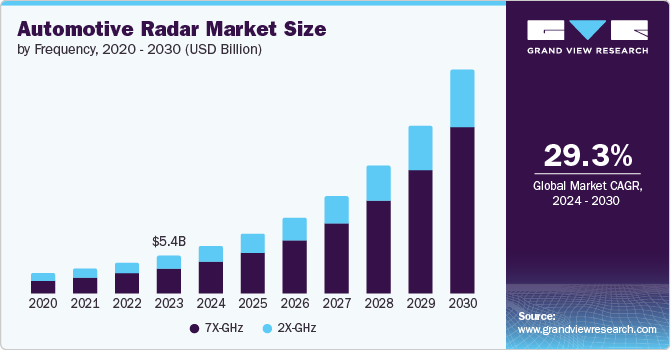

The global automotive radar market size was estimated at USD 5.40 billion in 2023 and is projected to reach USD 31.45 billion by 2030, growing at a CAGR of 29.3% from 2024 to 2030. Manufacturers and consumers are placing greater emphasis on passenger safety due to the rise in accidents worldwide.

Key Market Trends & Insights

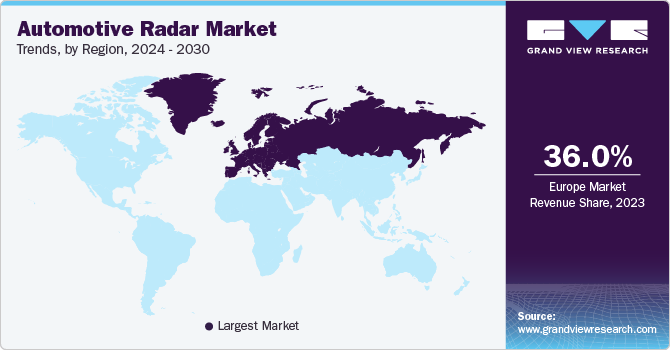

- Europe automotive radar market dominated the market 36.02% in 2023.

- The U.S. automotive radar market held a dominant position in 2023.

- Based on range, the medium & short-range radar segment dominated the market and accounted for a share of 54.9% in 2023 and is expected to register the fastest CAGR of 30.3% during the forecast period.

- Based on frequency, the 7X-GHz segment accounted for the largest market revenue share in 2023 and is expected to register the fastest CAGR during the forecast period.

- Based on engine, the internal combustion engine (ICE) segment dominated the market in 2023 due to its significant presence across the entire automotive sector.

Market Size & Forecast

- 2023 Market Size: USD 5.40 Billion

- 2030 Projected Market Size: USD 31.45 Billion

- CAGR (2024-2030): 29.3%

- Europe: Largest market in 2023

For instance according to WHO report around 1.19 million people die due to road traffic crashes every year. The increasing number of accidents impact led to strict safety regulations by governments to protect passengers and enhance the driving environment. Modern cars use a variety of radio frequency devices to enhance safety while driving. Moreover, the growing need for Advanced Driver Assistance Systems (ADAS) is a major driver, as radar technology plays a crucial role in functions such as parking assistance, adaptive cruise control, blind spot detection, and autonomous emergency braking.

Certain high-end cars come equipped with pilot mode and driver assistance modules, in which a central computing system uses radars, actuators and sensors to aid driving tasks. Automotive radars offer precise information on object tracking, object detection and motion prediction, to enhance the quality of automated driving.

Additionally, the growth of self-driving vehicles heavily depends on radar systems for detecting, measuring distances, and tracking objects, which in turn drives market growth. Furthermore, advancements in technology improving radar performance, size reduction, and cost are increasing the possibility of integrating radar into a broader selection of vehicles. Increasing awareness among consumers regarding vehicle safety and a preference for high-tech features are both factors contributing to the growth of the market.

Changes in safety regulations are leading to significant transformations in the global automotive radar market. Mandatory advanced capabilities in radar sensors are being required by European NCAP 2025 safety roadmap and strict safety ratings from the NATSA. It is anticipated that vehicles starting from the 2025 model year might equipped with multiple radar sensors to meet these demands. Mid-level cars could have as many as five radar sensors positioned strategically throughout the vehicle to achieve 360-degree perimeter sensing. Top-of-the-line cars could use over ten sensors, and managing the larger amount of data they generate will be essential, as well as coordinating between the sensors.

Range Insights

Medium & short-range radar dominated the market and accounted for a share of 54.9% in 2023 and is expected to register the fastest CAGR of 30.3% during the forecast period. The rise of technology like rear cross-traffic alert and adaptive cruise control (ACC), heading distance indicators and autonomous emergency braking (AEB) is driving growth in the segment.

