- Home

- »

- Advanced Interior Materials

- »

-

Automotive Lightweight Materials Market Size Report, 2030GVR Report cover

![Automotive Lightweight Materials Market Size, Share & Trends Report]()

Automotive Lightweight Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Metals, Composites, Plastics), By Application (Body in White, Chassis and Suspension, Powertrain Closures, Interiors), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-050-4

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Lightweight Materials Market Summary

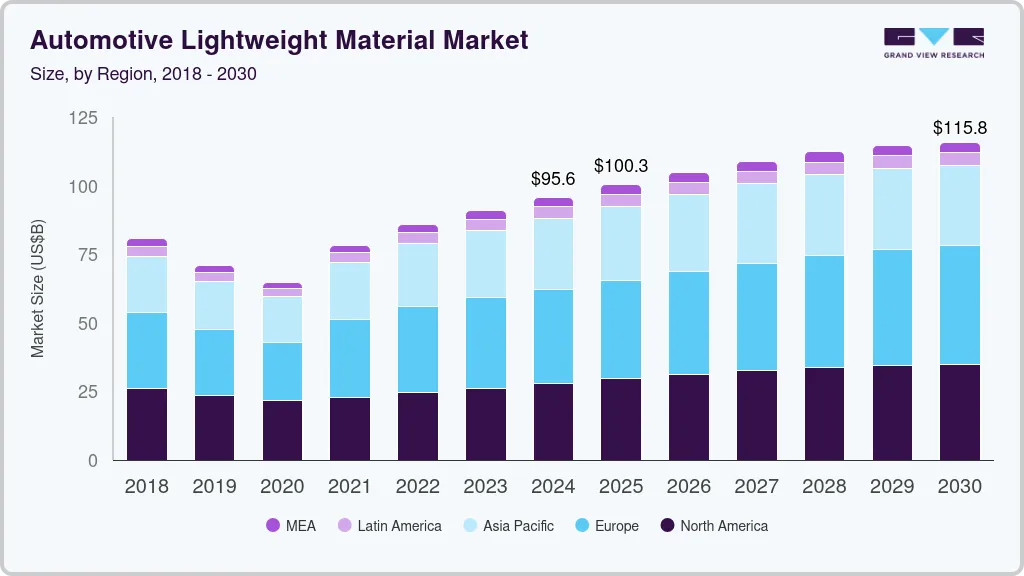

The global automotive lightweight material market size was estimated at USD 95.64 billion in 2024 and is projected to reach USD 115.85 billion by 2030, growing at a CAGR of 2.3% from 2025 to 2030. Regulatory bodies, such as the Environmental Protection Agency (EPA) in the United States and the European Union’s CO2 emission standards, have set ambitious targets for reducing vehicle greenhouse gas emissions.

Key Market Trends & Insights

- Europe automotive lightweight materials market accounted for the largest market revenue share of 35.7% in 2024.

- Germany automotive lightweight materials market is anticipated to grow at a CAGR of 6.3% over the forecast period.

- By material, the composites segment accounted for the largest market revenue share of 66.0% in 2024.

- By application, the body in white (BiW) segment accounted for the largest market revenue share of 25.3% in 2024.

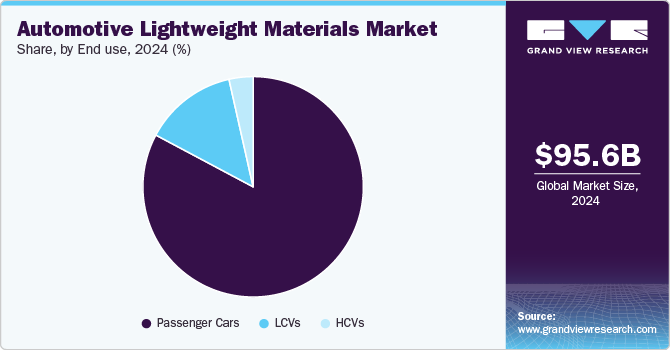

- By end-use, passenger cars accounted for the largest market revenue share of 83.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 95.64 Billion

- 2030 Projected Market Size: USD 115.85 Billion

- CAGR (2025-2030): 2.9%

- Europe : Largest market in 2024

As a result, automakers are compelled to adopt lightweight materials to enhance fuel efficiency and comply with these regulations. By reducing vehicle weight, manufacturers can improve fuel economy, which helps meet regulatory requirements and appeals to environmentally conscious consumers. While some lightweight options may initially be more expensive than traditional materials, their long-term benefits, such as improved fuel efficiency and lower operational costs, make them economically attractive over time. Additionally, manufacturers are exploring ways to optimize production processes for these advanced materials, thereby reducing overall costs associated with their implementation. As cost pressures continue within the industry, automakers recognize that investing in lightweight solutions can significantly save fuel consumption and maintenance over a vehicle’s lifecycle.

