- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Automotive OEM Coatings Market Size & Share Report, 2030GVR Report cover

![Automotive OEM Coatings Market Size, Share & Trends Report]()

Automotive OEM Coatings Market Size, Share & Trends Analysis Report By Product, (Clear Coat, Base Coat, Primer, E-coat), By Resin, By Application, By Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-368-7

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Automotive OEM Coatings Market Trends

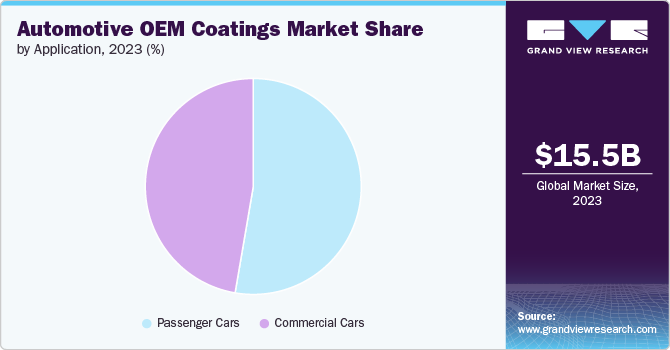

The global automotive OEM coatings market size was estimated at USD 15.50 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The market is experiencing significant growth driven by the increasing demand for commercial utility vehicles, a shift towards more efficient transportation, and a rising preference for personal automotive transport, especially in the premium vehicles segment.

Additionally, the growing demand for passenger cars and the trend towards lightweight vehicles offering lower fuel consumption and higher efficiency are creating new opportunities in the global market. Despite challenges such as high-cost raw materials, strict environmental emission standards, and concerns related to solvent-borne automotive coatings, the market is poised for growth. Furthermore, investments in R&D for new production alternatives, strategic collaborations, and new product launches are expected to drive lucrative opportunities in the global market.

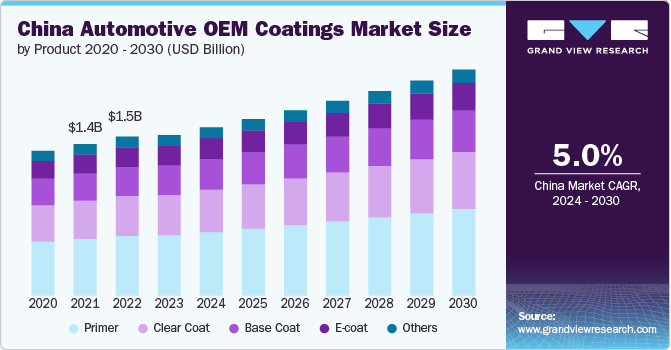

The Asia Pacific region, including countries like China, India, Japan, and South Korea, dominates the market in terms of consumption. China is one of the countries with the largest consumption of market in the world. The demand for product, particularly in the passenger cars segment, is expected to increase post-recovery. This is due to factors such as rising investment opportunities in the Middle East and Africa and the growing demand for electric vehicles. The increase in per capita disposable incomes, especially in developing economies like China, India, and Thailand, has propelled the overall demand for passenger cars and, consequently, automotive OEM coatings.

The considerable expansion of the automotive industry, combined with the increased demand for commercial utility vehicles and energy-efficient transportation, has contributed to the growth of the automotive OEM coatings market. The production of new cars, trucks, and other vehicles boosts the demand for product, as these vehicles require coatings as part of the painting and manufacturing process. Overall, the demand for product is driven by factors such as increasing vehicle sales, rising disposable incomes, and the expansion of the automotive industry. China, as a major consumer, plays a significant role in the global market.

Product Insights

Primer automotive OEM coatings type dominated the market with a revenue share of 37.67% in 2023. Primer dominates the market due to the qualities and benefits it provides. Primers are typically used as an undercoat before applying the base coat or topcoat. They provide a stable base for subsequent coats, ensuring better paint and coating adhesion, increasing durability, and concealing imperfections. Primers play a crucial role in ensuring proper adhesion of subsequent coats to the surface. They help in improving the overall quality and longevity of the coating system.

