Automatic Content Recognition Market Size, Share & Trends Analysis Report By Component (Software), By Content (Audio, Video, Image), By Platform, By Technology, By Industry Vertical, By End Use, By Resolution, By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-128-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

The global automatic content recognition market size was estimated at USD 3.39 billion in 2024 and is projected to grow at a CAGR of 20.7% from 2025 to 2030. The automatic content recognition industry is being driven by the rising demand for personalized content experiences, the increasing adoption of smart devices, and the growing popularity of interactive and connected TV platforms. The integration of ACR with AI and machine learning is enhancing content recommendations and improving user engagement, while the surge in digital advertising and real-time audience analytics fuels market growth.

Moreover, the expansion of over-the-top (OTT) services and second-screen applications is creating new opportunities for ACR deployment. With advancements in audio and video fingerprinting technologies, ACR is becoming more accurate and efficient, enabling seamless content identification and synchronization. The increasing need for audience measurement and content performance analysis is also pushing businesses toward ACR solutions. As media consumption habits evolve, the ACR market is poised for significant expansion, driven by the demand for smarter, data-driven content delivery strategies.

The automatic content recognition industry is seeing rapid growth due to the widespread adoption of smart devices like smart TVs, smartphones, and connected home systems. These devices increasingly rely on ACR technology to offer personalized content recommendations and seamless cross-device experiences. As more households adopt smart home ecosystems, the integration of ACR becomes crucial for synchronizing media consumption across multiple screens. This trend is also boosting the demand for targeted advertising, as ACR data provides precise insights into user preferences and viewing habits. Consequently, the proliferation of smart devices is a key driver shaping the ACR market’s expansion.

AI and machine learning are transforming the automatic content recognition industry by enhancing the accuracy and efficiency of content identification. These technologies enable ACR systems to analyze audio, video, and image data in real time, providing more accurate metadata and better content recommendations. Machine learning algorithms improve over time, learning from user interactions to refine content suggestions and ad targeting. AI-driven ACR is also being used in sentiment analysis, helping brands gauge audience reactions to media content. This integration is pushing the boundaries of what ACR can achieve, making it a vital tool for media and entertainment companies.

The surge in over-the-top (OTT) platforms and streaming services has created a strong demand for automatic content recognition technologies. ACR helps these platforms monitor viewership metrics, track content performance, and deliver personalized viewing experiences. As competition among streaming services intensifies, the need for precise audience analytics and content recommendations becomes even more critical. ACR also supports ad-supported streaming models by enabling dynamic ad insertion based on real-time content recognition. This growth in streaming services is directly fueling advancements and adoption in the ACR industry.

The automatic content recognition industry is revolutionizing digital advertising by enabling more targeted and effective ad placements. ACR technology identifies what content a user is engaging with and delivers relevant ads in real time, increasing ad relevance and engagement. This capability is particularly valuable for connected TV (CTV) and addressable TV advertising, where precision targeting drives a higher return on investment. Advertisers also use ACR data to measure campaign performance, ensuring that ads reach the right audience at the right moment. Enhanced monetization opportunities through targeted advertising are making ACR a cornerstone of modern media strategies.

As the automatic content recognition industry grows, so do concerns about data privacy and content security. ACR systems collect and analyze vast amounts of user data, raising questions about how that data is stored, shared, and protected. Regulatory frameworks like GDPR and CCPA are pushing companies to adopt stricter data protection measures and ensure transparency in data usage. Innovations in encrypted ACR technologies and anonymized data processing are emerging to address these privacy concerns. Balancing personalized content experiences with robust data security will be crucial for the industry’s long-term success.

The automatic content recognition industry is evolving with significant advancements in audio and visual recognition technologies. Improved algorithms now enable ACR systems to detect and identify content with higher accuracy, even in noisy or low-quality environments. Visual ACR is being used in applications like augmented reality (AR) and virtual reality (VR), enhancing interactive media experiences. Audio-based ACR is finding use in identifying songs, dialogue, and ambient sounds across various platforms. These technological advancements are making ACR more versatile and effective across diverse media landscapes.

