- Home

- »

- Advanced Interior Materials

- »

-

Automotive Interior Materials Market, Industry Report, 2030GVR Report cover

![Automotive Interior Materials Market Size, Share & Trends Report]()

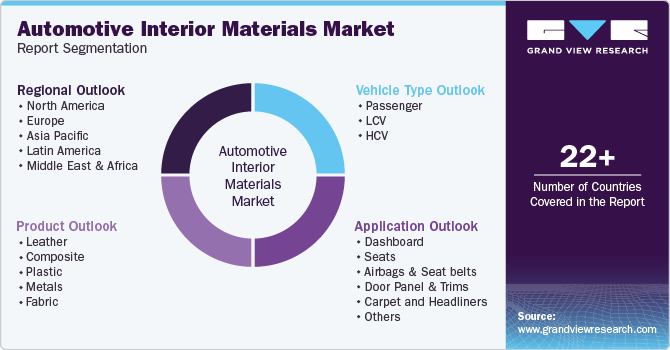

Automotive Interior Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Leather, Composite, Plastic, Metals, Fabric), By Application, By Vehicle Type (Passenger, LCV, HCV), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-275-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Interior Materials Market Summary

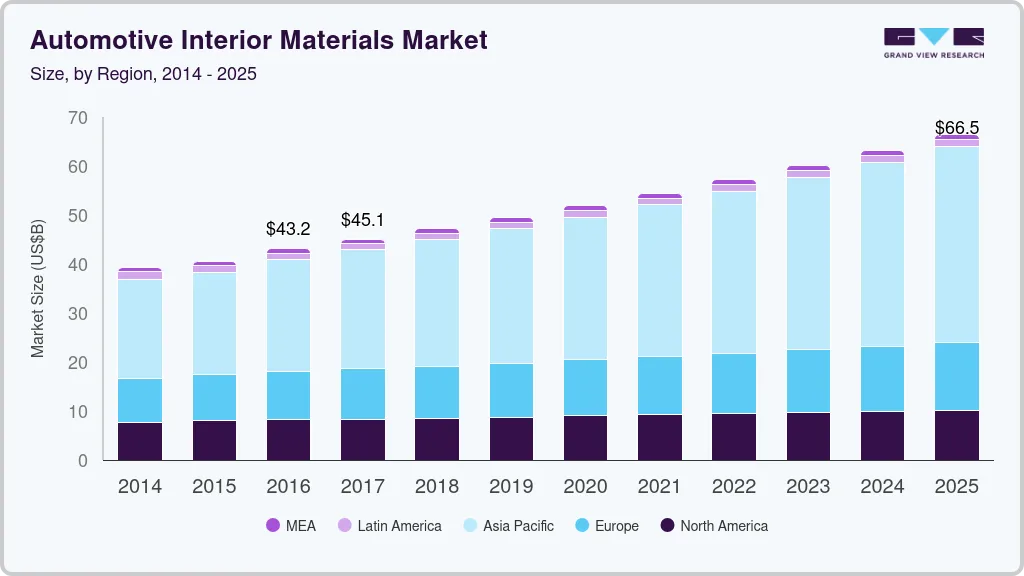

The global automotive interior materials market size was valued at USD 60.1 billion in 2023 and is projected to reach USD 79.7 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. This growth is attributed to the increasing demand for lightweight vehicles, stringent emissions regulations, and the rising consumer preference for comfort and luxury features.

Key Market Trends & Insights

- The Asia Pacific automotive interior material market dominated the global market with a share of 55.6% in 2023.

- The automotive interior material market in China dominated the Asia Pacific market with a share of 42.1% in 2023.

- Based on product, the plastic segment accounted for the largest revenue share of 46.6% in 2023.

- Based on application, the dashboard segment accounted for the largest share of 35.3% in 2023.

