Automotive Bushing Market Size, Share & Trends Analysis Report By Vehicle Type (Passenger, LCV, HCV), By Application (Engine, Chassis, Interior), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-439-1

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Automotive Bushing Market Size & Trends

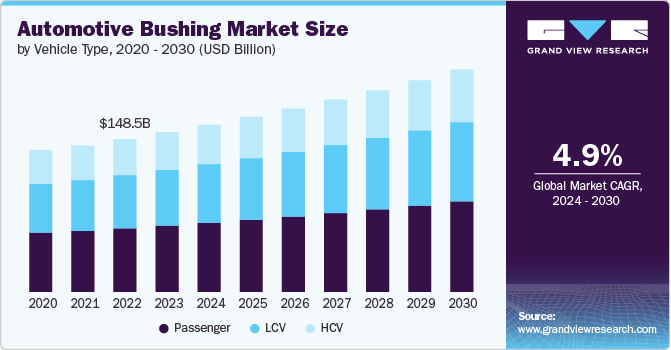

The global automotive brushing market was estimated at USD 155.24 billion in 2023 and is forecasted to grow at a CAGR of 4.9% over the forecast period. One major factor driving the demand for automotive bushings in the global market is the increasing focus on vehicle safety and performance. As automotive manufacturers and consumers emphasize enhancing vehicle handling, ride comfort, and safety features, the demand for high-quality bushings-essential components in the suspension system that help absorb shocks and reduce vibrations-has grown. These improvements contribute to a smoother driving experience and overall vehicle stability, leading to higher demand for advanced bushing solutions.

Automotive bushings are critical components in a vehicle's suspension system, designed to reduce vibration, noise, and impact between metal parts. These bushings are typically made from a combination of rubber and metal, providing a cushion that absorbs shocks and minimizes the transmission of road imperfections to the vehicle's frame. By isolating different parts of the suspension system, bushings help maintain smooth and controlled handling, ensuring the ride remains comfortable and stable. The types of bushings can vary, including control arm bushings, sway bar bushings, and engine mount bushings, each serving a specific function within the vehicle's architecture.

In contemporary automotive design, bushings are used to enhance comfort and improve vehicle performance and safety. Modern vehicles incorporate advanced materials and designs, such as polyurethane and silicone-based bushings, which offer greater durability and performance compared to traditional rubber. Furthermore, innovations in bushing technology aim to reduce weight and increase fuel efficiency by optimizing the materials used. Manufacturers also use computer-aided design (CAD) and simulation techniques to fine-tune bushing characteristics, ensuring they meet stringent performance and safety standards while enhancing overall driving dynamics.

Two major driving factors influencing the development and use of automotive bushings today are advancements in material science and increasing consumer demand for enhanced vehicle performance and comfort. As high-strength composites and synthetic elastomers become more available, they allow for bushings that offer improved durability, reduced noise, and better performance under various driving conditions. In addition, consumer expectations for a smooth, quiet, and responsive ride drive manufacturers to continually innovate and refine bushing technology to meet high standards of comfort and handling.

However, one significant restraining factor is the cost of advanced bushing materials and manufacturing processes. While high-performance bushings can provide substantial benefits, their production can be more expensive than traditional rubber bushings. This increased cost can impact the vehicle's overall price, making it a consideration for manufacturers and consumers. Balancing performance and cost remains a challenge, as manufacturers must weigh the benefits of advanced bushings against their impact on vehicle affordability and market competitiveness.

Vehicle Type Insights

Based on vehicle type, the market is segmented into passenger, LCV, and HCV. Passengers dominated the market with a revenue share of 41.45% in 2023 and is expected to grow significantly over the forecast period. In passenger vehicles, automotive bushings are pivotal in ensuring a smooth and comfortable driving experience. These vehicles, which include sedans, SUVs, and hatchbacks, heavily rely on bushings to isolate vibrations and noise from the road, thereby enhancing ride quality. The most common applications are control arms, sway bars, and engine mounts. High-quality bushings in passenger vehicles contribute to better handling, improved alignment, and reduced cabin noise, aligning with the consumer demand for a refined driving experience. As passenger vehicles increasingly integrate advanced suspension systems and strive for higher fuel efficiency, developing durable and high-performance bushings becomes crucial to maintaining comfort and functionality.

In light commercial vehicles, such as delivery vans and small trucks, automotive bushings are essential for balancing load-bearing capacity with ride comfort. These vehicles often experience higher levels of stress and wear due to frequent stops, varying loads, and urban driving conditions. Consequently, bushings in light commercial vehicles need to be more robust to withstand the demands of heavy-duty use while still providing adequate vibration damping and noise reduction. The application of advanced materials and design improvements in bushings helps extend the lifespan of these components, which is vital for minimizing maintenance costs and ensuring reliable operation in commercial environments where vehicle downtime can be costly.