Component Insights

Based on component, the software segment led the market with the largest revenue share of 74.22% in 2024.The rising demand for automatic content recognition software to track and analyze TV viewership data is fueling its adoption across various industries. Broadcasting stations, film production companies, marketing and advertising agencies, and game developers are among the key users leveraging ACR technology for better audience insights and content management. With the rapid advancement of smart devices like smart TVs, smartphones, and tablets, ACR software is finding diverse applications in targeted advertising, ad monitoring, copyright protection, and license tracking. In the AdTech industry, ACR plays a crucial role by providing valuable engagement metrics, ad viewability data, and conversion rate analysis, enabling more effective ad strategies. This growing reliance on ACR software highlights its importance in enhancing content delivery, optimizing advertising efforts, and ensuring proper rights management across digital platforms.

The services segment is expected to witness at the fastest CAGR of 21.7% from 2025 to 2030. The service segment of the automatic content recognition industry is gaining traction as companies seek expert support for implementing and managing ACR solutions. These services include system integration, maintenance, and consulting, ensuring seamless deployment and optimal performance of ACR software across various platforms. As demand for real-time content identification and audience analytics grows, service providers play a vital role in customizing ACR solutions to meet specific business needs. This increasing reliance on specialized services is driving the expansion of the service segment, making it a crucial component of the ACR market’s overall growth.

Content Insights

Based on content, the audio segment accounted for the largest revenue share in 2024. The audio segment of the automatic content recognition industry is experiencing significant growth due to its ability to identify and analyze audio content in real-time. This technology is widely used in media monitoring, music recognition, and audience measurement, providing valuable insights into listener behavior and content performance. Streaming platforms, broadcasters, and advertisers leverage audio-based ACR to track song plays, detect copyrighted material, and deliver targeted ads based on audio context. The increasing consumption of audio content across smart devices like speakers, TVs, and smartphones is further fueling demand for this segment. As a result, the audio segment remains a vital driver of innovation and expansion within the ACR industry.

The video segment is expected to record at the fastest CAGR from 2025 to 2030. The video segment of the automatic content recognition industry is growing rapidly, driven by the increasing demand for real-time video identification and analytics. This technology helps streaming platforms, broadcasters, and advertisers track video content performance, monitor copyright compliance, and deliver personalized recommendations. With the rise of smart TVs, OTT platforms, and video-sharing services, the need for accurate video recognition has become essential for enhancing viewer engagement and optimizing ad placement. Video recognition also supports advanced applications like interactive advertising and content synchronization across devices. As video consumption continues to surge globally, this segment plays a crucial role in shaping the industry’s future growth and innovation.

Platform Insights

Based on platform, the smart TVs segment accounted for the largest market revenue share in 2024, due to their widespread adoption and advanced capabilities. These devices use content recognition technology to identify what users are watching, enabling personalized recommendations and targeted advertising. By gathering real-time viewership data, smart TVs help broadcasters and streaming platforms better understand audience preferences and optimize content delivery. This technology also supports interactive features like on-screen information and synchronized second-screen experiences, enhancing user engagement. As smart TV penetration continues to rise globally, their role in expanding content recognition applications becomes even more critical.

The over-the-top (OTT) segment is expected to record at the fastest CAGR from 2025 to 2030. Over-the-top (OTT) platforms are playing a pivotal role in driving the growth of the automatic content recognition industry by offering vast amounts of digital video content directly to consumers. These platforms use content recognition technology to track viewer preferences, monitor content performance, and deliver highly personalized recommendations. By analyzing real-time viewing data, OTT services can enhance audience engagement and optimize their ad targeting strategies. Content recognition also helps ensure copyright compliance and prevents unauthorized distribution of digital media. As the demand for streaming services continues to grow globally, the adoption of this technology within the OTT segment is expected to expand significantly.

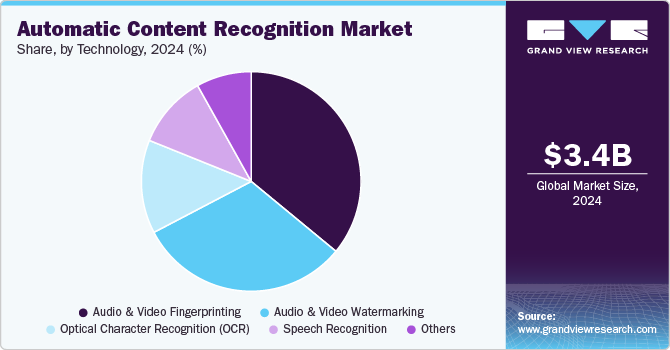

Technology Insights

Based on technology, the audio & video fingerprinting segment accounted for the largest revenue share in 2024. The audio and video fingerprinting segment is a crucial component of the automatic content recognition industry, offering advanced capabilities for identifying and tracking media content. This technology creates unique digital "fingerprints" from audio and video files, enabling precise content recognition without relying on metadata or watermarks. Streaming platforms, broadcasters, and advertisers use fingerprinting to monitor content usage, protect intellectual property, and deliver targeted ads based on real-time media analysis. With the growing demand for personalized viewing experiences and accurate audience measurement, audio and video fingerprinting has become essential for optimizing content delivery and monetization. As media consumption continues to rise across digital channels, this segment is poised for significant growth within the automatic content recognition industry.

