Automotive Internet Of Things Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By System (Embedded, Tethered, Integrated), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-337-2

- Number of Report Pages: 148

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Automotive IoT Market Size & Trends

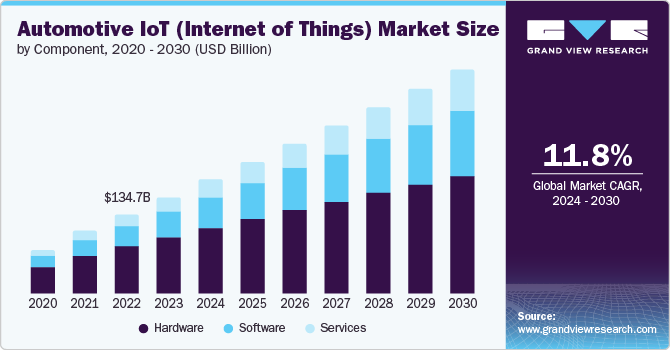

The global automotive internet of things market size was valued at USD 164.06 billion in 2023 and is expected to grow at a CAGR of 11.8% from 2024 to 2030. The growing need for connected cars for enhanced user comfort and convenience is a significant factor augmenting the automotive IoT (Internet of Things) market growth. As consumers increasingly seek enhanced in-vehicle experiences ranging from infotainment systems to real-time vehicle diagnostics, automakers are integrating IoT solutions to meet these expectations. Moreover, the integration of IoT in vehicles enables improved safety features and efficient vehicle management, appealing to a broader consumer base and thereby boosting market growth.

Moreover, the advancements in wireless communication technologies are propelling the automotive IoT market further. The deployment of 5G networks ensures high-speed data transmission, lower latency, and improved connectivity, essential for the seamless operation of connected vehicles. This facilitates real-time data exchange between vehicles and infrastructure, enhancing driving experiences and supporting the way for autonomous driving technologies. Such developments boost market growth and also create opportunities for innovation in vehicle-to-everything (V2X) communication, further driving the automotive IoT market.

Government initiatives and regulations promoting vehicle safety and emissions standards are driving the automotive IoT market's growth. Legislation mandating the incorporation of advanced safety features like emergency call systems (eCall) and stringent emission monitoring are compelling vehicle manufacturers to adopt IoT technologies. These regulations highlight the role of technology in addressing safety and environmental concerns, subsequently leading to market expansion as manufacturers and consumers equally prioritize sustainable and safe driving experiences.

Additionally, the rise in smart city projects globally fuels the demand for automotive IoT solutions. As cities aim to enhance urban mobility and reduce traffic congestion, the integration of IoT in transportation becomes crucial. Smart city initiatives foster the development of intelligent transportation systems (ITS) that leverage IoT for traffic management, smart parking, and connected public transit systems. This contributes to the automotive IoT market growth but and also aligns with broader goals of sustainability and efficient urban planning.

Furthermore, the increasing consumer focus on vehicle health monitoring and predictive maintenance is expected to drive the growth of the automotive IoT market. With IoT-enabled devices, vehicle owners can receive real-time updates on their vehicle's condition and maintenance needs, avoiding costly repairs and downtime. This trend towards predictive maintenance is driven by the desire for longevity and efficiency in vehicle usage, thereby encouraging the adoption of IoT technologies in the automotive sector. The convenience and cost-saving potential of these technologies make them attractive to consumers, thereby driving the market growth in coming years.

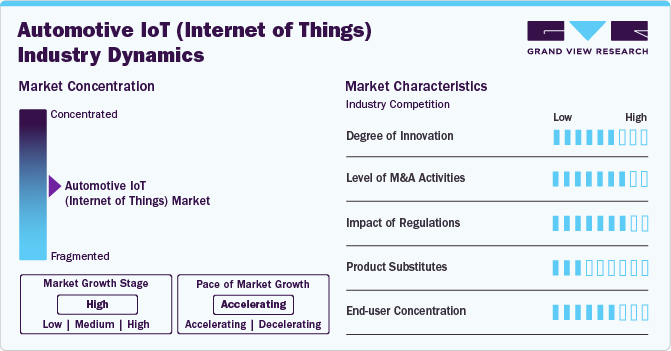

Market Concentration & Characteristics

The automotive IoT market exhibits a high degree of innovation, driven by advancements in technologies like artificial intelligence (AI), machine learning (ML), and automation. These innovations aim to enhance safety, comfort, and convenience in automotive IoT globally.