Electric Vehicles (EVs) require efficient energy use to maximize battery life and range; therefore, reducing vehicle weight becomes crucial. Lightweight materials such as aluminum, carbon fiber-reinforced polymers, and advanced high-strength steels are increasingly used in EV manufacturing to achieve this goal. As more consumers opt for electric vehicles due to their environmental benefits and lower operating costs, automakers invest heavily in lightweight technologies to enhance performance and extend driving ranges.

Lightweight materials significantly enhance vehicle dynamics, acceleration, and handling while maintaining structural integrity during crashes. This dual benefit aligns with consumer expectations for modern vehicles that deliver excitement on the road and robust safety features. As automakers strive to meet these evolving consumer demands, they increasingly turn to lightweight materials as a solution that satisfies both performance criteria and safety regulations.

Material Insights

The composites segment accounted for the largest market revenue share of 66.0% in 2024. It offers durability and lightweight properties to vehicles without affecting the design and dynamics. The composites offer robust properties to the vehicles and are easy to mold, thus gaining traction in vehicle manufacturing. The rise in the production of electric vehicles is expected to influence the demand for composites.

The plastics segment is anticipated to grow at the fastest CAGR of 3.8% over the forecast period. As regulations around emissions tighten globally, automakers are under pressure to reduce vehicle weight to improve fuel economy. Plastics, significantly lighter than traditional materials such as steel and aluminum, provide a compelling solution. Their use in components such as body panels, interiors, and under-the-hood applications helps manufacturers meet these stringent standards while maintaining performance and safety.

Application Insights

The body in white (BiW) segment accounted for the largest market revenue share of 25.3% in 2024. The BiW constitutes the vehicle's structural frame and is crucial in overall weight management. By incorporating lightweight materials such as advanced high-strength steel (AHSS), aluminum, and composites, manufacturers can effectively reduce the weight of the BiW, enhancing the vehicle's efficiency and sustainability.

The closures segment is anticipated to grow at the fastest CAGR of 2.6% over the forecast period. The closures segment includes doors, hoods, and trunk lids. The increasing demand for fuel-efficient vehicles pushes manufacturers to adopt lightweight materials in various components, including doors, hoods, and trunk lids. By reducing the overall weight of vehicles, automakers can enhance fuel efficiency and comply with stringent regulatory standards to lower carbon emissions. This trend is particularly prevalent in regions with strict environmental regulations, where manufacturers must innovate and utilize materials that contribute to lighter vehicle designs.

The interiors segment is anticipated to grow significantly over the forecast period. Modern consumers are not just looking for functional vehicles; they desire interiors that offer a premium feel and experience. Lightweight materials enable designers to create intricate, stylish, and comfortable interior features while maintaining a lighter overall weight. The ability to mold and shape these materials allows for innovative designs that elevate the overall cabin experience, making lightweight materials a key consideration for automotive manufacturers aiming to meet consumer expectations.

End Use Insights

Passenger cars accounted for the largest market revenue share of 83.2% in 2024. Consumer preferences are shifting towards more sustainable and efficient vehicles, fueling the demand for lightweight materials. With the rise of electric vehicles (EVs) and hybrid cars, the need for lightweight solutions is more pronounced, as reducing weight is critical for maximizing battery range and overall performance. Automakers are increasingly focusing on creating vehicles that meet regulatory standards and appeal to environmentally conscious consumers. This trend is driving investments in research and development for innovative lightweight materials explicitly tailored for passenger vehicles.

LCVs is anticipated to grow at the fastest CAGR of 3.3% over the forecast period. As online shopping continues to rise, logistics companies seek vehicles that can handle heavier loads while remaining agile and efficient. Lightweight materials help achieve this balance by allowing greater payload capacity without significantly increasing vehicle weight. This capability is essential for companies aiming to optimize their delivery fleets and reduce operational costs, a crucial factor in the highly competitive logistics industry.

Regional Insights

The North American automotive lightweight materials market is anticipated to grow at the fastest CAGR of 2.7% over the forecast period. Governments in the U.S. and Canada have implemented stringent fuel economy standards that require automakers to enhance vehicle efficiency. The Corporate Average Fuel Economy (CAFE) standards mandate that manufacturers achieve specific mileage targets, which can be significantly improved by reducing vehicle weight. Lightweight materials such as aluminum, carbon fiber, and advanced high-strength steel are being adopted to meet these regulations while maintaining safety and performance.

U.S. Automotive Lightweight Materials Market Trends

The rising consumer demand for fuel-efficient and environmentally friendly vehicles propels the lightweight materials market in the U.S. As awareness of climate change and environmental issues grows, consumers increasingly opt for vehicles that minimize their carbon footprint. Lightweight materials are crucial in achieving this goal, making them attractive to manufacturers looking to meet consumer expectations. This shift in consumer preferences encourages automakers to invest more in lightweight technologies, thus boosting market growth.

