- Home

- »

- Automotive & Transportation

- »

-

Automotive Catalytic Converter Market Size, Share Report, 2030GVR Report cover

![Automotive Catalytic Converter Market Size, Share & Trends Report]()

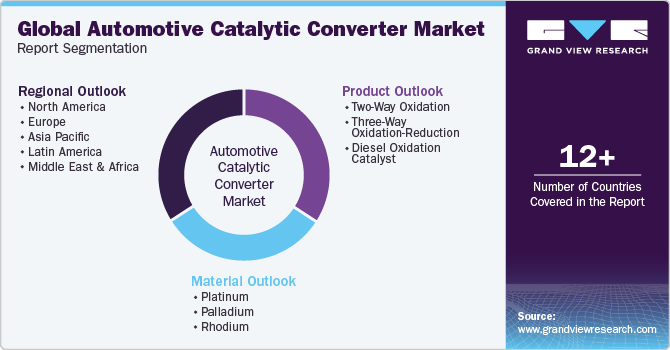

Automotive Catalytic Converter Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Two-Way Oxidation, Three-Way Oxidation-Reduction, Diesel Oxidation Catalyst), By Material, By Region, And Segment Forecasts

- Report ID: 978-1-68038-832-9

- Number of Report Pages: 77

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Catalytic Converter Market Summary

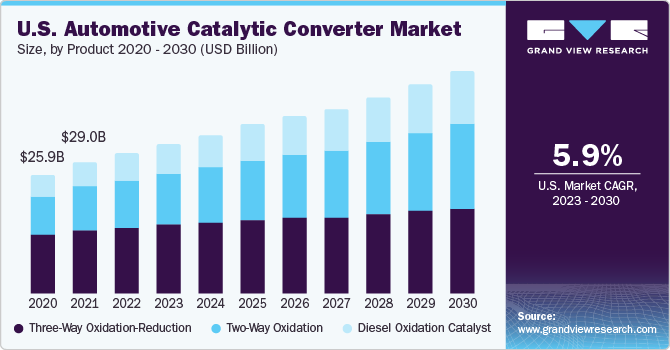

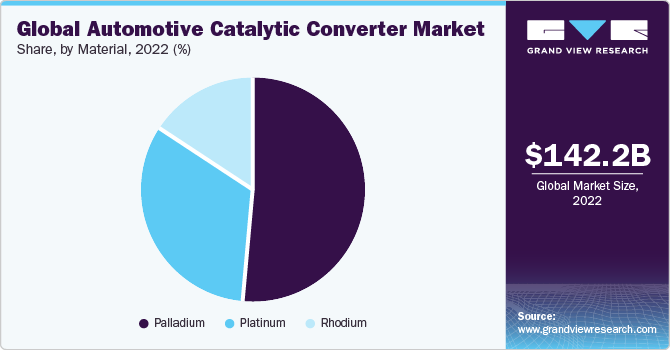

The global automotive catalytic converter market size was valued at USD 142.19 billion in 2022 and is projected to reach USD 277.53 billion by 2030, growing at a CAGR of 8.6% from 2023 to 2030. Technological advancements and increasing automobile production across emerging economies such as China and India are expected to drive industry growth over the forecast period. Strict emissions-related regulations by governments and authorities worldwide and increasing awareness among automobile users have positively impacted market growth.

Key Market Trends & Insights

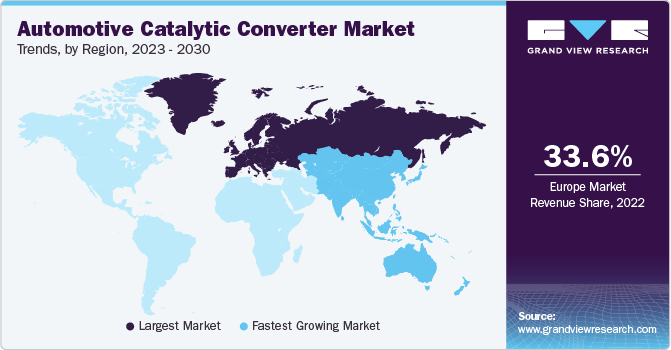

- Europe dominated the market and accounted for the largest revenue share of 33.6% in 2022..

- Asia Pacific is expected to register the highest CAGR of 12.7% over the forecast period

- Based on material, the palladium segment accounted for the largest revenue share of around 51.5% in 2022 and is expected to witness the fastest CAGR of 10.3% during the forecast period.

- Based on product, three-way oxidation-reduction segment captured the largest revenue share of over 47.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 142.19 Billion

- 2030 Projected Market Size: USD 277.53 Billion

- CAGR (2023-2030): 8.6%

- Europe: Largest market in 2022

Automotive transportation is the largest source of air pollution and has elevated to be classified as a global concern. With increasing number of vehicles on the road, reducing emissions is crucial for better air quality. A catalytic converter forms one of the most critical components used in every automobile produced to reduce the toxicity of the emissions in a vehicle by removing harmful substances in the exhaust systems.

