- Home

- »

- Automotive & Transportation

- »

-

Automotive Automatic Tire Inflation System Market Report, 2030GVR Report cover

![Automotive Automatic Tire Inflation System Market Size, Share & Trends Report]()

Automotive Automatic Tire Inflation System Market Size, Share & Trends Analysis Report By Type, By Vehicle, By Component, By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-420-7

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

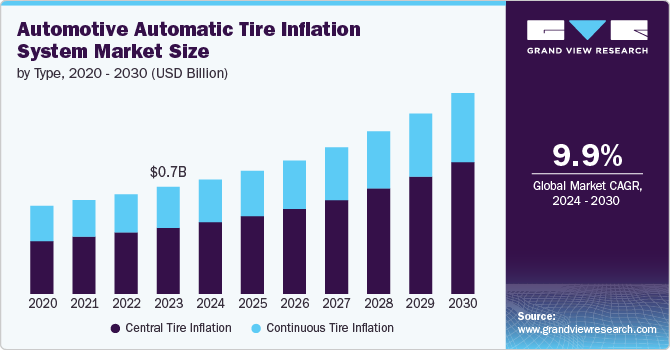

The global automotive automatic tire inflation system market size was estimated at USD 726.2 million in 2023 and is expected to grow at a CAGR of 9.9% from 2024 to 2030. The primary factor driving the market's growth is the rising awareness among consumers and regulatory bodies about the importance of maintaining optimal tire pressure. Proper tire inflation is crucial for enhancing fuel efficiency, reducing tire wear, and minimizing the risk of tire-related accidents, leading to stricter regulations and standards globally.

These regulations mandate integrating advanced tire pressure monitoring and inflation systems in vehicles, propelling the demand for automotive automatic tire inflation systems. The increase in demand for all-terrain and military vehicles is significantly contributing to the growth of the market. These vehicles often operate in harsh and unpredictable environments where maintaining optimal tire pressure is crucial for performance and safety. All-terrain vehicles require robust tire management systems to navigate diverse terrains effectively, while military vehicles need reliable tire inflation solutions to ensure mission readiness and operational efficiency. This growing demand is driving manufacturers to develop advanced ATIS tailored specifically for the rigorous requirements of all-terrain and military applications, thereby expanding the market scope.

Technological advancements in automotive systems are also a major driving force for the market. The development of sophisticated sensors and IoT-enabled devices has revolutionized the way tire pressure is monitored and maintained. These advancements have made automotive automatic tire inflation systems more reliable, efficient, and user-friendly, encouraging their adoption in both commercial and passenger vehicles. Moreover, the integration of ATIS with other vehicle management systems, such as telematics and fleet management solutions, has further enhanced its appeal. This synergy allows for real-time monitoring and automated adjustments, leading to improved vehicle performance and reduced maintenance costs.

The growing emphasis on vehicle automation and smart technologies is another key factor driving the automatic tire inflation system market growth. The automotive industry is rapidly moving towards autonomous and connected vehicles, which require advanced systems for optimal operation. An automatic tire inflation system plays a crucial role in maintaining the performance and safety of these vehicles by ensuring that tire pressure is consistently at the recommended levels. As the adoption of autonomous vehicles increases, so does the need for a reliable and efficient automatic tire inflation system. This trend is supported by significant investments in research and development by leading automotive manufacturers and technology providers.

Fleet operators are increasingly recognizing the benefits of automatic tire inflation systems in terms of fuel savings, tire longevity, and overall operational efficiency. The logistics and transportation industries, in particular, are adopting these systems to enhance fleet management and reduce downtime caused by tire-related issues. This sector’s growth, driven by the surge in e-commerce and global trade, is expected to further propel the demand for automatic tire inflation systems. Consequently, manufacturers are focusing on developing more robust and scalable automatic tire inflation system solutions to cater to the needs of this expanding market.