Europe Automotive Lightweight Materials Market Trends

Europe automotive lightweight materials market accounted for the largest market revenue share of 35.7% in 2024. The EU has set ambitious targets to reduce greenhouse gas emissions, pushing automakers to seek solutions that enhance fuel efficiency. Lightweight materials, such as aluminum, carbon fiber, and advanced high-strength steel, are crucial in reducing vehicle weight, improving fuel economy and meeting regulatory standards.

Germany automotive lightweight materials market is anticipated to grow at a CAGR of 6.3% over the forecast period. As one of the largest automotive markets in Europe, Germany is at the forefront of adopting lightweight materials such as aluminum, carbon fiber reinforced polymers (CFRP), and advanced high-strength steels (AHSS). These materials are essential for manufacturers aiming to enhance vehicle performance while adhering to stringent emissions regulations set by the European Union.

Asia Pacific Automotive Lightweight Materials Market Trends

The Asia Pacific market is anticipated to grow significantly over the forecast period. Innovations such as high-strength steel (HSS), aluminum alloys, and composite materials have enabled significant weight reductions without compromising structural integrity or safety. Research institutions and universities across the Asia Pacific are collaborating with automotive manufacturers to develop next-generation materials that offer enhanced properties such as improved strength-to-weight ratios and corrosion resistance. These technological advancements not only facilitate lighter vehicle designs but also contribute to cost savings over the lifecycle of vehicles.

Key Automotive Lightweight Materials Company Insights

Some of the key players operating in the market include Toray Industries, Inc., LyondellBasell, ArcelorMittal, and others:

-

Toray Industries, Inc., a global manufacturer based in Japan, specializes in advanced materials and technologies across various sectors, including automotive, textiles, and chemicals. The company is renowned for its commitment to innovation and sustainability, focusing on developing lightweight materials that enhance fuel efficiency and reduce vehicle emissions.

-

LyondellBasell is a global company that produces plastics, chemicals, and refining, strongly emphasizing innovation and sustainability. The company offers a wide range of lightweight materials specifically designed for the automotive industry, focusing on enhancing fuel efficiency and reducing emissions. Their product portfolio includes advanced polymers such as polypropylene (PP) and polyethylene (PE), utilized in various automotive applications, including interior components, exterior panels, and structural parts.

Key Automotive Lightweight Materials Companies:

The following are the leading companies in the automotive lightweight materials market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Toray Industries, Inc.

- LyondellBasell

- Novelis Inc

- ArcelorMittal

- Alcoa Corporation

- Owens Corning

- Stratasys Ltd.

- Tata Steel

- POSCO

Automotive Lightweight Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 100.31 billion

Revenue forecast in 2030

USD 115.85 billion

Growth rate

CAGR of 2.3% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in thousand tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia

Segments covered

Material, application, end use, region

Key companies profiled

BASF SE; Toray Industries, Inc.; LyondellBasell; Novelis Inc.; ArcelorMittal; Alcoa Corporation; Owens Corning; Stratasys Ltd.; Tata Steel; POSCO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Lightweight Materials Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive lightweight materials market on the basis of material, application, end use, and region:

-

Material Outlook (Volume in Kilo Tons and Revenue in USD Million, 2018 - 2030)

-

Metals

-

Composites

-

Plastics

-

Elastomers

-

-

End Use Outlook (Volume in Kilo Tons and Revenue in USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles (LCV)

-

Heavy Commercial Vehicles (HCV)

-

-

Application Outlook (Volume in Kilo Tons and Revenue in USD Million, 2018 - 2030)

-

Body In White

-

Chassis & Suspension

-

Powertrain

-

Closures

-

Interiors

-

Others

-

-

Regional Outlook (Volume in Kilo Tons and Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global automotive lightweight materials market is expected to grow at a compound annual growth rate, a CAGR of 2.3% from 2025 to 2030, to reach USD 115.85 billion by 2030.

b. The metals segment of automotive lightweight materials market accounted for the largest revenue share of 57.2% in 2024.

b. Some of the key players operating in the automotive lightweight material market include BASF SE; Toray Industries, Inc.; LyondellBasell; Novelis Inc.; ArcelorMittal; Alcoa Corporation; Owens Corning; Stratasys Ltd.; Tata Steel; and POSCO.

b. Key factors that are driving the automotive lightweight material market include the high demand for weight reduction in performance vehicles is expected to increase the demand for lightweight materials for vehicle manufacturing.

b. The global automotive lightweight materials market size was estimated at USD 95.64 billion in 2024 and is expected to reach USD 100.31 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.