- Home

- »

- Automotive & Transportation

- »

-

Automotive Logistics Market Size, Industry Report, 2030GVR Report cover

![Automotive Logistics Market Size, Share & Trends Report]()

Automotive Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Activity, By Type (Finished Vehicle, Automobile Parts), By Distribution, By Logistic Solution, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-575-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Logistics Market Summary

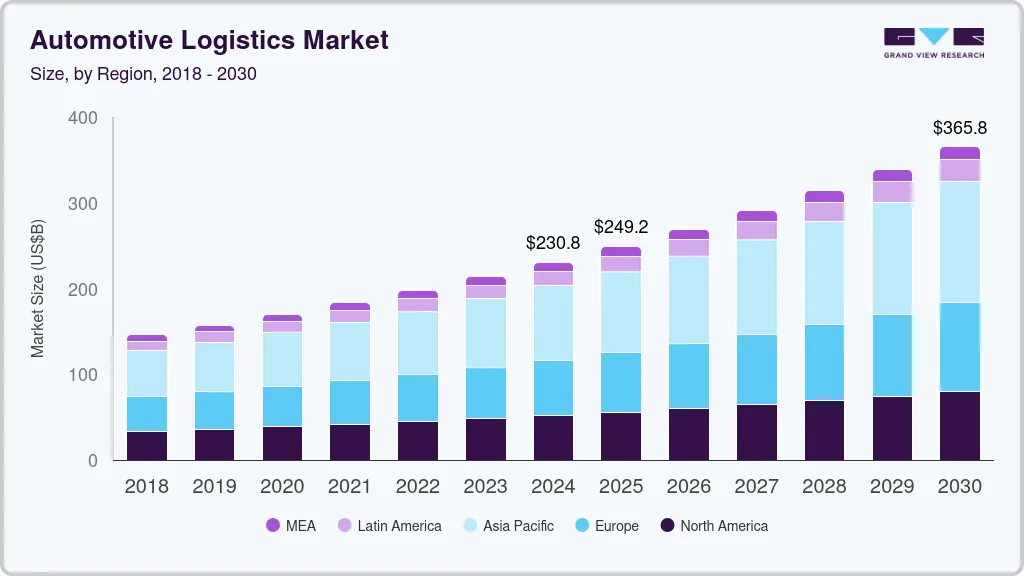

The global automotive logistics market size was estimated at USD 230.8 billion in 2024 and is projected to reach USD 365.78 billion by 2030, growing at a CAGR of 8.0% from 2025 to 2030. Growing demand from vehicle manufacturers across various regions, increasing growth experienced by the automotive industry in countries such as India, and a significant increase in demand for electric vehicles worldwide have contributed to this market's growth.

Key Market Trends & Insights

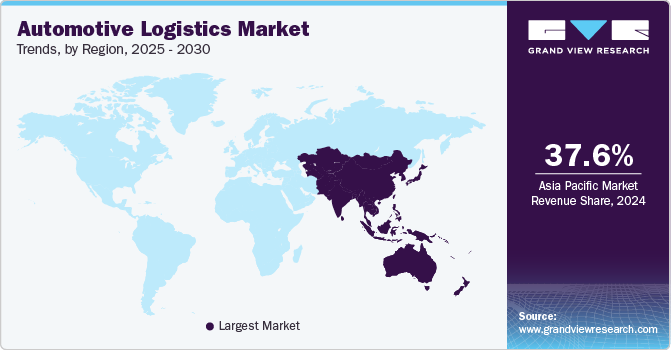

- The Asia Pacific dominated the global automotive logistics industry with a revenue share of 37.6% in 2024.

- Based on activity, the transportation segment dominated the global automotive logistics industry with a revenue share of 81.1% in 2024.

- Based on type, the automobile parts segment held the largest revenue share of the global automotive logistics industry in 2024.

- Based on logistic solution, the inbound segment dominated the global automotive logistics industry in 2024.

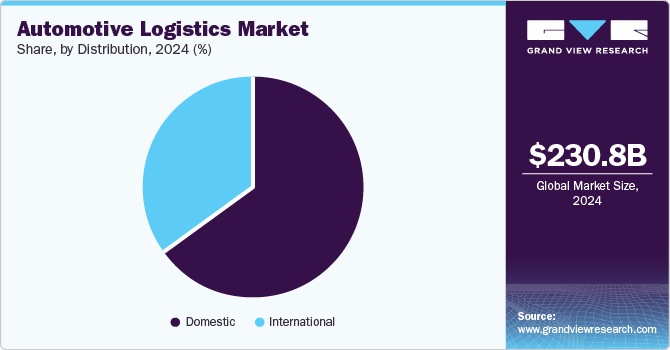

- Based on distribution, the domestic distribution segment held the largest revenue share of the global automotive logistics market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 230.8 Billion

- 2030 Projected Market Size: USD 365.78 Billion

- CAGR (2025-2030): 8.0%

- Asia Pacific: Largest market in 2024

Vehicle production has increased significantly in multiple countries over the last few years. This includes countries such as China, India, South Korea and others. In 2023, nearly 93 million vehicles were produced worldwide. Diverse consumer requirements mainly drive demand for these vehicles and the variety of automotive products. Once shipped to different regions and countries, the vehicles and numerous automotive parts are stored in warehousing facilities before getting dispatched to multiple distribution centers. These activities rely on key market participants' automotive logistics services and solutions. This includes warehousing, transportation, distribution, loading, unloading, aftermarket logistics, and others.

