- Home

- »

- Automotive & Transportation

- »

-

Automotive Control Panel Market Size & Share Report, 2030GVR Report cover

![Automotive Control Panel Market Size, Share & Trends Report]()

Automotive Control Panel Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Manual, Push Button), By Application (Passenger Cars, Heavy Commercial Vehicle), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-409-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Control Panel Market Trends

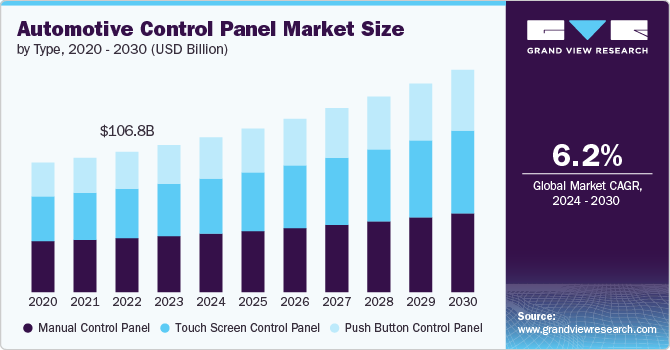

The global automotive control panel market was estimated at USD 111.92 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. An automotive control panel is a central interface within a vehicle that allows drivers and passengers to interact with various vehicle systems and functions. It typically includes a range of controls and displays for managing essential functions, providing information, and enhancing the overall driving experience. Technological advancements and evolving consumer preferences drive market growth. In addition, the increasing integration of digital and touchscreen interfaces, which provides a streamlined and interactive user experience, is also driving the market’s growth.

The transition to electric vehicles (EVs) is transforming the automotive industry, increasing demand for specialized equipment such as control panels. The adoption of EVs significantly drives the demand for automotive control panels, as they require specialized interfaces to manage battery status, charging processes, and energy efficiency. Control panels in EVs often feature unique displays and controls tailored to these needs, such as real-time battery life indicators, charging station locators, and energy consumption analytics. Furthermore, the growing production and sales of EVs, rising emphasis on cabin comfort and convenience, and the increasing need for application-based improvements further propel market growth.

Capacitive touch technology can be easily integrated into automotive dashboards and control panels. These touch screens offer a user interface familiar to drivers and passengers, representing the touch gestures on everyday devices such as smartphones. This familiarity enhances the user experience and simplifies the operation of various vehicle functions. In addition, capacitive touch screens are versatile and can display various information and controls, including infotainment, navigation systems, climate control, and vehicle settings. Modern capacitive touch screens are built to endure the demands of daily use, featuring scratch-resistant and shatterproof surfaces, which ensures durability and minimizes maintenance costs for vehicle manufacturers. Thus, the rising integration of capacitive touch screen technology in automotive control panels owing to its benefits, such as intuitive interface, multi-functionality, improved durability, and sleek and modern design, is fueling the market’s growth.

Furthermore, enhanced connectivity and infotainment systems are a major trend in automotive control panels, driven by consumer demand for seamless integration with mobile devices and internet-based services. Modern control panels are increasingly equipped with platforms such as Apple CarPlay and Android Auto and built-in connectivity features that allow drivers to access navigation, music, and communication apps directly from the panel. This trend highlights a growing demand for a connected driving experience, allowing users to seamlessly sync their smartphones and other devices with the vehicle's systems. As connectivity technologies advance, automotive control panels are poised to offer even more sophisticated features, such as over-the-air updates, cloud-based services, and expanded app ecosystems, driving the market's growth.

Despite their advancements, automotive control panels face several challenges that could hamper the market’s growth. One major drawback is their complexity, particularly with digital touchscreens that provide drivers with multiple menus and options, leading to potential distractions and decreased focus on driving. Reliability can also be a concern, as digital systems are prone to software glitches and touch sensitivity problems, which can impair functionality and safety if the system malfunctions. Moreover, the cost of these advanced control panels is higher regarding initial production and potential repairs, making vehicles more expensive to own and maintain.

Type Insights

The manual control panel segment dominated the market in 2023 and accounted for a 38.12% share of global revenue. Manual control panels, which rely on physical buttons, knobs, and switches, offer several benefits despite the growing popularity of touchscreen interfaces. Manual controls are often simpler and more intuitive than digital interfaces, especially for essential functions such as climate control and audio settings. In addition, these control panels generally cost less to produce and maintain compared to advanced touchscreen systems. The simpler design and fewer electronic components reduce manufacturing and repair costs. This cost-effectiveness, simplicity, and ease of use of manual control panels can be attributed to the segment’s growth.

The touchscreen control panel segment is projected to grow significantly from 2024 to 2030. Touch screens rapidly replace traditional mechanical buttons and manual control panels across various industries. The automotive industry is at the forefront of innovation, continuously pushing the boundaries of user interface technology to improve the driving experience. Most of the new-model vehicles now feature touch screens, replacing certain components of their center consoles. Thus, the rising adoption of touchscreen control panels in vehicles, providing benefits such as a convenient and intuitive user experience and quick access to information such as fuel levels and engine diagnostics, is propelling the segment’s growth.

