Automotive Artificial Intelligence Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (Machine Learning, Computer Vision), By Level Of Autonomy, By Vehicle Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-994-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Automotive AI Market Size & Trends

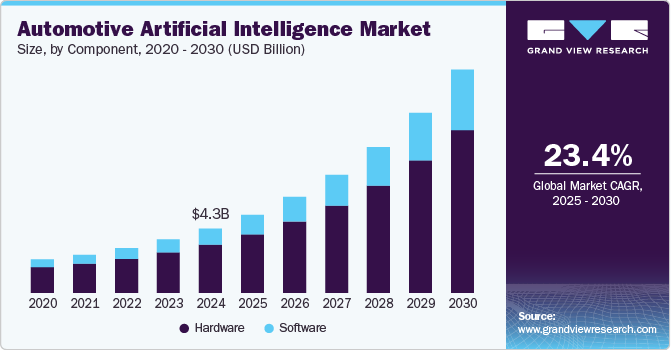

The global automotive artificial intelligence market size was estimated at USD 4.29 billion in 2024 and is expected to grow at a CAGR of 23.4% from 2025 to 2030. Integrating artificial intelligence (AI) into the automotive sector marks a transformative era, empowering companies to monitor operations, refine business strategies, advance autonomous and semi-autonomous vehicle technologies, and boost digital performance. Growth in the global automotive AI industry is largely fueled by increasing demand for self-driving vehicles, the use of AI in traffic management, advanced automotive solutions, and supportive government policies.

The development and deployment of autonomous driving technology are major growth drivers in the automotive AI industry. AI-powered systems allow vehicles to make instantaneous decisions, significantly improving safety and operational efficiency. With increasing consumer interest in self-driving cars and supportive regulatory frameworks, investment in AI for autonomous applications is accelerating, fueling the broader adoption and innovation in the automotive AI industry. Moreover, governments worldwide support AI-driven automotive technologies through incentives, policies, and funding. These initiatives drive innovation and encourage automotive companies to adopt AI-based solutions as they strive to meet regulatory standards for vehicle safety and emissions.

AI plays a central role in digitalizing various automotive processes, from production to sales. Integrating AI in manufacturing improves quality control and operational efficiency, while AI applications in customer service and vehicle sales enhance customer engagement and satisfaction. Furthermore, significant investment in AI research and development, alongside partnerships between automotive companies and technology firms, continues to propel advancements in the automotive AI industry. These collaborations are accelerating the development of AI-driven solutions tailored to automotive needs.

Component Insights

Hardware dominated the global automotive AI industry and accounted for a revenue share of over 75.0% in 2024. Automotive AI hardware is considered a crucial component of modern vehicles as it enables advanced features and capabilities. Hardware in automotive AI includes sensors such as cameras, radar, ultrasonic sensors, and Inertial Measurement Units (IMUs), which are employed to collect data related to vehicles’ surroundings and internal state. These sensors provide crucial inputs for AI algorithms to make informed decisions. In addition, it includes processing units such as CPUs (Central Processing Units), GPUs (Graphics Processing Units), and specialized AI chips that perform complex computations required for AI algorithms and actuators that convert electrical signals into physical actions, enabling AI-controlled functions.

Software is expected to experience the fastest CAGR from 2025 to 2030. Automotive AI software plays a significant role in improving vehicle performance, safety, and user experience. AI and machine learning work together in the automotive sector to develop algorithms that analyze traffic situations, make quick decisions, and learn from other participants. Adapting technology to quickly changing conditions and reducing human factors in auto accidents are challenging for automotive software developers. Top car firms compete based on ML and AI software for autonomous vehicles.

Level of Autonomy Insights

Level 2 held the largest revenue share of this automotive AI industry in 2024. Advanced driving assistance systems (ADAS) in level 2 vehicles can take over acceleration, steering, and braking under specific circumstances. Several automated systems cooperate during more complex driving tasks, but human drivers must always intervene if a car encounters a problem it cannot resolve. Semi-autonomous vehicles provide pragmatic, rapid solutions to requirements for on-demand mobility. In addition to being sustainable, autonomous, and convenient, semi-autonomous cars are safer and easier to manage than completely automated vehicles. Therefore, safety concerns drive the automotive AI industry growth in this segment.

Level 3 is projected to grow at the fastest CAGR in the automotive AI industry during the forecast period. Level 3 autonomous driving systems are predicted to become more sophisticated and capable as technology advances. This provides increased autonomy under specific scenarios while assuring driver safety and readiness. Level 3 autonomous automobiles perceive and analyze their surroundings using AI systems. AI systems can recognize and comprehend road signs, traffic lights, lane markings, and other pertinent information to make informed vehicle control and navigation decisions.