Primers offer additional benefits such as providing protection to the materials being coated, helping to conceal seams and imperfections, and enhancing the overall performance of the coating system. The demand for clear coat and primer in the automotive OEM coatings market is driven by their protective properties, advantages, and their role in enhancing the appearance and durability of the coating system.

Clear coat is an essential product segment in the market. High demand due to protective properties: Clear coat is known for their protective properties, such as providing protection from the sun, ultraviolet (UV) rays, and environmental factors. This makes it an important component in the market.

Clear coat is known for their protective properties, such as providing protection from the sun, ultraviolet (UV) rays, and environmental factors. Clear coat requires a thicker application compared to other layers, as it needs to provide adequate protection. This contributes to the demand for clear coat in the market.

Resin Insights

The epoxy resin segment dominated the market with a revenue share of 32.74% in 2023 owing to the fact that epoxy resins offer a wide range of qualities that make them desirable for product. They are known for their excellent adhesion, durability, resistance to stains, cracks, extreme temperatures, blistering, and chemicals. Epoxy resins are extensively utilized in various industries, including automotive, construction, marine, aerospace, and more. In the automotive industry, epoxy coatings are used as primers for corrosion protection, and their usage is expected to grow further due to rising demand from the electric vehicle, marine, and aerospace sectors.

Polyurethane resins is another significant segment of the industry. Polyurethane coatings are known for their exceptional durability and resistance to various environmental factors. They provide a robust protective layer that shields vehicles from UV radiation, weathering, chemicals, and abrasion. Polyurethane resins find extensive applications in the automotive industry, including clearcoats, basecoats, and other coating layers. They adhere well to various substrates, including metal, plastic, and composites. Polyurethane resins hold a significant share in the overall automotive coatings market and are expected to witness continued demand in the coming years. Their excellent performance and protective properties contribute to their popularity in automotive OEM coatings.

Technology Insights

The water-based technology segment dominated the market with a revenue share of 39.67% in 2023. The automotive industry is increasingly focused on sustainability and reducing environmental impact. Water-based coatings offer advantages in terms of lower VOC emissions, reduced hazardous waste, and improved air quality compared to solvent-based coatings. This aligns with the industry's efforts to meet stringent environmental regulations and sustainability goals.

The preference for water-based coatings is on the rise due to their ability to provide excellent performance, durability, and aesthetics while being more environmentally friendly. Water-based coatings are used in various layers of coatings, including primers, basecoats, and clearcoats. Manufacturers are investing in research and development to improve the performance and application properties of water-based coatings. This includes innovations in formulation, drying time, adhesion, and color matching capabilities.

Application Insights

The passenger cars segment dominated the market with a revenue share of 52.67% in 2023 owing the passenger cars category indisputably generated the highest income. The overall demand for product in the passenger cars segment has unquestionably surged due to the escalating demand for passenger cars and general utility vehicles, augmented public transportation spending, and a distinct rise in consumer preference for efficient and convenient transportation options

The passenger car segment represents the segment with the greatest potential in the global market. The rising demand for general utility vehicles and passenger cars globally, along with the increase in expenditure toward public transportation, has contributed to the increased demand for product in passenger cars. Moreover, the rising inclination of consumers towards easy and efficient transportation facilities further augments the overall demand for such coatings in passenger cars. The use of product in commercial vehicles has been foreseen as a key development. The increase in demand for commercial vehicles, particularly due to rapid growth in logistics and transportation.

Regional Insights

Asia Pacific Automotive OEM Coatings Market Trends

Asia Pacific is the largest market for product globally, driven by the region's huge automotive production base and increased investments in countries like China, India, and ASEAN countries. The region's high-volume vehicle production, particularly in countries like China, India, Japan, and Thailand, creates a considerable demand for automotive OEM coatings.

The automotive OEM coatings market in China is influenced by technological advancements. This includes innovations in light weighting, color design, and manufacturing process improvements.

