Automotive Printed Circuit Board Market Size, Share & Trends Analysis Report By Type (Double-Sided PCB, Multi-Layer PCB, Single-Sided PCB), By Vehicle Type, By Level of Autonomy, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-379-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

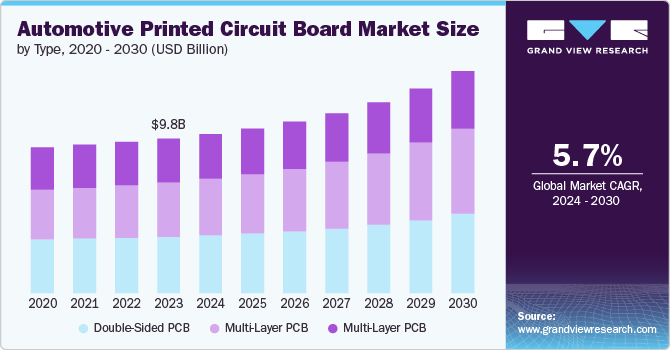

The global automotive printed circuit board market size was estimated at USD 9.79 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. The automotive PCB market is experiencing significant growth driven by various trends, dynamics, and opportunities. One major trend is the shift towards electric vehicles (EVs), which require sophisticated electronic systems like battery management and powertrain control modules, heavily reliant on PCBs. Additionally, advancements in autonomous driving technologies, including ADAS, demand high-performance PCBs to support the complex array of sensors and AI processors involved. The integration of advanced infotainment systems, driven by consumer demand for in-car connectivity and entertainment, is also a key trend, necessitating more sophisticated PCBs.

Several market drivers are fueling this growth. Technological advancements in automotive electronics and printed circuit board (PCB) manufacturing enhance performance and reliability, while stricter safety and emission regulations compel automakers to incorporate advanced electronic systems, boosting PCB demand. Consumer expectations for safety, connectivity, and infotainment further drive market expansion.

However, the market faces restraints such as high initial costs for developing advanced PCBs and complex manufacturing processes that require significant investment in expertise and equipment. Additionally, challenges like supply chain disruptions and economic fluctuations can impact raw material availability and overall market stability.

Despite these challenges, there are substantial opportunities in the automotive PCB market. The rapid growth of the electric vehicle segment presents a significant opportunity, as EVs require more electronic components than traditional vehicles. Emerging markets in Asia Pacific and Latin America offer further growth prospects due to increasing vehicle production and the adoption of advanced automotive technologies. Sustainability initiatives are also driving the development of eco-friendly and energy-efficient PCBs, opening new avenues for innovation. Furthermore, continuous technological advancements, such as flexible and rigid-flex PCBs, support the increasing complexity and miniaturization of automotive electronic systems, providing additional growth opportunities.

Type Insights

The double-sided PCBs segment dominated the market in 2023 and accounted for a more than 36% share of global revenue. Double-sided PCBs dominate the automotive PCB market due to their versatility and efficiency in providing intermediate-level complexity at a lower cost than multi-layer PCBs. These PCBs are widely used in various automotive level of autonomy, including lighting systems, power supplies, and instrumentation, due to their ability to support surface mount technology (SMT) and through-hole components on both sides. The market dominance of double-sided PCBs can be attributed to their balance between performance and cost, making them ideal for mid-range level of autonomy.

As automotive technology evolves, the demand for more electronic content in vehicles continues to rise. This trend supports the growth of double-sided PCBs, which offer enhanced functionality compared to single-sided PCBs without the higher costs associated with multi-layer PCBs. Their widespread use in electronic control units (ECUs), engine control systems, and transmission control systems underscores their critical role in modern vehicles. Additionally, the growing focus on electric vehicles (EVs) and advanced driver-assistance systems (ADAS) is boosting the need for reliable and cost-effective PCB solutions, further solidifying the market position of double-sided PCBs.

The multi-layer PCB segment is projected to witness significant growth from 2024 to 2030. The multi-layer PCB segment is the fastest growing in the automotive PCB market, driven by the increasing complexity and functionality required in modern vehicles. These PCBs consist of three or more conductive layers, offering high circuit density and enhanced performance. The growth of multi-layer PCBs is fueled by the rapid adoption of advanced automotive technologies, including ADAS, infotainment systems, and electric vehicle powertrains. As vehicles become more sophisticated, the need for PCBs that can handle higher frequencies and greater electrical performance becomes paramount. Multi-layer PCBs are ideal for these Level of Autonomy due to their ability to support complex circuitry and higher component densities. The trend towards autonomous driving and the integration of more electronic features in vehicles also contribute to the rising demand for multi-layer PCBs. Additionally, the shift towards electric and hybrid vehicles, which require more robust and reliable electronic systems, further accelerates the growth of this segment. Multi-layer PCBs are essential for critical Level of Autonomy such as battery management systems, inverters, and motor controllers, making them indispensable in the automotive industry's push towards electrification and advanced driver assistance.