Vehicle Type Insights

Passenger vehicles dominated the global automotive AI industry in 2024. AI-powered technologies in passenger vehicles enable features such as autonomous driving, lane assistance, and automatic braking, improving consumer safety and convenience. The increasing demand for self-driving cars, coupled with advancements in AI systems, is fueling growth in this segment. Moreover, consumers are increasingly seeking connected and smarter vehicle features. AI-powered infotainment systems, voice-activated controls, personalized driving experiences, and ADAS enhance the in-car experience, driving growth in the passenger vehicle segment.

Commercial vehicles is projected to grow at the fastest CAGR during the forecast period. AI increasingly integrates into commercial vehicles to facilitate intelligent routing and logistics, predictive maintenance, fleet management, and autonomous capabilities. These applications have made the development of self-driving commercial vehicles more feasible by augmenting safety, enhancing vehicle efficiency and performance, and improving logistics. As such, AI is poised to make significant strides in commercial vehicles as it develops and advances further, thereby boosting overall productivity.

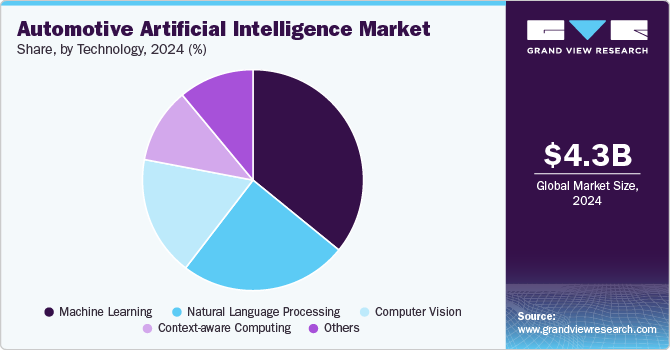

Technology Insights

The machine learning segment dominated the global automotive AI market in 2024. Machine learning has played a potent role in the latest advances, such as self-driving cars, lane-change assistance, park assist, and intelligent energy systems associated with the automotive industry. Machine learning algorithms can deliver vehicle maintenance recommendations to drivers. Using references from previous occurrences, they can forecast when an event or issue will occur again, enhancing vehicle safety, effectiveness, and performance. As such, machine learning algorithms are often integrated into ADAS to alert drivers about potential road hazards and into scheduling and routing systems to reduce fuel consumption. Machine learning can also help identify car issues before they become serious, reducing maintenance costs and averting major downtime. By adjusting vehicular settings to drivers' preferences, machine learning can also enhance the driving experience.

The computer vision segment is expected to witness the fastest CAGR during the forecast period. Computer vision is a crucial component of ADAS, enabling features such as lane departure warning, pedestrian detection, traffic sign recognition, and automatic emergency braking. These technologies significantly enhance safety and are becoming standard in many modern vehicles, driving demand for computer vision solutions. Moreover, with the rising importance of vehicle safety and stricter regulations, automakers are turning to computer vision to meet safety standards. By leveraging AI-driven visual perception systems, vehicles can better understand their surroundings and react to potential hazards, reducing accidents and improving driver and passenger safety.

Regional Insights

North America automotive artificial intelligence market dominated the industry with a revenue share of over 35.0% in 2024 and is projected to grow at a significant CAGR over the forecast period. North American governments, particularly in the U.S. and Canada, introduced various initiatives and regulations to encourage developing and adopting AI technologies in the automotive sector. This includes support for autonomous vehicles, safety standards for AI-driven systems, and AI research and development funding. Regulatory frameworks in these regions push automakers to adopt AI solutions to meet safety, environmental, and performance standards.

U.S. Automotive Artificial Intelligence Market Trends

The automotive AI market in the U.S. dominated the regional industry in 2024. The U.S. is a prominent country in AI research and development, with significant advancements in machine learning, deep learning, and computer vision technologies. These innovations directly apply to automotive AI, helping companies develop more efficient and sophisticated AI solutions for autonomous driving, ADAS, and in-car experiences.

Europe Automotive Artificial Intelligence Market Trends

The automotive AI market in Europe is investing heavily in autonomous driving technologies. Companies such as AUDI AG, BMW AG, and Daimler AG are focusing on AI-powered systems that enable semi-autonomous and fully autonomous vehicles. The EU’s emphasis on smart cities and smart mobility solutions further supports this shift, providing an environment conducive to the growth of autonomous vehicles.

