- Home

- »

- Automotive & Transportation

- »

-

Automotive 3PL Market Size, Share & Growth Report, 2030GVR Report cover

![Automotive 3PL Market Size, Share & Trends Report]()

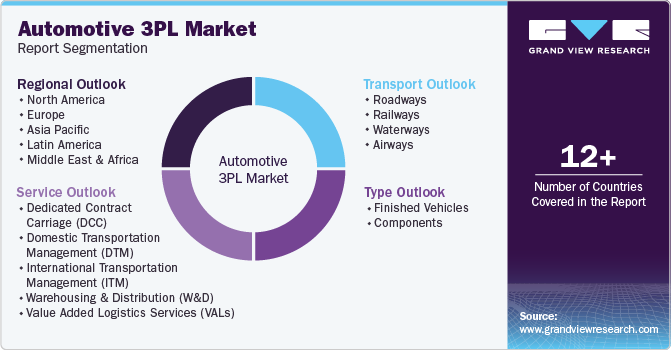

Automotive 3PL Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Finished Vehicles, Components), By Service (DCC, DTM, ITM, VAL), By Transport (Roadways, Railways, Airways, Waterways), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-452-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive 3PL Market Size & Trends

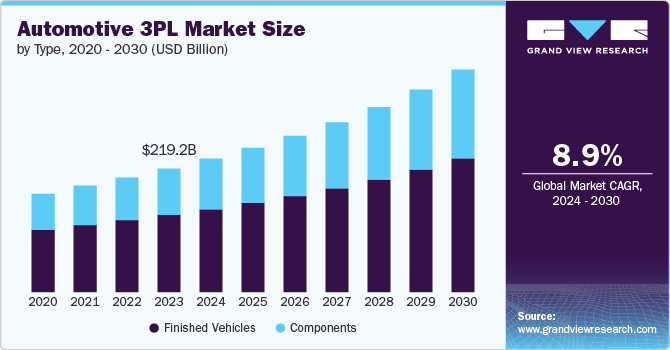

The global automotive 3PL market size was estimated at USD 219.16 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030. The market growth is driven by the increasing complexity of automotive supply chains and rising demand for efficient logistics solutions. The steady increase in global vehicle production has been a major driver of the market growth. As automakers ramp up production to meet growing demand, particularly in emerging markets, the need for efficient logistics solutions becomes more critical. 3PL providers play a vital role in ensuring that components and finished vehicles are delivered on time and in the right condition, helping manufacturers meet their production targets.

Growing consumer demand for fast and reliable delivery of their vehicles and parts has put pressure on 3PL providers to optimize their supply chains and offer faster shipping options. The rise of e-commerce has further heightened these expectations, as consumers now demand the same level of service when purchasing automotive parts online as they do with other products. 3PL providers have responded by investing in advanced transportation management systems (TMS) and other technologies that enable them to offer faster and more reliable delivery options.

As vehicles become more sophisticated, the demand for aftermarket services such as maintenance, repair, and customization has grown. This has created new opportunities for 3PL providers to offer value-added services that go beyond traditional logistics. By leveraging their expertise in supply chain management. 3PL providers can offer tailored solutions that meet the specific needs of automotive manufacturers and consumers alike.

The globalization of the automotive industry is driving the expansion of the 3PL market. As automotive manufacturers expand their operations into new markets, they require logistics partners with global reach and the supply chain. This trend is particularly evident in emerging markets such as China, India, and Southeast Asia, where the demand for vehicles in rapidly growing. Automotive 3PL providers are expanding their presence in these regions by establishing new facilities and forming strategic partnerships with local logistics companies.

Advances in technology are playing a significant role in driving the growth of the automotive 3PL market. Digital technologies such as Internet of Things (IoT), artificial intelligence (AI), and big data analytics are transforming the logistics industry by providing real-time visibility, predictive analytics, and automation capabilities. Automotive 3PL providers are leveraging these technologies to optimize their operations, improve supply chain transparency, and enhance customer service. Furthermore, blockchain technology is gaining traction in the market as a secure and transparent way to manage supply chain transactions. Blockchain technology provides a single source for all supply chain stakeholders, which enhance trust, reduce fraud, and improve the efficiency of logistics operations is further anticipated to drive the demand for automotive 3PL during the forecast period.

