- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Automotive Coatings Market Size, Industry Report, 2030GVR Report cover

![Automotive Coatings Market Size, Share & Trends Report]()

Automotive Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report, By Product (Primer, E-coat, Basecoat, Clearcoat), By Technology, By Application (Metal, Plastic), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-440-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Coatings Market Summary

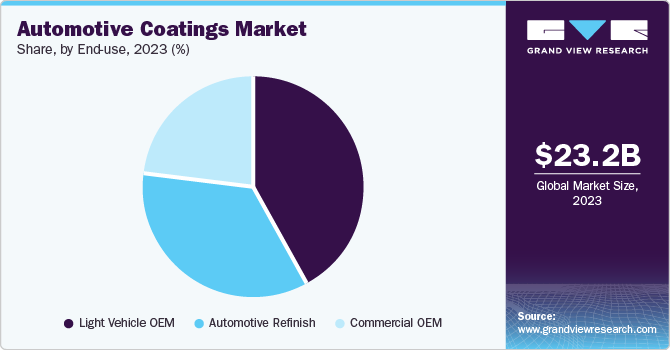

The global automotive coatings market size was estimated at USD 23.2 billion in 2023 and is projected to reach USD 33.4 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. This growth is attributed to the increasing vehicle production worldwide, particularly in emerging markets such as Asia Pacific.

Key Market Trends & Insights

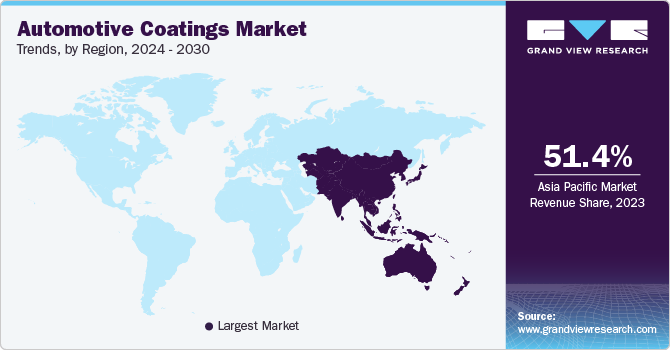

- The Asia Pacific automotive coatings market dominated the global market and accounted for the largest revenue share of 51.4% in 2023.

- The automotive coatings market in China led the Asia Pacific market and held a substantial market share in 2023.

- By product, basecoats segment dominated the market and accounted for the largest revenue share of 43.9% in 2023.

- By technology, waterborne coatings segment led the market and accounted for the largest revenue share in 2023.

- By application, metals segment dominated the market and accounted for the largest revenue share of 71.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 23.2 Billion

- 2030 Projected Market Size: USD 33.4 Billion

- CAGR (2024-2030): 5.4%

- Asia Pacific: Largest market in 2023

In addition, rising consumer preferences for aesthetically pleasing and customizable vehicles are pushing automakers to offer a wider range of coating options, including metallic, pearlescent, and matte finishes. Furthermore, technological advancements in coating formulations, application techniques, and manufacturing processes enable the development of high-performance, durable coatings that protect vehicles from corrosion, UV radiation, and other environmental factors.

The global automotive paints market is poised for significant growth in the coming years, driven by several key factors. The increasing production of automobiles in emerging economies such as China, India, Brazil, Mexico, South Korea, and South Africa is a major driver, as rising population and income levels fuel demand. Furthermore, the growing need for automotive refinishing for vehicle maintenance and repair will stimulate demand for paints and coatings. One of the primary growth opportunities lies in the increasing adoption of powder coatings. These solvent-free coatings offer environmental and economic benefits by eliminating volatile organic compound emissions. The rising demand for electric and hybrid vehicles, driven by concerns over carbon emissions, is also expected to expand the market.

Furthermore, consumers increasingly invest in vehicle customization and personalization, driven by rising disposable incomes. Automotive coatings are crucial in enhancing the appearance, protecting paint finishes, and ensuring longevity. Custom paint designs, vinyl wraps, and unique color choices have become popular trends, driving market growth. The automotive sector also demands coatings with superior performance characteristics. High-performance coatings offer durability, scratch resistance, weather resistance, and UV protection, making them essential for maintaining the quality and appearance of vehicles.