Vehicle Type Insights

The passenger car segment dominated the market in 2023. The passenger car segment dominates the automotive PCB market, primarily due to the high volume of production and the increasing incorporation of advanced electronic systems in these vehicles. Passenger cars are equipped with a wide array of electronic components, including infotainment systems, navigation systems, advanced safety features, and comfort-related electronics, all of which require sophisticated PCBs.

The rising consumer demand for enhanced driving experiences, connectivity, and safety features drives the need for more PCBs in passenger cars. Additionally, the trend towards electric and hybrid passenger cars further boosts the demand for automotive PCBs, as these vehicles rely heavily on electronic systems for battery management, powertrain control, and energy efficiency.

The dominance of passenger cars in the PCB market is also supported by the continuous advancements in automotive technology, such as ADAS and autonomous driving capabilities, which are more commonly integrated into passenger cars before commercial vehicles. As a result, the passenger car segment remains the largest consumer of automotive PCBs, reflecting the broader trends of increasing electronic content and technological innovation in the automotive industry.

The commercial vehicle is the fastest-growing segment in the automotive printed circuit board (PCB) market driven by the increasing adoption of advanced electronic systems in trucks, buses, and other commercial vehicles. These vehicles are incorporating more sophisticated electronics to enhance safety, efficiency, and connectivity. Key Level of Autonomy include telematics, fleet management systems, advanced braking systems, and powertrain control modules. The rise of electric and hybrid commercial vehicles is also a significant factor contributing to the growth of this segment. Electric buses and trucks require robust electronic systems for battery management, motor control, and charging infrastructure, driving the demand for high-performance PCBs.

Furthermore, the logistics and transportation industry's shift towards smart and connected vehicle solutions is accelerating the integration of advanced electronics in commercial vehicles. This trend is supported by regulatory requirements for enhanced safety and emissions standards, which necessitate more complex and reliable electronic systems. As a result, the commercial vehicle segment is experiencing rapid growth in the automotive PCB market, reflecting the broader move towards smarter, safer, and more efficient transportation solutions.

Level of Autonomy Insights

The conventional vehicles segment dominated the market in 2023 conventional vehicles dominate the automotive PCB market, primarily due to their widespread presence and the gradual transition to more advanced vehicle technologies. Despite the growing interest in electric and autonomous vehicles, conventional vehicles still represent the majority of the global automotive fleet. These vehicles rely on a variety of electronic systems for engine control, transmission, infotainment, and safety features, all of which require PCBs.

The dominance of conventional vehicles is supported by the ongoing demand for gasoline and diesel-powered vehicles, especially in regions with less developed infrastructure for electric vehicles. Additionally, the incremental improvements in fuel efficiency and emissions control in conventional vehicles continue to drive the integration of advanced electronic systems, sustaining the demand for automotive PCBs.

The market for PCBs in conventional vehicles is also bolstered by the retrofitting and upgrading of existing vehicles with modern electronics, further enhancing their performance and safety. As a result, conventional vehicles remain the dominant segment in the automotive PCB market, reflecting the broader trends of technological enhancement and sustained demand for traditional vehicle types.

The autonomous vehicles segment is experiencing significant growth in the automotive printed circuit board (PCB) market, The autonomous vehicles segment is the fastest growing in the automotive PCB market, driven by the rapid advancements in self-driving technology and the increasing investments in autonomous vehicle development. Autonomous vehicles rely heavily on complex electronic systems to operate safely and efficiently, including sensors, cameras, LiDAR, radar, and artificial intelligence (AI) processors, all of which require advanced PCBs. The high demand for multi-layer and flexible PCBs in these vehicles is due to their ability to support the intricate and high-density circuitry needed for autonomous driving. The growth of this segment is fueled by the push from major automotive manufacturers and technology companies towards achieving fully autonomous driving capabilities.

Additionally, the regulatory environment is gradually evolving to support the deployment of autonomous vehicles, further accelerating the adoption of advanced PCBs. The integration of vehicle-to-everything (V2X) communication technologies, which enable autonomous vehicles to interact with their surroundings, also drives the need for sophisticated PCBs. As the development and testing of autonomous vehicles progress, the demand for high-performance and reliable PCBs continues to rise, making this segment the fastest growing in the automotive PCB market.

