Automotive Natural Gas Vehicle Market Size, Share & Trends Analysis Report By Fuel Type (CNG, LNG), By Vehicle Type (Passenger, Light & Heavy-duty Buses & Trucks, Three Wheelers), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-567-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

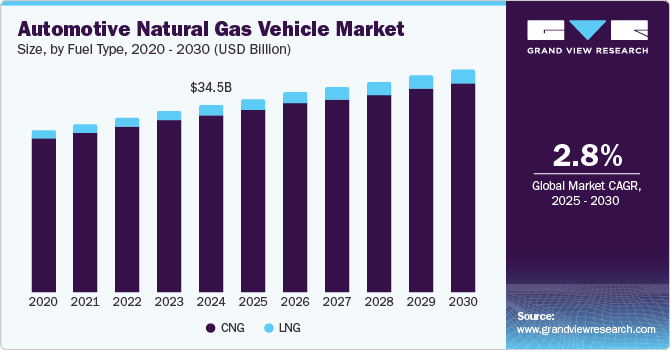

The global automotive natural gas vehicle market size was estimated at USD 34.5 billion in 2024 and is projected to grow at a CAGR of 2.8% from 2025 to 2030. The increasing demand for alternative fuel solutions in the transportation sector, driven by environmental concerns and stringent emissions regulations, supports market expansion. Natural gas is gaining popularity as a fuel due to its lower emissions, cost-effectiveness, and widespread availability compared to gasoline and diesel. The adoption of LNG trucks is increasing, particularly in the transportation industry, as companies seek sustainable and economical fuel options. In addition, government initiatives to develop natural gas distribution infrastructure further contribute to the market's growth.

The widespread adoption of automotive natural gas vehicles is driven by their economic and environmental benefits, particularly in reducing fuel expenses and lowering carbon emissions. These vehicles are gaining traction across public transportation networks, logistics operations, and corporate fleets as companies seek cost-effective and sustainable mobility solutions. Ongoing advancements in NGV technology, such as optimized combustion systems and lightweight fuel storage, enhance vehicle efficiency and reliability. In addition, policy frameworks supporting alternative fuel usage, including tax incentives and subsidies, are encouraging businesses and consumers to transition to natural gas-powered vehicles. Expanding refueling infrastructure and collaborative efforts between governments and private stakeholders further contribute to market growth.

Advancements in natural gas vehicle technology are enhancing engine efficiency, fuel storage, and emissions control, making these vehicles more viable for mainstream adoption. Automotive natural gas vehicles support critical transportation applications, including long-haul trucking, urban transit, and municipal fleets, ensuring cost-effective and environmentally friendly mobility solutions. The rising emphasis on reducing greenhouse gas emissions and dependence on conventional fuels has increased the demand for NGVs in commercial and personal transportation segments. In addition, government initiatives promoting clean energy transportation, such as the U.S. Environmental Protection Agency’s Natural Gas STAR Program and the European Green Vehicles Initiative (EGVI), are accelerating the adoption of alternative fuels like CNG and LNG. Integrating advanced fuel management systems, lightweight storage tanks, and hybrid natural gas-electric powertrains further enhances vehicle performance and sustainability. With ongoing investments in refueling infrastructure and stringent emission regulations worldwide, the adoption of NGVs is expected to grow steadily.

Fuel Type Insights

CNG dominated the automotive natural gas vehicle market, accounting for a share of 95.3% in 2024. The widespread adoption of CNG is driven by its cost-effectiveness, lower carbon emissions, and extensive refueling infrastructure. Government initiatives to reduce vehicular emissions and enhance environmental security further support market growth. The non-toxic nature of CNG contributes to lower environmental impact, making it a preferred fuel choice in commercial fleets, public transportation, and personal vehicles. Moreover, CNG fuel systems comply with stringent safety regulations, such as the Federal Motor Vehicle Safety Standards 303 and 304 (U.S.), ensuring fuel system integrity for dedicated and dual-fuel CNG vehicles. Advancements in fuel injection and storage systems continue to enhance vehicle performance and driving range, reinforcing the dominance of CNG in the market.

