- Home

- »

- Automotive & Transportation

- »

-

Automotive Night Vision System Market Size Report, 2030GVR Report cover

![Automotive Night Vision System Market Size, Share & Trends Report]()

Automotive Night Vision System Market Size, Share & Trends Analysis Report By Technology (Far Infrared, Near Infrared), By Component (Display Unit, Sensor), By Vehicle, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-428-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

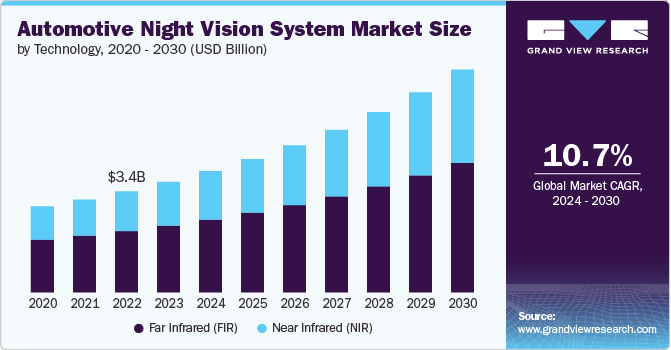

The global automotive night vision system market was estimated at USD 3.66 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030. The growing emphasis on vehicle safety drives the market's growth. Night vision systems enhance drivers' ability to detect pedestrians, animals, and other obstacles in low-light conditions, reducing the risk of accidents. As governments and regulatory bodies worldwide continue to tighten safety standards, automakers are increasingly adopting advanced safety technologies like night vision systems. The desire to improve road safety, especially in regions with high accident rates, drives market growth significantly.

With increasing awareness of road safety issues and the benefits of advanced safety features, consumers are more informed and willing to invest in vehicles with advanced technologies such as night vision systems. The rising incidence of accidents during night-time driving has highlighted the importance of these systems, encouraging more consumers to opt for vehicles that offer enhanced night-time visibility. In addition, marketing efforts by automotive manufacturers and suppliers to educate consumers about the benefits of night vision systems contribute to higher adoption rates.

Furthermore, integrating night vision systems is part of the broader trend toward advanced driver assistance systems (ADAS), which are becoming a standard feature in modern vehicles. Consumers increasingly seek vehicles equipped with the latest technology to enhance driving convenience and safety. Night vision systems, integrated with other ADAS technologies such as adaptive headlights and automatic emergency braking, offer a comprehensive safety package that appeals to safety-conscious consumers. This trend is particularly enunciated in luxury vehicles, where manufacturers compete to provide cutting-edge technologies.

Environmental factors, such as fog, heavy rain, and snow, can significantly impair visibility during nighttime driving. Night vision systems are beneficial in such conditions, as they can detect objects that are not easily visible with standard headlights. Adopting night vision systems to enhance driving safety is becoming increasingly common in regions with harsh climatic conditions. This is particularly useful in areas with long winters and frequent adverse weather conditions. The need for safer driving solutions in challenging environments drives the demand for night vision systems.

However, the high cost of automotive night vision systems restrains the market's growth. These systems require advanced technology, such as thermal imaging cameras and infrared sensors, which are expensive to develop and manufacture. As a result, night vision systems are typically only available in high-end or luxury vehicles, limiting their accessibility to a broader consumer base. The high price point can deter consumers and automakers from investing in these systems, particularly in cost-sensitive markets where price competition is fierce, thus resulting in slower penetration of night vision systems into the mass market.

Technology Insights

The Far Infrared (FIR) segment dominated the market in 2023 and accounted for a 60.45% share of global revenue. Far Infrared technology offers superior detection capabilities, particularly in low-light or no-light conditions. Unlike near-infrared or visible light cameras, FIR sensors can detect thermal radiation emitted by objects, making them highly effective in identifying living beings like pedestrians, animals, and cyclists, even in complete darkness. This ability to "see" heat signatures, regardless of lighting conditions, provides a significant safety advantage, especially when traditional headlights and cameras fall short.

The near-infrared (NIR) segment is projected to grow significantly from 2024 to 2030. The segment's growth is driven by its improved performance in adverse weather conditions compared to traditional visible-light cameras and thermal imaging systems. NIR can penetrate through rain, fog, and snow more effectively, providing clearer images in challenging conditions. This capability is particularly valuable in regions with harsh weather, where nighttime visibility can be severely compromised.

Component Insights

The night vision camera segment dominated the market in 2023. Rapid advancements in camera technology drive the market's growth. Modern night vision cameras have become more sophisticated, offering higher resolution, greater sensitivity to low light, and enhanced image processing capabilities. These improvements allow more precise and accurate detection of objects, pedestrians, and animals in low-light or nighttime driving conditions.

The display unit segment is projected to grow significantly from 2024 to 2030. Integrating display units with advanced infotainment and driver assistance systems significantly drives the segment's automotive night vision market growth. Modern vehicles are increasingly equipped with sophisticated infotainment systems that display various information, from navigation to diagnostics. Integrating night vision system outputs into these infotainment displays makes it easier for drivers to access critical safety information without diverting their attention from the road.