Type Insights

In terms of type, the market is classified into finished vehicles and components. The finished vehicles segment dominated the market in 2023 and accounted for more than 62.0% share of global revenue. The global shift towards electric vehicles (EV) has had a profound impact on the logistics of finished vehicles. As EV requires specialized handling due to their battery systems, there is a growing demand for 3PL providers with the expertise and equipment to transport these vehicles safely. The growing popularity of direct-to-consumer (D2C) sales models, where vehicles are delivered directly to customer’s doorsteps, is further driving the need for specialized logistics solutions.

The component segment is projected to witness the fastest CAGR of 9.8% from 2024 to 2030. The complex nature of automotive component supply chain drives the need for sophisticated logistics solutions to manage the flow of components efficiently. The rise of emerging markets as key automotive manufacturing hubs is further adding to this complexity, with 3PL providers playing a critical role in ensuring the smooth movement of components across borders.

Service Insights

In terms of service, the market is classified as Dedicated Contract Carriage (DCC)/Freight forwarding, Domestic Transportation Management (DTM), International Transportation Management (ITM), Warehousing & Distribution (W&D), and Value Added Logistics Services (VALs). The International Transportation Management (ITM) segment dominated the market in 2023 and accounted for more than 31.0% share of global revenue. The segment dominance due to the increasing globalization of the automotive industry. Manufacturers sourcing parts from multiple countries and distributing finished vehicles globally increase the demand for ITM segment. Additionally, the integration of advanced technologies like IoT, blockchain, and AI into logistics operations is enhancing the visibility and security of international shipments, thus driving the demand for ITM segment.

The Value Added Logistics Services (VALs) segment is projected to register a significant growth rate from 2024 to 2030. The increasing demand for customized and flexible logistics solutions and the push for operational efficiency is driving the demand for VAL segment over the forecast period. As automotive companies strive to reduce lead times and inventory levels, they are increasingly relying on 3PL providers to manage complex logistics tasks. Additionally, the growing demand for EVs and the shift toward more sustainable automotive practices are driving demand for specialized VALS, such as handling of batteries and the implementation of reverse logistics for recycling.

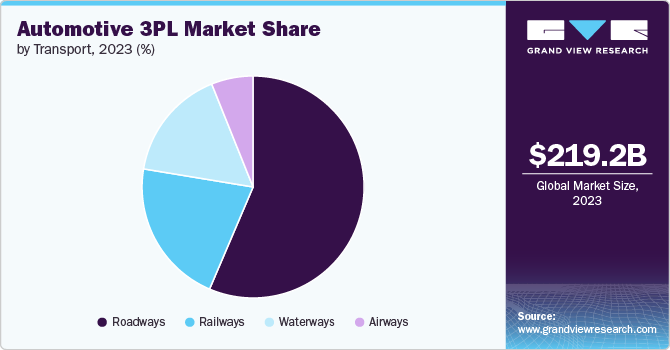

Transport Insights

In terms of transport, the market is classified as roadways, railways, waterways, and airways. The roadways segment dominated the market in 2023 and accounted for more than 56.0% share of global revenue. The increasing demand for just-in-time (JIT) delivery in the automotive sector requires efficient and flexible logistics solutions that road transport offers. The ongoing expansion of e-commerce, particularly in the automotive aftermarket, has fueled the need for robust road logistics networks to ensure timely delivery of products. Moreover, advancements in autonomous trucking are gaining traction, with companies investing heavily in developing self-driving trucks. These vehicles would help in reducing delivery times, lower fuel consumption, and address the shortage of truck drivers is further anticipated to drive the growth of roadways segment.

The airways segment is projected to register the highest growth rate from 2024 to 2030. Air transport facilitates the quick and reliable movement of these goods across continents, ensuring that supply chains remain agile and responsive to market demand. The integration of digital technologies in air freight, such as advanced tracking systems and automated customs clearance processes, is enhancing the efficiency of air logistics. The rise of e-commerce has also contributed to the increased demand for air freight services, as consumers expect faster delivery times for automotive products.

Regional Insights

Asia Pacificdominated the global automotive 3PL market and accounted for a revenue share of over 44.0% in 2023. The rapid expansion of the automotive industry in emerging economies is driving the demand for the market in Asia Pacific. Countries like China and India are witnessing surge in vehicle production, leading to increased demand for logistics services to manage the supply chain.

Europe Automotive 3PL Market Trends

The automotive 3PL market in Europe is expected to grow at a notable growth rate from 2024 to 2030. The push towards sustainability is one of the main growth drivers for the market. The European Green Deal, which aims to make the EU climate-neutral by 2050, is encouraging automakers and 3PL providers to adopt green logistics practices. This includes the use of electric trucks, alternative fuels, and carbon offset programs.