LNG is projected to register the highest CAGR of 6.1% over the forecast period. The segment’s growth is driven by government policy support, the diesel-LNG price differential, and the increasing demand for cleaner fuel alternatives in freight transportation. The logistics industry, particularly the heavy-duty trucking segment, is a key contributor to LNG adoption. LNG-powered vehicles offer a higher energy density and an extended driving range than CNG, making them an attractive option for long-haul transportation. Ongoing research and development initiatives across various countries further expand the potential of LNG as an automotive fuel. With the development of LNG refueling infrastructure and stringent emission regulations encouraging the transition to alternative fuels, the adoption of LNG vehicles is expected to grow substantially.

Vehicle Type Insights

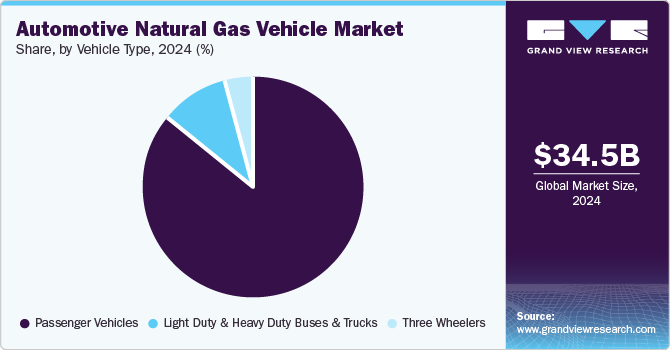

Passenger vehicles dominated the automotive natural gas vehicle market with a considerable market share. Growing concerns over air quality and environmental sustainability drive consumers to adopt natural gas-powered vehicles as an alternative to gasoline and diesel options. Countries experiencing severe pollution levels, such as China, India, Saudi Arabia, Iran, and Pakistan, are witnessing increased adoption of natural gas vehicles due to their lower emissions and cost efficiency. Automakers are introducing factory-fitted CNG models, while government incentives and expanding refueling infrastructure further support this segment's growth. With stricter emission regulations and a shift toward sustainable mobility, the demand for natural gas-powered passenger vehicles is expected to remain strong.

The light-duty and heavy-duty buses and trucks segment is projected to register the highest CAGR over the forecast period. The logistics and public transportation industries are adopting natural gas as an alternative fuel to reduce operating costs and emissions. Governments worldwide are implementing policies encouraging commercial fleet operators to transition to CNG and LNG-powered vehicles, particularly in long-haul trucking and public transit. The adoption of LNG heavy-duty trucks (HDTs) is rising due to their suitability for long-distance transportation and lower fuel costs than diesel. In addition, advancements in engine technology and the expansion of LNG refueling networks further support the transition to natural gas-powered commercial vehicles. With ongoing investments in clean transportation and infrastructure, this segment is expected to experience significant growth.

Regional Insights

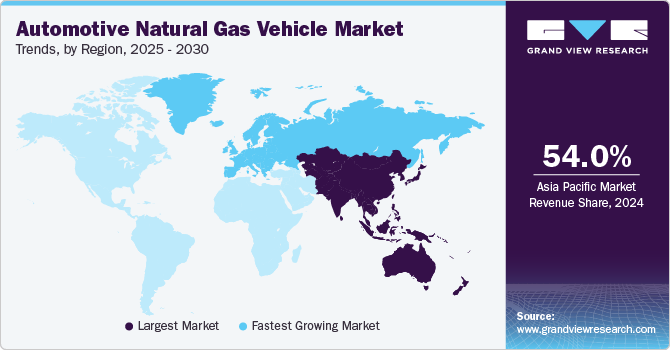

North America automotive natural gas vehicle market is set to experience significant growth, driven by stringent emission regulations, government incentives, and expanding refueling infrastructure. The increasing adoption of CNG and LNG across commercial fleets, public transportation, and personal vehicles accelerates market expansion. The presence of key automotive manufacturers investing in NGV technology, along with policies promoting clean energy transportation, further strengthens market prospects. In addition, the rising demand for cost-effective and environmentally friendly mobility solutions, particularly in long-haul trucking and municipal fleets, continues to support the region’s transition toward sustainable transportation.

