- Home

- »

- Advanced Interior Materials

- »

-

Automotive Garage Equipment Market Size Report, 2030GVR Report cover

![Automotive Garage Equipment Market Size, Share & Trends Report]()

Automotive Garage Equipment Market Size, Share & Trends Analysis Report By Equipment, By Garage Type (OEM Authorized Garages, Independent Garages), By Distribution Channel, By Application, By Vehicle Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-362-4

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

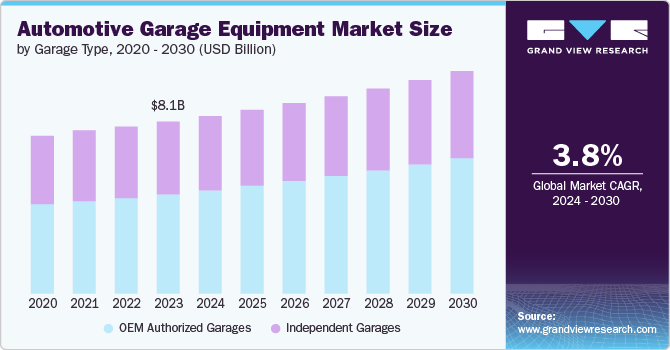

The global automotive garage equipment market size was estimated at USD 8.13 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. The increasing number of vehicles on the road, the rising demand for vehicle maintenance and repair services, and advancements in garage equipment technology are driving market growth.

There is a growing emphasis on vehicle safety, which is pushing the demand for garage equipment designed to ensure optimal vehicle performance and reliability. Advanced diagnostic tools, vehicle lifts, and precision alignment systems are in high demand to promote road safety.

Drivers, Opportunities & Restraints

The automotive garage equipment market is driven by several factors, including the growing emphasis on vehicle safety and maintenance, the increasing number of vehicles globally, and the rising demand for advanced diagnostic and repair solutions. The expansion of the automotive aftermarket and the increasing complexity of modern vehicles are also contributing to market growth.

Moreover, the integration of advanced technologies, such as automation and IoT (Internet of Things), in garage equipment is providing significant growth opportunities. The growing demand for eco-friendly and efficient garage equipment and the rising number of automotive repair shops in emerging economies are also driving the market.

However, the high initial cost of advanced garage equipment and the need for regular maintenance and calibration may pose challenges to market growth. Additionally, the availability of counterfeit and low-quality equipment can hinder market growth.

Equipment Insights

“The demand for lifting equipment segment is expected to grow at a significant CAGR of 4.4% from 2024 to 2030 in terms of revenue”

The lifting equipment segment accounting for a considerable proportion of the global revenue share in 2023. Lifting equipment, such as automotive lifts, jacks, and hoists, are essential for performing various maintenance and repair tasks. The increasing demand for efficient and safe lifting solutions in automotive workshops and repair shops is driving the growth of this segment.

The wheel & tire service equipment segment held a 16.2% share of the global revenue share in 2023 and includes tire changers, wheel balancers, and alignment systems. The segment is expected to witness significant growth due to the rising demand for tire maintenance and replacement services. The vehicle diagnostic & testing equipment segment is driven by the increasing complexity of modern vehicles and the need for accurate diagnostics and testing.

Garage Type Insights

“The demand for OEM Authorized Garages segment is expected to grow at a significant CAGR of 4.6% from 2024 to 2030 in terms of revenue”

The demand for OEM authorized garages is driven by the need for specialized tools and equipment essential for diagnosing and repairing modern vehicles equipped with sophisticated electronic systems and hybrid or electric powertrains. Additionally, stringent government policies and safety regulations regarding vehicle upkeep and emission control further boost the need for the advanced equipment and services offered by OEM authorized garages.

The independent garages segment accounted for 42.3% in 2023 and is expected to expand at a considerable pace over the forecast period. Independent garages typically have lower overheads compared to franchised dealerships, allowing them to offer more competitive prices for labor and parts. This price advantage makes independent garages an attractive option for cost-conscious vehicle owners and is driving segment growth.

Distribution Channel Insights

“The demand for the online segment is expected to expand at a significant CAGR of 4.5% from 2024 to 2030 in terms of revenue”

The growing popularity of DIY automotive work has led to increased demand for compact, user-friendly, and affordable garage equipment that can be easily purchased online. This trend is a key factor driving the growth of the online distribution channel for automotive garage equipment.

