- Home

- »

- Advanced Interior Materials

- »

-

Automotive Advanced High Strength Steel Market Report, 2030GVR Report cover

![Automotive Advanced High Strength Steel Market Size, Share & Trends Report]()

Automotive Advanced High Strength Steel Market Size, Share & Trends Analysis Report By Vehicle Type (PV, LCV, HCV), By Product (DP, TRIW), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-286-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

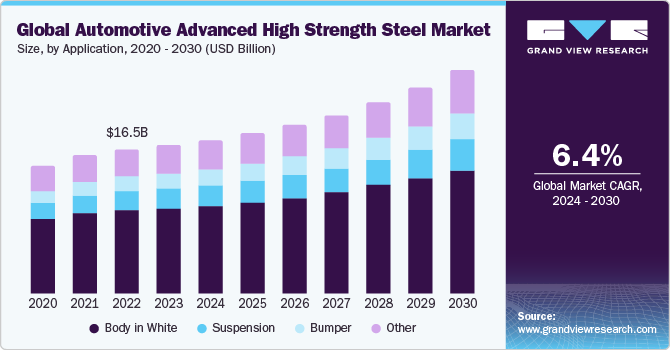

The global automotive advanced high strength steel market size was estimated at USD 16.95 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. Rising demand for lightweight vehicles is increasing the need for advanced high-strength steels (AHSS) in the automotive industry, driving market growth. According to the American Iron and Steel Institute, incorporating AHSS in automobiles can have significant benefits. By reducing vehicle weight, automakers can increase fuel efficiency and decrease tailpipe emissions. The latest grades of AHSS have the potential to significantly reduce vehicle weight by 35.0-40.0% compared to that of traditional steel.

For instance, in the case of a five-passenger family car, the use of a product can lead to a substantial reduction of four tons of greenhouse gases over the vehicle's lifespan by decreasing its overall weight.

The U.S. is among the major consumers of advanced high-strength steel globally. Rising penetration of lightweight vehicles and electric vehicles (EVs) is driving demand for the product in the country. Positive government policies are also augmenting market growth. In August 2023, the Department of Energy introduced a policy package amounting to USD 15.50 billion aimed at facilitating the upgrade of plant facilities to produce battery electric vehicles (BEVs). This announcement is expected to significantly boost BEV production across the country. The package also includes USD 2.0 billion in funding to convert existing plants into BEV and parts manufacturing plants.

Market Concentration & Characteristics

The AHSS market is growing at a steady pace, owing to its unique properties. The market is driven by rising demand for lightweight materials in the automotive industry. The need for more efficient, cost-effective, and safer vehicles is propelling the utilization of products that offer a combination of formability, strength, and weight reduction.

AHSS market has a large number of players active in this sector and is characterized by intense competition. The market has the presence of both existing and new players that offer a wide variety of products and solutions. ArcelorMittal, POSCO, AK Steel, ThyssenKrupp, and Tata Steel are among the key players in the market. These players are focusing on product research & development, strategic partnerships, and mergers and acquisitions to expand their market presence and gain a competitive edge.

In January 2022, SSAB announced that it is going to convert its plants in Lulea and Raahe (Sweden) into cost-effective mini mills by installing electric arc furnaces and rolling mills. This investment is expected to result in a wider range of SSAB's premium products, such as AHSS and quenched and tempered steel (Q&T).

Private players are investing in the expansion and construction of EV manufacturing plants, which is expected to propel consumption of products in the forecast period.For instance, in May 2022, Hyundai announced its plan to establish an electric vehicle and battery production plant in Bryan County, Georgia, with an investment of USD 5.5 billion. The company is aiming to commence commercial production by the first half of 2025 and intends to achieve an annual production capacity of 300,000 units.

AHSS Price Trends

Prices of AHSS commodities have been fluctuating since 2021 in most countries due to changes in raw material prices such as iron, coal, and steel scrap. Raw materials used in producing semi-finished steel products, such as steel billets, ingots, blooms, and slabs, are very crucial. Prices of these raw materials are highly volatile due to the demand and supply dynamics. In addition, costs of production and storage capacity also play a role in influencing product prices. Price fluctuations of these raw materials directly affect the production cost of steel, which consequently impacts the costs of AHSS.

