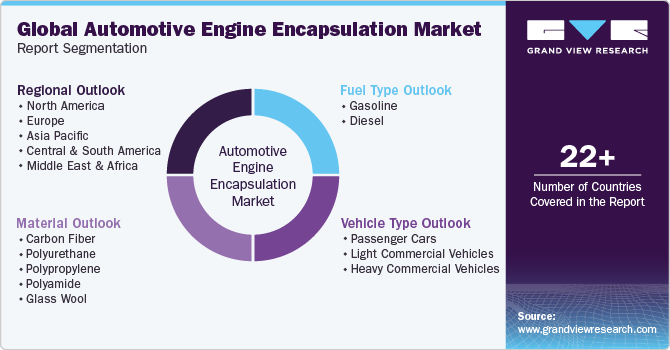

Automotive Engine Encapsulation Market Size, Share & Trends Analysis Report By Material (Carbon Fiber, Polyurethane), By Fuel Type (Gasoline, Diesel), By Vehicle Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-249-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

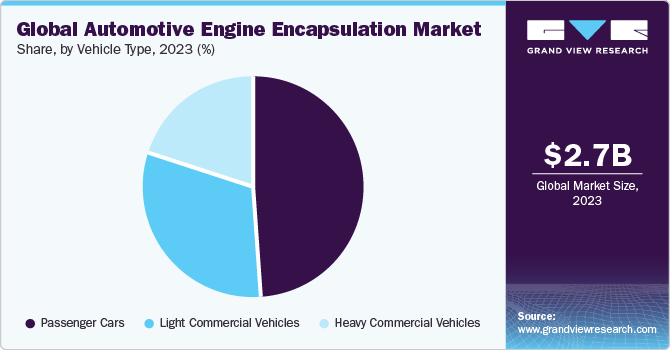

The global automotive engine encapsulation market size was estimated at USD 2.68 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The growing demand for fuel-efficient, high-performance and silent vehicles is driving the widespread adoption of automotive engine encapsulation in the global market. In 2023, the U.S. was the largest market for automotive engine encapsulation in North America. Increasing consumer awareness of engine encapsulation benefits is a new trend that is driving market expansion. Consumers are becoming more aware of the cost of gasoline and the need for fuel-efficient vehicles.

In addition, the rising environmental awareness among consumers is expected to propel the demand for vehicles with lesser emissions, thus boosting the market growth. Moreover, the rise in stringent fuel efficiency and emission regulations to reduce carbon emissions and combat climate change across the country is expected to create demand for engine encapsulation across automotive industry. For instance, in April 2023, The EPA announced ambitious criteria to further cut hazardous air pollutant emissions from light and medium-duty cars beginning with model year 2027. The proposal builds on the EPA's final federal greenhouse gas emissions standards for passenger cars and light trucks for model years 2023 to 2026, leveraging advances in clean car technology to unlock benefits for Americans ranging from reducing climate pollution, improving public health, and saving drivers money on fuel and maintenance costs. The proposed standards would be phased in over the model years from 2027 to 2032.

Moreover, the ongoing advancements in materials science and engineering technologies are resulting in the development of novel encapsulation materials with improved performance characteristics such as heat resistance, acoustic insulation, and durability, which is driving the adoption of engine encapsulation solutions.

One of the major challenges faced by the market includes the price volatility of product materials, which is subject to fluctuation according to demand and supply. This can make it difficult for companies to plan for the long term and can also make it challenging to ensure that the price of encapsulation provides a sufficient financial incentive for emissions reductions.

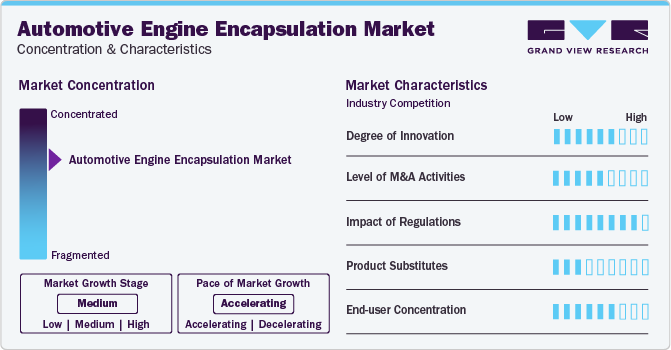

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include Hennecke GmbH; Roechling Group; Furukawa Electric Co., Ltd.; Continental AG; Woco Industrietechnik GmbH; Autoneum; and 3M among others. Several players are engaged in framework development to improve their market share. For instance, in June 2023, Toyota Motor Corporation (Toyota) introduced high-performance solid-state batteries and other technologies to increase driving range and lower the cost of future electric cars (EVs). The business plans to launch next-generation lithium-ion batteries in 2026, delivering longer ranges and faster charging.

Regulations in the industry have a significant impact, driving industry players to invest in advanced technologies and quality assurance measures. Compliance with regulatory frameworks ensures patient safety, fosters innovation, and establishes trust among customers.

Engine encapsulation technologies can be more expensive to develop, manufacture, and implement than conventional engines, especially for smaller automakers and manufacturers with limited resources. This can create potential market growth, mainly in under-developed economies.

