- Home

- »

- Automotive & Transportation

- »

-

Automotive Gear Shifter Market Size & Share Report, 2030GVR Report cover

![Automotive Gear Shifter Market Size, Share & Trends Report]()

Automotive Gear Shifter Market Size, Share & Trends Analysis Report By Component Type, By Vehicle Type (Passenger Vehicle, Commercial Vehicle), System Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-378-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Automotive Gear Shifter Market Trends

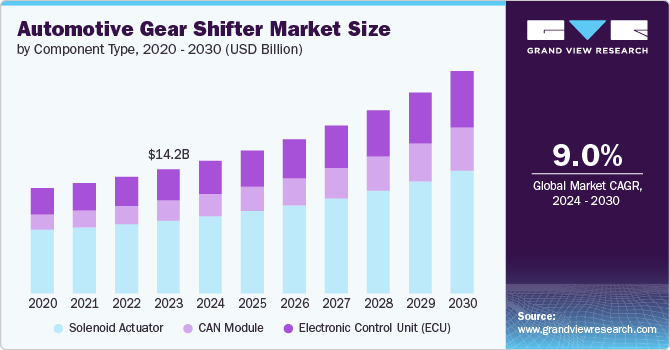

The global automotive gear shifter market size was estimated at USD 14.21 billion in 2023 and is anticipated to grow at a CAGR of 9.0% from 2024 to 2030. One of the most notable trends in the market is the shift towards electronic gear shifters. Unlike traditional mechanical gear shifters, electronic shifters use sensors and actuators to change gears, offering smoother and more precise gear changes. This technology not only improves driving comfort but also integrates seamlessly with the advanced driver assistance system (ADAS).

Rising adoption of automatic transmissions across various vehicle segments. According to a report published by the U.S. Department of Transportation, more than 90% of new cars equipped with automatic transmissions were sold in 2022. This trend is driven by the convenience and ease of use that automatic transmissions offer, particularly in urban environments with frequent stop-and-go traffic. Modern gear shifters are increasingly being integrated with ADAS features such as adaptive cruise control, lane-keeping assist, and autonomous parking systems. This integration allows for a more cohesive and intuitive driving experience, where gear changes can be optimized based on real-time driving conditions and driver inputs.

To meet stringent fuel efficiency and emission regulations, automotive manufacturers are focusing on reducing the weight of vehicle components, including gear shifters. The use of lightweight materials such as aluminum and high-strength plastics is becoming more prevalent, helping to enhance overall vehicle performance and efficiency. Moreover, paddle shifters, commonly found in high-performance and luxury vehicles, are gaining popularity in mainstream cars.

Stringent regulatory standards aimed at enhancing vehicle safety and reducing emissions are driving the adoption of advanced gear shifter technologies. In the European Union, for instance, the General Safety Regulations mandate the inclusion of various safety features, including electronic stability control and advanced emergency braking systems, which often rely on advanced gear shifter mechanisms.

Continuous investments in research & development by automotive manufacturers are fueling innovation in gear shifter technologies. Companies are exploring new materials, designs, and electronic systems to create gear shifters that are not only efficient but also enhance the overall driving experience. The trend towards electric vehicles is also spurring innovations, as EVs require different gear shifter mechanisms compared to traditional ICE vehicles. Moreover, modern consumers prioritize a seamless and enjoyable driving experience, which has led to the growing popularity of automatic and electronically controlled gear shifters. Features such as smooth gear transitions, easy-to-use interfaces, and integration with infotainment systems are highly sought after, influencing manufacturers to adopt these technologies.

Component Type Insights

The solenoid actuator segment accounted for the largest revenue share of 58.74% in 2023. The rapid evolution of automotive electronics has paved the way for sophisticated transmission systems. Enhanced microcontrollers, sensors, and software algorithms enable more efficient and reliable gear shifting, making solenoid actuator-based systems more attractive. Furthermore, consumer experience for smooth, seamless, and responsive driving experiences is rising across the globe.

