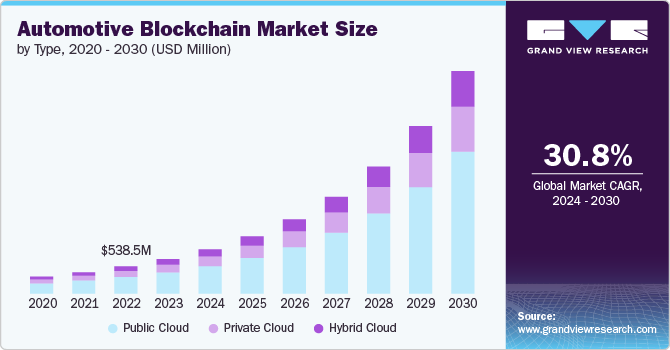

Automotive Blockchain Market Size, Share & Trends Analysis Report By Type (Public Cloud, Private Cloud, Hybrid Cloud), By Component, By Mobility, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-356-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Automotive Blockchain Market Size & Trends

The global automotive blockchain market size was valued at USD 686.7 million in 2023 and is expected to grow at a CAGR of 30.8% from 2024 to 2030.The complexity of the automotive supply chain, involving multiple tiers of suppliers and manufacturers, necessitates a robust system for tracking and verifying parts and materials. Blockchain technology offers unparalleled transparency and immutability, allowing stakeholders to trace components from origin to installation. This reduces the risk of counterfeit parts and enhances trust among manufacturers, suppliers, and consumers. By providing a transparent record of each transaction, blockchain ensures that all parties have access to reliable data, streamlining operations and improving accountability.

The automotive industry handles a vast number of financial transactions, from purchasing raw materials to consumer financing for vehicle purchases. Blockchain's decentralized nature reduces the risk of fraud and errors in financial transactions by creating a secure, immutable ledger. Smart contracts automate payment processes, ensuring timely and accurate execution of transactions without the need for intermediaries. This not only reduces costs but also accelerates transaction times, providing a more efficient financial ecosystem within the automotive industry.

One of the significant challenges in the automotive market is ensuring the accuracy of vehicle history reports. Blockchain technology can store an immutable record of a vehicle's lifecycle, including manufacturing details, ownership history, and maintenance records. This transparency empowers consumers to make informed decisions when buying used cars and helps manufacturers maintain a reliable database of their products. By reducing the incidence of fraud and misrepresentation, blockchain fosters greater trust and integrity in the vehicle resale market, thereby contributing to the growth of the market.

The rise of autonomous and connected vehicles demands a secure and efficient way to handle vast amounts of data generated by these technologies. Blockchain can securely record and manage data from vehicle sensors, navigation systems, and communication networks. This ensures the integrity and security of data crucial for autonomous driving and real-time vehicle tracking. Additionally, blockchain facilitates secure interactions between vehicles and infrastructure, enhancing the overall safety and efficiency of autonomous transportation systems.

Environmental and ethical considerations are becoming increasingly important in the automotive industry. Blockchain technology can track the sourcing of raw materials, ensuring they meet environmental standards and are ethically produced. By providing an immutable record of the supply chain, blockchain helps manufacturers adhere to regulatory requirements and consumer expectations for sustainability. This not only enhances the brand reputation of automakers but also contributes to the global effort to promote environmentally friendly and socially responsible manufacturing practices.

Type Insights

Based on type, the public cloud segment led the market and accounted for 61.8% of the global revenue in 2023. The segment is driven by its scalability and cost-effectiveness. Automotive manufacturers are increasingly adopting public cloud solutions for blockchain to leverage shared infrastructure and reduce capital expenditures. This trend is fueled by the need for enhanced collaboration across geographically dispersed supply chains and the desire to streamline operations through centralized data management. Furthermore, public cloud solutions offer flexibility and agility, allowing manufacturers to quickly deploy and scale blockchain applications to meet evolving business needs.

The private cloud segment is expected to register significant growth from 2024 to 2030. The private cloud segment is witnessing steady adoption due to its focus on data security and compliance. Automotive companies opt for private cloud solutions to maintain greater control over sensitive data and ensure regulatory adherence within their supply chains. This segment emphasizes customizable infrastructure and dedicated resources, catering specifically to the stringent requirements of automotive OEMs and suppliers.

Component Insights

The infrastructure & protocols segment accounted for the largest market revenue share in 2023. The infrastructure & protocols segment of the automotive blockchain market is witnessing rapid advancements driven by the need for robust and scalable blockchain frameworks. Automotive manufacturers and suppliers are increasingly investing in foundational infrastructure such as distributed ledger technology (DLT) platforms and consensus mechanisms to establish secure and transparent transaction networks. This segment focuses on enhancing the efficiency of supply chain operations by providing reliable data storage and transaction processing capabilities.