Companies are pursuing regional expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with encapsulation needs in each region.

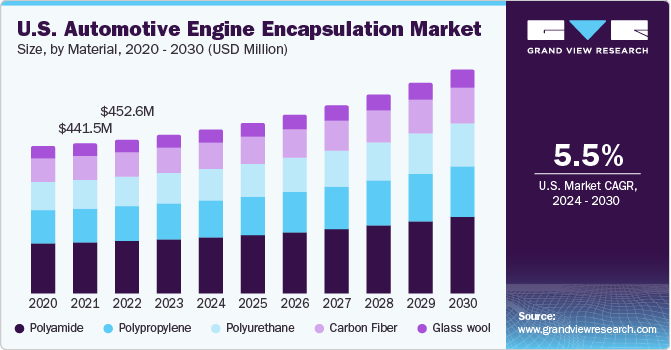

Material Insights

Based on material, the polyamide segment led the market with the largest revenue share of more than 32% in 2023. Polyamide is widely used in several under hood components manufacturing including engine encapsulation. Polyamide (PA), commonly known as nylon, is an important automotive plastic for engine encapsulation that offers versatile properties and robust performance. It is used in various automotive components as the polymide offers exceptional strength, durability, and resistance to abrasion, making it ideal for engine covers, and intake manifolds.

The polypropylene segment is expected to grow at a significant CAGR over the forecast period. Polypropylene is a relatively inexpensive thermoplastic material compared to alternatives like carbon fiber. It offers corrosion resistance and chemical degradation, making it an ideal component for automotive engine encapsulation.

Polypropylene-based engine encapsulation assists automakers in achieving regulatory criteria for vehicle performance, emissions, and safety standards. Moreover, the abundant supply of polypropylene and scalability for mass production is expected to boost the demand for engine encapsulation.

Fuel Type Insights

Based on fuel type, the gasoline segment led the market in 2023 by accounting for a substantial revenue share in the overall market, attributable to the huge volume of sales and manufacture of gasoline engines globally. The rising shift in fuel economy is likely to push automotive manufacturers to enhance their gasoline engines by implementing engine encapsulation. As the engine encapsulation reduces the engine noise and vibrations, providing a quieter and more comfortable driving experience.

Encapsulation technology helps manufacturers improve environmental sustainability by increasing fuel efficiency and decreasing emissions. Moreover, advanced materials and manufacturing processes enable lighter, stronger, and more efficient encapsulation designs, resulting in increased acceptance in the gasoline fuel sector.

Vehicle Type Insights

Based on vehicle type, the passenger cars segment led the market with the largest revenue share of 48.94% in 2023. Engine encapsulation systems are widely used in passenger cars. The market's growth is being driven by the large volume of passenger car sales and production, particularly in Asia Pacific and Europe.

In addition, increasing adoption and innovation to meet regulatory requirements, customer preferences, and competitive pressures are expected to boost the demand for engine encapsulation in passenger cars. For instance, in January 2023, Roechling Group, a prominent producer of lightweight solutions, launched a new engine encapsulation system for electric vehicles. The system is intended to improve the thermal management of electric vehicles and increase battery life.

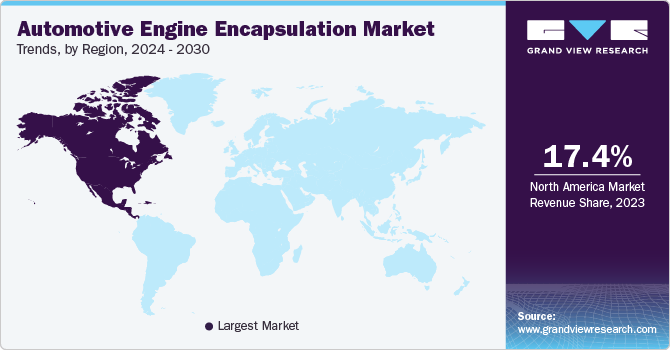

Regional Insights

The automotive engine encapsulation market in North America accounted for the largest revenue share of 17.4% in 2023. The market is expected to grow at a significant CAGR over the forecast period, owing to the presence of advanced manufacturing facilities, along with the rising automotive industry in the region. In addition, increasing emphasis on improving fuel efficiency across the region is expected to fuel the demand for engine encapsulation in automobiles. Engine encapsulation is critical for improving aerodynamics, lowering drag, and optimizing thermal management, all of which contribute to increased fuel economy and compliance with fuel efficiency standards.

U.S. Automotive Engine Encapsulation Market Trends

The automotive engine encapsulation market in U.S. is expected to grow at the fastest CAGR over the forecast period, due to the presence of incentives and support programs to promote the use of ecologically friendly technologies, such as engine encapsulation. Moreover, the shift of consumers towards more eco-friendly and cost-friendly automotive materials is likely to boost the market growth in the country.