Regulations aimed at enhancing road safety and reducing emissions are driving the adoption of IoT technologies in the automotive industry. These regulations mandate the integration of advanced IoT systems for compliance, boosting market growth.

The market is also being influenced by the rising number of mergers & acquisition activities that help companies increase market share, expand the customer base, and strengthen product portfolios.

The impact of product substitutes in the automotive IoT market can lead to increased competition and pressure on pricing, as alternative technologies or solutions may offer similar functionalities. This can drive innovation and differentiation among IoT providers, pushing them to enhance their offerings to maintain market share.

End-use concentration in the automotive IoT market refers to the degree to which a small number of automakers and fleet operators dominate the demand for IoT solutions. This concentration impacts market dynamics, as major players significantly influence technological advancements and adoption rates.

Component Insights

Based on component, the hardware segment dominated the market with the largest revenue share of around 58% in 2023 due to the increasing integration of advanced sensors, connectivity modules, and computing devices in vehicles. These components are essential for enabling real-time data collection, processing, and communication, which are crucial for applications such as ADAS, autonomous driving, and vehicle-to-everything (V2X) communication. Additionally, the rising demand for electric vehicles (EVs) and connected car technologies further drives the need for advanced hardware solutions, thereby driving the segment growth.

The services segment is expected to record the highest CAGR of 14.8% from 2024 to 2030. The segment is experiencing significant growth due to the increasing demand for data-driven insights and connectivity solutions. Companies are offering advanced analytics, telematics, and remote diagnostics services that enhance vehicle performance and safety. The rise of connected car ecosystems and the need for continuous software updates and cybersecurity measures are driving this expansion. As a result, automakers and service providers are collaborating to deliver comprehensive IoT-enabled services, which is expected to support the expansion of the segment.

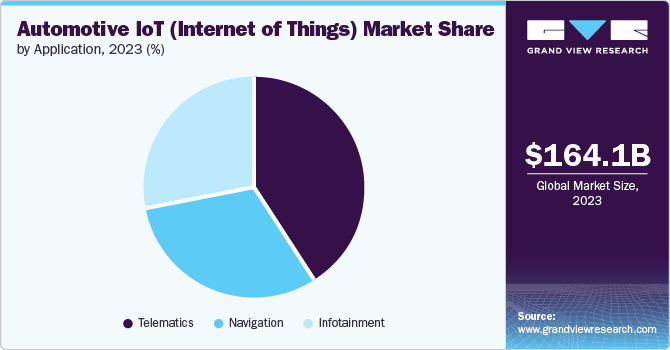

Application Insights

Based on application, the telematics segment accounted for the highest market share in 2023. The segment growth is attributed to the increasing demand for connected car services and fleet management solutions. Telematics systems provide real-time data on vehicle location, diagnostics, driver behavior, and fuel efficiency, enhancing operational efficiency and safety. Additionally, the integration of telematics with insurance models, such as usage-based insurance (UBI), is driving its adoption.

The infotainment segment is anticipated to expand at the highest CAGR from 2024 to 2030. The growth of the infotainment segment can be attributed to the increasing consumer demand for enhanced in-car experiences. Modern drivers seek advanced features such as real-time navigation, streaming services, and seamless smartphone integration, all facilitated by IoT technology. Automakers are increasingly implementing sophisticated infotainment systems to differentiate their offerings and meet customer expectations. This trend is further accelerated by advancements in connectivity and the proliferation of smart devices, driving continuous innovation and adoption in the infotainment segment.

System Insights

Based on system, the embedded segment held the highest revenue share in 2023, due to the increasing integration of smart technologies in vehicles. These systems, which include microcontrollers, sensors, and real-time operating systems, are essential for enabling advanced features such as autonomous driving, vehicle-to-everything (V2X) communication, and predictive maintenance. The demand for enhanced safety, efficiency, and connectivity in modern vehicles is driving the adoption of embedded systems.