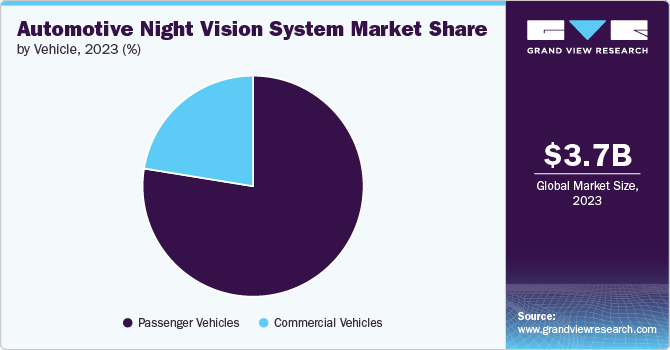

Vehicle Insights

The passenger vehicles segment dominated the market in 2023. Adding advanced features such as night vision systems can enhance the resale value of passenger cars. Buyers often perceive vehicles with safety technologies as more valuable and desirable, which can lead to higher resale prices. For consumers and automotive manufacturers alike, night vision systems can be seen as an investment in the vehicle’s long-term value. This perception of added value encourages more automakers to offer night vision systems as a feature in their passenger cars, contributing to market growth.

The commercial vehicles segment is projected to grow significantly from 2024 to 2030. Commercial vehicle operators increasingly recognize night vision systems' operational efficiencies and cost savings. Improved visibility can lead to more efficient driving by reducing the likelihood of accidents and related delays, thus improving overall fleet productivity. In addition, night vision systems can help avoid costly repairs and legal issues from accidents. Commercial fleets can achieve better operational efficiency and long-term savings by reducing the number of incidents and associated costs.

Regional Insights

The North America automotive night vision system market dominated the global market and accounted for a revenue share of 33.86% in 2023. This market has a significant segment dedicated to premium and luxury vehicles, where advanced safety features are highly sought after. Night vision systems are often included in the option packages for these high-end vehicles, catering to consumers willing to invest in the latest technology for enhanced safety and comfort.

The U.S. Automotive Night Vision System Market Trends

The automotive night vision system market in the U.S. is anticipated to grow at a significant CAGR from 2024 to 2030. The potential for cost savings on insurance premiums contributes to the market's growth in the U.S. Vehicles equipped with night vision systems may qualify for reduced insurance rates, providing a financial incentive for consumers and fleet operators to invest.

Europe Automotive Night Vision System Market Trends

The automotive night vision system market in Europe is anticipated to witness notable growth from 2024 to 2030. Europe is at the forefront of developing and testing autonomous and semi-autonomous vehicles, which rely heavily on advanced sensor technologies for safe operation. Night vision systems are essential for these vehicles to operate effectively in low-light conditions and ensure comprehensive situational awareness.

Asia Pacific Automotive Night Vision System Market Trends

The automotive night vision system market in Asia Pacific is anticipated to grow at the highest CAGR from 2024 to 2030. Rapid urbanization and increased vehicle ownership drive the demand for advanced automotive safety technologies, including night vision systems.

Key Automotive Night Vision System Company Insights

Companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Automotive Night Vision System Companies:

The following are the leading companies in the automotive night vision system market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Valeo

- OmniVision

- Lanmodo

- InfiRay

- Teledyne Technologies Incorporated

- Teledyne FLIR LLC

- Continental AG

- HUDWAY

- Autoliv Inc.

Recent Developments

-

In January 2024, Valeo, an automotive technology company, collaborated with Teledyne FLIR, a thermal imaging solutions provider, to bring thermal imaging technology to the automotive industry for enhanced road user safety. The collaboration will introduce Automotive Safety Integrity Level (ASIL) B-rated thermal imaging technology for night vision in Advanced Driver Assistance Systems (ADAS). The system will enhance Valeo's broad array of sensors and leverage its ADAS software stack to enable features like automatic emergency braking (AEB) during nighttime for both commercial and passenger vehicles and autonomous cars.

-

In October 2023, Koito Manufacturing Co., Ltd. and Denso Corporation announced a collaboration to enhance the object recognition capabilities of vehicle image sensors. By integrating their advancements in lamps and image sensors, the two companies seek to boost nighttime driving safety. Their joint efforts are part of a broader commitment to enhancing vehicle safety and striving towards a future with zero traffic accident fatalities, addressing one of the automotive industry's most pressing challenges. Improving safety during night driving is a key focus of this development.

Automotive Night Vision System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.02 billion

Revenue forecast in 2030

USD 7.38 billion

Growth rate

CAGR of 10.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million /billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Technology, component, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Indi; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Robert Bosch GmbH; Valeo; OmniVision; Lanmodo; InfiRay; Teledyne Technologies Incorporated; Teledyne FLIR LLC; Continental AG; HUDWAY; Autoliv Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Night Vision System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive night vision system market based on technology, component, vehicle, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Far Infrared (FIR)

-

Near Infrared (NIR)

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Night Vision Camera

-

Controlling Unit

-

Display Unit

-

Sensor

-

Others

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive night vision system market size was estimated at USD 3.66 billion in 2023 and is expected to reach USD 4.02 billion in 2024.

b. The global automotive night vision system market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 7.38 billion by 2030.

b. North America dominated the automotive night vision system market with a share of 33.86% in 2023. The North American automotive market has a significant segment dedicated to premium and luxury vehicles, where advanced safety features are highly sought. This, as a result, is expected to create growth opportunities for the regional market growth.

b. Some key players operating in the automotive night vision system market include Robert Bosch GmbH, Valeo, OMNIVISION, Lanmodo, InfiRay, Teledyne Technologies Incorporated, Teledyne FLIR LLC, Continental AG, HUDWAY, and Autoliv Inc.

b. Key factors that are driving the market growth include the growing emphasis on vehicle safety and increasing government regulations about road safety.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."