Automotive Over-The-Air Updates Market Size, Share & Trends Analysis Report By Type (Software, Firmware), By Propulsion, By Vehicle Type (Passenger, Commercial), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-357-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

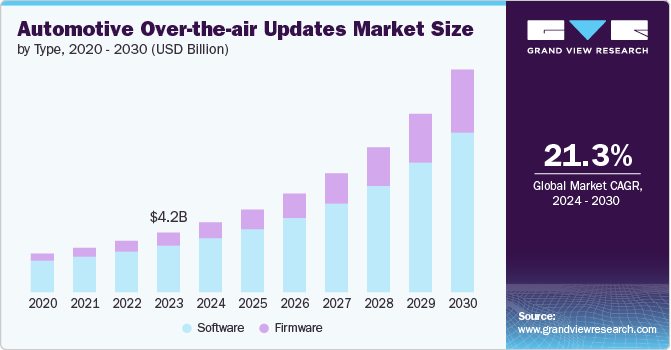

The global automotive over-the-air updates market size was valued at USD 4.21 billion in 2023 and is expected to grow a CAGR of 21.3% from 2024 to 2030. The growth is attributed to the rising number of connected cars and electric vehicles. As the number of these software-dependent automobiles grows, the demand for over-the-air updates also increases. Consequently, OEMs are investing in wireless automotive software update technologies to ensure vehicles remain in optimal working condition.

New technologies such as electrification, 5G, computer vision, and advanced AI and machine learning-based software solutions are converging. Consequently, automotive manufacturers are experiencing an increase in security and safety challenges. At the same time, they have the opportunity to transform business models by offering new aftermarket services and features on demand, delivered through over-the-air solutions. moreover, the increasing adoption of connected cars, improving customer experience, reducing costs and improving efficiency, enabling new business models, increasing regulatory requirements, and advancements in technology are all contributing to the growth of Automotive over-the-air updates. As more cars become connected, the demand for remote software updates increases, allowing automakers to enhance the driving experience by providing bug fixes, security patches, and new features without requiring customers to visit a dealership

Type Insights

The software segment led the market and accounted for 78.3% of the global revenue in 2023. The automotive industry is undergoing a significant transformation with the increasing adoption of over-the-air updates, which allow for wireless software updates to be delivered directly to vehicles, eliminating the need for physical visits to dealerships or service centers. There are two main types of over-the-air updates: Software over-the-air (SOTA) updates, which focus on the software applications running on the vehicle's infotainment system and other non-critical systems, and Firmware over-the-air (FOTA) updates, which target the firmware of electronic control units responsible for critical vehicle functions. As the automotive industry continues to evolve, the software aspect of over-the-air updates will play an increasingly critical role in enabling the seamless delivery of new features, security patches, and performance enhancements to vehicles, ultimately enhancing the driving experience and shaping the future of the industry.

The firmware segment is estimated to grow significantly over the forecast period. Firmware is a crucial aspect of Automotive over-the-air updates, enabling the wireless updating of firmware in electronic control units (ECUs) responsible for controlling various critical vehicle functions such as engine management, transmission, and braking systems. Firmware over-the-air updates can target ECUs as well as infotainment systems, offering significant benefits like improved safety through the rapid deployment of security patches and bug fixes, enhanced performance leading to better fuel efficiency and driving experience, reduced costs by eliminating the need for physical recalls and service visits, and increased efficiency by streamlining the update process.

Vehicle Type Insights

Passenger vehicles accounted for the largest market revenue share in 2023. Over-the-air updates help automakers ensure their passenger vehicles comply with the latest safety and environmental regulations, which is particularly important for EVs subject to strict emissions and efficiency standards. As OTA technology matures, there are opportunities for more personalized updates tailored to individual user preferences and driving patterns, which could be especially beneficial for EV owners with unique charging and usage requirements. TA updates are transforming the passenger vehicle industry, enabling continuous improvements, reducing costs, enhancing user experiences, and ensuring regulatory compliance, shaping the future of passenger vehicles.

The commercial segment is predicted to foresee significant growth in the forecast period. Over-the-air updates are becoming increasingly important for commercial vehicles, as they enable fleet operators and manufacturers to continuously improve the performance, efficiency, and safety of their vehicles remotely. Over-the-air updates allow fleet operators to quickly address software-related issues and implement performance enhancements without taking vehicles off the road for extended periods. This reduces downtime and maintenance costs, improving the overall efficiency of commercial vehicle operations. Moreover, over-the-air updates are transforming the commercial vehicle industry by enabling continuous improvements, reducing maintenance costs, enhancing safety and compliance, optimizing efficiency, and enabling predictive maintenance strategies. As the technology continues to evolve, over-the-air updates will play an increasingly crucial role in shaping the future of commercial vehicles.