Asia Pacific Automotive Artificial Intelligence Market Trends

The automotive AI market in Asia Pacific is expected to experience the fastest CAGR during the forecast period. Countries in Asia Pacific, such as China, Japan, and South Korea, are heavily investing in AI and autonomous driving technologies. Government regulations promoting smart transportation, autonomous vehicles, and the use of AI in traffic management are creating a conducive environment for AI adoption in the automotive sector.

Key Automotive Artificial Intelligence Company Insights

Some key companies in the market include NVIDIA Corporation, Waymo LLC, and others. These two companies play a crucial role in the automotive AI industry by combining advanced AI research with real-world applications in autonomous driving.

-

NVIDIA Corporation provides advanced AI computing platforms, such as its DRIVE platform, which enables autonomous driving capabilities. NVIDIA’s GPUs and deep learning frameworks are fundamental to developing high-performance autonomous vehicles, making it a core technology provider for several automakers and autonomous vehicle startups

-

Waymo LLC is a prominent player in autonomous vehicle technology, with extensive AI-based solutions for perception, path planning, and decision-making. The company provides a fully autonomous ride-hailing service; Waymo LLC has a significant edge in real-world data and practical AI applications for autonomous driving.

Key Automotive Artificial Intelligence Companies:

The following are the leading companies in the automotive artificial intelligence (AI) market. These companies collectively hold the largest market share and dictate industry trends.

- Aptiv

- Cruise LLC

- Mobileye

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Tesla

- The Ford Motor Company

- TOYOTA RESEARCH INSTITUTE

- Waymo LLC

Recent Developments

-

In August 2024, Intel Corporation launched its first discrete graphics processing unit (dGPU), the Intel Arc Graphics for automotive industry. By incorporating Intel Arc graphics for automotive into its existing portfolio of AI-driven, software-defined vehicle (SDV) system-on-chips (SoCs), Intel delivers an open, flexible, and scalable platform solution that enables automakers to provide advanced, high-fidelity experiences in their vehicles. This integration enhances the vehicle's capabilities, offering next-generation features and performance to meet the demands of modern automotive applications.

-

In June 2024, MORAI Inc., a simulation platform provider for autonomous vehicles, partnered with Automotive Artificial Intelligence (AAI) GmbH, an autonomous driving software company, to enhance the development of autonomous driving technologies. By combining MORAI Inc.'s advanced simulation platforms with the specialized tools of Automotive Artificial Intelligence (AAI) GmbH, companies can expedite the development of safer and more efficient autonomous vehicle systems.

-

In March 2024, Arm Limited, an automotive technology company, launched Armv9-based technologies integrated into the automotive sector, allowing the industry to harness the advanced AI, security, and virtualization features of this latest generation of Arm architecture. The company introduced new Arm Automotive Enhanced (AE) processors, which combine advanced Armv9 technology with server-class performance, offering significant benefits for AI-driven applications in automotive use cases.

Automotive Artificial Intelligence Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.22 billion |

|

Revenue forecast in 2030 |

USD 14.92 billion |

|

Growth rate |

CAGR of 23.4% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, level of autonomy, technology, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

Aptiv; Cruise LLC; Mobileye; NVIDIA Corporation; Qualcomm Technologies, Inc.; Robert Bosch GmbH; Tesla; The Ford Motor Company; TOYOTA RESEARCH INSTITUTE; Waymo LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automotive Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global automotive artificial intelligence market report based on component, level of autonomy, technology, vehicle type, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Level of Autonomy Outlook (Revenue, USD Million, 2017 - 2030)

-

Level 1

-

Level 2

-

Level 3

-

Level 4

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing

-

Computer Vision

-

Context-aware Computing

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive artificial intelligence market size was estimated at USD 4.29 billion in 2024 and is expected to reach USD 5.22 billion in 2025.

b. The global automotive artificial intelligence market is expected to grow at a compound annual growth rate of 23.4% from 2025 to 2030 to reach USD 14.92 billion by 2030.

b. North America dominated the automotive artificial intelligence market with a share of 38.0% in 2024. This is attributable to the early adoption of technology such as artificial intelligence and analytics in the U.S.

b. Some key players operating in the automotive AI market include Aptiv; Cruise LLC; Mobileye; NVIDIA Corporation; Qualcomm Technologies, Inc.; Robert Bosch GmbH; Tesla; The Ford Motor Company; TOYOTA RESEARCH INSTITUTE; and Waymo LLC

b. Key factors driving the Automotive Artificial Intelligence market growth include the rising demand for autonomous vehicles, the adoption of artificial intelligence for traffic management, advanced automotive solutions, and government initiatives.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."