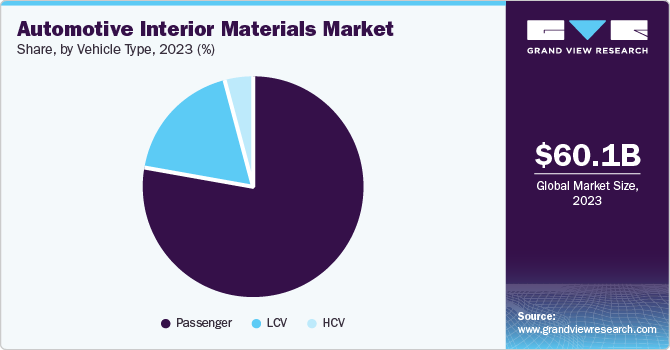

- Based on vehicle type, the passenger vehicle segment accounted for the largest share of 77.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 60.1 Billion

- 2030 Projected Market Size: USD 79.7 Billion

- CAGR (2024-2030): 4.0%

- Asia Pacific: Largest market in 2023

In addition, innovative materials such as composites and synthetic leather enhance vehicle aesthetics and performance, further propelling market growth. The shift towards electric and autonomous vehicles also necessitates using lighter materials to improve efficiency. Economic factors, including rising disposable incomes in emerging markets, also contribute to the expanding market landscapeThe automotive interior materials market is experiencing significant growth driven by customers’ increasing emphasis on comfort, aesthetics, and individuality in vehicle interiors, expanding the automotive sector, and rising sales of vehicles irrespective of their types. As automobile ownership becomes more personalized, there is a growing demand for high-quality, customizable materials such as premium leather, metals, plastic, composites, polymer-based, wood trim, and sophisticated textiles or fabrics. This trend is further augmented by the advent of electric and self-driving vehicles, prioritizing elegant and technologically advanced interiors to enhance the overall driving experience. Consequently, manufacturers invest heavily in innovative and cost-effective interior materials to meet these changing customer preferences and improve overall vehicle efficiency, fueling the automotive interior materials market.

The market for automotive interior materials is driven by the rising demand for personalization and advancements within the industry. The growing customer safety concerns, technological progress, and heightened demand for luxury vehicles are expected to propel market growth. Government initiatives supporting lightweight and safe vehicles further contribute to this expansion. Technological developments and increasing safety concerns fuel the demand for enhanced car interiors. At the same time, the market also benefits from the rising need for lightweight commercial vehicles for goods transportation.

In addition, the worldwide automotive interior market is experiencing significant growth, driven by the adoption of smart lighting systems, advanced seating solutions, and substantial investments in creating comfortable and convenient interiors. The rapid enhancement of manufacturing processes for automotive interior materials, facilitated by new technologies, contributed to lower overall production costs. In addition, the demand for passenger vehicles, aligned with higher living standards, is propelling the expansion of the automotive interior materials market. Furthermore, the increasing trend of vehicle interior self-customization and the emphasis on maintaining aesthetic appeal are expected to stimulate positive market growth of automotive interior materials.

Product Insights

Plastic dominated the market and accounted for the largest revenue share of 46.6% in 2023. The newer advancements in blended plastics, design, and production methods have enabled modern plastic interiors to offer the appearance and feel of luxury materials. Another advantage of these plastic interiors is the lightweight design, which contributes to overall vehicle weight reduction. However, car manufacturers increasingly prioritize fuel efficiency and emissions reduction; light-weighting has become a crucial strategy, with plastics providing an effective solution for reducing weight in vehicle interiors without compromising performance or durability. Consequently, the demand for plastics in automotive interiors is expected to rise throughout the forecast period, backed by the growing demand for aesthetically appealing car interiors.

The composite is expected to grow significantly during the forecast years. Composite materials offer noteworthy cost reductions compared to traditional materials, thereby elevating opportunities for vehicle manufacturers. These materials are favored for their unique properties, including low corrosion, easy maintenance, and design flexibility. The primary advantage of composite materials lies in their strength, rigidity, and lightweight characteristics, contributing to improved fuel economy. In addition, their thermal and corrosion resistance makes them an economical preference. This eco-friendly material also exhibits high damage tolerance, ensuring passenger safety. Collectively, these factors contribute to positive market growth for composite materials in the automotive industry.

Application Insights

Dashboard applications dominated the market and accounted for the largest revenue share of 35.3% in 2023. The continuous advancements in car dashboards and the materials used in their building and designing have significantly impacted the automotive industry. Modern dashboards are designed to be environmentally friendly and free from harmful substances, aligning with increasing regulatory and customer demands for sustainability. The market for automotive interior materials is expected to grow due to the rising production of dashboards that integrate innovative technologies, designs, and materials. They are integral to interior design, contributing to comfort, safety, and user experience. Integrating advanced human-machine interfaces (HMIs) and eco-friendly materials in dashboards drives market growth as manufacturers strive to fulfill customers' changing preferences and regulatory standards.