Application Insights

The infotainment system segment accounted for the largest market revenue share in 2023. The infotainment system segment is a major driver of growth in the automotive over-the-air updates market, particularly for software over-the-air updates, as automakers leverage this technology to deliver advanced features, improve user experience, and enhance customer satisfaction. The infotainment application is expected to continue growing at a rapid pace in the coming years, driven by the increasing adoption of connected vehicle technologies and the need for regular software updates to keep pace with evolving user demands and expectations.

The Telematics Control Unit (TCU) segment is predicted to foresee significant growth in the forecast period. TCUs serve as the brain behind connected car technologies, enabling vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X) communications. Asia-Pacific emerges as a leading market for automotive TCUs, driven by automotive production growth, urbanization, and digitalization in countries such as China, Japan, South Korea, and India. TCUs support the integration of advanced technologies like autonomous driving systems and Vehicle-to-Everything (V2X) communication, which rely on seamless software updates to maintain optimal functionality. As the demand for connected cars grows, TCUs are expected to continue facilitating over-the-air updates as a standard practice, ensuring vehicles remain up-to-date with the latest advancements and improvements throughout their lifecycle.

Propulsion Outlook

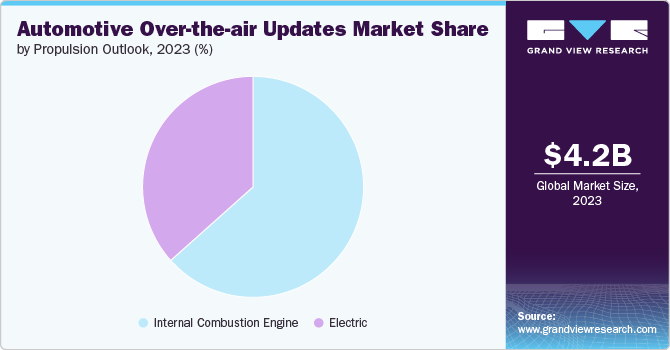

The internal combustion engine segment dominated the market, accounting for the highest revenue share in 2023. Over-the-air updates have traditionally been associated with electric vehicles (EVs) and advanced driver-assistance systems (ADAS). However, their application in vehicles with internal combustion engines is equally transformative. Internal combustion engine vehicles are playing a crucial role in the growth of automotive over-the-air updates. By leveraging this technology, manufacturers can enhance vehicle performance, ensure regulatory compliance, improve safety and security, and provide new features and services to customers. As connectivity and software continue to advance, the role of over-the-air updates in internal combustion engine vehicles will only become more significant, driving further growth in this area.

The electric segment is projected to grow significantly over the forecast period. The growth of electric vehicles (EVs) is having a significant impact on the adoption and capabilities of automotive over-the-air updates. EV manufacturers are leading the way in implementing more extensive OTA update capabilities, as electric vehicles tend to have more software-intensive components and systems compared to traditional internal combustion engine vehicles. This has enabled EV makers, such as Tesla, Lucid, Polestar, Rivian, and Volvo, to leverage over-the-air updates more broadly, including Firmware over-the-air (FOTA) updates that can target critical vehicle systems like the powertrain, battery management, and advanced driver assistance systems (ADAS). The flexibility of over-the-air updates allows EV manufacturers to continuously improve the performance and efficiency of their vehicles, as demonstrated by Tesla's ability to increase the 0-60 mph acceleration times of its Model 3 through remote updates.

Regional Insights

North America automotive over-the-air update market accounted for a 31.6% share in 2023. The North American market is witnessing robust growth fueled by several key factors. As vehicles become more technologically advanced and connected, over-the-air updates are becoming essential for automakers to deliver software updates and improvements seamlessly to their vehicles. This technology allows manufacturers to remotely update vehicle software, including infotainment systems, safety features, and engine performance, without requiring owners to visit a dealership. This not only enhances customer convenience but also ensures that vehicles stay current with the latest technological advancements and regulatory requirements.

U.S. Automotive Over-the-air Updates Market Trends

The automotive over-the-air updates market in the U.S. is experiencing significant growth, driven by the growing adoption of electric and hybrid vehicles, fueled by the development of charging infrastructures, which is supporting the regional market growth. Additionally, the rising demand for safe and secure vehicle infotainment systems is another factor fueling the industry statistics in the U.S.