Heavy commercial vehicles, including large trucks and buses, utilize automotive bushings in a more demanding context where durability and performance are of utmost importance. In these vehicles, bushings are subjected to extreme loads and harsh driving conditions, such as rough roads and high-speed travel. As a result, bushings for heavy commercial vehicles are designed to be exceptionally durable and resistant to wear and tear. They must also effectively manage vibrations and noise to enhance driver comfort and vehicle stability. Innovations in bushing materials and designs, such as high-strength composites and advanced elastomers, are critical in addressing the unique challenges faced by heavy commercial vehicles, ensuring they can operate efficiently and reliably under severe conditions.

Application Insights

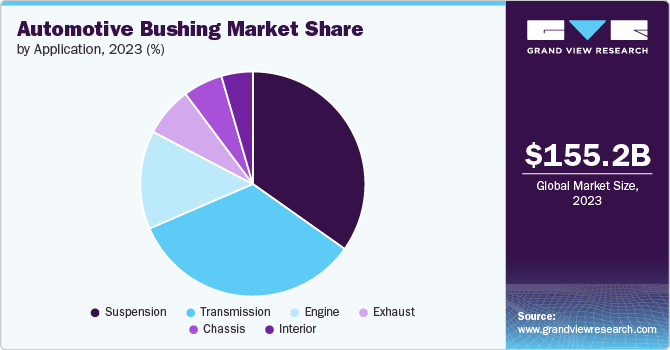

Based on application, the market is segmented into suspension, engine, chassis, interior, exhaust, and transmission. Among these, suspension accounted for the largest revenue share of 39.37% in 2023 and is expected to grow fastest over the forecast period. In the suspension system of an automobile, automotive bushings are crucial for managing the interface between various suspension components, such as control arms, sway bars, and struts. These bushings provide a buffer that absorbs shocks and vibrations from the road, enhancing ride comfort and vehicle handling. By reducing the transfer of road imperfections and minimizing noise, bushings in the suspension system contribute significantly to the vehicle's overall stability and smoothness. In modern vehicles, advanced bushing materials and designs improve performance and durability, addressing the need for comfort and responsive handling in increasingly sophisticated suspension systems.

In transmission applications, automotive bushings support and isolate the transmission system from the vehicle’s chassis. Transmission bushings are typically found in the transmission mount, where they help absorb vibrations and shocks that arise during engine operation and gear shifts. This isolation is crucial for reducing drivetrain noise and improving overall vehicle refinement. High-performance bushings in transmission systems help ensure precise gear engagement and smooth power delivery, which are essential for everyday driving and high-performance applications. As vehicles increasingly incorporate advanced transmission technologies, such as dual-clutch and continuously variable transmissions (CVTs), developing more resilient and effective bushings becomes increasingly important to maintain optimal performance and driver comfort.

For engine applications, automotive bushings are used primarily in engine mounts to isolate engine vibrations and reduce the transfer of engine noise to the vehicle’s cabin. Engine mounts with high-quality bushings ensure the engine remains securely positioned while absorbing the vibrations and stresses generated during operation. This contributes to a quieter, more refined driving experience while protecting other vehicle components from undue stress. As automotive technology advances, including the introduction of electric and hybrid powertrains, the role of engine bushings is evolving. For instance, electric vehicles with different vibration characteristics than traditional internal combustion engines require specialized bushings to manage their powertrains' unique demands effectively.

Regional Insights

The automotive bushing market in North America is expected to grow at the fastest CAGR during the forecast period. In North America, the consumption of automotive bushings is influenced by a strong focus on vehicle performance and consumer comfort. The U.S. automotive market, with its diverse range of vehicles from heavy-duty trucks to luxury sedans, drives demand for high-quality bushings that offer durability and enhanced ride quality. The popularity of pickup trucks and SUVs in North America has led to increased use of robust bushings designed to handle larger loads and off-road conditions. For example, the American automotive aftermarket industry frequently upgrades bushings to improve handling and comfort in performance vehicles and trucks, reflecting a consumer preference for high-performance enhancements and long-term durability.

U.S. Automotive Bushing Market Trends

In the U.S., specific trends within the automotive bushing market focus on performance and customization. A strong aftermarket sector characterizes the U.S. automotive market. Consumers often seek to enhance their vehicles with upgraded bushings that improve handling, reduce noise, and extend component lifespan. This trend is evident in the popularity of aftermarket performance bushings for sports cars and trucks, designed to provide better control and comfort. Moreover, the rise of electric vehicles (EVs) in the U.S. market is driving demand for specialized bushings that address the unique characteristics of electric powertrains. Companies are developing advanced bushings to cater to the growing segment of EVs and hybrid vehicles, ensuring that they meet the specific needs of these new technologies.