North America Automotive 3PL Market Trends

The automotive 3PL market in North America is expected to grow at a notable CAGR of 7.8% from 2024 to 2030. The regional growth can be attributed to the increasing complexity of the automotive supply chain and the rising demand for electric vehicles. Growing consumer demand for faster delivery times, automakers and suppliers are turning to 3PL providers to manage inventory and streamline distribution.

U.S. Automotive 3PL Market Trends

The automotive 3PL market in the U.S. is expected to grow at a CAGR of 7.3% from 2024 to 2030. Increasing use of data analytics and AI in logistics operation is a major trend observed in the U.S. market. Furthermore, the rise of digital freight platforms is also transforming the industry by providing real-time visibility and greater flexibility.

Key Automotive 3PL Company Insights

Some of the key companies operating in the automotive 3PL market include CEVA Logistics, DB Schenker, DHL Group, DSV A/S, Coyote Logistics, Hellmann Worldwide Logistics SE and Co KG, Hub Group, Kerry Logistics Network Limited, Nippon Express Holdings, and XPO Logistics.

- CEVA Logistics is a provider of logistics services, including transportation, warehousing, and supply chain management. The company offers tailored solutions specific to the automotive industry, such as just-in-time delivery, parts distribution, and aftermarket services. The company has a robust global network with operations in key automotive markets.

XPO Logistics, Rivigo, and BYD Logistics are some of the emerging companies in the target market.

- XPO logistics is the U.S. based transportation service provider. The company offers diverse services including freight transportation, contract logistics, intermodal transportation, and last-mile-delivery. The company operates a vast network of transportation assets and facilities worldwide, serving customers in various industries, including automotive, retail, technology, and healthcare.

Key Automotive 3PL Companies:

The following are the leading companies in the automotive 3PL market. These companies collectively hold the largest market share and dictate industry trends

- CEVA Logistics

- DB Schenker

- DHL Group

- DSV A/S

- Coyote Logistics

- Hellmann Worldwide Logistics SE and Co KG

- Hub Group

- Kerry Logistics Network Limited

- Nippon Express Holdings

- XPO Logistics

Recent Developments

-

In July 2024, CEVA Logistics acquired Bolloré Logistics, a transport & logistic company to expand operations in ocean and air freight management. The acquisition would help the former company to strengthen freight operations between Europe & Americas and Asia & Europe.

-

In July 2023, DHL Supply Chain, a subsidiary of DHL Group invested around USD 550 million (EUR 500 million) in Latin America to strengthen the operations in Latin America. The investment made until 2028 focuses on strengthening logistics capabilities in automotive, healthcare, retail, technology, and e-commerce sectors in Latin America.

Automotive 3PL Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 236.60 billion

Revenue forecast in 2030

USD 394.64 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, transport, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

CEVA Logistics; DB Schenker; DHL Group; DSV A/S; Coyote Logistics; Hellmann Worldwide Logistics SE and Co KG; Hub Group; Kerry Logistics Network Limited; Nippon Express Holdings; XPO Logistics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive 3PL Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automotive 3PL market report based on type, service, transport, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Finished Vehicles

-

Components

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Dedicated Contract Carriage (DCC)

-

Domestic Transportation Management (DTM)

-

International Transportation Management (ITM)

-

Warehousing & Distribution (W&D)

-

Value Added Logistics Services (VALs)

-

-

Transport Outlook (Revenue, USD Million, 2017 - 2030)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive 3PL market size was estimated at USD 219.16 billion in 2023 and is expected to reach USD 236.60 billion in 2024.

b. The global automotive 3PL market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 394.64 billion by 2030.

b. The finished vehicles segment dominated the market in 2023 and accounted for more than 62.0% share of global revenue. The global shift towards electric vehicles (EV) has had a profound impact on the logistics of finished vehicles. As EV requires specialized handling due to their battery systems, there is a growing demand for 3PL providers with the expertise and equipment to transport these vehicles safely.

b. Some of the companies operating in the automotive 3PL market include CEVA Logistics, DB Schenker, DHL Group, DSV A/S, Coyote Logistics, Hellmann Worldwide Logistics SE and Co KG, Hub Group, Kerry Logistics Network Limited, Nippon Express Holdings, and XPO Logistics.

b. The market growth is driven by the increasing complexity of automotive supply chains and rising demand for efficient logistics solutions. The steady increase in global vehicle production has been a major driver of the automotive 3PL market. As automakers ramp up production to meet growing demand, particularly in emerging markets, the need for efficient logistics solutions becomes more critical.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.