- Home

- »

- Automotive & Transportation

- »

-

Automotive Connectors Market Size & Share Report, 2030GVR Report cover

![Automotive Connectors Market Size, Share & Trends Report]()

Automotive Connectors Market Size, Share & Trends Analysis Report By Product (PCB, Fiber Optic), By Connectivity, By Vehicle, By Application (Powertrain, Navigation & Instrumentation), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-572-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2024

- Forecast Period: 2024 - 2030

- Industry: Technology

Automotive Connectors Market Size & Trends

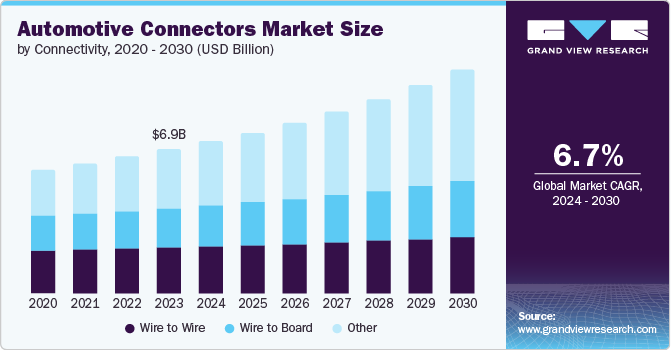

The global automotive connectors market size was valued at USD 6.89 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. Growth can be attributed to rising demand for connectivity, convenience, and safety features in passenger cars as well as commercial vehicles. Technological advancements have resulted in many features that enhance driving experience and provide better safety.

Safety and security features such as adaptive cruise control, anti-theft alarm system, lane keeping assist, keyless entry, and auto emergency braking help in avoiding fatal accidents as well as provide extra security. Such advanced features are integrated within a vehicle using a considerable number of electronic components. The main function of connectors is to deliver a proper power distribution among these components. Additionally, these connectors are made of a robust material to endure rough operating conditions such as temperature fluctuations, wear and tear and dirt.

Electrification has become an integral part across all the vehicle categories and ultimately boosted demand for connectors. Also, customers are choosing electric vehicles due to growing awareness about environmental concerns, further driving the market of automotive connectors. Several big companies operating in the automobile market are launching latest electric vehicles which is expected to further increase the demand of connectors.

Many countries across the world have proposed a ban on petrol /diesel cars in coming years considering the threat of air pollution, resulting in high demand of electric vehicles. Governments are providing subsidies to encourage adoption of electric vehicles and manufacturers are providing lucrative offers. For instance, Norway has set 2025 as the target year for banning ICE vehicles; similarly, China and India have announced to ban ICE vehicles by 2030. Increasing adoption of electric vehicles is positively impacting the automotive connectors market.

Product Insights

The fiber optic segment is expected to register a fastest CAGR of 9.6 % over the forecast period. Safety during the transmission, its compact size and flexibility in terms of design are some of the key drivers for the segment growth.

As automobile manufacturers are improving the features integrated in vehicles continuously, the quality and performance of the connectors used are important prerequisites for manufacturers. Fiber optics provide faster communication and sensing capacity enhancing the performance of security features in a vehicle, further propelling the market growth.

Connectivity Insights

The wire-to-wire segment held a market share of 32.10 % in 2023. For power distribution and data transmission these connectors are widely used because of their seamless power transmission and communication between various electrical components.

The wire to board segment is expected to register a CAGR of 5.5 % over the forecast period. These are used for transfer of commands from electronic devices to PCB and vice versa. The others segment includes board to board connectors and are used to connect two or more printed circuit boards.

Vehicle Insights

The passenger car segment dominated the market capturing 73.7% in terms of revenue in 2023. The increasing sale of passenger cars in highly populated and developing countries such as China, India are driving the market. Customers prefer vehicles with additional features that enable the vehicle to be safe and secure.

The commercial vehicles segment is expected to register the fastest CAGR of 7.3 % during the forecast period, 2024 to 2030. The stringent safety regulations applied on commercial vehicles by governments are driving the market. Additionally, the developing industrial sectors in countries across the world are expanding the demand of supply and distribution networks. These factors are expected to increase the number of commercial vehicles over the forecast period and positively impact the segment growth.

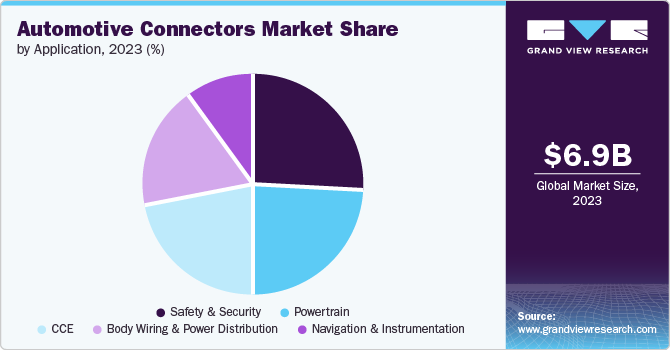

Application Insights

The safety and security segment held the largest share of 25.6 % in 2023. Technological advancements have introduced various safety features in vehicles, including adaptive front lighting, adaptive cruise control, park assistance and lane departure warning. Such functions require many electronic components, sensors, and ECUs.