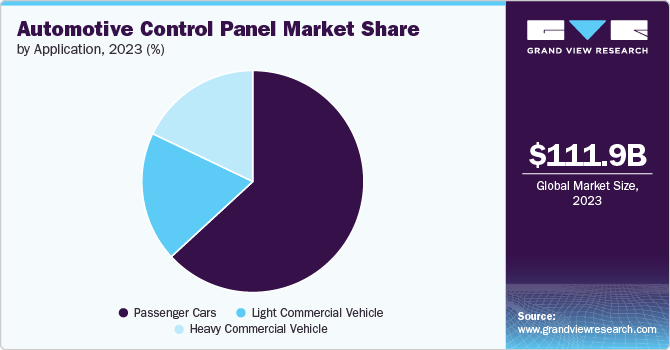

Application Insights

The passenger cars segment dominated the market in 2023. Increasing adoption of passenger cars such as luxury cars, SUVs, sedans, and electric cars across the globe is a major factor driving the segment’s growth. The evolution of user interfaces in luxury cars transforms the driving experience, enhancing its intuitiveness, safety, and satisfaction. Advanced systems such as touchscreens, voice control, and augmented reality are setting new standards in automotive control panel technology in passenger cars. On the other hand, multi-function control knobs or manual controls located on the center console enable drivers to navigate menus and make selections without needing to touch the screen. Thus, the surged adoption of manual, push buttons, and touchscreen control panels in passenger cars, owing to their benefits, is driving the segment's growth.

The Light Commercial Vehicle (LCV) segment is projected to grow significantly from 2024 to 2030. In LCVs, control panels are designed with a focus on durability and functionality to withstand the demanding conditions of commercial use. These vehicles often operate in rugged environments and high-mileage conditions, so control panels are built to be robust and reliable. Thus, increasing demand for control panels with features such as enhanced resistance to dust, moisture, and wear-and-tear to ensure long-term performance and reduce maintenance costs of commercial vehicles is propelling the segment’s growth.

Regional Insights

The automotive control panel market in North America is expected to witness moderate growth from 2024 to 2030. Growing technological advancements and rising consumer preference for high-tech features and convenience in premium vehicles are driving market growth in the region. Furthermore, the shift towards EVs and government initiatives to promote the adoption of EVs further drive the demand for automotive control panels in the region.

U.S. Automotive Control Panel Market Trends

The automotive control panel market in the U.S. is expected to grow significantly from 2024 to 2030. The segment's growth can be attributed to the growing trend toward integrating large touchscreen interfaces, customizable displays, and advanced driver assistance technologies in high-end and mainstream vehicles.

Asia Pacific Automotive Control Panel Market Trends

The Asia Pacific regiondominated the automotive control panel market in 2023 and accounted for a 35.55% share of the global revenue. Increasing vehicle production and rising integration of advanced infotainment systems, touchscreens, and connectivity features into vehicles are the major driving factors behind the market's growth in the region. Furthermore, the growing population and improving economic conditions further boost the demand for advanced vehicle systems, driving the market's growth.

Europe Automotive Control Panel Market Trends

The automotive control panel market in Europe is expected to grow at a notable CAGR from 2024 to 2030. The rapid growth of the automotive industry across countries such as Germany, the UK, and Italy and the increasing adoption rate of automotive cars are boosting the market's growth. In addition, the shift towards stricter environmental regulations and the growing popularity of electric and hybrid vehicles drive the development of specialized control panels that integrate with these technologies, fueling the market's growth.

Key Automotive Control Panel Company Insights

Key players operating in the market include Continental AG, MinebeaMitsumi Inc., ZF Friedrichshafen AG, Faurecia Clarion, GX Group Limited, Valeo S.A., Assembly Solutions Ltd, SIC Ltd, BCS Automotive Interface Solutions, Toyota Motor Sales, U.S.A. Companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals.

Key Automotive Control Panel Companies:

The following are the leading companies in the automotive control panel market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- MinebeaMitsumi Inc.

- ZF Friedrichshafen AG

- Faurecia Clarion

- GX Group Limited

- Valeo S.A.

- Assembly Solutions Ltd

- SIC Ltd

- BCS Automotive Interface Solutions

- Toyota Motor Sales, U.S.A.

Recent Developments

-

In December 2023, Antolin developed a touch control panel for Tata Harrier and Safari SUVs that integrates multiple functions to enhance the driving experience. This panel features a capacitive touch interface for operating the FATC-HVAC system and other vehicle functions. It features a sophisticated piano black trim that extends across the entire instrument panel, offers direct ambient light with RGB customization, and includes sophisticated electronics for a seamless user experience.

Automotive Control Panel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 117.80 billion

Revenue forecast in 2030

USD 169.18 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Continental AG; MinebeaMitsumi Inc.; ZF Friedrichshafen AG; Faurecia Clarion; GX Group Limited, Valeo S.A.; Assembly Solutions Ltd; SIC Ltd; BCS Automotive Interface Solutions; Toyota Motor Sales, U.S.A.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Control Panel Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive control panel market based on type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Manual Control Panel

-

Push Button Control Panel

-

Touch Screen Control Panel

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicle (LCV)

-

Heavy Commercial Vehicle (HCV)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive control panel market size was estimated at USD 111.92 billion in 2023 and is expected to reach USD 117.80 billion in 2024.

b. The global automotive control panel market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030, reaching USD 169.18 billion by 2030.

b. The manual control panel segment dominated the market in 2023 and accounted for a 38.1% share of global revenue. Manual control panels, which rely on physical buttons, knobs, and switches, offer several benefits despite the growing popularity of touchscreen interfaces. Manual controls are often simpler and more intuitive to use than digital interfaces, especially for essential functions such as climate control and audio settings. In addition, these control panels generally cost less to produce and maintain compared to advanced touchscreen systems.

b. Some of the players operating in the automotive control panel market include Continental AG, MinebeaMitsumi Inc., ZF Friedrichshafen AG, Faurecia Clarion, GX Group Limited, Valeo S.A., Assembly Solutions Ltd, SIC Ltd, BCS Automotive Interface Solutions.

b. The automotive control panel market growth is driven by technological advancements and evolving consumer preferences. In addition, increasing integration of digital and touchscreen interfaces, which provides a streamlined and interactive user experience also driving the market’s growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.