- Home

- »

- Automotive & Transportation

- »

-

Automotive Powertrain Market Size & Share Report, 2030GVR Report cover

![Automotive Powertrain Market Size, Share & Trends Report]()

Automotive Powertrain Market (2023 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Propulsion Type (ICE, Electric Vehicle), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-362-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Powertrain Market Summary

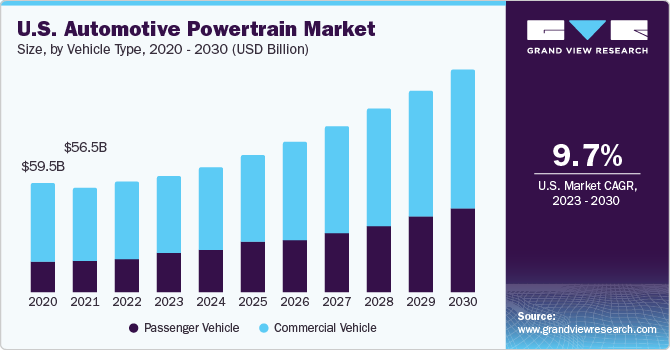

The global automotive powertrain market size was valued at USD 792.0 billion in 2022 and is projected to reach USD 2,446.74 billion by 2030, growing at a CAGR of 15.8% from 2023 to 2030. Low automotive sales and new requirements amid the COVID-19 pandemic have affected the overall automotive industry, leading to a subsequent decline in the market's growth. The growing demand for vehicle electrification in the automotive industry and the increasing sales of electric vehicles also contribute to the demand for automotive powertrains. Moreover, the increasing demand for automated transmission and engine downsizing to improve the fuel efficiency of vehicles is projected to accelerate the market's growth.

Key Market Trends & Insights

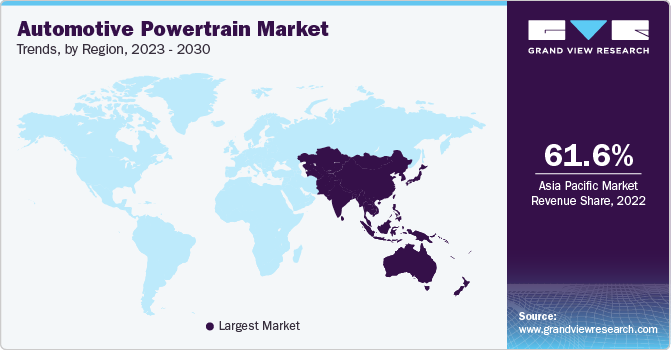

- Asia Pacific accounted for the largest market share of 61.6% in 2022.

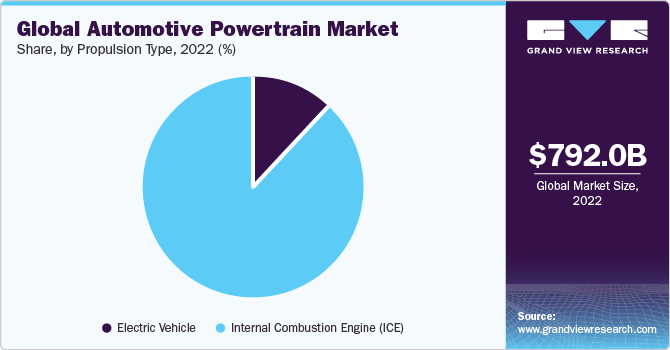

- By propulsion type, The Internal Combustion Engine (ICE) segment accounted for the largest share of 87.7% in 2022.

- By propulsion type, the electric vehicle segment is expected to register the highest CAGR of 28.1% over the forecast period.

- By vehicle type, the passenger vehicle segment dominated the market with a revenue share of 75.9% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 792.0 Billion

- 2030 Projected Market Size: USD 2,446.74 Billion

- CAGR (2023-2030): 15.8%

- Asia Pacific: Largest market in 2022

Increasingly stringent carbon and nitrogen emissions regulations globally will likely drive market growth over the forecast period. Furthermore, high demand for automobiles, increasing consumption expenditures, and upgrades of automobile systems are projected to be significant market growth drivers. The fluctuating prices of conventional fuel and the rising sales of electric vehicles are expected to drive vehicle electrification initiatives globally. Stringent emission norms and growing awareness about environmental issues among customers are also expected to favor vehicle electrification initiatives. Leading automotive players such as Bosch and Renault Group are focusing on adding electrified vehicles to their product portfolios. These factors are expected to drive the growth of the automotive powertrain market over the forecast period.

Benefits offered by advanced technologies, such as combustion control improvements in internal combustion engines, are expected to trigger growth. Furthermore, the increased preference for vehicles offering improved driving dynamics encourages manufacturers to develop new systems catering to this demand in the current environment. Moreover, the high demand for vehicles with advanced features in emerging countries is expected to offer lucrative growth opportunities for the market.