The optical character recognition (OCR) segment is expected to record at the largest CAGR from 2025 to 2030. Speech recognition is an essential segment of the automatic content recognition industry, enabling the real-time analysis and identification of spoken content across various media. This technology converts audio speech into text, allowing broadcasters, streaming platforms, and advertisers to analyze dialogue, detect keywords, and enhance content indexing. Speech recognition plays a crucial role in improving accessibility through features like automated captions and voice search, while also supporting targeted advertising by understanding the context of spoken words. Its ability to extract insights from conversations makes it invaluable for audience analytics and personalized content recommendations. As voice-driven interfaces and smart devices become more popular, the demand for speech recognition technology in the automatic content recognition industry continues to grow rapidly.

Industry Vertical Insights

Based on industry vertical, the media & entertainment segment accounted for the largest revenue share in 2024. The media and entertainment segment is a major driver of growth in the automatic content recognition industry, leveraging advanced technology to enhance audience engagement and content management. Broadcasters, streaming services, and production companies use content recognition to track viewership patterns, monitor copyright compliance, and optimize ad placements. This technology also enables personalized content recommendations and interactive viewing experiences, making entertainment more tailored and immersive. By providing real-time analytics on audience behavior, it helps media companies make data-driven decisions to improve programming and marketing strategies. As digital content consumption continues to rise, the media and entertainment segment remains at the forefront of adopting content recognition solutions.

The healthcare segment is expected to record at the fastest CAGR from 2025 to 2030. The healthcare segment is emerging as a promising area in the automatic content recognition industry, utilizing advanced technology to streamline operations and improve patient care. Hospitals and medical institutions use content recognition for managing and organizing vast amounts of medical video and audio data, such as surgical recordings, diagnostic imaging, and patient consultations. This technology helps in accurately indexing and retrieving medical content, aiding in training, research, and telemedicine. Speech recognition also plays a key role in transcribing doctor-patient conversations and generating real-time medical documentation. As digital transformation accelerates in healthcare, the adoption of content recognition solutions is set to enhance efficiency, accuracy, and patient outcomes.

End Use Insights

Based on end use, the audience measurement segment accounted for the largest revenue share in 2024. The audience measurement segment is a vital part of the automatic content recognition industry, providing real-time insights into viewer behavior and content consumption patterns. By analyzing data from smart TVs, OTT platforms, and digital devices, this technology tracks what audiences are watching and how they engage with media. It helps broadcasters, advertisers, and content creators measure viewership metrics, such as audience size, attention span, and interaction rates. These insights enable more effective ad targeting, personalized content recommendations, and data-driven programming decisions. As the demand for precise and automated audience analytics grows, the audience measurement segment continues to gain importance in shaping media strategies.

The ad-tracking segment is expected to record at the fastest CAGR from 2025 to 2030. The ad-tracking segment plays a crucial role in the automatic content recognition industry by offering real-time monitoring and analysis of advertisements across various media channels. Using advanced recognition technology, it identifies when and where ads are aired, tracks their frequency, and measures audience engagement. This enables advertisers and marketers to assess campaign performance, optimize ad placement, and ensure brand visibility. By providing detailed insights on ad viewability and effectiveness, the ad-tracking segment helps maximize return on investment for advertising spend. As digital advertising continues to evolve, the demand for accurate and automated ad-tracking solutions is expected to grow significantly.

Regional Insights

The automatic content recognition market in North America accounted for the second-largest revenue share of 33.84% in 2024. The automatic content recognition industry in North America is experiencing robust growth driven by increasing demand for personalized content and advanced audience measurement solutions. The proliferation of smart TVs and connected devices, along with the rise of OTT platforms, is further fueling market expansion. Strategic partnerships between tech companies and content providers are also shaping the evolving ecosystem of ACR in this region.

U.S. Automatic Content Recognition Market Trends

The automatic content recognition market in the U.S. held a dominant position in North America in 2024. The U.S. remains the dominant player in the North American ACR market due to its strong presence of global technology companies and early adoption of advanced media solutions. Growing investments in AI and big data analytics to enhance content recognition capabilities are pushing innovation. In addition, the rising popularity of interactive and targeted advertising is creating new opportunities for ACR adoption.