Type Insights

Based on type, the central tire inflation system segment led the market and accounted for 62.1% of the global revenue in 2023. The growth of the segment is being driven by its widespread adoption in commercial and military vehicles. Central tire inflation system allows drivers to adjust tire pressure according to the terrain and load conditions, providing enhanced control and safety. This system's ability to improve fuel efficiency and reduce tire wear makes it highly attractive for fleet operators looking to optimize operational costs. Additionally, the increasing use of the central tire inflation system in off-road and all-terrain vehicles is bolstered by the growing demand for adventure sports and exploration activities. As industries and consumers alike recognize the benefits of adaptive tire pressure management, the central tire inflation system market segment continues to expand.

The continuous tire inflation system segment is expected to register significant growth from 2024 to 2030. This system maintains constant tire pressure by automatically inflating tires while the vehicle is in motion, ensuring optimal performance and safety. The primary driving trend for continuous tire inflation systems is the increasing emphasis on reducing downtime and maintenance costs in the transportation and logistics industries. As supply chain efficiency becomes critical, fleet operators are investing in technologies that minimize disruptions caused by tire issues. Furthermore, the growing awareness of environmental sustainability is encouraging the adoption of continuous tire inflation systems, as they help maintain fuel efficiency and reduce emissions over long distances.

Vehicle Insights

The on-highway vehicle segment accounted for the largest market revenue share in 2023. The growth of the segment can be attributed to the increasing focus on enhancing fuel efficiency and ensuring safety in commercial transportation. Fleet operators are increasingly adopting automatic tire inflation systems as a response to stringent regulations aimed at lowering carbon emissions and improving road safety. These systems help maintain optimal tire pressure, thereby boosting fuel efficiency and extending tire life. Additionally, the surge in e-commerce has heightened the need for efficient logistics and transportation services, further driving the use of ATIS in trucks and trailers. The incorporation of smart technologies and telematics in commercial vehicles allows for real-time tire pressure monitoring and management, fostering the growth of ATIS in this sector.

The off-highway vehicle segment is expected to grow significantly from 2024 to 2030. The off-highway vehicle segment of the automotive automatic tire inflation system market is experiencing robust growth driven by the expansion of the construction, mining, and agricultural sectors. These industries frequently operate in challenging and uneven terrains, necessitating reliable tire inflation systems to ensure optimal vehicle performance and safety. The automatic tire inflation system's capability to automatically adjust tire pressure based on varying terrain conditions enhances traction, and stability, and minimizes the risk of tire blowouts, making it indispensable for off-highway vehicles. Furthermore, the increasing demand for all-terrain recreational vehicles and military applications is significantly boosting the adoption of automatic tire inflation systems in this market segment.

Component Insights

The Electronic Control Unit (ECU) segment accounted for the largest market revenue share in 2023. The ECU is a critical component in the market, serving as the system's brain. The ECU processes data from various sensors to maintain optimal tire pressure, ensuring vehicle safety and performance. Its importance lies in its ability to make real-time adjustments and provide feedback to the driver, enhancing overall vehicle efficiency and reducing the risk of accidents caused by improper tire pressure. As vehicles become more connected and autonomous, the role of the ECU in integrating with other vehicle systems and managing tire pressure dynamically becomes even more crucial. This makes the ECU an important element in the advancement and adoption of ATIS technology.

The pressure sensor segment is expected to grow significantly from 2024 to 2030. The ability of the pressure sensor to continuously monitor the air pressure within each tire is a major factor contributing to the growth of the segment. These sensors provide the necessary data to the ECU, enabling precise and timely adjustments to maintain optimal tire pressure. The importance of pressure sensors lies in their accuracy and reliability, which are essential for the effective functioning of the entire ATIS. By detecting even slight changes in tire pressure, these sensors help prevent tire wear, improve fuel efficiency, and enhance vehicle safety. Since the advancements in sensor technology continue, their role in ensuring the performance and reliability of ATIS is expected to grow, solidifying their position as a key component in the market.