Product Type Insights

The dual-phase (DP) segment held the largest revenue share of over 52.0% in 2023. DP steels are lightweight and offer energy-absorbing performance to automotive structures and crash components. Due to their ductility, they can be used in parts with complex geometries and find application in various automotive parts such as bumpers, cross members, engine cradles, seats, front rails, rear rails, and roof rails.

Transformation-induced plasticity (TRIP) segment is expected to experience a growth rate of 7.4% in terms of revenue across the forecast period. This is because it offers an excellent combination of strength and ductility due to its microstructure. Owing to these properties, it is suitable for use in complex shapes as structural and reinforcement parts such as longitudinal beams, cross members, B-pillar reinforcements, sills, and bumper reinforcements.

The Complex Phase (CP) segment is projected to experience the fastest CAGR during the forecast period. These steels are used to create lightweight structural components through cold forming. They possess high yield strength and are excellent for suspension system components and components requiring good impact strength due to their good bendability and stretch flangeability.

Application Insights

In terms of application, body in white (BIW) held the largest revenue share of over 57.0% in 2023. AHSS is utilized in the construction of vehicles' (BIW) structures. These structures are responsible for supporting the vehicle and safeguarding its drivers and passengers. They comprise large components and assembly parts such as doors, bonnets, mudguards, and roofs. In addition, they include other high-quality class-A surfaces and assembly parts, which are used to develop a visible exterior of the vehicle.

The suspension segment is anticipated to grow by a CAGR of 7.3% over the forecast period. The relevance of a product in suspension is based on its properties, such as strength, durability, weight reduction, and cost efficiency. The use of products in the suspension system allows manufacturers to efficiently reduce the weight of the system, thereby improving fuel efficiency.

The bumper segment is anticipated to register the fastest CAGR across the forecast period. AHSS offers high-force absorption capabilities for bumper reinforcements while achieving significant weight reduction. Owing to the increasing demand for EVs, the demand for this product is expected to witness a surge in the forecast period.

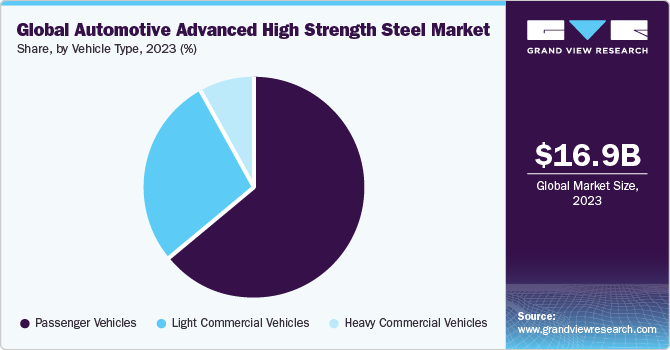

Vehicle Type Insights

The passenger vehicle category held the largest revenue share, over 64.0% of the global market in 2023. This segment's growth is being driven by the increasing income of the middle class and easy access to car loans, which is making it easier for people to purchase passenger vehicles.

Vehicle manufacturers are placing more emphasis on creating lightweight vehicles to improve performance and efficiency and reduce emissions, all while maintaining safety and comfort. Thus, rising investment by vehicle manufacturers to manufacture lightweight EVs is expected to propel consumption of AHSS across the forecast period.

For instance, in May 2023, Hyundai Motor, a leading global automotive company, announced its strategic plan to expand its EV operations in India by investing USD 2.45 billion over the next decade. The car manufacturer presently has the capacity to produce 775,000 vehicles per year at its Chennai plant, which it targets to increase to 850,000.

Regional Insights

The automotive advanced high strength steel market in North America is anticipated to register a CAGR of 5.1%, in terms of revenue, over the forecast period. Rising private investment to produce EVs in the region is expected to propel the consumption of AHSS in the region.For instance, in February 2023, BMW announced its plans to invest EUR 800.0 million (~USD 866.0 million) to produce high-voltage batteries and full EV Neue Klasse vehicles in San Luis Potosi, Mexico.

U.S. Automotive Advanced High Strength Steel Market Trends

The U.S. automotive advanced high strength steel market held the largest revenue share in North America in 2023. This is attributed to the U.S. government's stricter environmental regulations, such as Corporate Average Fuel Economy (CAFE) standards, which require more fuel-efficient vehicles.

