- Home

- »

- Advanced Interior Materials

- »

-

Automotive Aluminum Market Size, Share, Industry Trends Report, 2025GVR Report cover

![Automotive Aluminum Market Size, Share & Trends Report]()

Automotive Aluminum Market Size, Share & Trends Analysis Report By End Use (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Application, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-221-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Advanced Materials

Industry Insights

The global automotive aluminum market size was valued at USD 33.76 billion in 2018 and is expected to witness a CAGR of 8.7% from 2019 to 2025. The expansion of the automotive sector along with increasing vehicle production are the key growth drivers.

Growing demand for automobiles in North America, Europe, and Asia Pacific countries namely the U.S., Germany, and China are likely to propel the demand for aluminum components in these regions. Germany with its close association with Original Equipment Manufacturers (OEMs) of high-end passenger cars such as Audi, Mercedes, and BMW is likely to ensure long-term growth prospects in the forthcoming years.

Aluminum is majorly being used in the automotive industry owing to its properties such as high strength, lightweight, recyclability, corrosion resistance, and thermal and electrical conductivity. It is extensively being used in passenger cars, trucks, and buses. Moreover, at the end of the vehicle’s life, about 90% of the aluminum used is recycled.

The use of aluminum in various components including the hybrid engine compartment, roof, damper strut console, and doorframes by different automakers has surged in the recent past to improve the efficiency of vehicles. For instance, it has been reported that Mercedes-Benz GLA and Mercedes-Benz S Class (W222) had around 240 kg and 380 kg of aluminum content as of 2016 respectively.

Growing usage of secondary or recycled aluminum is a key focus area for many vehicle manufacturers. In February 2016, Novelis entered into a partnership with Jaguar Land Rover and launched a new alloy RC5754 with 75% high recycled content for automotive production.

Application Insights

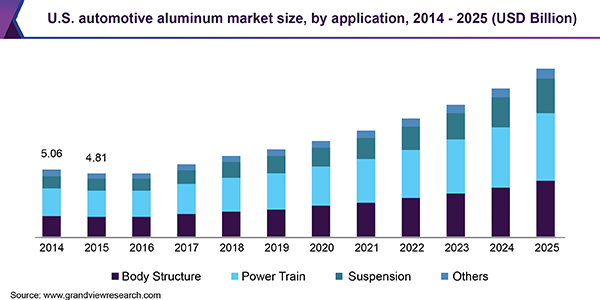

In terms of volume, the powertrain segment is projected to expand at a CAGR of 9.3% from 2019 to 2025. The growing interest in hybrid technology along with improving fuel economy and reducing fuel emissions has created a positive impact on the electric vehicles market. Hybrid and electric powertrain containing aluminum is projected to represent numerous opportunities on account of the increasing demand for electric vehicles in the coming years.

In terms of revenue, body structure application accounted for 31.4% market share in 2018. The growth is attributed to increasing production capacities in China, U.S., and India. For instance, in August 2018, Toyota announced its plan to open a new plant in Guangzhou, China to increase its production capacity by around 24% a year.

Cast spun aluminum wheels are being used for manufacturing cars as it reduces the weight of the system resulting in lower spring rates and damping vibrations. In terms of volume, the suspension segment accounted for a share of 29.3% of the global automotive aluminum market in 2018 and is expected to expand at a CAGR of 6.6% from 2019 to 2025.

End-Use Insights

In terms of revenue, passenger cars accounted for a market share of nearly 69.4% in 2018. The growing demand for lightweight products in passenger cars is the result of strict CO2 emission laws being laid down around the world. With the use of aluminum, the weight of various parts of a car can be drastically reduced, resulting in improved fuel efficiency.

Increasing demand for light commercial vehicles due to improvements in logistics and transportation along with stringent fuel emission standards is likely to promote the growth in the production of pickup vans, small trucks, and electric small trucks. Using lightweight materials such as aluminum in light commercial vehicles provides solutions for safety, fuel costs, and efficient haul transportation.

Government initiatives for automakers are anticipated to create growth opportunities in the market. In July 2018, the Indian government announced an increase in the load-carrying capacity of trucks to avoid overloading and to reduce the logistic costs for the consumer. This, in turn, is projected to boost the demand for heavy trucks in the country.

Regional Insights

In terms of revenue, Asia Pacific is projected to remain the largest regional market over the forecast period. The region accounted for 38.1% of the revenue share in 2018. The increasing demand for automobiles in countries such as China and India coupled with growing investments in the regional automotive sector are the key growth factors. In July 2018, Volkswagen Group announced its plan to invest around USD 1.12 billion by 2021 in India to expand its presence in the country.

In terms of revenue, North America is projected to expand at the highest CAGR of 10.9% during the forecast period. Consumer preferences toward high quality and fuel-efficient motor vehicles coupled with stringent CAFE regulations to improve the fuel economy of the vehicles are likely to increase the use of aluminum in the automotive industry in the region in the coming years.

The European automotive industry is anticipated to be driven by the establishment of new plants, policies, and innovations. For instance, in July 2018, BMW announced plans to invest USD 1.71 billion in a new car factory in Hungary. Thus, the establishment of new manufacturing plants is anticipated to increase the demand for aluminum in the European automotive sector.

Automotive Aluminum Market Share Insights

The vendors in the market are focused on organic growth strategies to achieve a competitive edge. For instance, in Nov 2018, Constellium launched its new automotive structures facility in Zilina, Slovakia. The new plant is an expansion strategy to enter into the Eastern European market. It produces body structure components and aluminum crash management systems.

Industry participants include Constellium N. V.; AMG Advanced Metallurgical Group; Martinrea Honsel Germany GmbH; UACJ Corporation; Norsk Hydro ASA; Bodine Aluminum, Inc.; Aleris, Federal-Mogul Holding Corporation; Consolidated Metco, Inc.; Dana Holding Corporation; Farinia Group; Dynacast; Aluminium Bahrain (Alba); Granges Innovative Aluminum Engineering; Kaiser Aluminum; Gibbs Die Casting Corporation; Endurance Technologies Limited; Ryobi Ltd; NEMAK Innovative Lightweighting; and CITIC Dicastal Co., Ltd.

Report Scope

Attribute

Details

The base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million & CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Germany, France, U.K., China, India, Japan, Brazil, Iran

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global automotive aluminum market report based on end-use, application, and region:

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Body Structure

-

Powertrain

-

Suspension

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central and South America

-

Brazil

-

-

MEA

-

Iran

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."