Emission standards in the U.S. regulated by the Environmental Protection Agency (EPA) and the EuroV and EuroVI in the European Union strictly define the acceptable limits for automotive exhaust emissions for every vehicle. Parts manufacturers are setting up their production units and R&D centers in European countries owing to the vast growth avenues for the industry in the region. For instance, in April 2023, the U.S. Environmental Protection Agency (EPA) announced new tailpipe emission limits. These regulations are aimed at significantly reducing greenhouse gas emissions from vehicles. According to the EPA, if these rules are implemented, it is estimated that approximately 67% of all new light-duty vehicles, including passenger cars, trucks, and SUVs, sold in the U.S. by the 2032 model year would be required to be all-electric.

Issues pertaining to high R&D expenditures are expected to hinder market growth over the forecast period. Increased prominence of electric and hybrid vehicles that produce minimal exhaust emissions and do not require installing such converters is expected to challenge industry growth.

Product Insights

Based on the product, the global automotive catalytic converter market is segmented into two-way oxidation, three-way oxidation-reduction, and diesel oxidation catalyst. These components are exclusively responsible for the conversion of oxides of nitrogen to nitrogen and oxygen along with the oxidation of un-burnt hydrocarbons and carbon monoxide to carbon dioxide and water.

The three-way oxidation-reduction segment captured the largest revenue share of over 47.3% in 2022. Advancements in material science and catalytic converter technology have played a significant role in the growth of the three-way oxidation-reduction segment. Ongoing research and development efforts have led to the development of novel catalyst formulations and improved converter designs, resulting in higher conversion efficiency and durability. These technological advancements attract automotive manufacturers keen on incorporating the latest emission control systems.

Diesel oxidation catalysts are expected to grow significantly over the forecast period. The diesel Oxidation Catalyst (DOC) type is exclusively used for diesel engines across various vehicle segments. Diesel engine exhausts contain particulate matter, diesel soot, aerosols such as ash particulates, metallic abrasion particles, and sulfates and silicates. They are cleaned up by a soot trap or diesel particulate filter in the DOC-type converters, thus releasing exhausts free of particulates. However, the declining acceptance of diesel engine vehicles and rising adoption of petrol, hybrid, and EVs has restrained the demand for DOC-type converters.

The two-way oxidation segment is estimated to register the fastest CAGR of 10.6% over the forecast period. The increasing popularity of gasoline-powered vehicles, particularly in emerging markets, is driving the expansion of the two-way oxidation segment. As the number of vehicles on the roads rises, there is a growing demand for efficient emission control systems. Two-way oxidation converters have emerged as a cost-effective solution for gasoline engines, making them the preferred choice for automotive manufacturers.

Material Insights

Based on material, the market is segmented into platinum, palladium, and rhodium. The palladium segment accounted for the largest revenue share of around 51.5% in 2022 and is expected to witness the fastest CAGR of 10.3% during the forecast period. Platinum acts as a good oxidation catalyst and exhibits decent resistance to poisons such as sulfur, phosphorus, or lead. However, low activity for converting nitrogen oxides, sensitivity towards high-temperature conditions, and high price compared to palladium have resulted in substituting platinum for rhodium and palladium.

Palladium has excellent activity for the oxidation of hydrocarbons and very good thermal stability and is currently the cheapest of the three metals. However, its sensitivity towards poisons in vehicular emissions restricts its use in such automotive components.

The platinum segment is expected to grow significantly, with a CAGR of 6.8% during the forecast period. Platinum acts as a good oxidation catalyst and exhibits decent resistance to poisons such as sulfur, phosphorus, or lead. However, low activity for converting nitrogen oxides, sensitivity towards high-temperature conditions, and high price compared to palladium have resulted in substituting platinum for rhodium and palladium.

Rhodium dominated the catalyst material segment and is growing at a significant market share in 2022. The metal shows the highest activity towards removing nitrogen oxides from exhaust emissions and has considerable activity for the oxidation of hydrocarbons and carbon monoxides.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 33.6% in 2022. The presence of major automobile manufacturers has led the European Union to dominate the industry. Increasing demand for premium European car brands such as Volkswagen, BMW, and Mercedes-Benz have led to the growth of automotive ancillaries in the region.

Asia Pacific is expected to register the highest CAGR of 12.7% over the forecast period. Increasing vehicle penetration driven by the overall improvement in the lifestyle in developing countries from the Asia Pacific region, such as India, is expected to drive the automobile industry's growth in the region. The surge in automobile manufacturing and stringent emissions norms are expected to drive the region's market growth.