Sales Channel Insights

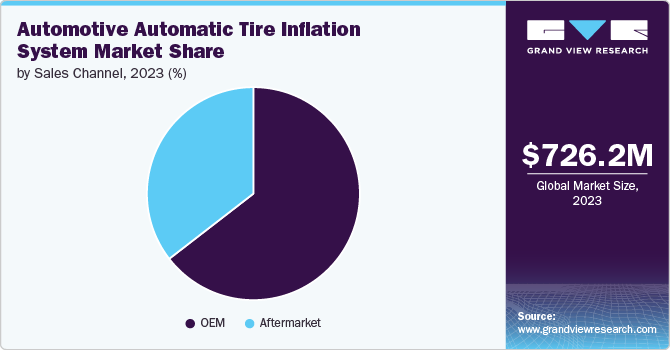

The OEM segment accounted for the largest revenue share in 2023. The increasing integration of advanced safety and efficiency features in new vehicles by OEMs is a significant factor contributing to the growth of the segment. Automakers are incorporating ATIS into their models to comply with stringent safety regulations and to meet consumer demand for enhanced vehicle performance and fuel efficiency. The trend towards smart and connected vehicles also supports the growth of ATIS in the OEM segment, as manufacturers aim to offer comprehensive, integrated solutions that improve the overall driving experience and safety.

The aftermarket segment is expected to grow significantly from 2024 to 2030. The growing awareness among vehicle owners about the benefits of maintaining optimal tire pressure is a significant factor contributing to the growth of the segment. As more consumers and fleet operators recognize the importance of tire health for safety, fuel efficiency, and tire longevity, there is an increasing demand for aftermarket ATIS installations. This segment is also propelled by the aging vehicle fleet, where owners seek to upgrade their vehicles with modern technologies without purchasing new ones. The rise of e-commerce platforms and specialized automotive service providers makes it easier for consumers to access and install ATIS, further fueling growth in the aftermarket segment.

Regional Insights

North America automotive automatic tire inflation system market dominated the global market and accounted for 34.45% in 2023. The growth of the regional market has been significantly influenced by the presence of prominent industry players such as The Boler Company, Airgo Systems, Aperia Technologies Inc., and Haltec Corporation. Additionally, government regulations requiring Tire Pressure Monitoring Systems (TPMS) in vehicles have increased the demand for advanced tire information systems. TPMS utilizes the ECU to track tire pressure and provide alerts to drivers. Moreover, the region's extensive agricultural industry, characterized by a high demand for tractors, has further accelerated the adoption of ATIS.

U.S. Automotive Automatic Tire Inflation System Market

The U.S. automotive automatic tire inflation system marketis anticipated to register significant growth from 2024 to 2030. Innovations that improve safety and operational efficiency are increasingly sought after by both manufacturers and consumers, propelling the market forward. Additionally, government mandates and incentives for safety features contribute to the growing U.S. market.

Asia Pacific Automotive Automatic Tire Inflation System Market

The Asia Pacific automotive automatic tire inflation system marketis anticipated to register significant growth from 2024 to 2030. The Asia Pacific region is witnessing a surge in the market, largely due to rapid urbanization and a burgeoning automotive industry. The expanding automotive sector, characterized by increased vehicle production and sales, significantly drives the demand for automotive automatic tire inflation systems. Rising concerns about road safety and vehicle maintenance further support the regional market growth. Additionally, the region's focus on modernizing infrastructure and adopting advanced technologies in vehicles enhances the appeal of automatic tire inflation systems, positioning it as a critical component for improving safety and performance in the growing automotive market.

