- Home

- »

- Next Generation Technologies

- »

-

Automotive Engineering Service Outsourcing Market Report 2030GVR Report cover

![Automotive Engineering Service Outsourcing Market Size, Share & Trends Report]()

Automotive Engineering Service Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Application, By Service (Designing, Prototyping), By Location (On-shore, Off-shore), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-635-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Engineering Service Outsourcing Market Summary

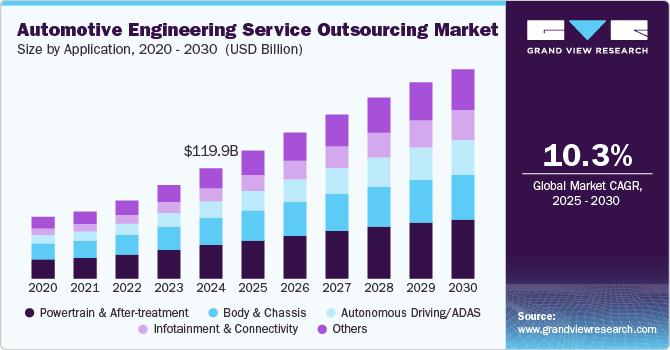

The global automotive engineering service outsourcing market size was estimated at USD 119,888.9 million in 2024 and is projected to reach USD 227,596.8 million by 2030, growing at a CAGR of 10.3% from 2025 to 2030. The rapid demand for advanced and enhanced connectivity solutions by automotive manufacturers is driving the automotive engineering service outsourcing (ESO) market growth.

Key Market Trends & Insights

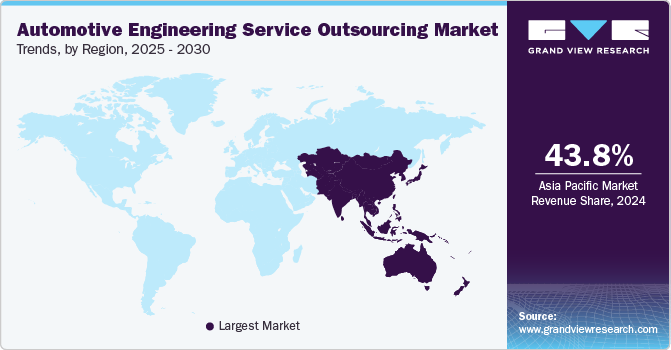

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, powertrain and after-treatment accounted for a revenue of USD 36,451.3 million in 2024.

- Infotainment & Connectivity is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 119,888.9 Million

- 2030 Projected Market Size: USD 227,596.8 Million

- CAGR (2025-2030): 10.3%

- Asia Pacific: Largest market in 2024

Similarly, the growing demand for enhanced connectivity solutions such as navigation, smart infotainment, passenger safety, and remote diagnostics which are fueling the market expansion. The growing technological skills of Engineering Service Providers (ESPs) to deliver research and development (R&D) and product innovation in their offerings for vehicle positioning, connected automobiles, and guidance systems is expected to fuel the market growth. Furthermore, the rising initiatives by governments to deploy green vehicles for reducing harmful gas discharges are also propelling the market growth.

The automotive ESO industry evolved from delivering mechanical services to the integration of advanced technology solutions such as Artificial Intelligence (AI), the Internet of Things (IoT), and others. With the rapid integration of Information Technology (IT) in automobiles, an increase in advanced services was witnessed, accomplishing the commutation objectives and providing consumers comfort, safety, and ease of use. The IT enabled the incorporation of various enhanced features such as Bluetooth and Wireless Local Area Network (WLAN) connectivity, navigation system, app connection, and other car information from sensors. During the inception of procuring services from the Engineering Service Providers (ESPs), the automotive industry focused on mass production by combining standardization, synchronization, precision, continuity, and interchangeability. With the paradigm shift in the requirements of customers, companies now emphasize offering mass customization of automobile production engineering services.

The growing inclination of Original Equipment Manufacturers (OEMs) for digitalized solutions is anticipated to offer opportunities for automotive ESO market growth. This is attributed to the paradigm shift of end-users towards more technological solutions. The Autonomous, Connected, Electric, and Shared vehicles (ACES) disruptions is a digitalized model being adopted by the key players in the market to allow advanced mobility standards to enhance consumer's interaction and experience with vehicles. Autonomous driving evolved through the Advanced Driver Assistance Systems (ADAS), including pedestrian detection, collision warning, and others. The connected systems enable processing data in the cloud and at the edge from a growing suite of endpoint sensors to enhance vehicle reliability and passenger safety, boost fleet efficiency, enable maintenance schedules, and offer information to smart city planners and other road users about the travel.