Application Insights

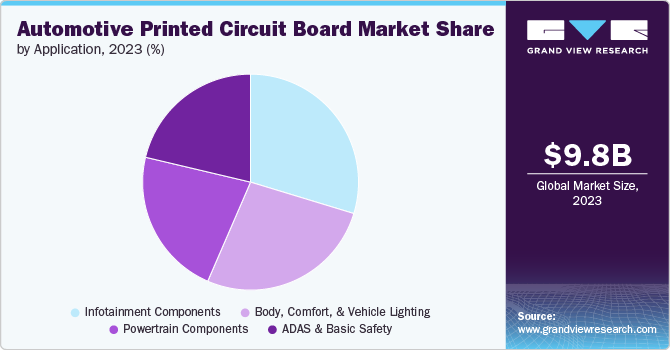

The infotainment components segment dominated the market in 2023 due to the growing consumer demand for connectivity, entertainment, and information systems in vehicles. Modern vehicles are equipped with advanced infotainment systems that include navigation, multimedia, internet connectivity, and smartphone integration, all of which require sophisticated PCBs.

The dominance of this segment is driven by the increasing incorporation of high-tech features in vehicles, particularly in mid-range and luxury segments. Infotainment systems enhance the driving experience by providing seamless connectivity and access to a wide range of digital content, making them a key differentiator in the competitive automotive market. The continuous advancements in display technologies, user interfaces, and connectivity options, such as 5G, further boost the demand for complex and high-density PCBs in infotainment applications. Additionally, the trend towards integrating infotainment systems with other in-car technologies, such as ADAS and telematics, amplifies the need for robust and reliable PCBs.

The ADAS and basic safety segment is experiencing significant growth in the automotive printed circuit board (PCB) market driven by the increasing focus on vehicle safety and the integration of advanced driver-assistance systems. ADAS includes features such as automatic emergency braking, collision avoidance, adaptive cruise control, and lane departure warning, which rely on a network of sensors, cameras, and radar systems, all requiring sophisticated PCBs.

The rapid growth of this segment is fueled by regulatory mandates and consumer demand for enhanced vehicle safety. Governments worldwide are implementing stricter safety standards, pushing automotive manufacturers to incorporate ADAS features in their vehicles, thereby increasing the demand for automotive PCBs. Additionally, the rising incidence of road accidents has heightened the awareness and adoption of these safety systems, further driving market growth. The advancements in sensor technology and the development of AI and machine learning algorithms for real-time data processing also contribute to the increased demand for high-performance PCBs in ADAS applications. As the automotive industry moves towards higher levels of vehicle automation, the ADAS and basic safety segment is expected to continue its rapid growth, significantly impacting the automotive PCB market.

Regional Insights

The automotive printed circuit board (PCB) market in North America is characterized by a strong emphasis on technological innovation and the rapid adoption of advanced automotive electronics. The region's robust automotive industry, particularly in the United States and Canada, drives significant demand for PCBs used in various applications, including advanced driver-assistance systems (ADAS), infotainment systems, and powertrain control modules.

The presence of major automotive manufacturers and technology companies, coupled with a strong focus on research and development, fosters the growth of the PCB market. The push towards electric and autonomous vehicles further accelerates this demand, as these vehicles require more sophisticated and high-density PCBs. Regulatory initiatives aimed at improving vehicle safety and emissions standards also contribute to the market growth by driving the adoption of advanced electronic systems in vehicles.

Additionally, the region's well-established infrastructure for electric vehicles, including extensive charging networks, supports the increasing integration of PCBs in electric and hybrid vehicles. The North American automotive PCB market is expected to continue its growth trajectory, supported by ongoing advancements in automotive technology and the region's commitment to enhancing vehicle safety and connectivity.

U.S. Automotive Printed Circuit Board Market Trends

The automotive printed circuit board (PCB) market in the U.S. plays a pivotal role in the North American automotive PCB market, driven by the country's strong automotive industry and technological advancements. The U.S. is home to major automotive manufacturers and a thriving ecosystem of technology companies that are at the forefront of developing advanced automotive electronics.

The demand for PCBs in the U.S. is propelled by the rapid adoption of electric and autonomous vehicles, as well as the integration of advanced driver-assistance systems (ADAS) and infotainment systems in vehicles. Regulatory mandates aimed at enhancing vehicle safety and reducing emissions also drive the market by encouraging the adoption of more sophisticated electronic systems.

The U.S. market is characterized by significant investments in research and development, leading to continuous innovations in PCB technology and applications. The growing consumer demand for connected and intelligent vehicles further supports the market growth, as these vehicles require complex and high-density PCBs. The U.S. automotive PCB market is expected to continue its robust growth, driven by the ongoing advancements in automotive technology and the country's commitment to leading the future of mobility.

Asia Pacific Automotive Printed Circuit Board Market Trends

The Asia Pacific region is the largest and fastest-growing market for automotive PCBs, driven by the high production volume of vehicles and the rapid adoption of advanced automotive technologies. China, Japan, and South Korea are key markets within the region, with China being the largest automotive market globally. The region's strong manufacturing base, coupled with significant investments in electric vehicle (EV) technology, drives the demand for PCBs.