The navigation & instrumentation segment is expected to grow at the fastest CAGR of 8.9% during the forecast period. Increasing accuracy of GPS-enabled devices and implementation of advanced software such as Apple Carplay and Android Auto has fostered the use of navigational applications in both commercial and passenger vehicles.

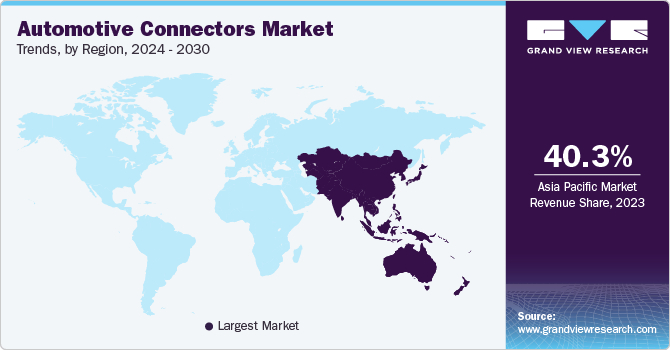

Regional Insights & Trends

North America automotive connectors market dominated the global market with a share of 25.2% in 2023. The U.S. automotive connectors market is expected to grow at CAGR of 3.6% over the forecast period. There has been a surge in the number of customers purchasing cars post COVID-19. An increasing number of working professionals are preferring cars as a mode of transport, which is positively impacting the market.

Europe Automotive Connectors Market Trends

Europe captured 30.3% of the global market in 2023. The presence of Germany and UK are contributing to the regional market growth. Developments in Germany automobile sector has further expanded the requirement of automotive connectors market. Several European countries have declared to switch to electric vehicles banning petrol/diesel cars, fueling the regional market growth significantly.

Asia Pacific Automotive Connectors Market Trends

Asia pacific dominated the market by capturing largest revenue share of 40.3 % in 2023 and is expected to grow as fastest CAGR of 10.0% over the forecast period. Countries such as China, Taiwan and Japan are leading manufacturers of various automotive electronic parts due to availability of raw material, low-cost labor and advanced manufacturing facilities.

China being a global hub of car manufacturing, is significantly contributing to the market. The mass production facilities, supported by government policies and robust infrastructure has exponentially expanded the market in China.

Key Automotive Connectors Company Insights

Prominent companies in the automotive connectors market includeTE Connectivity, Aptiv PLC, Amphenol Corporation, Yazaki Corporation, Molex Incorporated and others.

- TE Connectivity produces highly engineered sensing and connectivity solutions. It develops solutions for several industrial applications including automotive connectors used in electric vehicles.

Key Automotive Connectors Companies:

The following are the leading companies in the automotive connectors market. These companies collectively hold the largest market share and dictate industry trends.

- TE Connectivity

- Aptiv PLC

- Amphenol Corporation

- Yazaki Corporation

- Molex Incorporated

- Sumitomo Electric Industries, Ltd.

- Hirose Electric Co., Ltd.

- JST Manufacturing Co., Ltd.

- Kyocera Corporation

- Rosenberger Group

Recent Developments

-

In January 2024, Amphenol Corporation, a leader in sensor, interconnect, and antenna solutions, announced the acquisition of PCTEL. The acquisition is expected to accelerate growth opportunities by the combination of these two organizations.

-

In November 2023, Molex Incorporated, specializing in electronics & connectors, announced the expansion of its manufacturing footprint by opening a new campus in Poland.

-

In February 2021, KYOCERA announced the launch of 0.5mm-Pitch 5652 Series for automotive and other applications. It is a board-to-board floating connectors series, and the connectors are made available in varied range of stacking heights.

Automotive Connectors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.28 billion

Revenue forecast in 2030

USD 10.72 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2024

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, connectivity, vehicle, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Japan; China; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

TE Connectivity, Aptiv PLC, Amphenol Corporation,Yazaki Corporation, Molex Incorporated, Sumitomo Electric Industries, Ltd., Hirose Electric Co., Ltd., JST Manufacturing Co., Ltd., Kyocera Corporation, Rosenberger Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Connectors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the automotive connectors market report based on product, vehicle, application, connectivity, and region.

-

Product Outlook (Revenue, USD Billion, 2020 - 2030)

-

PCB

-

IC

-

RF

-

Fiber Optic

-

Other

-

-

Connectivity Outlook (Revenue, USD Million, 2020 - 2030)

-

Wire to Wire

-

Wire to Board

-

Other

-

-

Vehicle Outlook (Revenue, USD Million, 2020 - 2030)

-

Passenger Car

-

Commercial Vehicle

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

CCE

-

Powertrain

-

Safety & Security

-

Body Wiring & Power Distribution

-

Navigation & Instrumentation

-

-

Regional Outlook (Revenue, USD Billion, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."