Quality of automotive logistics and efficiency strategy execution directly influence customer satisfaction, brand loyalty, brand perception, and brand positioning in the global automotive industry. A well-managed supply chain adds to the customer experience and enhances brand loyalty. Manufacturers emphasize deploying pre-determined automotive logistics strategies while collaborating with major market players with required resources, fleets, warehouses, and infrastructural support.

Numerous technology and innovation-based companies are launching advanced digital solutions and enterprise software, which is expected to enhance performance and improve operations and growth for this market. Increasing research and development activities add greater potential to market growth. For instance, in June 2024, The Massachusetts Institute of Technology Center for Transportation & Logistics (MIT CTL) launched a new laboratory setup supported by seed funding provided by Mecalux, a participant in the intralogistics technology market. The lab is dedicated to examining high-impact applications of modern data-driven technologies for logistics businesses.

Port authorities, railways, and similar organizations join hands with different industry participants to establish effective warehousing and transportation infrastructure to facilitate growing international trade. For instance, in March 2024, CEVA Logistics and The Port of Dunkirk signed a contract regarding a plot of land spanning a 9.5-hectare area, which is set to be used for a vehicle logistics park. CEVA Logistics, one of the market participants in the freight services and logistics solutions industry, has announced its plan to deploy this part to support maritime import and export activities driven through the Port of Dunkirk.

Various other industries, such as the mobility market, car rental businesses, tourism industry, and others, support the growth of the automotive logistics industry. Demand for newly developed vehicles equipped with advanced technology features and enhanced user assistance has generated significant demand for automotive logistics services. New contracts among vehicle manufacturers and mobility businesses are expected to add growth opportunities for this market in the forecast period.

For instance, in February 2024, Ayvens, a market participant in long-term vehicle leasing and fleet management, signed a frame agreement with Stellantis NV, a global automotive manufacturer. The agreement involves Ayvens purchasing nearly 500,000 Stellantis NV vehicles over the next three years for its long-term leasing business in Europe. Such business activities and contracts among major market participants are expected to fuel demand for effective automotive logistics services over the forecast period.

Activity Insights

The transportation segment dominated the global automotive logistics industry with a revenue share of 81.1% in 2024. Growth of this segment is facilitated by increasing vehicle production, changing requirements driven by novel distribution strategies embraced by automotive manufacturers, and increasing market penetration of the automotive parts industry. The focus of multiple vehicle manufacturers on establishing production facilities and supply chain networks in different regions and developing countries such as India is expected to result in significant growth in demand from different domestic markets.

Roadways contribute the highest revenue share to the automotive logistics market's transportation activities, followed by railways, maritime transport, and airways. Multiple governments' focus on enhancing infrastructure, including ports, highways, railroads, and supportive ecosystems, is expected to support the growth of this market.

Transportation of newly designed vehicles from manufacturing facilities to multiple distribution centers plays a vital role in customer experience, brand positioning, and delivery of promised products. The availability of advanced logistics solutions and fleets equipped with advanced technology-assisted vehicles and machines is expected to result in lucrative growth opportunities for this segment.

The warehousing segment is anticipated to experience the highest CAGR from 2025 to 2030. This is attributed to the increasing demand for efficient warehousing solutions and services from the automotive industry. Numerous manufacturers and supply chain participants have focused on reducing C02 emissions by establishing a network of well-equipped warehouses and technology-driven operations. Demand for multiple warehousing facilities, the emergence of modern technology-assisted systems, and the increasing adoption of advanced software-based solutions are expected to add growth.

Type Insights

The automobile parts segment held the largest revenue share of the global automotive logistics industry in 2024. The increasing demand for automobile parts for vehicle refurbishment mainly drives the growth of this segment. Automobile parts manufacturers supply various parts, including brakes, batteries, coils, bushings, hardware, braking systems, suspension systems, and others to vehicle manufacturers. These parts are transported from the supplier’s facilities to the vehicle manufacturer’s location based on requirements and scheduled deliveries. Companies rely on in-house fleets, automotive logistics service providers, railways, and others for transportation activities. Innovation embraced by vehicle manufacturers, increasing inclination towards procurement of parts from dedicated vendors, and growing demand for effective warehousing and transportation of automobile parts are expected to generate growth for this segment.