Asia Pacific Automotive Engine Encapsulation Market Trends

Asia Pacific dominated the automotive engine encapsulation market with a revenue share of 45.78% in 2023. This growth is attributed to the rapid economic expansion which led to a rise in disposable income and automobile ownership. The growing demand for innovations that improve vehicle performance, comfort, and efficiency is pushing the development of engine encapsulation systems, thus driving market growth in the region.

The automotive engine encapsulation market in China held a significant share in the Asia Pacific region. The market is anticipated to register at the fastest CAGR of 5.6% over the forecast period. The burgeoning middle class will continue to drive the steady market growth of Chinese cars, with markets for new purchases and replacement vehicles developing fast.

The Japan automotive engine encapsulation market is expected to grow at a significant CAGR over the forecast period. The growth in the production of automotive, owing to the presence of several key manufacturers, along with a shift towards sustainability is expected to create demand for engine encapsulation in the Japanese automotive industry.

Europe Automotive Engine Encapsulation Market Trends

The automotive engine encapsulation market in Europe is expected to grow at a significant CAGR over the forecast period, due to a significant shift towards electric vehicles as part of initiatives to minimize carbon emissions and dependence on fossil fuels.

The Germany automotive engine encapsulation market held a significant share in Europe. The market is anticipated to register at a fastest CAGR of 3.8% over the forecast period, owing to the presence of developed R&D infrastructure, highly qualified workforce, and value chain integration to develop cutting-edge automotive technologies including engine encapsulation.

The automotive engine encapsulation market in Spain is expected to grow at the significant CAGR over the forecast period, attributed to the presence of highly automated production plants, along with modernization, automation, and R&D expenditure in the automotive industry. Continuous advancements in manufacturing technology drives the development of lightweight, durable, and efficient engine encapsulation solutions.

Central & South America Automotive Engine Encapsulation Market Trends

The automotive engine encapsulation market in Central & South America is expected to grow at the significant CAGR over the forecast period, due to the increasing demand for vehicles in the country and the country’s strategic location for export.

The Brazil automotive engine encapsulation market held a significant share in Central & South America. The market is anticipated to register at the fastest CAGR of 7.7% over the forecast period, as the country experiences urban growth and the need for efficient transportation solutions, there is a rising demand for lightweight materials that enhance vehicle performance and fuel efficiency.

Middle East & Africa Automotive Engine Encapsulation Market Trends

The automotive engine encapsulation market in Middle East & Africa is expected to grow at the significant CAGR over the forecast period, accounting for the rising GDP of GCC countries, trading partnerships with GCC countries with leading automotive markets like Germany, rising investment by OEMs, and partnerships by OEMs with the government to develop the automotive industry.

Key Automotive Engine Encapsulation Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Automotive Engine Encapsulation Companies:

The following are the leading companies in the automotive engine encapsulation market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Hennecke GmbH

- Roechling Group

- Furukawa Electric Co., Ltd.

- Continental AG

- Woco Industrietechnik GmbH

- Autoneum

- 3M

- Elringklinger AG

- Adler Pelzer Holding GmbH

- SA Automotive

Recent Developments

-

In October 2023, Freudenberg developed a novel heat shield designed specifically for electric vehicle batteries. This shield has excellent heat management and fire resistance, which are crucial for EV safety and performance

-

In September 2023, Covestro and BASF partnered to develop lightweight engine encapsulation solutions. The two chemical conglomerates formed a partnership to develop lightweight engine encapsulation components composed of Covestro polycarbonates and BASF polyamides. This alliance aims to reduce vehicle weight while enhancing fuel efficiency

-

In July 2023, LANXESS developed a new polyamide material for underbody shields which is highly resistant to sound, heat, and chemicals. This material is suitable for both internal combustion and electric vehicle

Automotive Engine Encapsulation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.77 billion |

|

Revenue forecast in 2030 |

USD 3.73 billion |

|

Growth rate |

CAGR of 5.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

April 2024 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, fuel type, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia ; UAE ; South Africa |

|

Key companies profiled |

BASF SE; Hennecke GmbH; Roechling Group; Furukawa Electric Co., Ltd.; Continental AG; Woco Industrietechnik GmbH; Autoneum; 3M; Elringklinger AG; Adler Pelzer Holding GmbH; SA Automotive |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Engine Encapsulation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive engine encapsulation market report based on material, fuel type, vehicle type, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon Fiber

-

Polyurethane

-

Polypropylene

-

Polyamide

-

Glass wool

-

-

Fuel Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Diesel

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive engine encapsulation market size was estimated at USD 2.68 billion in 2023 and is expected to reach USD 2.77 billion in 2024.

b. The global automotive engine encapsulation market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 3.73 billion by 2030.

b. Asia Pacific dominated the automotive engine encapsulation market with a share of 45.78% in 2023. This growth is attributed to the rapid economic expansion which led to a rise in disposable income and automobile ownership.

b. Some key players operating in the automotive engine encapsulation market include BASF SE, Hennecke GmbH, Roechling Group, Furukawa Electric Co., Ltd., Continental AG, and Woco Industrietechnik GmbH.

b. The growing demand for fuel-efficient, high-performance and silent vehicles is driving the widespread adoption of automotive engine encapsulation in the global market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."