The COVID-19 pandemic changed business dynamics in 2020 and is anticipated to affect the overall business scenario over the next few years. Lockdowns imposed worldwide to reduce the spread of the virus have led to supply chain disruptions and the temporary closure of numerous production facilities. As a result, shipments were delayed, and production volumes plummeted. The dwindling sales of passenger and commercial vehicles also impacted the automotive powertrain industry. Manufacturers of automotive powertrains continued to face issues with supplies of raw materials over the second half of 2020 owing to delays in international shipments and reported production delays.

Decreased production volumes in North America and Europe led to an overall decline in production volumes globally on a year-on-year basis. Global car sales between January and April 2020 dropped by about 33.3% compared to the same period in 2019, with around 9 billion fewer cars sold. In the U.S., passenger car sales were down by roughly 50% year-on-year in 2020 compared to 2019. The COVID-19 pandemic also caused a dramatic decline in electric car sales. The sales of plug-in light-duty electric vehicles in the U.S. in 2020 totaled 296,000 units, significantly less than the 331,000 units sold in 2019, a year-on-year decline of over 8.5%.

The increasing preference for high-performance vehicles with higher torque output and higher capacity engines is expected to encourage the market growth for automotive power train within the forecast period. The introduction of automated transmission is also expected to drive the overall market growth, given the diversifying powertrain portfolio to include electric and hybrid powertrains. The automotive industry is pivoting towards the thread of electric vehicles and autonomous cars; the use of automated transmission and other powertrain components will help the market grow.

Furthermore, the stringent government mandates, particularly by the North American and European region governments, to curb the rising carbon emission concentration in the environment are creating demand for better quality powertrains that are smaller and lightweight yet help reduce emissions while improving vehicle performance and fuel efficiency.

The uptake of electric vehicles is a major driving force behind the growth of the powertrain market. The highly volatile crude oil prices are prompting governments and automobile manufacturers to pivot towards alternative fuel sources such as electricity and hydrogen-powered vehicles. The growth is supported by the constant attempts of the automotive industry to reduce the battery-reducing cost while improving the driving range of EVs and reducing the total ownership cost of EVs.

Propulsion Type Insights

The Internal Combustion Engine (ICE) segment accounted for the largest share of 87.7% in 2022. The ICE segment consists of gasoline, diesel, and natural gas vehicles. Currently, gasoline engines are widely adopted and are projected to be replaced by diesel engines owing to the increasing difference between diesel and gasoline prices. However, the price difference between ICEs and EVs and improper charging infrastructure are the major factors that benefit the adoption of ICE vehicles. Due to these factors, component manufacturers are adopting hybrid powertrains to reduce vehicle fuel usage.

The electric vehicle segment is expected to register the highest CAGR of 28.1% over the forecast period. The slowdown in the sales of internal combustion engine vehicles and restrictions on CO2 targets have helped increase demand for electric vehicles. The mass adoption of BEVs is an effective solution to cutting emissions and reducing the total cost of ownership in the long run. Moreover, advancements in battery technology and a reduction in Lithium-ion battery prices are also expected to boost the demand for BEVs over the forecast period.

The electric vehicle segment is expected to register the highest CAGR of 28.1% over the forecast period. The slowdown in the sales of internal combustion engine vehicles and restrictions on CO2 targets have helped increase demand for electric vehicles. The mass adoption of BEVs is an effective solution to cutting emissions and reducing the total cost of ownership in the long run. Moreover, advancements in battery technology and a reduction in Lithium-ion battery prices are also expected to boost the demand for BEVs over the forecast period.Vehicle Type Insights

The passenger vehicle segment dominated the market with a revenue share of 75.9% in 2022. The need for more computer chips in the automotive industry has affected production volumes and hindered market growth. Moreover, diesel, oil, and gasoline-based passenger vehicle markets are witnessing a shift toward electric passenger vehicles owing to increasing investments by governments in EV infrastructure and tax benefits offered to consumers. For instance, in the U.S., under the Clean Vehicle Rebate Project (CVRP), eligible candidates are provided a tax rebate from the State of California from April 23, 2021.

The commercial vehicle segment is estimated to register the highest CAGR of 17.0% over the forecast period, owing to the increasing demand for a unified supply chain network connecting multiple transportation modes, including freight rail, air, express delivery services, maritime transport, and truck transport. The introduction of electric vehicles in the commercial vehicle sector and the decentralization of production activities are expected to increase the production volumes of commercial vehicles globally. Moreover, truck digitization or connected trucks is expected to offer new business opportunities for key regional OEMs, including Volkswagen (MAN & Scania), Daimler AG, and Volvo. These OEMs are expected to invest heavily in telematics solutions, which is anticipated to propel the growth of the commercial vehicle market.