The integrated segment is estimated to register the highest growth rate from 2024 to 2030. The growth is attributed to the increasing demand for comprehensive solutions that seamlessly combine hardware, software, and connectivity. These systems enable efficient communication between various vehicle components, enhancing functionalities such as advanced driver assistance systems (ADAS), infotainment, and predictive maintenance. As automakers and consumers prioritize safety, convenience, and overall driving experience, the adoption of integrated IoT systems is rapidly expanding.

Regional Insights

North America automotive IoT (Internet of Things) market accounted for the highest revenue share of over 36% in 2023. The North American automotive IoT market is driven by strong technological advancements and significant investments in smart transportation infrastructure, promoting widespread adoption of connected vehicle technologies.

U.S. Automotive IoT (Internet of Things) Market Trends

The automotive IoT (Internet of Things) market in the U.S. is anticipated to grow at a CAGR of over 8% from 2024 to 2030. In the U.S., the growth of the automotive IoT market is fueled by extensive R&D initiatives, a robust tech ecosystem, and government regulations focused on enhancing vehicle safety and emissions control.

Asia Pacific Automotive IoT (Internet of Things) Market Trends

The automotive IoT (Internet of Things) market in Asia Pacific is anticipated to grow at a significant CAGR of over 14% from 2024 to 2030. Rapid urbanization and increasing disposable incomes are driving the automotive IoT market, fostering demand for connected vehicles and smart transportation solutions.

India automotive IoT (Internet of Things) market is estimated to record a significant growth rate from 2024 to 2030. Government initiatives promoting smart cities and digital infrastructure are accelerating IoT adoption in automotive sectors, enhancing vehicle safety and efficiency.

The automotive IoT (Internet of Things) market in China is expected to grow significantly from 2024 to 2030. Strong government support for electric vehicles and smart mobility solutions is fueling the rapid growth of the automotive IoT market, fostering innovation and investment in connected vehicle technologies.

Japan automotive IoT (Internet of Things) market is projected to witness a considerable growth rate from 2024 to 2030. Technological innovation and a strong automotive manufacturing base are propelling IoT integration, leading to advanced driver assistance systems and autonomous vehicle development.

Europe Automotive IoT (Internet of Things) Market Trends

The automotive IoT (Internet of Things) market in Europe accounted for a market share of around 24% in 2023. The growth drivers in Europe include stringent regulations promoting vehicle safety and emissions standards, coupled with increasing investments in autonomous driving technologies.

The UK automotive IoT (Internet of Things) market is projected to grow at a notable CAGR from 2024 to 2030. In the U.K., growth is driven by a strong emphasis on electric vehicle adoption, supported by government incentives and infrastructure development for charging networks.

The automotive IoT (Internet of Things) market in Germany is expected to record a significant growth from 2024 to 2030. Germany's growth is fueled by robust automotive manufacturing capabilities, a focus on Industry 4.0 initiatives, and leadership in developing advanced automotive technologies such as connected vehicles and smart manufacturing solutions.

Middle East and Africa (MEA) Automotive IoT Market Trends

The automotive IoT (Internet of Things) market in the Middle East and Africa (MEA) region is anticipated to grow at the highest CAGR of around 16% from 2024 to 2030. The Middle East and Africa region's growth in the automotive IoT market is driven by rising urbanization, infrastructure investments, and government initiatives promoting smart mobility solutions.

Saudi Arabia automotive IoT (Internet of Things) market accounted for a significant revenue share in 2023. In Saudi Arabia, the automotive IoT market is propelled by Vision 2030 initiatives, increasing digital transformation efforts, and investments in smart city infrastructure, fostering the adoption of connected vehicle technologies.