Europe Automotive Advanced High Strength Steel Market Trends

The automotive advanced high strength steel market in Europe is expected to register the fastest CAGR across the forecast period. Several governments are offering attractive subsidies to encourage the use of electric vehicles, which is expected to drive the demand for AHSS in the region.

Germany automotive advanced high strength steel market held the largest revenue share in Europe. The rising demand for lightweight material is propelling the demand for the product in the country.

Asia Pacific Automotive Advanced High Strength Steel Market Trends

The Asia Pacific automotive advanced high strength steel market accounted for the largest revenue share, exceeding 47.0% of the global market in 2023. The region's rising demand for passenger vehicles is positively influencing the demand for products in the region.

The automotive advanced high strength steel market in China held the largest revenue share in Asia Pacific. The increasing production of electric vehicles is propelling the demand for AHSS in the country.

Key Automotive Advanced High Strength Steel Company Insights

Some of the key players operating in the market include Arcelor Mittal S.A, SSAB, JSW Steel Limited, Cleveland-Cliffs Inc., and United States Steel Corporation:

-

SSAB provides a wide range of special steel products, including high strength steel, AHSS, and flat carbon steels. According to the company, it has a 25% market share in special steel.

-

JSW Steel is one of the leading AHSS manufacturers. In 2023, the company introduced 125 new product grades, including 39 in the AHSS category.

National Material Company L.P, Inc. and Ternium are some of the emerging market participants.

-

National Material Company is an emerging player in the AHSS market. The company ships over 1.4 million tons of steel products each year.

-

Ternium began producing AHSS in 2016 to expand its presence in the automotive and metal mechanic steel markets.

Key Automotive Advanced High Strength Steel Companies:

The following are the leading companies in the automotive advanced high strength steel market. These companies collectively hold the largest market share and dictate industry trends.

- Arcelor Mittal S.A.

- BAOSTEEL

- Cleveland-Cliffs Inc.

- JSW Steel Limited

- POSCO

- SSAB

- Tata Steel Limited

- Thyssenkrupp AG

- United States Steel Corporation

- voestalpine Stahl GmbH

Recent Developments

-

In January 2022, SSAB announced that it was going to convert its plants in Lulea and Raahe (Sweden) into cost-effective mini mills by installing electric arc furnaces and rolling mills. This investment is expected to result in a wider range of SSAB's premium products, such as AHSS and quenched and tempered steel (Q&T

-

In December 2022, Jindal Steel announced that it is going to invest INR 73,930.0 million (USD 886.7 million) for the construction of a new specialty steel manufacturing plant under the PLI Scheme of India. The new plant is expected to produce auto-GR steel AHSS, cold rolled, and coated products.

Automotive Advanced High Strength Steel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.51 billion

Revenue forecast in 2030

USD 25.45 billion

Growth Rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; China; Japan; India; South Korea; Brazil,

Key companies profiled

Arcelor Mittal S.A.; BAOSTEEL; Cleveland-Cliffs Inc.; JSW Steel Limited; POSCO; SSAB; Tata Steel Limited; Thyssenkrupp AG; United States Steel Corporation; voestalpine Stahl GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Advanced High Strength Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive advanced high strength steel market report by vehicle type, product type, application, and region.

-

Vehicle Type Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Product Type Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Dual Phase

-

Transformation-Induced Plasticity (TRIP)

-

Complex Phase

-

Others

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Body in White

-

Suspension

-

Bumper

-

Other

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global automotive advanced high strength steel market size was estimated at USD 16.95 billion in 2023 and is expected to reach USD 17.51 billion in 2024.

b. The global automotive advanced high strength steel market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030, reaching USD 25.45 billion by 2030.

b. Based on the vehicle-type segment, passenger car segment dominated the global market, owing to rising production of lightweight vehicles, to curb carbon dioxide emissions, enhance fuel efficiency, and provide appealing aesthetics.

b. Some of the key vendors in the global automotive advanced high strength steel market are Arcelor Mittal S.A., BAOSTEEL, Cleveland-Cliffs Inc., JSW Steel Limited, POSCO, SSAB, Tata Steel Limited, Thyssenkrupp AG, United States Steel Corporation, and voestalpine Stahl GmbH among others.

b. The key factor driving the growth of the global automotive advanced high-strength steel market is the growing efforts to reduce carbon emissions. This is propelling the demand for lightweight vehicles and augmenting the consumption of AHSS products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."