Asia Pacific Automotive Bushing Market Trends

The automotive brushing market in Asia Pacific dominated in 2023 with a revenue share of 60.38% and is further expected to grow significantly over the forecast period. In the Asia Pacific region, the consumption of automotive bushings is experiencing significant growth due to the burgeoning automotive industry and increasing vehicle production rates. Countries like China and India are major drivers of this trend, with robust automotive manufacturing sectors and rising vehicle ownership. Expanding passenger and commercial vehicle segments in these markets have increased demand for advanced bushing technologies that improve riding comfort and vehicle performance. For instance, China's booming electric vehicle (EV) market has spurred interest in bushings catering to electric powertrains' unique vibration characteristics, leading to innovations in materials and design tailored to these new vehicle types.

Europe Automotive Bushing Market Trends

The automotive bushing market in Europe is expected to grow significantly over the forecast period. Europe, known for its emphasis on automotive engineering and environmental standards, is witnessing trends toward high-performance and eco-friendly automotive bushings. The European market strongly emphasizes reducing vehicle emissions and improving fuel efficiency, leading to increased demand for lightweight and durable bushings. In addition, stringent noise and vibration regulations drive the adoption of advanced bushing materials that enhance comfort and compliance with environmental standards. European automotive manufacturers are also investing in bushings that support the growing popularity of hybrid and electric vehicles. For instance, the push for lower carbon footprints has led to innovations in bushings that reduce the overall weight of vehicles and improve the efficiency of electric powertrains.

Key Automotive Bushing Company Insights

Some of the key players operating in the market are ContiTech Deutschland GmbH, Schaeffler AG, Powerflex USA, and MEYLE AG, among others:

-

ContiTech Deutschland GmbH, a division of Continental AG, excels in the automotive sector with a diverse range of high-quality automotive bushing products. Specializing in vibration control and noise reduction, ContiTech’s bushings are designed to enhance vehicle performance and comfort. Their portfolio includes engine mountings, transmission mounts, and suspension bushings, all engineered to meet stringent OEM standards. Leveraging advanced materials and innovative technologies, ContiTech’s automotive bushings offer superior durability and performance, contributing to smoother rides and extended vehicle life.

-

Schaeffler AG is a leading global supplier of automotive components, including a comprehensive range of automotive bushings integral to their product lineup. Their automotive bushing portfolio encompasses solutions for engine, transmission, and suspension systems, focusing on optimizing vehicle dynamics and reducing NVH (Noise, Vibration, and Harshness). Schaeffler’s bushings are crafted from high-performance materials and incorporate cutting-edge technology to ensure reliability and longevity. With a strong emphasis on precision engineering, Schaeffler's products are designed to meet the demanding requirements of modern vehicles while enhancing overall driving comfort.

-

Powerflex USA is renowned for its innovative approach to automotive bushing solutions, offering a wide selection of high-performance polyurethane bushings. Unlike traditional rubber bushings, Powerflex’s products provide superior stiffness and durability, making them ideal for high-performance and motorsport applications. Their extensive range includes options for suspension, engine, and transmission mounts designed to enhance handling and stability while reducing the negative effects of wear and tear. Powerflex USA’s commitment to quality and performance ensures that their bushings deliver exceptional results, catering to enthusiasts and professional drivers alike.

-

MEYLE AG, a distinguished name in the automotive aftermarket industry, offers a broad portfolio of automotive bushings tailored to enhance vehicle safety and performance. Their product range includes various suspension and engine bushings engineered for optimal comfort and durability. MEYLE’s bushings are manufactured using advanced materials and technology to meet high-quality standards and ensure longevity under rigorous driving conditions. By focusing on precision and reliability, MEYLE AG delivers automotive components that support everyday driving and demanding automotive applications, reinforcing its reputation for excellence in the aftermarket sector.

GYCX Factory, Teknorot, and Kesaria Rubber Industries Pvt. Ltd. are some of the emerging market participants.

-

GYCX Factory is a prominent automotive parts industry player specializing in a diverse range of high-performance automotive bushings. Their portfolio includes engine, suspension, and transmission bushings designed to provide superior durability and enhanced vehicle stability. Leveraging state-of-the-art manufacturing techniques and high-quality materials, GYCX Factory produces bushings that meet rigorous industry standards and deliver exceptional reliability under various driving conditions. The company's commitment to innovation and quality ensures that its automotive bushing solutions are both effective and long-lasting, catering to the needs of global automotive manufacturers and aftermarket customers.