The finished vehicles segment is projected to experience the fastest growth over the forecast period. This is attributed to the growing demand from vehicle manufacturers and other industries, such as mobility solutions providers. Warehousing and transportation of finished vehicles play vital roles in the brand position of automotive industry participants. Effective logistics services ensure enhanced customer experiences and damage-free transportation of finished vehicles.

Logistic Solution Insights

The inbound segment dominated the global automotive logistics industry in 2024. The inbound logistics mainly features transportation, storage, and distribution of automobile parts and vehicles to determined warehouse locations. The focus of manufacturers and automobile part vendors to establish a network of warehousing facilities and supply chain networks that facilitate reduced CO2 emissions, cost efficiency, and enhanced performances are expected to fuel growth for this segment.

The outbound segment is anticipated to experience the fastest CAGR from 2025 to 2030. Outbound logistic activities comprise the overall revenue collected by transporting finished vehicles and automobile parts from multiple warehousing facilities to the end user. Increasing demand for electric vehicles, effective distribution strategies adopted by brands, and growing demand from other industries, such as mobility solutions and the ride-sharing sector, are likely to develop growth for this segment during the forecast period.

Distribution Insights

The domestic distribution segment held the largest revenue share of the global automotive logistics market in 2024. Large-scale automotive production in countries such as China, India, Japan, South Korea, and others is adding to the growth experienced by this segment. Domestic distribution requirements are higher than international distribution as multiple manufacturers and vehicle producers have focused on establishing manufacturing facilities in various regions and locations. This has resulted in rapid growth in domestic transportation requirements.

For instance, in October 2023, BMW and high-performance battery technology company AESEC Group Ltd. reached an agreement where AESEC stated the company would exclusively obtain cathode active battery material from the Ontario, Canada-based facility of Umicore. Such contracts and inclination among multiple participants in the automotive industry to localize the supply chain management and participation are expected to add growth for the domestic distribution segment.

The international logistics segment is projected to experience significant growth during the forecast period. Large enterprises in certain regions and countries such as China, Germany, South Korea, India, and others primarily drive this market. Infrastructure enhancements initiated by various governments, including India, the U.S., China, Japan, Australia, and others, also contribute to the growth experienced by this segment. Additionally, the availability of international transportation services provided by numerous freight management and shipping companies, the growing presence of various automobile parts manufacturers on online portals, and increasing demand from Asia Pacific are adding to the growth.

Regional Insights

Asia Pacific dominated the global automotive logistics industry with a revenue share of 37.6% in 2024. The robust automotive manufacturing industry primarily drives this market in countries such as India, China, Japan, South Korea, and others. The presence of multiple producers of automobile parts, as well as significant growth in vehicle demand by individual users and commercial buyers such as governments, mobility solutions companies, hospitality industry participants, and others, is projected to fuel the growth of this market. The entryThe entry of numerous global automotive companies in the region also contributes to the development. For instance, in February 2024, ZF Friedrichshafen AG, one of the global automotive component suppliers and technology-driven companies, announced the establishment of a new plant in Oragadam, located in Tamil Nadu state of India. The company has planned to utilize a new facility to supply electric components for the Asia market.

China Automotive Logistics Market Trends

China held the largest revenue share of the regional industry in 2024. This market is driven by the domestic vehicle production market in China and a large share of the global trade of electric vehicles. China produces more than half of the overall electric vehicles produced worldwide yearly. Availability of materials in the country, large-scale parts manufacturers operating, and significantly growing demand from domestic users are expected to develop growth for the automotive industry in China and support the development of the automotive logistics market.

Europe Automotive Logistics Market Trends

Europe was identified as one of the key regions of the global automotive logistics industry in 2024. This is attributed to the region's robust vehicle production and parts manufacturing industry. Europe is home to multiple global vehicle companies, such as Renault, Volkswagen Group, Mercedes-Benz Group AG, AB Volvo, BMW, and others. Growing demand experienced by the European automotive industry and increasing international trade are expected to add lucrative growth opportunities for this market.

Germany held the largest regional automotive logistics market revenue share in 2024. This market is driven by the country's strong automotive and automobile parts manufacturing sector. A large number of ongoing research activities, increasing availability and adoption of advanced technologies associated with vehicle manufacturing and designs, and increasing demand for vehicles offered by companies operating in Germany are some of the key growth driving factors.

North America Automotive Logistics Market Trends

North America accounted for a significant global automotive logistics market revenue share in 2024. This market is primarily influenced by factors such as key industry manufacturers' increasing localization of supply chain networks and individual users and commercial buyers' growing demand for electric vehicles and self-driving cars, such as delivery solution providers, mobility companies, governments, and others.