The middleware segment is expected to grow significantly from 2024 to 2030. The middleware segment is evolving to address the complexities of integrating blockchain technology with existing IT infrastructures. Middleware solutions act as intermediaries between applications and infrastructure components, facilitating data exchange and communication across diverse platforms. Automotive OEMs are increasingly adopting middleware solutions to streamline blockchain implementations and enhance interoperability between disparate systems. This segment emphasizes the development of application programming interfaces (APIs) and integration frameworks that simplify the deployment and management of blockchain-based applications.

Mobility Insights

The personal mobility segment accounted for the largest market revenue share in 2023. The personal mobility segment is experiencing significant growth as consumer preferences shift towards shared and connected vehicles. Blockchain technology is increasingly integrated into personal mobility solutions to enhance security, transparency, and efficiency in services such as ride-sharing and vehicle rentals. Consumers are drawn to blockchain-enabled platforms that offer immutable records of vehicle usage, transparent pricing models, and enhanced trust between users and service providers.

The commercial mobility segment is expected to grow significantly from 2024 to 2030. The commercial mobility segment of the automotive blockchain market is evolving to meet the unique challenges and opportunities within the logistics and fleet management sectors. Businesses are increasingly adopting blockchain to optimize supply chain transparency, track vehicle maintenance records, and streamline cross-border logistics operations. Blockchain technology facilitates real-time data sharing among stakeholders, enabling greater efficiency in fleet management, route optimization, and compliance monitoring. Moreover, commercial mobility providers are exploring blockchain-based solutions to mitigate fraud, enhance asset utilization, and improve overall operational resilience.

Application Insights

The supply chain segment accounted for the largest market revenue share in 2023. Blockchain technology is revolutionizing supply chain management by providing immutable records of transactions, improving traceability of parts and components, and reducing counterfeiting risks. Automotive manufacturers and suppliers are increasingly leveraging blockchain to streamline procurement processes, ensure compliance with regulatory standards, and optimize inventory management. Furthermore, blockchain enables real-time tracking of goods, facilitating proactive decision-making and minimizing supply chain disruptions.

The mobility solutions segment is expected to grow significantly from 2024 to 2030. Blockchain technology is being integrated into mobility platforms to enable secure and efficient peer-to-peer transactions, vehicle sharing, and autonomous vehicle coordination. Consumers and businesses are increasingly adopting blockchain-enabled mobility solutions for enhanced data privacy, seamless integration across transportation modes, and improved user experience. Moreover, blockchain facilitates the development of smart contracts and decentralized applications (DApps) that automate payments, enforce service agreements, and optimize resource allocation in shared mobility scenarios.

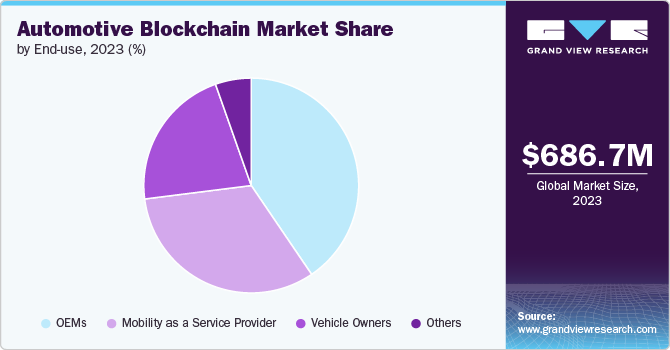

End Use Insights

The OEMs segment accounted for a significant market revenue share in 2023. Original Equipment Manufacturers (OEMs) are integrating blockchain technology to streamline procurement processes, track components through the manufacturing lifecycle, and authenticate parts authenticity. Blockchain's decentralized ledger ensures immutable records, reducing fraud risks and enhancing data integrity across the production and distribution chain. Furthermore, OEMs are exploring blockchain for warranty management, enabling seamless tracking and validation of warranty claims to improve customer service and satisfaction. As OEMs continue to digitize and optimize their operations, blockchain is poised to play a pivotal role in fostering innovation and competitiveness in the automotive industry.

The mobility as a service provider segment is expected to register significant growth from 2024 to 2030. The mobility as a service provider solutions segment is expanding rapidly, driven by the rise of shared mobility models and the demand for integrated, efficient transportation solutions. Mobility as a service providers are leveraging blockchain to create seamless, secure platforms for booking rides, managing payments, and ensuring data privacy. Blockchain enhances trust among users and service providers by enabling transparent transaction records and secure identity management.

Regional Insights

North America automotive blockchain market dominated the global market and accounted for 34.85% in 2023. In North America, the automotive blockchain market is driven by a strong focus on technological innovation and regulatory compliance. The region's advanced automotive industry is leveraging blockchain to enhance supply chain transparency, improve vehicle history tracking, and ensure the ethical sourcing of materials. The adoption of electric and autonomous vehicles is also propelling the need for secure and efficient data management solutions, which blockchain technology provides. Additionally, the robust financial services sector in North America is utilizing blockchain to streamline automotive financing and insurance processes.