Solenoid actuator-based gear shifters provide faster and more precise gear changes, contributing to superior driving experience and meeting consumer demands. The shift towards electric and hybrid vehicles requires innovative transmission solutions. These vehicles benefit from solenoid actuator-based gear shifters, which can seamlessly integrate with electric powertrains, enhancing efficiency and performance is anticipated to drive the demand for the solenoid actuator segment over the forecast period.

The CAN module segment is anticipated to register a significant growth from 2024 to 2030. Increasing focus on safety and stringent regulatory standards are driving the demand for the segment, as CAN modules contribute to enhancing safety features in gear shifters by enabling precise control and real-time monitoring of transmission systems.

Furthermore, growing demand for vehicles equipped with ADAS features and CAN modules are integral to the functioning of ADAS, facilitating communication between the gear shifter and other critical systems such as adaptive cruise control, lane assist, and automated parking is anticipated to drive the demand for CAN module over the forecast period.

Vehicle Type

The passenger vehicle segment held the largest revenue share in 2023. As more consumers prefer automatic transmissions for their convenience, manufacturers have focused on developing intuitive and ergonomic gear shifter designs. Gear shifters are increasingly seen as a key interior design element. Passenger vehicle manufacturers are offering customizable options, including premium materials and finishes, to cater to the luxury segment is anticipated to drive the demand for gear shifters in the passenger vehicle segment.

The commercial segment is expected to grow at a significant CAGR from 2024 to 2030. This growth can be attributed to increasing demand for efficient and reliable transmission systems. Modern commercial vehicles are equipped with telematics systems that provide real-time data on vehicle performance. Gear shifters are integrated with these systems to optimize transmission control and improve fleet management. The expansion of the logistics and transportation sectors has increased the demand for commercial vehicles, further driving the demand for gear shifters within the commercial vehicle segment.

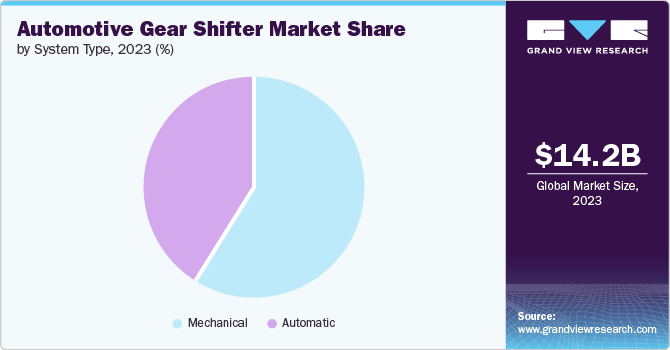

System Type Insights

The mechanical segment dominated the market in terms of revenue in 2023. Manual transmissions remain popular in sports cars and performance vehicles, where driver control is paramount. Enthusiasts prefer mechanical gear shifters for the enhanced control and engagement they offer. Such factors are contributed to the driving demand for manual gear shifters in the market.

Manual transmissions are generally cheaper than automatic transmissions, making them an attractive option for cost-conscious consumers. Additionally, mechanical gear shifters often have lower maintenance and repair costs compared to automatic systems. These factors are driving the growth of the mechanical segment over the forecast period.

The automatic segment is expected to register the highest CAGR from 2024 to 2030. Increasing urbanization across the globe has led to more traffic congestion, making automatic transmissions are preferred choice for their convenience. Furthermore, the demand for automatic gear shifters is rising among the aging population due to their ease of use compared to manual gear systems. Such factors are driving the demand for automatic gear shifters over the forecast period. Moreover, the growing popularity of hybrid and electric vehicles, which typically use automatic transmissions, is a significant driver for automatic segment.

Regional Insights

TheNorth America automotive gear shifter marketis expected to witness a notable growth from 2024 to 2030. Consumers in North America are increasingly seeking customization options and luxury features in their vehicles. This trend extends to gear shifters, with demand for premium materials, customizable interfaces, and unique design elements. Luxury automakers are leading this trend, offering bespoke gear shifter options to differentiate their models.