Seat application is expected to grow at a CAGR of 4.7% over the forecast period. The significant importance of seats for both driver and passenger comfort and convenience has driven extensive research into human perception, posture adjustability, and weight distribution, resulting in the application of various materials for automotive seats. High-performance polyurethane (PU) foams, with covering materials such as fabric or leather, are commonly used in seat cushion manufacturing. Moreover, the increasing demand for lightweight materials has led to the inception of carbon fibers and other composites to enhance comfort in modern vehicles. Seats are a critical component of the automotive interior materials market and are vital in ensuring ergonomic support and overall vehicle aesthetics.

Vehicle Type Insights

Passenger vehicle applications for interior materials led the market and accounted for the largest revenue share of 77.9% in 2023. The passenger segment is the highest contributor to the automotive market and is anticipated to grow during the forecast period. This category includes all vehicles designed for transportation, specifically those used solely for personal transportation, with seating capacities ranging from one to eight people, depending on the model. Increasing customer demand for comfort and convenience features drives constant technological evolution in this car category. When designing new passenger vehicles, automakers prioritize ensuring their products are as secure and comfortable as possible for customers. In addition, the demand for passenger vehicles is boosted by improved global road infrastructure, growing urbanization, and favorable regulatory regulations, further propelling the demand for automotive interior materials.

Light commercial vehicles (LCVs) are expected to grow significantly over the forecast period. The rise of the automotive interior materials application in light commercial vehicles is led by several key factors, including the increasing demand for lightweight and fuel-efficient cars, the increase in urbanization and e-commerce leading to higher demand for last-mile delivery services, and advancements in material science that enable the development of innovative, durable, and aesthetically appealing materials. Moreover, the trend of vehicle customization and customer inclination for premium interiors, with the adoption of electric vehicles emphasizing lightweight materials to extend battery life and improve efficiency, mutually contribute to the dynamic and evolving market.

Regional Insights

The Asia Pacific automotive interior material market dominated the global market and accounted for the largest revenue share of 55.6% in 2023. The region is experiencing growth in the global automotive interior material market due to the rapid development of the economy, rising disposable income, and urbanization, which are elevating demand for vehicles with comfortable and aesthetically eye-catching interior designs.

China Automotive Interior Materials Market Trends

The automotive interior material market in China dominated the Asia Pacific market and accounted for the largest revenue share of 42.1% in 2023. This growth is attributed to the rising customer interest in the aesthetic qualities of their vehicles. Furthermore, demand from the target market and the increasing innovative interior designs of millennials, along with the surge in disposable income of the population, propel the market growth of the automotive interior materials market.

India automotive interior material market is expected to at a CAGR of 4.7% over the forecast period. The demand for interior materials in the country is continuously growing with the mounting sales of cars and SUVs. The Indian automotive interior materials market is about to achieve significant progress in the upcoming years, led by the increasing demand for passenger and commercial vehicles backed by the demand for luxurious interior designs by Gen Z. This increase in the utilization of automotive interior materials is creating wider opportunities for automakers.

Europe Automotive Interior Materials Market Trends

The automotive interior material market in Europe is expected to grow at a CAGR of 3.6% over the forecast period. Europe is a prominent region in the global market known for its emphasis on luxury and high-quality interiors. In addition, European customers are more inclined to premium materials such as leather, wood, and sophisticated fabrics. Further, the market is boosted by the presence of luxury automotive manufacturers, stringent safety and emission regulations, and the increasing demand for enhanced and improved features.

Germany automotive interior material market is driven by the rising demand for vehicles, and the strong presence and expertise of automobile companies led to the automotive interior material market. These factors, along with increasing customer safety concerns, technological developments, and the rising demand for luxurious vehicles, fuel the market growth of automotive interior materials.

North America Automotive Interior Materials Market Trends

The automotive interior materials market in North Americais expected to grow significantly over the forecast period. The region has a strong presence with major automotive manufacturers and leads a well-established automotive industry. The region estimates the increasing demand for high-quality interior materials that balance aesthetics, comfort, and durability. Further, the stringent safety regulations imposed by the government and the integration of advanced technologies result in positive growth in the region for automotive interior materials.