U.S. Automotive Natural Gas Vehicle Market Trends

The U.S. automotive natural gas vehicle market held a significant share in 2024, supported by stringent emissions regulations and government incentives promoting alternative fuel adoption. The expansion of refueling infrastructure and the cost advantages of natural gas over conventional fuels have encouraged fleet operators to transition to NGVs. The commercial transportation sector, including freight and public transit, continues to drive demand due to the need for cost-effective and environmentally friendly mobility solutions. In addition, technological advancements in fuel storage and engine efficiency are strengthening the adoption of NGVs across various applications, further supporting the growth of the U.S. automotive natural gas vehicle industry.

Europe Automotive Natural Gas Vehicle Market Trends

Europe automotive natural gas vehicle market is expected to grow at the highest CAGR of 3.9% over the forecast period. The shift toward cleaner transportation solutions, driven by stringent emission regulations and government incentives, accelerates the adoption of natural gas-powered vehicles across the region. For instance, the European Union's Clean Vehicles Directive mandates public authorities to procure low- and zero-emission vehicles, including those powered by natural gas, thereby stimulating demand for NGVs across member states. Countries such as Germany, France, and Italy have been leading in NGV adoption, supported by expanding refueling infrastructure and favorable tax incentives. According to NGVA Europe, there were 55,028 new registrations of natural gas passenger cars and 3,189 new buses in 2020, indicating a growing acceptance of NGVs in the region. In addition, the growing focus on reducing dependence on conventional fuels and improving air quality further drives demand, positioning Europe as a key market within the automotive natural gas vehicle industry.

Germany Automotive Natural Gas Vehicle Market Trends

Germany automotive natural gas vehicle market dominated the Europe region with a significant market share. The country's strong commitment to reducing carbon emissions and promoting sustainable mobility has increased the adoption of natural gas-powered vehicles. Government incentives, tax benefits, and investments in refueling infrastructure further support market expansion. In addition, rising consumer awareness of cost-effective and environmentally friendly fuel alternatives drives demand for NGVs across private and commercial transportation sectors. With continued efforts to enhance alternative fuel adoption, Germany remains a key contributor to the automotive natural gas vehicle industry.

Asia Pacific Automotive Natural Gas Vehicle Market Trends

Asia Pacific automotive natural gas vehicle market dominated the automotive natural gas vehicle industry, accounting for a 54.0% share in 2024. The region’s growth is driven by supportive government policies, expanding refueling infrastructure, and the rising shift toward cleaner transportation solutions. Countries such as India are making significant strides in natural gas vehicle adoption, with initiatives to reduce reliance on conventional fuels and curb emissions. For instance, in October 2024, the Indian government announced plans to convert approximately one-third of its heavy truck fleet, comprising over 7 million vehicles, to LNG over the coming five to seven years. This initiative aims to reduce diesel consumption and curb emissions, supporting the country’s transition toward cleaner transportation solutions. These efforts reinforce Asia Pacific’s position as a key market in the industry.

China Automotive Natural Gas Vehicle Market Trends

China dominated the market, accounting for a significant share in 2024. The country’s strong policy support, expanding refueling infrastructure, and cost advantages of natural gas as a transportation fuel are key factors driving market growth. Efforts to reduce reliance on conventional fuels and curb emissions have accelerated the adoption of natural gas-powered vehicles across commercial and passenger segments. In addition, increasing investments in LNG and CNG distribution networks, along with advancements in engine technologies, are further strengthening China’s position in the market.