The medium-range radar is equipped with Digital Beamforming (DBF) and has three to four receiving channels. This enables medium-range radar to have separate receive channels for various directions, enhancing the measurement precision of MRR.

Frequency Insights

7X-GHz accounted for the largest market revenue share in 2023 and is expected to register the fastest CAGR during the forecast period due to its high accuracy in detecting objects and ability to operate in different weather conditions. The radar working at 77 GHz frequency is utilized for short-range purposes such as adaptive cruise control, collision alert, and lane departure warning, within the 76-81 GHz frequency range.

In addition, 7X-GHz offers high accuracy and detail, but can be affected by other car electrical components. Moreover, longer range, higher resolution, and improved object discrimination of this frequency band are essential for ADAS and autonomous vehicle functions. Accurate object detection and tracking need in today's complex systems, for which 7X-GHz radar is highly effective. Furthermore, the increasing focus on electric vehicles and self-driving technology in the automotive sector is driving the need of 7X-GHz frequency band.

Engine Insights

Internal Combustion Engine (ICE) dominated the market in 2023 due to its significant presence across the entire automotive sector. Despite the rapid growth of the electric vehicle (EV) market, ICE vehicles still make up the majority of vehicles on the road. The substantial market opportunity for radar technology integration is present due to the extensive fleet of ICE vehicles already in existence. Furthermore, numerous radar systems and technologies were originally created ICE vehicles, and their modification for EVs is in progress.

The electric sector is projected to grow at the fastest CAGR over the forecast period. The rise of electric vehicles due to environmental issues, technological progress and government support, are leading to a surge in production and sales. Radar systems play a crucial role in the safety and autonomous driving functionalities of EVs, rendering them indispensable parts. Furthermore, specialized radar solutions are required for electric vehicles due to their unique features like regenerative braking and varying weight distribution, leading to increased innovation and need.

Application Insights

Adaptive Cruise Control (ACC) dominated the market in 2023. Stringent government regulations are anticipated to increase the demand for ACC to prevent road collisions. ACC adjusts the speed of vehicle based on nearby vehicles. Radar located at front of vehicle detects speed of vehicles in front and adjusts its own speed accordingly. If the ACC system detects that the car in front is out of range, it resumes accelerating to the user's set speed. Automated vehicle processes do not require user intervention for both acceleration and deceleration.

Forward Collision Warning (FCW) system is projected to grow at the fastest CAGR over the forecast period. Attributed to the rising frequency of rear-end collisions. FCW systems lead to notable decrease in the risk of these accidents, resulting in an increase in demand. Moreover, the increasing consumer knowledge of vehicle safety features and a desire for technologically advanced vehicles are driving the growth. Furthermore, the market is driven even more by government regulations requiring the implementation of advanced safety systems in new vehicles. In addition, the ongoing progress in radar, sensor technologies and camera is improving the effectiveness and cost-effectiveness of FCW systems, expanding availability to a broader array of vehicles.

Vehicle Insights

Commercial vehicles dominated the market in 2023. The increased risk of accidents with big commercial vehicles highlights the need for advanced safety measures. Radar technology is vital for enhancing road safety, reducing injuries, and avoiding crashes for commercial vehicles. Moreover, the increasing need for fuel efficiency and fleet management solutions have driven the use of radar-based systems such as adaptive cruise control and collision avoidance. As commercial vehicle fleets expand and operate in diverse conditions, the need for reliable and robust radar technology becomes vital.

The passenger cars sector is projected to grow at the fastest CAGR over the forecast period. The growing interest in modern safety features is driving the demand for passenger cars equipped with radar. Features like lane departure warning, adaptive cruise control, and blind spot detection are increasingly being included as standard or optional in many different models of passenger vehicles. Additionally, the increase in urbanization and crowded traffic situations is highlighting the importance of ADAS in improving safety and the driving experience.

Regional Insights

The North America automotive radar market was identified as a lucrative region in 2023. The primary factors influencing the extensive adoption of automotive radar technology are strict safety mandates, growing consumer desire for advanced driver assistance systems (ADAS), and heightened emphasis on automotive radar applications.

U.S. Automotive Radar Market Trends

The U.S. automotive radar market held a dominant position in 2023. One major factor is increased need for advanced safety technologies and the involvement of major car manufacturers such as GM (U.S.), Tesla (U.S.), and Ford (U.S.), which are incorporating different radar-based semi-autonomous driving systems like and GM Super Cruise, Tesla Autopilot, Ford Blue Cruise, in vehicles.

