Automotive Multi-camera System Market Size, Share & Trends Analysis Report By Vehicle (Passenger Vehicles, Commercial Vehicles), By View (2D View Type, 3D View Type), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-388-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

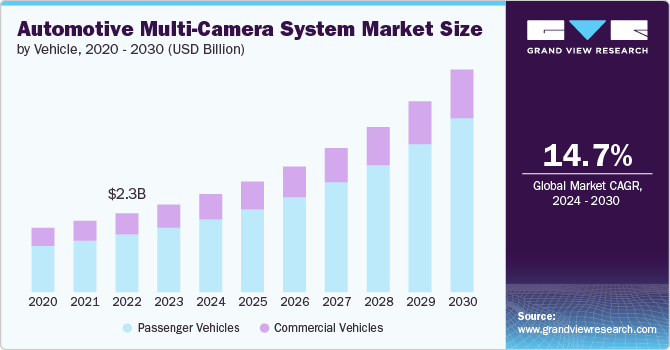

The global automotive multi-camera system market size was estimated at USD 2.53 billion in 2023 and is projected to grow at a CAGR of 14.7% from 2024 to 2030.The increasing emphasis on Advanced Driver-Assistance Systems (ADAS) is a major factor is a major factor contributing to the market growth. These systems rely heavily on multi-camera setups to provide real-time data and enhance safety features such as lane-keeping assistance, adaptive cruise control, and automated parking. As governments worldwide introduce stricter safety regulations, automakers are integrating more sophisticated camera systems to meet these requirements, thereby fueling market expansion.

The rising consumer demand for enhanced driving experiences is another key trend propelling the adoption of multi-camera systems. Modern drivers seek vehicles equipped with advanced technology that offers better visibility, easier maneuvering, and a more immersive experience. Multi-camera systems provide comprehensive views around the vehicle, assisting in detecting obstacles, pedestrians, and other vehicles. This significantly improves the overall driving experience and safety, making these systems highly desirable among consumers. Consequently, automakers are incorporating more multi-camera systems into their vehicles to meet this growing demand.

The advent of autonomous vehicles is a crucial trend influencing market growth. Autonomous driving technology requires a multitude of sensors and cameras to navigate and interpret the driving environment accurately. Multi-camera systems are essential for enabling the high-level perception capabilities needed for safe and efficient autonomous vehicle operation. As the development and deployment of autonomous vehicles accelerate, the demand for these camera systems is expected to rise substantially. This trend is driving investment in advanced multi-camera technologies, further boosting market growth.

Technological advancements in camera and image processing technologies are enhancing the capabilities of automotive multi-camera systems. Innovations such as high-definition cameras, improved image sensors, and advanced algorithms for image stitching and processing are making these systems more reliable and effective. These technological improvements are making multi-camera systems more attractive to both manufacturers and consumers. As a result, the adoption of these advanced systems is increasing, driving market growth. In addition, ongoing research and development efforts are expected to bring even more sophisticated camera technologies to the market in the near future.

The growing popularity of electric vehicles (EVs) is contributing to the increased adoption of multi-camera systems. EV manufacturers are keen to differentiate their products with cutting-edge technology, including advanced safety and driver-assistance features. Multi-camera systems are becoming a standard feature in many new EV models, driven by the need to provide a high-tech, safe, and user-friendly driving experience. This trend is expected to continue as the EV market expands, further driving the market growth. The integration of these systems into EVs also aligns with the broader industry push towards smarter, more connected vehicles, which is a key factor in the market's upward trajectory.

Vehicle Insights

Based on vehicle, the passenger vehicles segment led the market with the largest revenue share of 73.74% in 2023.The growing consumer demand for enhanced safety and convenience features is a primary driver contributing to the growth of the segment. ADAS incorporating multi-camera setups are increasingly sought after for their ability to provide comprehensive views around the vehicle and enhance overall driving safety. In addition, the rise of autonomous driving technology is pushing manufacturers to integrate more sophisticated camera systems to support high-level perception capabilities. As a result, the adoption of multi-camera systems in passenger vehicles is on the rise, fuelled by both regulatory requirements and consumer preferences.