Owing to the rapid production of green vehicles that reduce harmful emissions. The growing demand for safe and lightweight vehicle structures is driving the demand for chassis. Moreover, the demand for advanced materials and manufacturing technologies to support the development of lightweight materials, such as high-strength aluminum, composites, and steel, which reduce emissions and improve fuel efficiency, is driving the demand for ESO providers. They play a key role in the development and integration of these materials into the body and chassis as they offer techniques such as additive manufacturing (3D printing), hot stamping, and precision welding, which require specialized engineering expertise, which ESO providers offer.

The growth of the autonomous driving/ADAS segment is attributed to the increasing consumer inclination toward autonomous driving, which is driven by ongoing technological developments in AI and ML integration. These technologies enable the development of sophisticated algorithms for autonomous driving that enhance the vehicle’s ability to perceive, analyze, and respond to the environment in real-time. Furthermore, advancements in sensor technologies such as radar, LIDAR, cameras, and ultrasonic sensors are boosting the demand for autonomous vehicles, thereby generating significant opportunities for ESO providers. In addition, several automakers are increasingly focusing on implementing autonomous driving and ADAS technologies to differentiate their products in a highly competitive market, consequently increasing the demand for engineering outsourcing services and contributing to segmental growth.

Application Insights

The powertrain and after-treatment segment led the market in 2024, accounting for over 61% of the global revenue. The growth is attributed to the electrification of powertrains as a replacement for Internal Combustion Engines (ICE) fueled by petroleum and gasoline that can minimize the impact of carbon emissions on the environment. The significant investments by OEMs in powertrain technologies are positively influencing the powertrain and after-treatment segment. Moreover, the stringent regulatory scenario regarding emissions is also driving the demand for advanced powertrain and after-treatment solutions to comply with these standards. The increasing demand for electric vehicles is also favoring the segment’s growth as they require extensive engineering services for the development of electric powertrains, battery management systems, and electric drivetrains.

The infotainment & connectivity segment is predicted to foresee significant growth in the coming years. This is attributed to the emerging need among end-users to incorporate advanced digital solutions in vehicles. Connected cars offer movies, social media, music, voice control, and other features, thereby providing prospects for ESPs. Moreover, the integration of advanced technologies like AI, machine learning, and voice recognition has made infotainment systems more intuitive and responsive, driving the demand for these features. IoT enables connected cars to communicate with other devices and services, enhancing infotainment systems with real-time data, vehicle diagnostics, and remote-control capabilities, which significantly contribute to the overall segment growth.

Service Insights

The prototyping segment accounted for the largest market revenue share in 2024. The segment growth is attributed to the increased adoption of advanced technologies, such as 3D printing technology, by the automotive industry to design a prototype of an assembly, certain parts, or a model of an entire car. With 3D printing technology, manufacturers can quickly identify loopholes in the prototype and take corrective measures in a timely manner, supporting a cost-efficient approach. Moreover, prototyping enables faster iteration and validation of designs, delivering shorter product development cycles, which is crucial in the highly competitive automotive industry, where time-to-market is a significant differentiator. The rising demand for this service offers lucrative growth prospects for automotive ESO providers, thereby contributing to market growth.

The designing segment is predicted to foresee significant growth in the coming years owing to increasing investments by manufacturers toward the development of advanced automobile features. The rising demand for advanced design tools such as advanced Computer-Aided Design (CAD), Virtual Reality (VR) technologies, and simulation software that facilitate sophisticated and efficient vehicle design processes is creating significant opportunities for ESO providers. The shifting focus of automakers to offer enhanced user experience through modern vehicle design with ergonomic interiors, advanced infotainment systems, and intuitive interfaces is driving the demand for ESO providers that offer expertise in the design process.