The offline segment held a 69.8% market share in 2023 terms of the global revenue share and this trend is expected to persist over the forecast period. Offline channels provide direct access to products, allowing customers to physically inspect and interact with the equipment, which aids in fostering trust and a sense of reliability for high-value and complex products like automotive distribution equipment.

Vehicle Type Insights

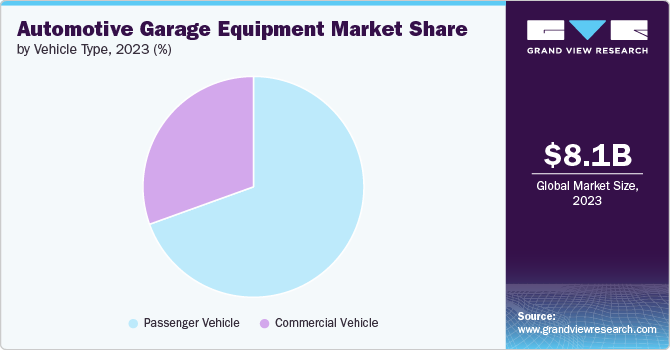

“The demand for passenger vehicles segment is expected to grow at a significant CAGR of 4.0% from 2024 to 2030 in terms of revenue”

The passenger vehicles segment witnessed significant demand in 2023. The increasing number of passenger cars on the road and the growing emphasis on vehicle maintenance and repair services are driving the demand for automotive garage equipment in this segment. Moreover, increasing incidence rate of vehicle accidents is boosting awareness regarding safety and the benefits of vehicle repair and maintenance which is contributing to an increase in demand for automotive garage equipment for passenger vehicles.

The commercial vehicles segment held 30.5% market share in 2023 and is expected to witness significant growth due to the increasing demand for maintenance and repair services for trucks, buses, and other commercial vehicles. The expansion of the logistics and transportation industry is a significant factor driving the need for efficient and reliable garage equipment for commercial vehicles.

Application Insights

“The demand for the tire shop segment is expected to grow at a significant CAGR of 4.5% from 2024 to 2030 in terms of revenue”

As the automotive industry continues to expand, with the production of passenger cars, trucks, buses, and specialized vehicles like electric and autonomous cars, the need for tire maintenance and replacement services has risen significantly. Moreover, advancements in vehicle design, manufacturing processes, and safety features have led to a greater emphasis on wheel and tire performance, driving the demand for specialized tire handling and service equipment.

The body shop segment held a 52.0% market share in 2023 accounting for the majority of the global revenue share. The increasing popularity of used vehicle sales and the growing emphasis on regular vehicle maintenance have led to a surge in the demand for aftermarket collision repair and body shop services. Body shops and repair centers are expanding their offerings to cater to the growing need for used vehicle modifications, collision repair, and maintenance, fueling the demand for automotive distribution equipment.

Regional Insights

“Asia Pacific to witness fastest market growth at 4.4% CAGR”

The market in Asia Pacific is experiencing substantial growth due to the increasing number of vehicles, the expansion of the automotive aftermarket, and the rising demand for vehicle maintenance and repair services in the region. Countries such as China, India, and Japan are major contributors to market growth, driven by government initiatives and investments in infrastructure development.

China's automotive aftermarket, particularly the maintenance and repair segment, has been growing rapidly due to the increasing age of vehicles and rising maintenance needs. Additionally, the automotive industry in China has been adopting automation and robotics to improve efficiency, accuracy, and safety in vehicle handling and repair processes. The integration of advanced technologies such as automatic tire changers, wheel balancers, and robotic paint spraying systems has increased the demand for specialized automotive distribution equipment

North America Automotive Garage Equipment Market Trends

In North America, the market is driven by the high adoption of advanced garage equipment, the presence of a well-established automotive industry, and the growing demand for vehicle maintenance services. The U.S. is a major contributor to market growth in North America, driven by high demand for automotive lifts, diagnostic equipment, and tire service equipment.

Europe Automotive Garage Equipment Market Trends

The rise of electric vehicles (EVs) and autonomous vehicles has created a need for specialized garage equipment to handle the unique requirements of these advanced vehicle types, such as charging infrastructure and advanced diagnostics. Moreover, the growing emphasis on safety by regulatory authorities in the region is creating a conducive environment for market growth.

Key Automotive Garage Equipment Share & Insights

Some of the key players operating in the market include Robert Bosch GmbH, Continental AG, ISTOBAL, and Boston Garage Equipment.