U.S. Automotive Blockchain Market Trends

The automotive blockchain market in the U.S. is anticipated to register significant growth from 2024 to 2030. The U.S. stands out as a key player in the automotive blockchain market, driven by its leadership in both the automotive and technology sectors. Blockchain is being used to tackle issues like counterfeit parts, vehicle identity verification, and secure financial transactions. The adoption of autonomous vehicles and the push towards electric mobility is further accelerating the need for blockchain solutions to manage data integrity and supply chain transparency.

Europe Automotive Blockchain Market Trends

The automotive blockchain market Europe is poised for significant growth from 2024 to 2030. Europe's automotive blockchain market is experiencing growth due to the region's stringent regulatory environment and commitment to sustainability. European automakers are adopting blockchain to comply with regulations on emissions and to ensure the ethical sourcing of raw materials. The region's emphasis on green technology and electric vehicles drives the need for blockchain solutions to manage charging infrastructure and track CO2 emissions. Furthermore, the integration of blockchain with existing supply chain systems is enhancing operational efficiency and fostering trust among stakeholders across the automotive ecosystem.

Asia Pacific Automotive Blockchain Market Trends

The automotive blockchain market in Asia Pacific is poised for significant growth from 2024 to 2030. In the Asia Pacific region, the automotive blockchain market is fueled by rapid technological advancements and the expansion of the automotive sector. Countries like China, Japan, and South Korea are at the forefront of adopting blockchain for supply chain management, vehicle tracking, and autonomous driving technologies. The region's booming electric vehicle market also benefits from blockchain solutions that streamline the charging process and ensure the authenticity of vehicle components. Additionally, the increasing focus on smart city initiatives and connected vehicle technologies is driving the adoption of blockchain to enhance data security and interoperability.

Key Automotive Blockchain Company Insights

The market is highly competitive, with both established industry players and newer entrants vying for dominance by offering a mix of cutting-edge technology, innovative solutions, and customer-centric services. This intense competition drives continuous advancements and improvements in the market, benefiting automakers and consumers alike.

Key Automotive Blockchain Companies:

The following are the leading companies in the automotive blockchain market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- IBM

- Accenture

- BigchainDB GmbH

- R3

- CarBlock Corp.

- Vechain Foundation San Marino S.r.l.

- SHIFTMobility Inc.

- Amazon Web Services, Inc.

- ConsenSys

Recent Developments

-

In August 2023, Mitsubishi Motors Europe adopted Vinturas' private blockchain technology to enhance transparency, traceability, and security in its supply chain for the New Generation ASX and upcoming All-New COLT models. This technology facilitated greater logistical transparency and data management, allowing Mitsubishi to control and own the data throughout its supply chain. Vinturas’ solution aimed to improve process automation and interoperability between Mitsubishi’s IT applications and trading partners. This initiative highlighted the growing trend of using blockchain to optimize supply chains in the automotive industry. The adoption of such technologies was expected to bring significant cost efficiencies and operational improvements for OEMs.

Automotive Blockchain Market Report Scope

|

Attribute |

Details |

|

Market size value in 2024 |

USD 880.6 million |

|

Revenue forecast in 2030 |

USD 4.41 billion |

|

Growth rate |

CAGR of 30.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, component, mobility, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Microsoft; IBM; Accenture; BigchainDB GmbH; R3; CarBlock Corp.; Vechain Foundation San Marino S.r.l.; SHIFTMobility Inc.; Amazon Web Services, Inc.; and ConsenSys |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Automotive Blockchain Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive blockchain market report based on type, component, mobility, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Application & Solution

-

Infrastructure & Protocols

-

Middleware

-

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Mobility

-

Shared Mobility

-

Commercial Mobility

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Contracts

-

Supply Chain

-

Financing

-

Mobility Solutions

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEMs

-

Vehicle Owners

-

Mobility as a Service Provider

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive blockchain market size was estimated at USD 686.7 million in 2023 and is expected to reach USD 880.6 million in 2024.

b. The global automotive blockchain market is expected to grow at a compound annual growth rate of 30.8% from 2024 to 2030 to reach USD 4.41 billion by 2030.

b. North America dominated the automotive blockchain market with a share of 34.85% in 2023. In North America, the automotive blockchain market is driven by a strong focus on technological innovation and regulatory compliance.

b. Some key players operating in the automotive blockchain market include Microsoft; IBM; Accenture; BigchainDB GmbH; R3; CarBlock Corp.; Vechain Foundation San Marino S.r.l.; SHIFTMobility Inc.; Amazon Web Services, Inc.; and ConsenSys.

b. Key factors that are driving the market growth include an increase in data security and transparency and reduced operational cost.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."