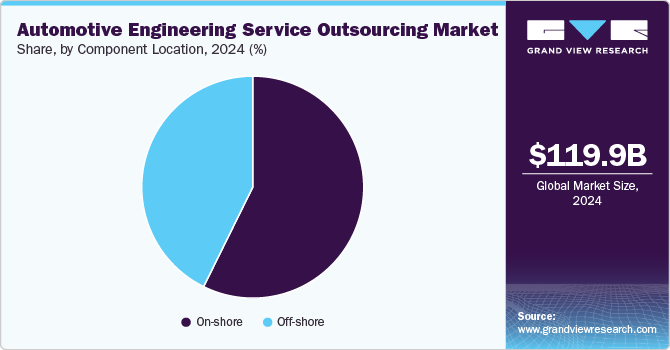

Location Insights

The on-shore segment accounted for the largest market revenue share in 2024.This is attributed to the preferences of OEMs to collaborate with locally available ESPs. On-shore locations often have access to a skilled workforce with specialized engineering expertise in automotive design, testing, validation, and regulatory compliance. Moreover, they offer stronger legal protections for intellectual property rights compared to offshore locations. The challenges, such as different time zones, language barriers, imposed laws and regulations, and others, while dealing with ESPs from a foreign land, restrict OEMs from outsourcing from other countries, leading to significant growth in demand for the on-shore segment. Moreover, the increased adoption of automation technology and self-serve solutions has encouraged automobile OEMs to seek assistance from on-shore engineering service firms.

The off-shore segment is anticipated to exhibit a significant CAGR over the forecast period. The offshore trend in the automotive ESO market is expanding as automakers increasingly seek to outsource complex engineering services to regions with lower labor costs. By utilizing skilled engineers from offshore locations, automotive firms benefit from reduced expenses while maintaining quality in areas such as R&D, CAD, and software integration. Emerging markets like India and Southeast Asia are leading this trend due to their growing talent pools and technological expertise. This shift to offshore outsourcing is helping companies meet the demands of a rapidly evolving automotive landscape, where innovation and cost efficiency are paramount.

Regional Insights

North America automotive Engineering Services Outsourcing market held the revenue share of over 21% in 2024. The market is driven by rapid technological advancements and the increasing adoption of electric and autonomous vehicles. The region's strong emphasis on innovation and R&D fosters a competitive landscape where companies seek specialized engineering expertise to stay ahead of the competition. In addition, market players regularly updating their services and products to offer clients a better outsourcing experience.

U.S. Automotive Engineering Service Outsourcing Market Trends

The U.S. Automotive Engineering Service Outsourcing market is expected to grow at a CAGR from 2025 to 2030. The market growth is fueled by rapid advancements in technology and a strong push for innovation within the automotive sector. With a significant emphasis on Electric Vehicles (EVs), autonomous driving, and connectivity, the U.S. automotive companies are increasingly partnering with ESO providers to accelerate product development cycles, integrate cutting-edge technologies, and maintain competitiveness in a fast-evolving global market.

Europe Automotive Engineering Service Outsourcing Market Trends

The automotive engineering service outsourcing market in the Europe is expected to witness significant growth over the forecast period. The market in the region is witnessing significant growth due to the stringent environmental regulations imposed by the European Union, which encourage the adoption of greener and more sustainable automotive technologies. The robust push toward Electric Vehicles (EVs) and Autonomous Vehicles (AVs) presents the need for specialized engineering services.

Asia Pacific Automotive Engineering Service Outsourcing Market Trends

The automotive engineering service outsourcing market in the Asia Pacific dominated with a revenue share of 43.77% in 2024 and is anticipated to register the highest CAGR over the forecast period. This can be attributed to the rapid adoption of electric passenger cars in China. Growing government focuses on minimizing or reducing emissions and adopting green technology, which is likely to compel automotive companies in the region to seek and outsource specialized engineering expertise. Government policies favoring automotive innovation, coupled with a skilled workforce and cost-effective engineering solutions, are boosting the automotive ESO market.

Key Automotive Engineering Service Outsourcing Company Insights

Some key players in the Automotive Engineering Service Outsourcing market, such as Horiba, LTD., IAV, ITK Engineering GmbH Kistler Group, P3 group GmbH, and RLE International Group are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and developing new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

RLE International Group is a leading player in the Automotive Engineering Service Outsourcing (ESO) market, offering specialized engineering, design, and consulting services to automotive manufacturers and suppliers. The company focuses on innovation in areas such as vehicle development, e-mobility, and lightweight design, helping clients achieve sustainability and efficiency goals. With a global network of technical centers, RLE International supports OEMs and Tier 1 suppliers across various automotive engineering domains, from powertrain to interiors. Its expertise also extends to consulting on regulatory compliance and safety, positioning the company as a key partner in advancing automotive innovation.

-

P3 Group GmbH is a prominent player in the Automotive Engineering Service Outsourcing (ESO) market, known for delivering specialized engineering, consulting, and digital transformation services. The company focuses on electrification, autonomous driving, and connectivity solutions, helping automotive manufacturers and suppliers navigate the industry's shift toward advanced technologies. With a global presence and expertise in project management and system integration, P3 Group supports clients in optimizing development processes, enhancing vehicle systems, and ensuring compliance with industry standards. P3 Group’s consulting services, combined with its technical proficiency, position the company as a strategic partner in driving innovation and efficiency in the automotive sector.