Europe Automotive Radar Market Trends

Europe automotive radar market dominated the market 36.02% in 2023. The substantial development in the region is primarily due to governmental efforts in UK, Germany, and other European nations to promote safe transportation. Furthermore, strict safety regulations are also contributing to the increased demand for ADAS. Additionally, the EU's General Safety Regulation requires the inclusion of ADAS functions such as automatic emergency braking and lane-keeping assist, which rely heavily on radar technology.

The UK automotive radar market is expected to grow rapidly in the coming years due to a focus on vehicle safety in the nation. The rise in popularity of ADAS and the rising desire for safer vehicles led to the integration of radar technology. Moreover, the growing electric car industry, which emphasizes cutting-edge technology, established a conducive setting for radar incorporation.

Automotive radar market in Germany is held a substantial market share in 2023 driven by a strong focus on car safety, technological advancements, and luxury. The strong automotive manufacturing industry in the country, featuring known brands such as Mercedes-Benz, BMW, and Audi, plays a major role in driving the market. These luxury car manufacturers are among the first to embrace ADAS and autonomous vehicle technologies, which heavily utilize radar.

Asia Pacific Automotive Radar Market Trends

The Asia Pacific automotive radar market is anticipated to grow during the forecast period due to an increasing ownership of vehicles in the region. Moreover surge in popularity of electric vehicles in this area is contributing to the growth of the market. Furthermore, market growth is propelled by the manufacturing industries in China, India, and Japan. With the increasing safety worries of consumers in India and the ASEAN countries, automotive companies are incorporating additional sensors into budget-friendly vehicles. There is an expected rise in the need for vehicle sensors.

The Japan automotive radar market is expected to grow rapidly in the coming years due to technological advancements and a significant focus on the safety of vehicles. This has led to a suitable environment for the growth and acceptance of ADAS, which depend on radar technology. Additionally, rising levels of traffic congestion have raised worries about road safety, leading to increased need for features like collision prevention and driver assistance. In addition, Japan has a strong automotive manufacturing sector that includes top global companies such as Nissan, Honda, and Toyota.

Key Automotive Radar Company Insights

Some of the key companies in the automotive radar include ZF Friedrichshafen AG, Robert Bosch GmbH, HELLA GmbH & Co. KGaA, Denso Corporation and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Valeo is automotive technology company known for its radar systems. Their range of radar products and services include mid-range radar sensors for ADAS and automated parking, high-definition radar sensors for advanced driver assistance and automated driving, and parking assistance systems, with different vehicle types and upcoming technological advances.

Key Automotive Radar Companies:

The following are the leading companies in the automotive radar market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Valeo

- ZF Friedrichshafen AG

- HELLA GmbH & Co. KGaA

- Autoliv Inc.

- Infineon Technologies AG

- Texas Instruments Incorporated

- NXP Semiconductors

Recent Developments

-

In September 2023, Mercedes-Benz launched Drive Pilot with Level 3 autonomous technology in the U.S. Safety is a major focus of Drive Pilot, incorporating a rear camera, LiDAR, road wetness sensor and microphones for the detection of emergency vehicle.

-

In January 2023, Continental, a technology corporation, and Ambarella, Inc., a semiconductor company specializing in edge AI, revealed a strategic alliance. Both the organizations are expected to develop scalable & end to end software and hardware based on AI for automated driving.

Automotive Radar Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.73 billion

Revenue forecast in 2030

USD 31.45 billion

Growth Rate

CAGR of 29.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Range, frequency, engine, vehicle, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France ,China, Japan, India, South Korea, Australia, Brazil,UAE, and South Africa

Key companies profiled

Robert Bosch GmbH; Continental AG; Denso Corporation; Valeo; ZF Friedrichshafen AG; HELLA GmbH & Co. KGaA; Autoliv Inc.; Infineon Technologies AG; Texas Instruments Incorporated; NXP Semiconductors;

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Radar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive radar market report based on range, frequency, engine, vehicle, application and region.

-

Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Long Range Radar

-

Medium & Short Range Radar

-

-

Frequency Outlook (Revenue, USD Billion, 2018 - 2030)

-

2X-GHz

-

7X-GHz

-

-

Engine Outlook (Revenue, USD Billion, 2018 - 2030)

-

ICE

-

Electric

-

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adaptive Cruise Control (ACC)

-

Autonomous Emergency Braking (AEB)

-

Blind Spot Detection (BSD)

-

Forward Collision Warning System

-

Intelligent Park Assist

-

Other ADAS systems

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.