Product Insights

Basecoats dominated the market and accounted for the largest revenue share of 43.9% in 2023. They provide automobiles with the desired color and exterior aesthetics. Powder coatings gained prominence due to their environmental benefits (low VOC emissions) and superior performance. Basecoats, which contain special-effect substances and pigments, played a pivotal role in this trend. Furthermore, the growing demand for vehicles with superior coating and better aesthetic appearance has fueled the market growth.

Clearcoats are expected to witness a significant CAGR of 5.4% over the forecast period. They serve as the final layer in the coating system, providing a glossy, transparent finish. These coats enhance the appearance of vehicles by adding depth and shine, making them more visually appealing to consumers. In addition, clearcoats protect the underlying basecoat from UV radiation, oxidation, and environmental factors, contributing to the durability of the overall coating. Furthermore, as consumers increasingly seek personalized vehicles, the demand for unique colors and finishes grows. Clearcoats are crucial in achieving various effects, such as metallic, pearl, or matte finishes. Customization options drive the adoption of clearcoat products in original equipment manufacturers (OEM) and refinish applications.

Technology Insights

Waterborne coatings led the market and accounted for the largest revenue share in 2023 driven by the stringent environmental regulations that prompted the automotive industry to shift toward these coatings. These formulations have minimal volatile organic compound (VOC) emissions, which makes them more eco-friendly. These coatings offer advantages such as quick drying, ease of application, and compatibility with various substrates. Their high surface area and excellent adhesion properties have contributed to efficient coating processes in automotive manufacturing.

Furthermore, ongoing research and development have led to improved waterborne coating formulations. Innovations in resin chemistry, additives, and cross-linking agents enhanced performance, durability, and appearance. These technological advancements attracted manufacturers and drove market growth.

The UV-cured coatings segment is projected to grow at a CAGR of 6.2% over the forecast period. These coatings are considered environmentally friendly as they consist of 100% curable compositions that do not require solvent evaporation for drying. They reduce volatile organic compound (VOC) emissions. In addition, UV coatings have gained popularity due to their superior performance compared to other coatings. They cure instantly upon exposure to UV radiation, eliminating the need for drying time. Companies have increasingly adopted the usage of UV-coating, as it requires less drying time and offers low wastage due to precise application and fast curing.

Application Insights

Metals dominated the market and accounted for the largest revenue share of 71.0% in 2023 attributed to the increasing production of vehicles, particularly in emerging economies, which boosts the demand for metal coatings essential for protecting automotive components from corrosion and wear. In addition, the rise in consumer preferences for vehicle customization and personalization enhances the need for high-quality coatings. The shift towards electric and hybrid vehicles also necessitates advanced coatings that cater to specific performance requirements, further propelling market growth.

Plastics are expected to grow at the fastest CAGR during the forecast period. Automotive manufacturers have increasingly turned to plastics for lightweight components. These materials enhance fuel efficiency, reduce vehicle weight, and improve safety. Plastic-made airbags and bumpers contribute to occupant protection during collisions. Plastic offers weight reduction, design flexibility, corrosion resistance, cost reduction, greater durability, and recyclability. Their impact resistance, dimensional stability, and ability to dampen noise made them ideal for dashboards, door panels, and trim components.

End use Insights

Light vehicle OEM held the largest revenue share in 2023, owing to the increasing vehicle production, particularly in emerging markets, as manufacturers seek high-quality coatings for durability and aesthetics. The rising consumer demand for vehicle customization and advanced features further propels this segment. In addition, stricter environmental regulations are pushing OEMs to adopt eco-friendly coatings, while the shift towards electric vehicles necessitates innovative coating solutions that enhance performance and sustainability, driving overall market growth.

The automotive refinish segment is expected to grow at a CAGR of 5.4% during the forecast period. Consumers have increasingly opted for personalized vehicles, and automotive refinish coatings allow them to achieve their desired aesthetics, driving demand. Furthermore, the rise in road accidents has led to increased demand for vehicle repair and refinishing workshops. Consumers have increasingly used coatings to add an extra layer of protection, preventing flaky or peeling paints.

Regional Insights

The Asia Pacific automotive coatings market dominated the global market and accounted for the largest revenue share of 51.4% in 2023 attributed to the explosive growth in the automotive sector, particularly in emerging countries such as China, Japan, India, South Korea, and Thailand. The vehicle production and sales surge have directly impacted the demand for automotive coatings. Furthermore, the rising demand for lightweight, fuel-efficient automobiles has led to the development of customized coatings for these vehicles. In addition, stricter emission norms, such as those outlined in the Kyoto Protocol, prompted using lightweight materials, including plastics in paint.