The commercial vehicles segment is expected to register at a significant CAGR from 2024 to 2030. Commercial vehicles, such as trucks and buses, benefit greatly from multi-camera setups that enhance driver visibility, reduce blind spots, and prevent accidents. Fleet operators are increasingly investing in these technologies to minimize downtime, lower insurance costs, and improve overall safety records. Moreover, the implementation of regulatory mandates for commercial vehicle safety systems in various regions is driving the uptake of multi-camera systems. The growth of e-commerce and the consequent expansion of delivery and logistics fleets also contribute to the demand for advanced camera systems, as they play a crucial role in ensuring timely and secure deliveries.

View Insights

Based on view, the 2D segment led the market with the largest revenue share of 61.43% in 2023. The 2D view segment continues to grow, primarily driven by its cost-effectiveness and adequate performance for basic safety and convenience features. 2D camera systems are widely used in applications such as rearview cameras, blind-spot detection, and lane departure warnings, providing essential visual support to drivers. These systems remain popular in entry-level and mid-range vehicles where affordability is a key consideration. The simplicity and reliability of 2D camera systems make them an attractive option for manufacturers looking to offer safety features without significantly increasing vehicle costs. As a result, while the market is increasingly leaning towards 3D view systems for advanced functionalities, the 2D view segment maintains a strong presence due to its practicality and cost benefits.

The 3D view type segment is expected to grow at a significant CAGR from 2024 to 2030. The increasing demand for advanced visibility while driving and lane parking is a significant factor contributing to the growth of the segment. 3D camera systems offer superior depth perception and spatial awareness, which are crucial for features such as automated parking, 360-degree surround view, and obstacle detection. The rapid advancements in image processing technology and the growing consumer preference for high-tech, safety-oriented vehicle features further boost the adoption of 3D view systems.

Application Insights

Based on application, the parking assist system segment led the market with the largest revenue share of 30.07% in 2023 and is expected to retain its dominance. Increasing urbanization and the consequent rise in parking challenges are major drivers contributing to the growth of the segment. Consumers are increasingly seeking vehicles equipped with advanced technologies that simplify parking in tight spaces. Multi-camera systems offer superior accuracy and a 360-degree view, making parking assist systems highly desirable. In addition, the integration of automated parking features in mid-range and luxury vehicles is boosting the adoption of these systems, catering to consumer demands for convenience and safety.

The blind spot detection segment is expected to grow at a significant CAGR from 2024 to 2030. Blind spot detection systems significantly reduce the risk of accidents by alerting drivers to vehicles or obstacles in their blind spots. As safety regulations become more stringent worldwide, automakers are compelled to integrate these systems into their vehicles. The growing consumer awareness and demand for safer driving experiences further propel the adoption of blind spot detection technology. Technological advancements in multi-camera systems, which enhance the accuracy and reliability of blind spot detection, also contribute to the segment's growth, making these systems a standard feature in modern vehicles.

Regional Insights

The automotive multi-camera system market in North Americais anticipated to register at a significant CAGR from 2024 to 2030. The high rate of vehicle production and technological innovation in the automotive sector further fuels market growth, with major automakers integrating these systems into both passenger vehicles and commercial fleets. In addition, the emphasis on reducing accidents and enhancing the overall driving experience contributes to the market's prominence, positioning North America as a pivotal hub for advancements and deployments in automotive camera technology.

U.S. Automotive Multi-camera System Market Trends

The automotive multi-camera system market in U.S. is anticipated to register at a significant CAGR from 2024 to 2030. The strong focus on innovation and technological advancements in vehicle safety features further fuels the demand for multi-camera systems. The growing trend of integrating advanced safety features in both premium and mid-range vehicles is a key driver in the U.S. market.

