- Home

- »

- Automotive & Transportation

- »

-

Automotive Electric Water Pump Market Size Report, 2030GVR Report cover

![Automotive Electric Water Pump Market Size, Share & Trends Report]()

Automotive Electric Water Pump Market Size, Share & Trends Analysis Report By Voltage Type, By Vehicle Type, By Distribution Channel, By Propulsion Type, By Application, By Region, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-357-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

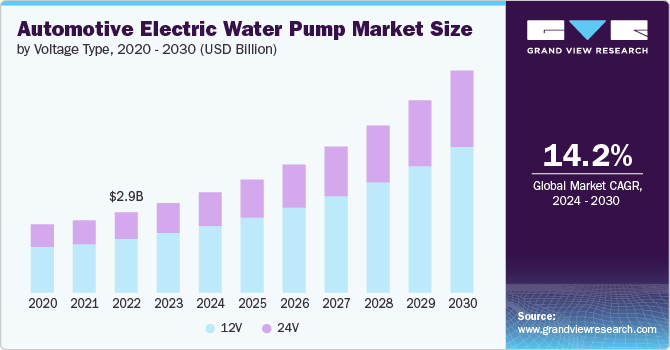

The global automotive electric water pump market size was estimated at USD 3.21 billion in 2023 and is projected to grow at a CAGR of 14.2% from 2024 to 2030. An automotive electric water pump is a device used in vehicles to circulate coolant through the engine and other components to regulate their temperature. The increasing adoption of electric water pumps in maintaining efficient cooling systems, both in hybrid and electric vehicles, is the major driving factor behind the market growth. In addition, these advanced pumps are powered by a motor and a battery, allowing for precise control over the coolant flow needed by the engine, which further drives their demand.

The integration of electric water pumps in automobiles significantly boosts fuel efficiency. These pumps significantly enhance fuel efficiency by operating only when needed and adjusting their speed accordingly. Besides their efficient performance, electric water pumps consume around 90% less energy than their mechanical counterparts. This increased demand for electric water pumps has enhanced vehicle efficiency and played a crucial role in reducing emissions, promoting a safer and more environmentally friendly environment. In addition, electric water pumps extend engine life by preventing overheating and reducing wear and tear on engine components. Thus, increasing demand for automotive electric water pumps owing to their benefits, including improved fuel efficiency, enhanced engine performance, reduced emissions, extended engine life, and quieter operations, are expected to drive market growth.

Increasing production and sales of electric and hybrid vehicles across the globe is further driving the demand for automotive electric water pumps. These vehicles require advanced cooling systems for their high-voltage batteries and inverters, driving demand for efficient electric water pumps. Manufacturers are focusing on developing pumps that can seamlessly integrate with the unique cooling needs of electric drivetrains. Furthermore, according to IEA, electric car sales are constantly increasing and are projected to reach approximately 17 million units in 2024, representing over one in five cars sold globally. Thus, as electric vehicle adoption continues to grow, the market for automotive electric water pumps spurring innovation and technological advancements.

As vehicles become more technologically advanced, the need for effective thermal management systems is increasing. Automotive electric water pumps play a crucial role in maintaining optimal engine and component temperatures, especially in high-performance and hybrid vehicles. Manufacturers are developing pumps with precise control capabilities to meet the specific cooling requirements of modern engines. This increased focus on thermal management is driving innovation and market growth.

Factors such as high initial costs and the complexity of integrating these systems into existing vehicle architectures could hamper the growth of the market. In addition, ongoing improvements in design and materials are making automotive electric water pumps more reliable. However, there are still concerns about their long-term durability and performance across a wide range of operating conditions. Thus, the need for advanced technological expertise and potential reliability issues could restrain market growth.

Voltage Type Insights

Based on voltage type, the 12V segment led the market with the largest revenue share of 66.79% in 2023. Increasing adoption of 12V electric water pumps in passenger cars can be attributed to the segment’s growth. The adoption has increased due to modern traffic conditions, stringent emissions regulations, and consumer demands for improved fuel efficiency, particularly for city driving. In addition, companies such as VOVYO TECHNOLOGY CO., LTD. provides 12v electric water pump automotive VP80F, a high-quality car electric water pump, widely used in the cooling water circulation of new energy vehicles and the warm air conditioning cycles of cars. Thus, the vast availability of 12V automotive electric water pumps in the market is expected to boost the segment’s growth.

The 24V segment is projected to witness at a significant CAGR from 2024 to 2030. Increasing demand for 24V electric water pumps to dissipate heat from new energy electric vehicle batteries, vehicle engines, and motor control systems is a major driver behind the segment’s growth. In addition, 24V electric water pumps are used in larger engines, such as those found in heavy-duty trucks and commercial vehicles. They can handle the higher cooling requirements of bigger engines more effectively than lower voltage pumps.