Key Companies & Market Share Insights

The market is highly competitive, and the players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in January 2022, BM Catalysts Limited announced its business expansion to strengthen its capacity for product supply across Europe, catering to the growing demand. The company has a wide reach, exporting to over 35 countries globally. By making consistent investments and prioritizing an extensive product development program, BM Catalysts Limited is well-positioned to anticipate and respond to future trends in terms of products and technology. With the anticipated rise in demand for emissions control devices in the coming years, this expanded capacity will enable BM Catalysts to expand its market presence and effectively meet the increased demand.

Additionally, the adoption of modern ways of distribution, such as e-commerce and online catalogs by certain vendors, has added value to their product offerings and distribution network. Manufacturers are rapidly increasing their regional presence catering to automobile manufacturers across the globe and forming alliances with raw material and technology suppliers as their key growth strategy to make their presence felt in the industry. The following are some of the major participants in the global automotive catalytic converter market:

-

BASF SE

-

BENTELER International Aktiengesellschaft

-

BM Catalysts Limited

-

BOSAL

-

Marelli Corporation

-

Calsonic Kansei

-

Deccats

-

Eberspächer

-

European Exhaust & Catalyst Ltd

-

FORVIA Faurecia

-

HJS Emission Technology GmbH & Co. KG

-

Jetex Exhausts Ltd

-

Katcon SA de CV

-

Klarius Products Ltd

-

Marelli Holdings Co., Ltd.

-

Tenneco, Inc.

Recent Developments

-

In May 2022, the Connecticut Government enacted Public Act 22-43, which sets a set of guidelines regulating the buying and selling of automotive catalytic converters by different entities such as automobile recyclers, scrap catalytic converter processors, junkyard dealers and owners, and motor vehicle repair shops.

-

In April 2021, BASF SE announced the expansion of its platinum group metals refining facility located in Seneca, Carolina. The primary objective of this expansion is to increase the company's capacity to recycle precious metals obtained from used automobile catalytic converters and other sources. BASF invested double-digit millions of dollars in capital improvements to achieve this.

-

In March 2020, BASF SE, in collaboration with Sibanye-Stillwater and Impala Platinum, announced the launch of Tri-Metal Catalyst technology. This cutting-edge development allows for partially replacing expensive palladium with more affordable platinum in light-duty gasoline vehicles while maintaining compliance with emissions regulations.

-

In March 2020, Vitesco Technologies, the powertrain division of Continental, signed a contract with a prominent European manufacturer to provide electric heating components for diesel catalytic converters. The company showcased impressive performance, achieving a 40% reduction in NOX emissions and a 3% decrease in CO2 emissions for vehicles equipped with diesel engine products.

-

In February 2020, Tenneco Inc. expanded its product range in February 2020 by introducing a variety of new replacement catalytic converters, mufflers, hardware, and accessories. This extension of offerings allowed Tenneco to provide coverage for over 16 million vehicles currently operating in North America.

Automotive Catalytic Converter Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 155.92 billion

Revenue forecast in 2030

USD 277.53 billion

Growth rate

CAGR of 8.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

BASF SE; BENTELER International Aktiengesellschaft; BM Catalysts Limited; BOSAL; Marelli Corporation; Calsonic Kansei; Deccats; Eberspächer; European Exhaust & Catalyst Ltd; FORVIA Faurecia; HJS Emission Technology GmbH & Co. KG; Jetex Exhausts Ltd; Katcon SA de CV; Klarius Products Ltd; Marelli Holdings Co., Ltd.; Tenneco; Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Catalytic Converter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive catalytic converter market based on product, material, and region:

-

Product Outlook (Revenue in USD Million, 2017 - 2030)

-

Two-Way Oxidation

-

Three-Way Oxidation-Reduction

-

Diesel Oxidation Catalyst

-

-

Material Outlook (Revenue in USD Million, 2017 - 2030)

-

Platinum

-

Palladium

-

Rhodium

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive catalytic converter market size was estimated at USD 142.19 billion in 2022 and is expected to reach USD 155.92 billion in 2023.

b. The global automotive catalytic converter market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 277.53 billion by 2030.

b. Europe dominated the automotive catalytic converter market with a share of over 33% in 2022. The presence of major automobile manufacturers has led the European Union to dominate the industry. Increasing demand for premium European car brands such as Volkswagen, BMW, and Mercedes-Benz has led to the growth of automotive ancillaries in the region.

b. Some key players operating in the automotive catalytic converter market include Faurecia, BASF Catalysts, Eberspaecher, Magneti Marelli, and Tenneco, among others

b. Technological advancements and increasing automobile production across emerging economies such as China and India are expected to drive the industry growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.