The growth ofthe U.S. automotive interior materials market is expected to be driven by increasing demand for better interiors and attractive designs with better features. These innovative interior designs are often constantly upgraded, and automakers and auto interior designers launch innovations and trending features to improve customer experience. Moreover, the other driving factors of the U.S. automotive interior market are the presence of the latest and enhanced materials and improved technologies with the increasing penetration of larger displays.

Key Automotive Interior Materials Company Insights

Some of the key companies in the automotive interior materials marketinclude Lear Corp., DRÄXLMAIER Group, Asahi Kasei Corporation., DK SCHWEIZER, Grupo Antolin, TOYOTA BOSHOKU CORPORATION, SEIREN CO. LTD. in the market are focusing on development.

-

Dräxlmaier Group is a prominent automotive supplier headquartered in Vilsbiburg, Germany. It specializes in high-quality interior systems, wiring harnesses, and electrical components. Founded in 1958, the company focuses on premium vehicles, delivering products such as instrument panels, center consoles, and door panels. Dräxlmaier has pioneered using natural fiber composites in automotive interiors, enhancing sustainability while maintaining luxury and performance standards for clients such as BMW and Porsche.

-

Grupo Antolin is a global supplier of automotive interiors headquartered in Spain. Established in 1950, the company specializes in manufacturing various interior components, including overhead, door panels, and lighting systems. Antolin is recognized for its innovative approach to design and technology, focusing on lightweight materials and sustainable practices. The company collaborates with major automotive manufacturers to enhance vehicle aesthetics and functionality, contributing significantly to the evolving automotive interior landscape.

Key Automotive Interior Materials Companies:

The following are the leading companies in the automotive interior materials market. These companies collectively hold the largest market share and dictate industry trends.

- Lear Corp.

- DRÄXLMAIER Group

- Asahi Kasei Corporation.

- DK SCHWEIZER

- Antolin

- TOYOTA BOSHOKU CORPORATION

- SEIREN CO. LTD.

- FORVIA HELLA

- Yanfeng

- TOYODA GOSEI CO., LTD.

Recent Developments

-

In July 2024, Antolin announced a collaboration with MIT ADT University to work on automotive interior design projects. This partnership aims to leverage the expertise of both organizations to develop innovative solutions for vehicle interiors. By combining Antolin's industry knowledge with MIT ADT University's academic research, the collaboration will explore new materials, technologies, and design concepts to enhance the passenger experience. This initiative demonstrates Antolin's commitment to staying at the forefront of automotive interior design and innovation.

-

In May 2024, Yanfeng and Trinseo announced a partnership to accelerate the development of circular materials for automotive interiors. This collaboration focuses on creating materials that comply with the 2030 End-of-life vehicle requirements and support the circular economy. Combining Yanfeng's industry knowledge with Trinseo's technical expertise, the two companies plan to advance mechanical recycling technologies and deliver high-quality recycled solutions tailored to automakers. This initiative marks a significant step in both companies' sustainability commitments.

-

In October 2023, Asahi Kasei announced an investment in the U.S. startup NFW, which specializes in producing a non-petroleum-based leather alternative for automotive interiors. This partnership, part of Asahi Kasei's "Care for Earth" initiative, aims to support global automakers in reducing their environmental impact. NFW's patented product, MIRUM, is made from natural materials and is certified as 100% biobased. This collaboration marks a significant step in advancing sustainable materials in the automotive industry, aligning with Asahi Kasei's growth strategy and commitment to eco-friendly solutions.

Automotive Interior Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.2 billion

Revenue forecast in 2030

USD 79.7 billion

Growth Rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

Lear Corp.; DRÄXLMAIER Group; Asahi Kasei Corporation.; DK SCHWEIZER; Antolin; TOYOTA BOSHOKU CORPORATION; SEIREN CO. LTD.; FORVIA HELLA; Yanfeng; TOYODA GOSEI CO., LTD.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Interior Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive interior materials market report based on product, application, vehicle type, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Leather

-

Composite

-

Plastic

-

Metals

-

Fabric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dashboard

-

Seats

-

Airbags & Seat belts

-

Door Panel & Trims

-

Carpet and Headliners

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

LCV

-

HCV

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.