Governments in the Asia Pacific region are actively promoting electric mobility through subsidies and favorable policies, further boosting the market. The rapid urbanization and increasing consumer demand for advanced safety and infotainment features in vehicles also contribute to the market growth. Additionally, the presence of major PCB manufacturers and suppliers in the region enhances the supply chain efficiency and supports the production of high-quality PCBs.

The Asia Pacific automotive PCB market benefits from the region's focus on technological advancements and the growing trend towards smart and connected vehicles. As the automotive industry continues to evolve, the Asia Pacific region is expected to maintain its leading position in the global automotive PCB market.

Europe Automotive Printed Circuit Board Market Trends

The automotive printed circuit board market in Europe is marked by the region's strong automotive heritage and commitment to innovation in vehicle electronics. Germany, France, and the United Kingdom are key contributors to the market, with Germany being a major hub for automotive manufacturing and technology development.

The region's stringent environmental regulations and focus on reducing carbon emissions drive the adoption of electric and hybrid vehicles, which in turn boosts the demand for advanced PCBs. European automakers are at the forefront of integrating advanced driver-assistance systems (ADAS) and autonomous driving technologies, further increasing the need for high-performance PCBs.

The market is also influenced by the growing demand for enhanced in-car connectivity and infotainment systems, reflecting consumers' preferences for more connected and intelligent vehicles. Europe's strong focus on safety and innovation, coupled with significant investments in research and development, positions the region as a critical market for automotive PCBs. The ongoing shift towards electric mobility and the development of smart transportation infrastructure are expected to sustain the growth of the automotive PCB market in Europe.

Key Automotive Printed Circuit Board Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Automotive Printed Circuit Board Companies:

The following are the leading companies in the automotive printed circuit board market. These companies collectively hold the largest market share and dictate industry trends.

- Chin Poon Industrial

- Meiko Electronics

- Nippon Mektron

- TTM Technologies

- KCE Electronics

- Tripod Technology

- Unimicron Technology

- Kingboard Chem GRP

- Amitron Corp

- CMK Corp.

Recent Development

-

In May 2024, Chin-Poon Industrial, known for its significant focus on automotive PCB production, has announced plans to invest an additional approximately US$ 27.3 million to expand its factory site in Thailand.

-

In November 2022, Unimicron Germany allocated an additional EUR 12 million to upgrade its infrastructure, equipment, and facilities. The new structure, which is situated next to the inner layer production site established in 2018, is intended to enhance the company's technological edge and promote sustainability. This substantial investment includes funding for the new building, as well as infrastructure and equipment for desmearing processes, chemical and galvanic copper plating, modern fire protection systems, and a new groundwater decontamination facility.

Automotive Printed Circuit Board Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.08 billion |

|

Revenue forecast in 2030 |

USD 14.09 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, vehicle type, level of autonomy, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Chin Poon Industrial; Meiko Electronics; Nippon Mektron; TTM Technologies; KCE Electronics; Tripod Technology; Unimicron Technology; Kingboard Chem GRP; Amitron Corp; CMK Corp. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Printed Circuit Board Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive printed circuit board market-based on type, vehicle type, level of autonomy, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Double-Sided PCB

-

Multi-Layer PCB

-

Single-Sided PCB

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Car

-

Commercial Vehicle

-

-

Level of Autonomy Outlook (Revenue, USD Million, 2018 - 2030)

-

Autonomous Vehicles

-

Conventional Vehicles

-

Semi-Autonomous Vehicles

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

ADAS and Basic Safety

-

Body, Comfort, and Vehicle Lighting

-

Infotainment Components

-

Powertrain Components

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive printed circuit board market size was estimated at USD 9.79 billion in 2023 and is expected to reach USD 10.08 billion in 2024.

b. The global automotive printed circuit board market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 14.09 billion by 2030.

b. Asia Pacific dominated the automotive printed circuit board market with a share of over 35% in 2023. The Asia Pacific region is the largest and fastest-growing market for automotive PCBs, driven by the high production volume of vehicles and the rapid adoption of advanced automotive technologies. China, Japan, and South Korea are key markets within the region, with China being the largest automotive market globally

b. Some key players operating in the automotive PCB market include Chin Poon Industrial, Meiko Electronics, Nippon Mektron, TTM Technologies, KCE Electronics, Tripod Technology, Unimicron Technology, Kingboard Chem GRP, Amitron Corp, and CMK Corp.

b. Key factors driving market growth include technological advancements in automotive electronics and PCB manufacturing enhance performance and reliability, while stricter safety and emission regulations compel automakers to incorporate advanced electronic systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."