China Automotive Coatings Market Trends

The automotive coatings market in China led the Asia Pacific market and held a substantial market share in 2023, owing to its large automobile production base. China is the largest automobile manufacturer and is expected to remain the leading manufacturer due to economic labor. Moreover, the relocation of manufacturing bases by companies such as Toyota, Audi, Skoda, Honda, Nissan, Volkswagen, Fiat, and Hyundai to China, owing to the availability of an affordable workforce, is anticipated to drive the market demand.

North America Automotive Coatings Market Trends

North America automotive coatings market accounted for a market share of 21.8% in 2023 owing to the presence of major vehicle companies coupled with rising demand for private and commercial vehicles. Increased adoption of cars with better appearance has resulted in major companies manufacturing vehicles offering premium coatings and durability. Despite challenges posed by volatile organic compound (VOC) regulations, the industry has adapted by focusing on eco-friendly coatings. Waterborne and UV-curable coatings gained prominence due to their lower VOC emissions.

The automotive coatings market in the U.S. is driven by the rising demand for commercial, private, and EV vehicles. Consumers have increasingly sought vehicles with attractive coatings and durable finishes. Furthermore, the rising adoption of vehicle customization and refurbishing has increased demand for automotive coatings.

Europe Automotive Coatings Market Trends

The Europe automotive coatings market held a significant market share in 2023 credited to the country’s well-established automobile manufacturing industry in countries including Germany, Sweden, Italy, France, and others, coupled with the rising sales in the sector. Furthermore, European consumers have increasingly sought visually appealing and customized vehicles. The demand for different shades and attractive coatings drove market growth. The rising implementation of coatings compliant with environmental regulations has further aided in the increased demand for environmentally friendly coatings.

Key Automotive Coatings Company Insights

The global automotive coatings market is intensely competitive. Some of the major companies in the market are Sherwin Williams, PPG Industries, Inc., AkzoNobel N.V., NIPSEA GROUP, and others. Companies have increasingly focused on continuous R&D activities and product development through strategic collaborations, mergers and acquisitions, and more.

-

Sherwin Williams specializes in manufacturing, distributing, and selling coatings, paints, floor coverings, and products for professional, commercial, industrial, and retail customers. Known for brands such as Sherwin-Williams and Valspar, they serve professional, commercial, and consumer customers worldwide.

-

PPG Industries, Inc., is a chemical company that manufactures and distributes paints, coatings, specialty materials, and optical products. Its global portfolio includes branded and private-label products, serving diverse construction, automotive, aerospace, marine coating, and packaging markets.

Key Automotive Coatings Companies:

The following are the leading companies in the automotive coatings market. These companies collectively hold the largest market share and dictate industry trends.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Akzo Nobel N.V.

- NIPSEA Group

- RPM International Inc.

- BASF SE

- Kansai Paint Co., Ltd.

- Asian Paints

- Berger Paints India

- Axalta Coating Systems, LLC

- FUJIKURA KASEI CO., LTD.

- KCC Corporation

Recent Developments

-

In February 2024, Sherwin-Williams General Industrial launched Duraspar Industrial Performance (IP) - a coating system designed for demanding markets. It combines the aesthetics of an automotive finish with rugged performance. Trusted by work truck manufacturers globally, Duraspar IP improves first-pass yield, reduces paint process time, and minimizes rework.

Automotive Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.4 billion

Revenue forecast in 2030

USD 33.4 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

The Sherwin-Williams Company; PPG Industries, Inc.; Akzo Nobel N.V.; NIPSEA Group; RPM International Inc.; BASF SE; Kansai Paint Co.,Ltd.; Asian Paints; Berger Paints India; Axalta Coating Systems, LLC; FUJIKURA KASEI CO.,LTD.; KCC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive coatings market report based on product, technology, application, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Primer

-

E-coat

-

Basecoat

-

Clearcoat

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Waterborne Coatings

-

Solventborne Coatings

-

Powder Coating

-

UV-Cured Coatings

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metal

-

Plastic

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Light Vehicle OEM

-

Commercial OEM

-

Automotive Refinish

-

-

Regional Outlook (Revenue, USD Million, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.