Middle East & Africa Automotive Natural Gas Vehicle Market Trends

The Middle East & Africa automotive natural gas vehicle market is experiencing growth, driven by investments in alternative fuel infrastructure, government initiatives promoting clean energy, and the cost advantages of natural gas as a transportation fuel. Countries such as the UAE and Saudi Arabia are expanding their NGV refueling networks to support the transition toward cleaner mobility. For instance, Saudi Arabia's Saudi Green Initiative (SGI) aims to reduce carbon emissions and enhance environmental sustainability by promoting alternative fuels, including natural gas, in the transportation sector. In addition, the Kingdom's focus on increasing natural gas production aligns with its goals to diversify energy sources and reduce reliance on oil, further supporting the adoption of NGVs. These efforts reinforce the region's growing role in the market.

Key Automotive Natural Gas Vehicle Company Insights

Some of the key companies operating in the market are Hexagon Agility GmbH; AB Volvo; and Foton International. These companies are expanding their market presence by launching new products, collaborating, and adopting various other strategies.

-

Hexagon Agility GmbH is a key player in the market, specializing in the development and manufacturing of high-performance CNG and LNG fuel systems. The company focuses on delivering lightweight, durable, and efficient solutions that enhance vehicle performance and reduce emissions. With a strong emphasis on innovation and sustainability, Hexagon Agility GmbH is expanding its market presence through advanced technology, strategic collaborations, and a commitment to supporting the global transition toward cleaner transportation.

-

AB Volvo is a global manufacturer in the automotive natural gas vehicle industry, offering advanced solutions for heavy-duty trucks and buses powered by CNG and LNG. The company focuses on developing fuel-efficient and low-emission vehicles, supporting the global shift toward sustainable transportation. With a commitment to innovation and stringent environmental standards, AB Volvo enhances vehicle performance, reliability, and operational efficiency, strengthening its position in the evolving natural gas vehicle market.

Key Automotive Natural Gas Vehicle Companies:

The following are the leading companies in the automotive natural gas vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Hexagon Agility GmbH

- AB Volvo

- Foton International.

- CNH Industrial N.V.

- Clean Energy Fuels

- Cummins, Inc.

- PACCAR Inc.

- Navistar, Inc.

- Quantum Fuel Systems LLC.

- Westport Fuel Systems Inc.

Recent Developments

-

In September 2020, Westport Fuel Systems Inc. and its joint venture partner, UNO MINDA Group, reached a firm agreement to combine their businesses. The deal was made with an aim to enhance their ability to serve the growing Indian natural gas vehicle (NGV) market.

-

In February 2021, Agility Fuel Solutions and Hexagon Mobile Pipeline united under the new brand name Hexagon Agility. This strategic merger aimed to strengthen its business as a key provider of natural gas and natural gas automobiles, enhancing its capacity to serve the expanding market for clean energy transportation.

Automotive Natural Gas Vehicle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 35.6 billion |

|

Revenue forecast in 2030 |

USD 40.9 billion |

|

Growth rate |

CAGR of 2.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Fuel type, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, France, Russia, Sweden, China, India, Bangladesh, Thailand, Brazil |

|

Key companies profiled |

Hexagon Agility GmbH; AB Volvo; Foton International; CNH Industrial N.V.; Clean Energy Fuels; Cummins, Inc.; PACCAR Inc.; Navistar, Inc.; Quantum Fuel Systems LLC; Westport Fuel Systems Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Natural Gas Vehicle Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Automotive Natural Gas Vehicle market report based on fuel type, vehicle type, and region:

-

Fuel type Outlook (Revenue, USD Million, 2018 - 2030)

-

CNG

-

LNG

-

-

Vehicle type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger vehicles

-

Light duty & heavy duty buses and trucks

-

Three wheelers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Germany

-

France

-

Sweden

-

-

Asia Pacific

-

Bangladesh

-

China

-

India

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."