Regional Insights

Asia Pacific accounted for the largest market share of 61.6% in 2022.Home to the largest automobile manufacturing nations and markets, such as India, China, and Japan. The growth in the Asia Pacific region is mainly attributed to rising disposable income, increasing urbanization, and a highly competitive market that favors car ownership across the region. Furthermore, the sale of luxury cars known for their high speed and performance further propels the market demand for efficient powertrains.

On the other hand, Europe is projected to demonstrate growth at a significant CAGR of 16.7% over the forecast period. The region's rapidly growing market for automotive powertrains can be attributed to the growing demand for electric vehicles due to the carbon emissions laws passed by the European Union and respective national governments. The major automotive manufacturers in the region also invest a hefty amount in research and development activities aimed at producing high-performance, fuel-efficient, and low-carbon-emitting powertrains.

Key Companies & Market Share Insights

The key market players offer various automotive powertrains for ICE and electric vehicles. The companies are focused on providing advanced and technologically driven products to enhance their offerings. These leading vendors also focus on strategic initiatives such as regional expansions, acquisitions, mergers, partnerships, and collaborations to strengthen their positions in the market.

Moreover, these players are consolidating their market shares by undertaking M&A activities. For example, in June 2021, Mercedes-Benz, a German automaker, announced the acquisition of Yasa. Yasa is engaged in the development of next-generation electric drive technology. In March 2021, Bharat Forge, an automotive component supplier, announced that it had purchased a 100% stake in Kalyani Powertrain KPPL. KPPL would act as a Special Purpose Vehicle (SPV) segment in the company’s EV business.

Key Automotive Powertrain Companies:

- BorgWarner Inc.

- Continental AG

- Magna International Inc.

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- NIDEC CORPORATION

- Robert Bosch GmbH

- Schaeffler AG

- ZF Friedrichshafen AG

- VALEO

Recent Developments

-

In July 2023, Geely and Renault Group entered into a joint venture agreement wherein each entity would hold a 50% stake in the newly formed company. The primary objective of this collaboration is to establish dominance in the market for next-generation highly efficient and hybrid powertrain solutions in response to the global demand anticipated in the forthcoming years. Renault Group and Geely aim to combine their expertise, resources, and technological advancements to address the evolving needs of the automotive industry.

-

In January 2023, Tata Motors Electric finalized its acquisition of Ford India's Sanand plant on January 10, 2023. This development marks a significant step for Tata Motors Electric in expanding its manufacturing capabilities and bolstering its electric vehicle (EV) market presence. The acquisition of the Sanand plant will provide Tata Motors Electric with a state-of-the-art facility for producing electric vehicles. The plant in Gujarat, India, has a strategic location and infrastructure well-suited for efficient production operations.

Automotive Powertrain Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 875.78 billion

Revenue forecast in 2030

USD 2,446.74 billion

Growth rate

CAGR of 15.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

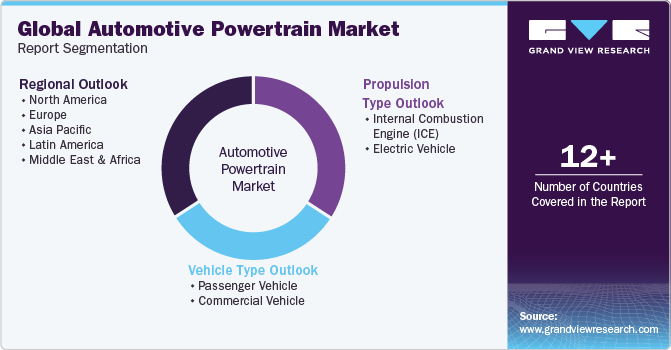

Segments covered

Propulsion type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

BorgWarner Inc.; Continental AG; Magna International Inc.; Marelli Holdings Co., Ltd.; Mitsubishi Electric Corporation; NIDEC CORPORATION; Robert Bosch GmbH; Schaeffler AG; ZF Friedrichshafen AG; VALEO

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Powertrain Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive powertrain market based on propulsion type, vehicle type, region:

-

Propulsion Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

ICE

-

Gasoline

-

Diesel

-

Natural Gas Vehicle

-

-

Electric Vehicle

-

BEV

-

PHEV

-

-

-

Vehicle type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive powertrain market size was estimated at USD 792.0 billion in 2022 and is expected to reach USD 875.78 billion in 2023.

b. The global automotive powertrain market is expected to grow at a compound annual growth rate of 15.8% from 2023 to 2030 to reach USD 2,446.74 billion by 2030.

b. The Asia Pacific dominated the automotive powertrain market with a share of 61% in 2022. This is attributable to the electrification of vehicles, especially small passenger cars, which is expected to influence market growth in the future.

b. Some key players operating in the automotive powertrain market include BorgWarner, ZF Friedrichshafen AG, Schaeffler AG, Mitsubishi Electric Corp., and Magna International Inc.

b. Key factors that are driving the automotive powertrain market growth include the growing demand for vehicle electrification in the automotive industry and the increasing sales of electric vehicles are also contributing to the demand for automotive powertrains.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.