Key Automotive Internet of Things Company Insights

Some of the key players operating in the market are IBM Corporation, Texas Instruments Incorporated, Microsoft Corporation, and Intel Corporation

-

IBM Corporation is a global technology and consulting company known for its hardware, software, and services in cloud computing and Artificial Intelligence (AI). The company caters to government agencies and the incumbents of diverse industries and industry verticals, including automotive, consumer goods, defense, energy, financial services, healthcare, life sciences, and manufacturing, among others.

-

Microsoft Corporation is a global technology company known for offering a diverse portfolio of software products, services, and gadgets encompassing everything from operating systems and cloud computing solutions to versatile software tools, all designed to enable both individuals and enterprises around the globe enhance productivity. The company caters to diverse industries and industry verticals, including healthcare, with its product offerings, such as Azure, Azure Marketplace, Azure Resource Manager, and Azure Virtual Network, among others.

Robert Bosch GmbH, Thales S.A., HARMAN International Industries, Inc. are some of the emerging market participants in the automotive IoT market.

-

Robert Bosch GmbH has evolved into a global company in the engineering and technology sectors. The company's diverse product range includes auto parts, power tools, security systems, and household appliances. Bosch's dedication to improving quality of life through innovative solutions has solidified its position as a leader in both the industrial and consumer markets worldwide.

-

HARMAN International Industries, Inc. is a prominent player in the development, design, and engineering of connected products for automakers, consumers, and enterprises worldwide, including connected car systems, audio and visual products, enterprise automation solutions, and services supporting the Internet of Things.

Key Automotive Internet of Things Companies:

The following are the leading companies in the automotive IoT market. These companies collectively hold the largest market share and dictate industry trends.

- NXP Semiconductors N.V.

- HARMAN International Industries, Inc.

- Robert Bosch GmbH

- Thales S.A.

- IBM Corporation

- Texas Instruments Incorporated

- Microsoft Corporation

- Intel Corporation

- Verizon Communications Inc.

- QUALCOMM Incorporated

Recent Developments

-

In May 2023, Alphabet Inc., utilizing its subsidiary Google, launched a series of innovative features and services custom-made for vehicles, including video conferencing, gaming, and YouTube access. By expanding the scope of applications that developers can integrate with Android Auto, Google now accommodates Internet of Things (IoT) and weather-related applications.

-

In January 2023, HARMAN International Industries, Inc. launched Ready on Demand. This innovative software platform offers an easy-to-use app for branded audio benefits, feature upgrades, and monetization options. As a first in the industry, it allows for enhanced experiences and future updates that users can activate anytime through in-app purchases, extending the vehicle's lifespan.

-

In January, 2023, NXP Semiconductors N.V. and VinFast Auto, LLC announced their partnership on the development of VinFast's new generation of automotive applications. This partnership was aimed at supporting VinFast's ambition to produce smarter, cleaner, and more connected electric vehicles.

Automotive Internet of Things Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 194.04 billion |

|

Revenue forecast in 2030 |

USD 379.05 billion |

|

Growth rate |

CAGR of 11.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, system, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

NXP Semiconductors N.V.; HARMAN International Industries, Inc.; Robert Bosch GmbH; Thales S.A.; IBM Corporation; Texas Instruments Incorporated; Microsoft Corporation; Intel Corporation; Verizon Communications Inc.; QUALCOMM Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Internet of Things Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels and provides the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive IoT (Internet of Things) market report based on component, system, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Embedded

-

Tethered

-

Integrated

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Navigation

-

Telematics

-

Infotainment

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive internet of things market size was estimated at USD 164.03 billion in 2023 and is expected to reach USD 194.04 billion in 2024.

b. The global automotive internet of things market is expected to grow at a compound annual growth rate of 11.8% from 2024 to 2030 to reach USD 379.05 billion by 2030.

b. The North America region accounted for the largest share of 36.1% in the automotive IoT market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the automotive IoT market include NXP Semiconductors N.V., HARMAN International Industries, Inc., Robert Bosch GmbH, Thales S.A., IBM Corporation, Texas Instruments Incorporated, Microsoft Corporation, Intel Corporation, Verizon Communications Inc., QUALCOMM Incorporated.

b. Key factors that are driving the automotive internet of things market growth include the growing need for connected cars for enhanced user comfort and convenience.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."