Vehicle Type Insights

Based on vehicle type, the passenger cars segment led the market with the largest revenue share of 61.75% in 2023. The growth can be attributed to the increased production of these luxury cars, SUVs, sedan, and hatchbacks in developing countries and their extensive use for daily transportation. Benefits such as improved Exhaust Gas Recirculation (EGR) cooling and air conditioning are also expected to positively impact the growth of the passenger car segment. In addition, increasing urbanization and congestion are driving demand for compact and fuel-efficient passenger cars, ultimately driving the demand for electric water pumps in this segment.

The light commercial vehicle segment is projected to witness at a significant CAGR from 2024 to 2030. The growth of the segment is driven by the increasing adoption of light commercial vehicles for last-mile delivery and urban transportation. With stricter emissions regulations and a growing focus on sustainability, commercial vehicle manufacturers are increasingly adopting electric water pumps to lower fuel consumption and CO2 emissions. Thus, the increasing use of electric water pumps in hybrid buses, trucks, and other commercial vehicles to circulate coolant throughout the engine, ensuring optimal operating temperatures and preventing overheating, is propelling the segment’s growth.

Distribution Channel Insights

Based on distribution channel, the OEM segment led the market with the largest revenue share of 67.20% in 2023. OEM stands for Original Equipment Manufacturer, meaning the parts are produced by the same company that manufactures the vehicle. OEM parts are assured to fit perfectly and typically come with a manufacturer-backed warranty. While they may be more expensive than aftermarket options, they offer benefits such as compatibility with vehicles, longer life and warranty. Therefore, the rising consumer preference for electric water pumps through OEM distribution channels, owing to its benefits is anticipated to propel the segment's growth.

The aftermarket segment is projected to witness at a significant CAGR from 2024 to 2030. The aftermarket segment for automotive electric water pumps is expanding as more vehicles equipped with these pumps enter the market. This trend is creating opportunities for aftermarket suppliers to offer high-quality replacement parts to meet the growing demand for these components. Owners of older vehicles are also seeking to upgrade to more efficient and reliable electric water pumps, recognizing the benefits of improved engine cooling and performance. Thus, the growing focus on vehicle maintenance and performance is further boosting demand for electric water pumps in this segment.

Propulsion Type Insights

Based on propulsion type, the ICE segment led the market with the largest revenue share of 72.57% in 2023. Automotive electric water pumps play a crucial role in the cooling systems of traditional internal combustion engine (ICE) vehicles. In ICE vehicles, electric water pumps circulate coolant through the turbocharger, supercharger, and heater core and sometimes serve as the primary engine coolant pump. The benefits of electric water pumps, including reduced carbon emissions, reduced energy consumption, and a smaller environmental footprint, are driving their demand for ICE vehicles.

The electric segment is projected to witness at a significant CAGR from 2024 to 2030. Automotive electric water pumps are increasingly integrated into the water-cooling systems of electric vehicles due to their rapid development. As the demand grows for fast-charging high-power batteries, water cooling systems have become standard for cooling the Onboard Charger (OBC), DC/DC converter, and battery in electric vehicles. Compared to air cooling systems, water cooling systems are notably more efficient and compact. This shift from air cooling to water cooling is an inevitable trend in the automotive industry, thus driving more demand for electric water pumps in electric vehicles.

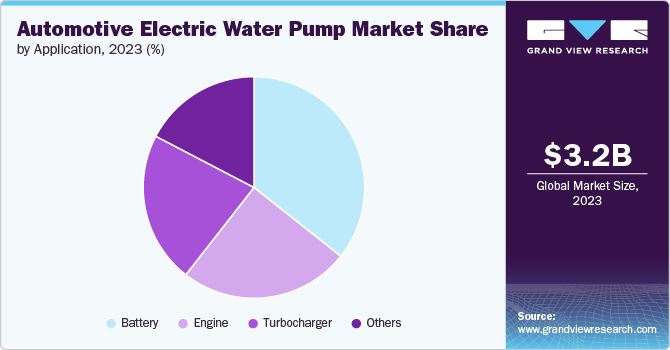

Application Insights

Based on application, the battery segment led the market with the largest revenue share of 35.66% in 2023. These pumps play a crucial role in battery cooling systems for electric and hybrid vehicles, ensuring the temperature of high-voltage batteries remains within optimal ranges. By circulating coolant effectively throughout the battery pack, these pumps contribute significantly to maintaining ideal operating conditions. This capability is essential for extending battery life and enhancing overall performance, reflecting the critical role of electric water pumps in supporting the efficiency and durability of modern vehicle technologies.

The turbocharger segment is projected to witness at a significant CAGR from 2024 to 2030. Turbochargers generate a significant amount of heat, especially during high-performance operation. This heat can damage the turbocharger components if not properly managed. Thus, increasing the use of electric water pumps in the turbocharger cooling circuit to maintain optimal temperatures and enhance the turbocharger's efficiency and overall engine performance is driving the segment's growth.

Regional Insights

The automotive electric water pump market in the North America is expected to grow at a considerable CAGR from 2024 to 2030. The rising adoption of hybrid and electric vehicles in the region is a major driver, as these vehicles require electric water pumps to efficiently manage cooling and thermal management. Stricter emissions regulations and the focus on improving fuel efficiency are also propelling the demand for electric water pumps, which can provide demand-driven cooling and reduce overall energy consumption.