-

Robert Bosch GmbHis a leading manufacturer and provider of automotive garage equipment, offering a wide range of products such as sensors, fuel injectors, and steering systems. The company invests heavily in research and development and the entrepreneurial ownership activities are conducted by the Robert Bosch Industrietreuhand KG, an industrial trust. This structure allows Bosch to plan for the long-term and make significant investments in the company's future.

-

Continental AGContinental AG is a automotive parts manufacturer based in Germany that specializes in brake systems, tires, automotive safety, chassis components, powertrain, vehicle electronics, and other technologies for sustainable and connected mobility.

-

ISTOBALISTOBAL is a Spanish multinational company that specializes in the design, manufacturing, and marketing of a wide range of equipment such as wash tunnels, jet washes, rollovers for commercial vehicles, and solutions for washing trains and trams. Istobal also offers accessories, chemicals, and water treatment solutions. The company markets its products in more than 60 countries through its extensive distributor network and its own subsidiaries

Key Automotive Garage Equipment Companies:

The following are the leading companies in the automotive garage equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental AG

- ISTOBAL

- Aro Equipments Pvt. Ltd

- Guangzhou Jingjia Auto Equipment Co. Ltd

- Arex Test Systems BV

- Boston Garage Equipment

- Vehicle Service Group

- Gray Manufacturing Company Inc.

- VisiCon Automatisierungstechnik GmbH

- MAHA Maschinenbau Haldenwang GmbH & Co. KG

Recent Developments

-

In July 2023, Robert Bosch GmbH announced plans to expand their product range for the independent aftermarket by adding cabin blowers, which are essential components of vehicle air-conditioning systems. The new cabin blowers run quietly and are specifically designed to match the vehicle's AC system, ensuring efficient and reliable air flow. Initially, five blowers will be available for common Ford and VW models in the European market, with plans to expand the product range in the coming months to provide a wide selection of high-quality replacement parts for both workshops and consumers.

-

In June 2024, Boston Garage Equipment announced the availability of its new measurement and diagnostic device called the EOBD-400. These devices used to measure the emissions of vehicles. These testers are designed to analyze the exhaust of a vehicle and determine if it meets the required emissions standards. The EOBD-400 tester is a specific model that is commonly used for this purpose and features Bluetooth 5 (LE) for long rage operations, equipped with a neoprene rubber surround, and other features.

Automotive Garage Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.38 billion

Revenue forecast in 2030

USD 10.51 billion

Growth Rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, garage type, distribution channel, application, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Robert Bosch GmbH; Continental AG; ISTOBAL; Aro Equipments Pvt. Ltd; Guangzhou Jingjia Auto Equipment Co. Ltd; Arex Test Systems BV; Boston Garage Equipment; Vehicle Service Group; Gray Manufacturing Company Inc.; VisiCon Automatisierungstechnik GmbH; MAHA Maschinenbau Haldenwang GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Garage Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive garage equipment market report based on equipment, garage type, distribution channel, application, vehicle type, and region.

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Lifting Equipment

-

Wheel & Tire Service Equipment

-

Vehicle Diagnostic & Testing Equipment

-

Body Shop Equipment

-

Washing Equipment

-

Others

-

-

Garage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM Authorized Garages

-

Independent Garages

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Body Shop

-

Tire Shop

-

Car Dealership

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global automotive garage equipment market size was estimated at USD 8.13 billion in 2023 and is expected to reach USD 8.38 billion in 2024.

b. The automotive garage equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 10.51 billion by 2030

b. Asia Pacific dominated the automotive garage equipment market with a revenue share of 42.4% in 2023. The automotive garage equipment market in Asia Pacific is experiencing substantial growth due to increasing investments in the automotive industry, rising incidence rate of automotive collisions, and growing production of electric vehicles

b. Some of the key players operating in the automotive garage equipment market include Robert Bosch GmbH, Continental AG, ISTOBAL, Aro Equipments Pvt. Ltd, Guangzhou Jingjia Auto Equipment Co. Ltd, Arex Test Systems BV, Boston Garage Equipment, Vehicle Service Group, Gray Manufacturing Company Inc., VisiCon Automatisierungstechnik GmbH, MAHA Maschinenbau Haldenwang GmbH & Co. KG

b. The demand for the automotive garage equipment market is attributed to the increasing number of vehicles on the road, investments by market players in making new and innovative products, a growing emphasis on safety across the globe

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."