Asia Pacific Automotive Multi-camera System Market Trends

Asia Pacific dominated the automotive multi-camera system market with a revenue share of 36.44% in 2023. The Asia Pacific region registers the largest share in the global market due to its significant automotive manufacturing industry. Countries such as China, Japan, and South Korea are home to some of the world's largest automakers, driving high demand for advanced vehicle technologies. In addition, the growing middle-class population and increasing urbanization in the region are boosting consumer demand for vehicles equipped with advanced safety and convenience features, including multi-camera systems.

Europe Automotive Multi-camera System Market Trends

The automotive multi-camera system market in Europe is anticipated to grow at a significant CAGR from 2024 to 2030. The presence of major automotive manufacturers and a well-established automotive industry further supports the demand for multi-camera systems. In addition, the growing trend towards autonomous driving and the integration of advanced safety features in vehicles are key factors driving the market growth in Europe.

Key Automotive Multi-camera System Company Insights

Key players operating in the global market include Robert Bosch GmbH.,Continental AG, DENSO TEN Limited,Magna International Inc, Motherson, Valeo SA, Faurecia Clarion, NXP Semiconductors., OMNIVISION, and Advanced Micro Devices, Inc. These companies focus on continuous research and development to enhance camera resolution, integration capabilities, and software algorithms for advanced features such as object detection and automated parking. In addition, partnerships with automotive OEMs and technology firms are crucial for expanding market presence and integrating multi-camera systems into next-generation vehicles. Several companies in the market are focusing on introducing advanced multi-camera systems with enhanced features

Key Automotive Multi-camera System Companies:

The following are the leading companies in the automotive multi-camera system market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental AG

- DENSO TEN Limited

- Magna International Inc.

- Motherson

- Valeo SA

- Faurecia Clarion

- NXP Semiconductors

- OMNIVISION

- Advanced Micro Devices, Inc.

Recent Developments

- In March 2023, ZF Friedrichshafen AG launched its latest innovation, the Smart Camera 6. This advanced camera system is designed to enhance the development of automated driving and safety systems for urban and highway environments. It boasts a wide 120-degree field of view and a significant upgrade in image resolution to 8 megapixels, which is more than four times higher than its predecessor. The Smart Camera 6 also features enhanced processing power, enabling it to support sophisticated functions such as 3D surround view and interior monitoring systems

Automotive Multi-camera System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.83 billion |

|

Revenue forecast in 2030 |

USD 6.42 billion |

|

Growth rate |

CAGR of 14.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle, view, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Robert Bosch GmbH; Continental AG; DENSO TEN Limited; Magna International Inc; Motherson; Valeo SA; Faurecia Clarion; NXP Semiconductors.; OMNIVISION; Advanced Micro Devices, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Multi-camera System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive multi-camera system market report based on vehicle, view, application, and region.

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

View Outlook (Revenue, USD Million, 2018 - 2030)

-

2D View Type

-

3D View Type

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Night Vision Recording

-

Parking Assist System

-

Blind Spot Detection

-

Lane Departure System

-

Other ADAS Systems

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive multi-camera system market size was estimated at USD 2.53 billion in 2023 and is expected to reach USD 2.83 billion in 2024.

b. The global automotive multi-camera system market is expected to grow at a compound annual growth rate of 14.7% from 2024 to 2030 to reach USD 6.42 billion by 2030.

b. Asia Pacific dominated the automotive multi-camera system market with a share of 36.4% in 2023. The Asia Pacific region registers the largest share in the automotive multi-camera system market due to its significant automotive manufacturing industry.

b. Some key players operating in the automotive multi-camera system market include Robert Bosch GmbH, Continental AG, DENSO TEN Limited, Magna International Inc, Motherson, Valeo SA, Faurecia Clarion, NXP Semiconductors., OMNIVISION, and Advanced Micro Devices, Inc.

b. Key factors that are driving the market growth include the increasing emphasis on Advanced Driver-Assistance Systems (ADAS) and the rising consumer demand for enhanced driving experiences.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."