-

Teknorot is a leading manufacturer of automotive suspension and steering components with a robust portfolio of high-quality automotive bushings. Their product range includes advanced solutions for engine mounts, suspension arms, and transmission supports, all engineered to improve vehicle handling and ride comfort. Teknorot's bushings are crafted using cutting-edge technology and premium materials to ensure optimal performance and durability. By focusing on precision and innovation, Teknorot delivers products that meet and exceed the expectations of automotive OEMs and aftermarket suppliers, solidifying its reputation as a trusted name in the automotive parts industry.

-

Kesaria Rubber Industries Pvt. Ltd. is a well-established manufacturer specializing in a wide array of automotive bushings that enhance vehicle performance and comfort. Their comprehensive product line includes engine, suspension, and transmission bushings, which offer superior vibration control and noise reduction. Kesaria Rubber Industries focuses on using high-quality rubber compounds and advanced manufacturing processes to ensure the durability and reliability of their bushings. Committed to innovation and customer satisfaction, Kesaria Rubber Industries provides automotive solutions that support high-performance and everyday driving needs, catering to a diverse global market.

Key Automotive Bushing Companies:

The following are the leading companies in the automotive bushing market. These companies collectively hold the largest market share and dictate industry trends.

- Powerflex USA

- GYCX Factory

- MEYLE AG

- ContiTech Deutschland GmbH

- Vogelsang Fastener Solutions

- Schaeffler AG

- Teknorot

- Barberi Rubinetterie Industriali S.r.l.

- Xiamen Liangju Rubber Technology Co., Ltd.

- Kesaria Rubber Industries Pvt. Ltd.

Recent Developments

-

In June 2024, Bosch Automotive Service Solutions LLC introduced two new tool kits designed for the removal and installation (R&I) of single-wrap and double-wrap heavy-duty suspension bushings. The latest offerings include the Suspension Bushing Kit with Pump and the Suspension Bushing Adapter Kit. These tool kits efficiently replace worn, rusted, or seized heavy-duty suspension bushings, minimizing the risk of heat damage or other complications. With a 25-ton capacity, these tools significantly reduce the time required for each job, streamlining the process of removing and installing Pivot and D-pin bushings.

-

In January 2024, Rheinmetall secured a significant new contract for engine components from a prominent, internationally operating vehicle manufacturer. The order comprises rocker arm bushings for various engine variants within the heavy transport sector. The value of the contract is estimated to be in the lower two-digit million-euro range.

-

In 2024, Jiangyin Fangchen Auto Parts Co., Ltd. introduced its latest Suspension Bushing Sets designed for Mercedes-Benz, BMW, and Audi series vehicles.

Automotive Bushing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 162.42 billion |

|

Revenue forecast in 2030 |

USD 215.98 billion |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Powerflex USA; GYCX Factory; MEYLE AG; ContiTech Deutschland GmbH; Vogelsang Fastener Solutions; Schaeffler AG; Teknorot; Barberi Rubinetterie Industriali S.r.l.; Xiamen; Kesaria Rubber Industries Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Bushing Market Report Segmentation

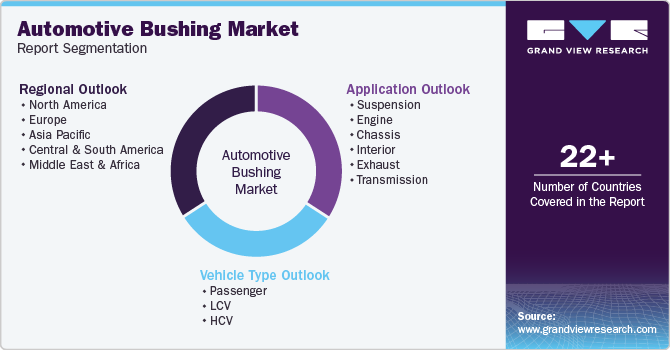

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive bushing market based on vehicle type, application, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger

-

LCV

-

HCV

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Suspension

-

Engine

-

Chassis

-

Interior

-

Exhaust

-

Transmission

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive bushing market size was estimated at USD 155.24 billion in 2023 and is expected to reach USD 162.41 billion in 2024.

b. The global automotive bushing market is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030 to reach USD 215.98 billion by 2030.

b. Asia Pacific accounted for largest revenue share of 60.38% in 2023. The consumption of automotive bushings is experiencing significant growth due to the burgeoning automotive industry and increasing vehicle production rates

b. Some key players operating in the automotive bushing market include Powerflex USA, GYCX Factory, MEYLE AG, ContiTech Deutschland GmbH, Vogelsang Fastener Solutions, Schaeffler AG, Teknorot, Barberi Rubinetterie Industriali S.r.l., Xiamen Liangju Rubber Technology Co., Ltd., and Kesaria Rubber Industries Pvt. Ltd.

b. One major factor driving the demand for automotive bushings in the global market is the increasing focus on vehicle safety and performance.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."