U.S. Automotive Gear Shifter Market Trends

The automotive gear shifter market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The rising popularity of SUVs and crossovers in the U.S. is driving the demand for gear shifters in the country. These vehicles often come equipped with advanced automatic of semi-automatic transmission systems, leading to higher demand for innovative gear shifters that can enhance driving performance and fuel efficiency.

Asia Pacific Automotive Gear Shifter Market Trends

The Asia Pacific region automotive gear shifter market dominated in 2023 and accounted for a 42.73% share of the global revenue. The region is expected to register a highest CAGR from 2024 to 2030. The region is experiencing rapid growth in the automotive sector, driven by increasing urbanization, rising income levels, and expanding middle-class populations. Countries like China, Japan, and India are significant contributors to this growth.

Europe Automotive Gear Shifter Market trends

The automotive gear shifter market in Europe is anticipated to register a considerable growth rate from 2024 to 2030. The European Union’s strict emission norms and safety regulations are compelling manufacturers to adopt advanced gear shifter technologies. According to the European Automobile Manufacturer’s Association (ACEA), the EU produced 18.1 million motor vehicles in 2022, with a growing number of them featuring electronic and automatic gear shifters.

Key Automotive Gear Shifter Company Insights

Key players operating in the market are focusing on strategic initiatives including, launching new products, partnering with distributors, and establishing agreements to achieve a competitive edge in the market. The following are some instances of such initiatives

Key Automotive Gear Shifter Companies:

The following are the leading companies in the automotive gear shifter market. These companies collectively hold the largest market share and dictate industry trends.

- ATSUMITEC Co., Ltd.

- BorgWarner Inc

- Eaton

- Ficosa Internacional SA

- Kongsberg Automotive

- Leopold Kostal GmbH & Co. KG

- Lumax Industries

- Orscheln Products

- Stoneridge

- ZF Friedrichshafen AG.

Recent Developments

-

In June 2023, Toyota Motor Corporation is advancing plans to enhance the driving experience for traditional enthusiasts of combustion engines by making it entirely cosmetic though adding manual EV. Toyota electric vehicle will mimic manual transmission, complete with a simulated stick shift, clutch, and even virtual revving sounds.

-

In April 2023, BYD introduced the BYD Seal sports sedan featuring the KOSTAL Gear Shifter. This control element not only serves as a gear shifter but also includes additional buttons for operating various comfort functions.

Automotive Gear Shifter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.19 billion

Revenue forecast in 2030

USD 25.48 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component type, vehicle type, system type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

ATSUMITEC Co., Ltd.; BorgWarner Inc; Eaton; Ficosa Internacional SA; Kongsberg Automotive; Leopold Kostal GmbH & Co. KG; Lumax Industries; Orscheln Products; Stoneridge; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Gear Shifter Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive gear shifter market report based on the vehicle type, component type, system type, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Component Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solenoid Actuator

-

CAN Module

-

Electronic Control Unit (ECU)

-

-

System Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical

-

Automatic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive gear shifter market size was estimated at USD 14.21 billion in 2023 and is expected to reach USD 15.19 billion in 2024.

b. The global automotive gear shifter market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030, reaching USD 25.48 billion by 2030.

b. The solenoid actuator segment accounted for the largest market share of 58.74% in 2023. The rapid evolution of automotive electronics has paved the way for sophisticated transmission systems. Enhanced microcontrollers, sensors, and software algorithms enable more efficient and reliable gear shifting, making solenoid actuator-based systems more attractive.

b. Some of the players operating in the automotive gear shifter market include ATSUMITEC Co., Ltd., BorgWarner Inc, Eaton, Ficosa Internacional SA, Kongsberg Automotive, Leopold Kostal GmbH & Co. KG, Lumax Industries, Orscheln Products, Stoneridge, ZF Friedrichshafen AG.

b. One of the most notable trends in the automotive gear shifter market is the shift towards electronic gear shifters. Unlike traditional mechanical gear shifters, electronic shifters use sensors and actuators to change gears, offering smoother and more precise gear changes. This technology not only improves driving comfort but also integrates seamlessly with the advanced driver assistance system (ADAS).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."