Europe Automotive Over-The-Air Updates Market Trends

The automotive over-the-air updates market in Europe is at the forefront of integrating advanced connectivity solutions into their vehicles. Over-the-air updates enable manufacturers to remotely update software and firmware, improving vehicle features such as infotainment systems, driver-assistance technologies, and battery management systems. This capability allows vehicles to stay updated with the latest functionalities and safety enhancements throughout their lifecycle.

Asia Pacific Automotive Over-The-Air Updates Market Trends

The automotive over-the-air updates market in Asia-Pacific (APAC) is experiencing significant growth in the Automotive over-the-air updates market, Countries like Japan, South Korea, and China are leaders in technology innovation and adoption. Automakers in these markets are increasingly integrating advanced connectivity features into their vehicles, making over-the-air updates essential for delivering software updates and improvements seamlessly to consumers. This includes updates for infotainment systems, navigation software, driver-assistance systems, and vehicle performance optimizations.

Key Automotive Over-The-Air Updates Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in March 2023, Broadcom (US) unveiled BCM85812, a transceiver optimized for 800G DR8, 2x400G FR4, and 800G AOC module applications. It enables high-performance and efficient active optical cable solutions for hyper-scale data centers.

Key Automotive Over-The-Air Updates Companies:

The following are the leading companies in the automotive over-the-air updates market. These companies collectively hold the largest market share and dictate industry trends.

- Denso Corporation

- Aptiv PLC

- Continental AG

- Garmin Ltd

- Robert Bosch GmbH

- HARMAN International

- Infineon Technologies AG

- BlackBerry Limited

- Qualcomm Technologies, Inc.

- Verizon Communications Inc.

- NVIDIA Corporation

- Airbiquity Inc.

Recent Developments

-

In March 2024, NVIDIA announced that prominent companies in the transportation sector have adopted the NVIDIA DRIVE Thor centralized car computer. This technology powers their upcoming generations of consumer and commercial fleets, spanning from electric vehicles and trucks to robotaxis, robobuses, and autonomous last-mile delivery vehicles.

-

In February 2021, Ford Motor Company, a US-based automotive manufacturer, entered into a partnership with Google LLC, the details of which were not disclosed. This collaboration aims to profoundly impact the design and production of vehicles while expanding the implementation of OTA (over-the-air) updates.

Automotive Over-The-Air Updates Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.93 billion |

|

Revenue forecast in 2030 |

USD 15.75 billion |

|

Growth Rate |

CAGR of 21.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, propulsion, vehicle type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Denso Corporation; Aptiv PLC; Continental AG; Garmin Ltd; Robert Bosch GmbH; HARMAN International; Infineon Technologies AG; BlackBerry Limited; Qualcomm Technologies, Inc.; Verizon Communications Inc.; NVIDIA Corporation; Airbiquity Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Automotive Over-The-Air Updates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive over-the-air updates market report based on type, propulsion, vehicle type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018-2030)

-

Software

-

Firmware

-

-

Propulsion Outlook (Revenue, USD Million, 2018-2030)

-

Internal Combustion Engine

-

Electric

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telematics Control Unit

-

Infotainment System

-

Electronics Control Unit

-

Safety & Security

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive over-the-air updates market size was estimated at USD 4.21 billion in 2023 and is expected to reach USD 4.93 billion in 2020.

b. The global automotive over-the-air updates market is expected to grow at a compound annual growth rate of 21.3% from 2024 to 2030 to reach USD 15.75 billion by 2030.

b. Asia Pacific dominated the automotive over-the-air updates market with a share of 32.92% in 2024. The Asia-Pacific (APAC) region is experiencing significant growth in the Automotive Over The Air (OTA) Updates market, Countries like Japan, South Korea, and China are leaders in technology innovation and adoption.

b. Some key players operating in the automotive over-the-air updates market include Denso Corporation, Aptiv PLC, Continental AG, Garmin Ltd, Robert Bosch GmbH, HARMAN International, Infineon Technologies AG, BlackBerry Limited, Qualcomm Technologies, Inc., Verizon Communications Inc., NVIDIA Corporation, Airbiquity Inc.

b. Key factors that are driving the market growth include, the increasing adoption of connected cars, improving customer experience, reducing costs and improving efficiency, enabling new business models, increasing regulatory requirements, and advancements in technology are all contributing to the growth of Automotive Over The Air (OTA) updates.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."