Key Automotive Engineering Service Outsourcing Companies:

The following are the leading companies in the automotive engineering service outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- AKKA

- Altair Engineering Inc.

- Alten Group

- Altran (Capgemini Engineering)

- ARRK Product Development Group Ltd.

- ASAP Holding Gmbh

- AVL List GmbH

- Bertrandt AG

- EDAG Group

- ESG Elektroniksystem- und Logistik-GmbH

- FEV Group GmbH

- Horiba, LTD.

- IAV

- ITK Engineering GmbH Kistler Group

- P3 group GmbH

- RLE INTERNATIONAL Group

Recent Developments

-

In June 2024, HORIBA, Ltd. introduced the STARS Battery software, designed to meet various battery testing requirements. The STARS Automation platform by HORIBA is a versatile platform for test automation, offering an extensive collection of tools for numerous testing tasks within the mobility sector. Incorporating STARS Battery into the STARS Automation suite allowed HORIBA to offer a specialized application for conducting battery performance and longevity tests.

-

In May 2024, Bertrandt AG completed the acquisition of CENTUM SOLUTIONS, S.L.U. (Centum Digital), a company known for offering engineering services based on cutting-edge technologies and innovative products. The acquisition was in accord with Bertrandt AG’s objectives of expanding its global presence, enhancing its digital capabilities, and speeding up innovative efforts.

-

In January 2024, EDAG Engineering GmbH strengthened its global presence by establishing two new facilities in Austria in Steyr and Neustift. The Steyr and Neustift locations were already operational since December 2023, provided an extensive range of services in vehicle development and robotics.

Automotive Engineering Service Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 139.12 billion

Revenue forecast in 2030

USD 227.60 billion

Growth rate

CAGR of 10.3% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, service, location, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

AKKA; Altair Engineering Inc.; Alten Group; Altran (Capgemini Engineering); ARRK Product Development Group Ltd.; ASAP Holding Gmbh; AVL List GmbH; Bertrandt AG; EDAG Group; ESG Elektroniksystem- und Logistik-GmbH; FEV Group GmbH; Horiba, LTD.; IAV; ITK Engineering GmbH Kistler Group; P3 group GmbH; RLE International Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

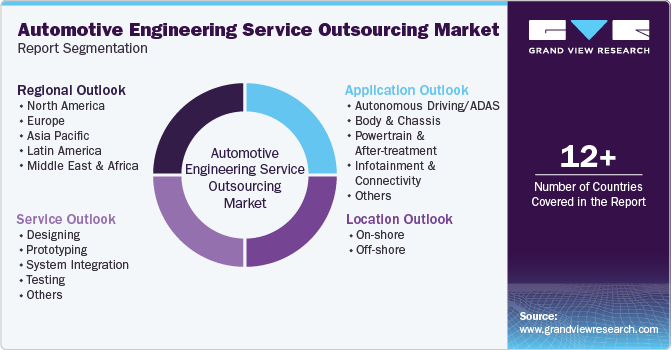

Global Automotive Engineering Service Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive engineering service outsourcing market report based on application, service, location, and region:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autonomous Driving/ADAS

-

Body & Chassis

-

Powertrain And After-treatment

-

Infotainment & Connectivity

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Designing

-

Prototyping

-

System Integration

-

Testing

-

Others

-

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-shore

-

Off-shore

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global automotive engineering service outsourcing market size was estimated at USD 119.89 billion in 2024 and is expected to reach USD 139.12 billion in 2024.

b. The global automotive engineering service outsourcing market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 227.60 billion by 2030.

b. Asia Pacific dominated the automotive ESO market with a share of 43.8% in 2024. This is attributable to the availability of an economical and professional workforce in countries such as the Philippines, India, and China. Major automobile OEMs are outsourcing manufacturing and government norms to minimize or reduce emissions and adopt green technology encouraging the market to grow in the forecast period.

b. Some key players operating in the automotive engineering service outsourcing market include Altair Engineering Inc., AVL List GmbH, Bertrandt AG, EDAG Group, FEV Group GmbH, Horiba, LTD. and IAV among others.

b. The growing technological skills of Engineering Service Providers (ESPs) to deliver research and development (R&D) and product innovation in their offerings for vehicle positioning, connected automobiles, and guidance systems is expected to fuel the automotive ESO market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.