North America Automotive OEM Coatings Market Trends

Major companies in the market have made significant investments in North America to expand their production capacity. There is a trend towards the adoption of water-based coatings in North America. Many OEMs in the region have switched their assembly facilities from solvent-based coatings to water-based primers and basecoat layers to reduce VOC emissions and improve environmental sustainability.

Europe Automotive OEM Coatings Market Trends

The European sector has seen investments in new and expanded automated paint shops. These investments, particularly by Chinese carmakers, are driving advancements in paint applications and process technologies, which are likely to have a long-term impact on the European coatings industry. European OEMs are reorganizing their coatings and production processes in anticipation of a significant increase in demand for electric vehicles (EVs) and hybrids. This shift in demand requires adjustments in coatings and production to meet the specific requirements of EVs.

Key Automotive OEM Coatings Company Insights

Some of the key players operating in the market include PPG Industries, Inc., BASF SE, PPG Industries Inc.,Nippon Paints Holdings Co. Ltd. Akzo Nobel N.V., Axalta Coating Systems Ltd, Berger Paints India Ltd, Kansai Paint Co. Ltd, The Sherwin-Williams Company, KCC Corporation, Covestro AG.

-

Akzo Nobel is a Dutch multinational company that creates paints and performance coatings for both industry and consumers worldwide. The company has a long history of mergers and divestments and has activities in more than 150 countries.

-

The Sherwin-Williams Company is a major player in the protective coatings market, with a significant share in global production. It is one of the top five players dominating global production in the automotive OEM coatings market.

Key Automotive OEM Coatings Companies:

The following are the leading companies in the automotive OEM coatings market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- PPG Industries Inc.

- Nippon Paints Holdings Co. Ltd

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd

- Berger Paints India Ltd

- Kansai Paint Co. Ltd

- The Sherwin-Williams Company

- KCC Corporation

- Covestro AG

Recent Developments

-

In April 2024, BASF's Coatings division launched a new range of environmentally friendly clearcoats and undercoats. This innovative portfolio not only enhances quality and productivity but also helps to reduce CO2 emissions significantly.

-

In June 2023, PPG launched PPG ENVIRO-PRIME EPIC 200R coatings, a new suite of electrocoat (e-coat) products designed for automotive manufacturers. These coatings cure at lower temperatures compared to other technologies.

Automotive OEM Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.15 billion

Revenue forecast in 2030

USD 20.85 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, resin, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

BASF SE; PPG Industries Inc.; Nippon Paints Holdings Co. Ltd; Akzo Nobel N.V.; Axalta Coating Systems Ltd; Berger Paints India Ltd; Kansai Paint Co. Ltd; The Sherwin-Williams Company; KCC Corporation; Covestro AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive OEM Coatings Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive OEM coatings Market report based on product, resin, technology, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Clear coat

-

Base coat

-

Primer

-

E-coat

-

Others

-

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Acrylic

-

Epoxy

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solvent-based

-

Water-based

-

Powder-based

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive OEM coatings market was valued at USD 15.50 billion in 2023 and is projected to reach USD 16.15 billion by 2024

b. The global automotive OEM coatings market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 20.85 billion by 2030.

b. Asia Pacific dominated the automotive OEM coatings market in 2023.Asia-Pacific is the largest market for product globally, driven by the region's huge automotive production base and increased investments in countries like China, India, and ASEAN countries. The region's high-volume vehicle production, particularly in countries like China, India, Japan, and Thailand, creates a considerable demand for automotive OEM coatings.

b. Some of the key players operating in the market include PPG Industries, Inc., BASF SE, PPG Industries Inc., Nippon Paints Holdings Co. Ltd , Akzo Nobel N.V., Axalta Coating Systems Ltd, Berger Paints India Ltd, Kansai Paint Co. Ltd, The Sherwin-Williams Company, KCC Corporation, Covestro AG.

b. Key factors driving the market growth include the increasing demand for commercial utility vehicles, a shift towards more efficient transportation, and a rising preference for personal automotive transport, especially in the premium vehicles segment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."