The U.S. dominated the regional industry in 2024. This market is mainly driven by aspects such as growing demand for electric vehicles from domestic buyers, increasing utilization of novel services such as ride-sharing, and growing focus of government agencies and authorities on ensuring the availability of advanced cars equipped with improved technology features and assistance for government use, military and other purposes. Increasing import of vehicles from various countries, growing international trade of automobile parts, and availability of modern technology-driven software solutions designed for the automotive logistics industry are expected to add growth to this market during the forecast period.

Key Automotive Logistics Company Insights

Some key global automotive logistics companies include CEVA Logistics, DSV, Hellmann Worldwide Logistics SE & Co. KG, KERRY LOGISTICS NETWORK LIMITED, NIPPON EXPRESS HOLDINGS, and others. To address growing competition and increasing demand from various regions, key market participants are embracing strategies such as technology adoption, diversification of service portfolios, collaborations, mergers, acquisitions, facility enhancements, capacity additions, and more.

-

DSV, a global transportation and logistics service provider, offers a range of solutions. The company operates nearly 500 warehouses for effective logistic operations. Its services include air freight, sea freight, road freight, project transport, green logistics, logistic solutions, etc. Its value-added services portfolio includes transporting dangerous goods, road control towers, logistics insurance, DSV protection, customs clearance, broker services, purchase order management, remote monitoring, supply chain security, and others.

-

CEVA Logistics, a global supply chain and logistics company, offers one of the largest networks of third-party logistics services worldwide. Its services include ground and rail freight, ocean freight, air freight, finished vehicle logistics, customs, fiscal representation, CEVA Lead Logistics (CLL), and more.

Key Automotive Logistics Companies:

The following are the leading companies in the automotive logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Kintetsu World Express, Inc.

- BLG LOGISTICS GROUP AG & Co. KG

- CMA CGM Group

- DHL

- DSV

- Expeditors International of Washington, Inc.

- CEVA Logistics

- Hellmann Worldwide Logistics SE & Co. KG

- LOGISTEED

- Imperial

- KERRY LOGISTICS NETWORK LIMITED

- Kuehne+Nagel

- NIPPON EXPRESS HOLDINGS

- Penske Automotive Group, Inc.

- Ryder System, Inc.

Recent Developments

-

In December 2024, NIPPON EXPRESS HOLDINGS, a global logistics service provider, entered into a strategic partnership agreement with Tive, Inc. for real-time monitoring services associated with cargo information. This has enabled NIPPON to provide enhanced services for semiconductors and other industries with the availability of real-time monitoring and control technology, especially for cargo transports sensitive to temperature, humidity, and more.

-

In July 2024, DHL Group signed a strategic partnership agreement with Envision Group, a green technology provider. The deal aims to develop logistic solutions with comprehensive cooperation and accelerate progress towards improved sustainability targets. The partnership is planned to address four areas: logistic solutions, green energy, Net Zero industrial & logistic park development, and Sustainable Aviation Fuel (SAF).

-

In November 2024, Nippon Express de España, SA, a group company by NIPPON EXPRESS HOLDINGS, YAZAKI Europe Limited, held the inauguration ceremony of the new NX-YAZAKI warehousing facility in Palencia, Spain. The addition to warehousing capacity is expected to facilitate the growth of the European automotive industry and develop new job opportunities in the area.

-

In September 2024, DSV signed an agreement to acquire one of the global logistics and supply chain industry participants, DB SCHENKER. The acquisition is expected to strengthen DSV's presence worldwide while adding valuable reinforcement to its networks, competitive advantages, expertise, and more.

-

In February 2024, CMA CGM Group acquired Bolloré Logistics. This move is anticipated to significantly strengthen maritime transportation capacities and logistic development strategies. The newly established entity, comprising CEVA and Bolloré, is equipped with expertise and a network to offer its services to new business areas and industries.

Automotive Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 249.22 billion

Revenue forecast in 2030

USD 365.78 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Activity, type, distribution, logistic solution, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Kintetsu World Express, Inc.; BLG LOGISTICS GROUP AG & Co. KG; CMA CGM Group; DHL; DSV; Expeditors International of Washington, Inc.; CEVA Logistics; Hellmann Worldwide Logistics SE & Co. KG; LOGISTEED; Imperial; KERRY LOGISTICS NETWORK LIMITED; Kuehne+Nagel; NIPPON EXPRESS HOLDINGS; Penske Automotive Group, Inc.; Ryder System, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global automotive logistics market report based on activity, type, distribution, logistic solution, and region:

-

Activity Outlook (Revenue, USD Million, 2018 - 2030)

-

Warehousing

-

Transportation

-

Roadways

-

Airways

-

Maritime

-

Railways

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Finished vehicle

-

Automobile Parts

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Domestic

-

International

-

-

Logistic Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Inbound

-

Outbound

-

Reverse

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.