Europe Automotive Automatic Tire Inflation System Market

The European automotive automatic tire inflation system market is poised for significant growth from 2024 to 2030. In Europe, the automotive automatic tire inflation system market is being propelled by stringent environmental regulations and safety standards. The region's commitment to reducing carbon emissions and improving road safety drives the demand for advanced technologies such as ATIS. European automotive manufacturers and consumers are increasingly prioritizing innovations that align with strict regulatory requirements and sustainability goals. The emphasis on enhancing vehicle safety and performance, combined with supportive policies and incentives, contributes to the robust growth of the ATIS market across the region.

Key Automotive Automatic Tire Inflation System Company Insights

Key players operating in the market are Strategic collaborations, extensive research and development, and technological advancements are core strategies employed by these market leaders to maintain a competitive edge. Furthermore, their emphasis on meeting stringent regulatory standards and catering to the evolving demands of the automotive industry positions them as crucial contributors to the market's expansion. Through continuous product innovation and strategic market positioning, these key companies are expected to sustain their influence and drive the future growth of the automotive automatic tire inflation system market.

Companies across the globe are focusing on developing efficient automotive automatic tire inflation systems to expand their automatic tire inflation systems in various regions. For instance, in October 2023, Tidd Ross Todd Limited unveiled the Traction Air EM Series, the newest enhancements to their Central Tyre Inflation System (CTI) originally introduced over twenty years ago to tackle the demanding conditions of the Australian Outback, Traction Air was evolved to become a vital component in over 4,000 vehicles, predominantly in New Zealand and Australia. The latest iteration of this system was made available to customers in these regions, with Traction Air also reaching markets in Sweden and across Asia, ensuring global accessibility.

Key Automotive Automatic Tire Inflation System Companies:

The following are the leading companies in the automotive automatic tire inflation system market. These companies collectively hold the largest market share and dictate industry trends.

- Aperia Technologies Inc.

- Dana Limited.

- Continental AG

- Bigfoot Equipment LTD

- Goodyear Tire & Rubber Company

- Cummins Inc.; Denso Corporation

- Parker Hannifin Corporation

- ti. systems GmbH

- SAF-HOLLAND SE.

Automotive Automatic Tire Inflation System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 0.78 billion

Revenue forecast in 2030

USD 1.38 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, vehicle, component, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Aperia Technologies Inc.; Dana Limited.; Continental AG; Bigfoot Equipment LTD; Goodyear Tire & Rubber Company; Cummins Inc.; Denso Corporation; Parker Hannifin Corporation; ti. systems GmbH; SAF-HOLLAND SE.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Automatic Tire Inflation System Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive automatic tire inflation system market based on type, vehicle, component, sales channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Tire Inflation system

-

Continuous Tire Inflation system

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Highway Vehicle

-

Light Duty Vehicle

-

Heavy Duty Vehicle

-

Off-High Vehicle

-

Agriculture Tractors

-

Construction Equipment

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Rotary Union

-

Air Compressor

-

Pressure Sensor

-

Housing

-

Air Delivery System

-

Electronic Control Unit (ECU)

-

Buffer Tank

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive automatic tire inflation system market size was estimated at USD 726.2 million in 2023 and is expected to reach USD 0.78 billion in 2024.

b. The global automotive automatic tire inflation system market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 1.38 billion by 2030.

b. North America dominated the automotive automatic tire inflation system market with a share of 34.45% in 2023. The growth of the regional market has been significantly influenced by the presence of prominent industry players such as The Boler Company, Airgo Systems, Aperia Technologies Inc., and Haltec Corporation.

b. Some key players operating in the automotive automatic tire inflation system market include Aperia Technologies Inc., Dana Limited., Continental AG, Bigfoot Equipment LTD, Goodyear Tire & Rubber Company, Cummins Inc., Denso Corporation, Parker Hannifin Corporation, ti. systems GmbH, and SAF-HOLLAND SE.

b. Key factors that are driving the market growth include rising awareness among consumers and regulatory bodies about the importance of maintaining optimal tire pressure and the increase in demand for all-terrain and military vehicles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."