U.S. Automotive Electric Water Pump Market Trends

The automotive electric water pump market in the U.S. is expected to register at the fastest CAGR from 2024 to 2030. The vast presence of several automotive manufacturers, increasing adoption of electric vehicles, and rising integration of advanced automotive components to increase vehicle efficiency are some of the major factors behind the market's growth in the country.

Europe Automotive Electric Water Pump Market Trends

The automotive electric water pump market in Europe is expected to grow at the fastest CAGR from 2024 to 2030. The rapid growth of the automotive industry in countries such as Germany, the UK, and France is expected to drive the demand for electric water pumps. For instance, Germany is Europe's major market for automotive production and sales. The country boasts an advanced R&D infrastructure, a fully integrated industry value chain, and a highly skilled workforce, creating an improved automotive environment. This robust ecosystem enables automotive companies to develop advanced technologies, such as electric water pumps, that effectively meet future mobility demands.

Asia Pacific Automotive Electric Water Pump Market Trends

Asia Pacificdominated the automotive electric water pump market with the revenue share of 40.91% in 2023. The region's growing automotive production and sales, particularly in countries such as China, Japan, and India, are increasing the demand for efficient cooling solutions in both traditional and electric vehicles. In addition, rising consumer awareness about environmental sustainability and stringent emissions regulations are encouraging automakers to integrate advanced cooling technologies, driving further market growth.

Key Automotive Electric Water Pump Company Insights

Key players operating in the global market include Gates Corporation, Schaeffler Technologies AG & Co. KG, Robert Bosch GmbH, Rheinmetall AG, BLDC PUMP Co., Ltd., Valeo SA, Carter Fuel Systems, LLC, Hitachi Astemo Americas, Inc., Continental AG, and VOVYO TECHNOLOGY CO., LTD. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Automotive Electric Water Pump Companies:

The following are the leading companies in the automotive electric water pump market. These companies collectively hold the largest market share and dictate industry trends.

- Gates Corporation

- Robert Bosch GmbH

- Schaeffler Technologies AG & Co. KG,

- Rheinmetall AG

- BLDC PUMP Co., Ltd.

- Valeo SA

- Carter Fuel Systems, LLC

- Continental AG

- Hitachi Astemo Americas, Inc.

- VOVYO TECHNOLOGY CO., LTD.

Recent Developments

-

In February 2024, Schaeffler Technologies AG & Co. KG, under its INA brandlaunched a series of electric auxiliary water pumps. These pumps meet OEM standards and provide extensive coverage for the European vehicle market. Auxiliary water pumps are crucial for functions such as after-run cooling, fuel system cooling, and turbocharger cooling. In addition, they are vital for cooling the high-voltage battery and inverter in electric and hybrid vehicles

-

In September 2023, NTN Corporation, a manufacturer of automotive components announced the launch of range of auxiliary electric water pumps. This range includes over 40 models designed to meet the increasing demand for efficient cooling systems in electric and hybrid vehicles. Featuring innovative PPS plastic bearing technology, these pumps reduce friction by more than 30%, leading to energy savings and lower CO2 emissions

Automotive Electric Water Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.60 billion

Revenue forecast in 2030

USD 7.97 billion

Growth rate

CAGR of 14.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Voltage type, vehicle type, distribution channel, propulsion type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Gates Corporation; Robert Bosch GmbH; Schaeffler Technologies AG & Co. KG; Rheinmetall AG; BLDC PUMP Co., Ltd.; Valeo SA, Carter Fuel Systems, LLC; Continental AG; Hitachi Astemo Americas, Inc.; VOVYO TECHNOLOGY CO., LTD.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Electric Water Pump Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive electric water pump market report based on voltage type, vehicle type, distribution channel, propulsion type, application, and region.

-

Voltage Type Outlook (Revenue, USD Million, 2018 - 2030)

-

12V

-

24V

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEMs

-

Aftermarket

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery

-

Engine

-

Turbocharger

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive electric water pump market size was estimated at USD 3.21 billion in 2023 and is expected to reach USD 3.60 billion in 2024.

b. The global automotive electric water pump market is expected to grow at a compound annual growth rate of 14.2% from 2024 to 2030, reaching USD 7.97 billion by 2030.

b. The 12V segment dominated the market in 2023 and accounted for a more than 66% share of global revenue. The segment's growth can be attributed to the increasing adoption of 12V electric water pumps in passenger cars.

b. Some of the players operating in the automotive electric water pump market include Gates Corporation, Schaeffler Technologies AG & Co. KG, Robert Bosch GmbH, Rheinmetall AG, BLDC PUMP Co., Ltd., Valeo SA, Carter Fuel Systems, LLC, Hitachi Astemo Americas, Inc., Continental AG, and VOVYO TECHNOLOGY CO., LTD.

b. Increasing production and sales of electric and hybrid vehicles across the globe is further driving the demand for automotive electric water pumps. These vehicles require advanced cooling systems for their high-voltage batteries and inverters, driving demand for efficient electric water pumps.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."