Asia-Pacific Automatic Content Recognition Market Trends

Asia Pacific dominated the automatic content recognition market with the largest revenue share of 33.92% in 2024. The market is expanding rapidly, driven by the surge in digital content consumption and the growing popularity of streaming platforms. Increasing smartphone penetration and the adoption of smart home devices are supporting the growth of ACR solutions. Countries in this region are investing heavily in AI-driven analytics to improve content personalization and viewer insights.

The automatic content recognition market in China is thriving due to its vast digital user base and the dominance of local streaming giants. The country’s focus on technological innovation and the development of AI-powered recognition systems are accelerating market growth. Strong government support for digital transformation is also playing a key role in market expansion.

The India automatic content recognition market is on an upward trajectory driven by increasing internet penetration and the popularity of regional OTT platforms. The demand for localized and personalized content is pushing content providers to adopt advanced ACR solutions. Growing investments in AI and data-driven analytics are enhancing content discovery and audience engagement.

Europe Automatic Content Recognition Market Trends

The automatic content recognition market in Europe was identified as a lucrative region in 2024. In Europe, the market is growing steadily due to increasing demand for real-time content analytics and audience engagement tools. The region’s focus on data privacy and stringent regulations like GDPR are influencing the development of compliant ACR technologies. The expansion of smart home ecosystems and streaming services is also driving the need for more sophisticated content recognition capabilities.

The UK automatic content recognition market is a key contributor to Europe’s market, driven by the rapid digitalization of media and entertainment sectors. Growing consumer preference for personalized content and tailored recommendations is boosting the adoption of ACR solutions. Partnerships between broadcasters and technology providers are accelerating market innovation and deployment.

The automatic content recognition market in Germany is witnessing growth due to the country’s strong engineering expertise and emphasis on precision technology. Demand for advanced audience measurement and interactive advertising is pushing broadcasters to integrate ACR solutions. The rise of connected devices and smart TVs is further enhancing market potential.

Key Automatic Content Recognition Company Insights

Some of the key players operating in the market include Gracenote and Audible Magic Corporation.

-

Gracenote is a prominent entity in the ACR landscape, offering comprehensive media recognition solutions. Their flagship product, Gracenote Video Automatic Content Recognition, enables smart TVs and other devices to identify and synchronize content in real time, enhancing user engagement through interactive features. This technology has been widely adopted by major consumer electronics manufacturers, embedding Gracenote's ACR capabilities into millions of devices worldwide. By providing accurate content identification, Gracenote facilitates personalized viewing experiences and targeted advertising.

-

Audible Magic Corporation has made significant strides in content identification and rights management. Their flagship product, the Audible Magic Content Recognition Service, offers real-time identification of audio and video content, enabling platforms to manage user-generated content effectively. This service is crucial for social media platforms and content-sharing websites to monitor and control the distribution of copyrighted material, ensuring compliance and reducing unauthorized use. Audible Magic's extensive database and recognition capabilities have positioned it as a trusted partner for content owners and distributors.

ACRCloud, andClarifai Inc are some of the emerging participants in the automatic content recognition industry.

-

ACRCloud is gaining attention with its robust audio recognition services. Their flagship offering, the ACRCloud Music Recognition Service, provides real-time identification of music tracks, enabling developers to integrate music recognition features into their applications seamlessly. This service supports a vast database of songs and is utilized in various applications, from music discovery apps to broadcast monitoring systems. ACRCloud's scalable and efficient solution makes it a preferred choice for developers seeking reliable music recognition capabilities.

-

Clarifai Inc. is an emerging player focusing on artificial intelligence-driven image and video recognition. Their flagship product, the Clarifai Visual Recognition Platform, offers advanced machine-learning models that can identify and tag various elements within visual content. This platform is used across industries for applications such as content moderation, visual search, and automated metadata generation. Clarifai's emphasis on AI and deep learning enables it to provide highly accurate and customizable recognition solutions, catering to diverse client needs.

Key Automatic Content Recognition Companies:

The following are the leading companies in the automatic content recognition market. These companies collectively hold the largest market share and dictate industry trends.

- ACRCloud

- Apple Inc.

- Audible Magic Corporation

- Clarifai Inc.

- Digimarc Corporation

- Google LLC (Alphabet Inc.)

- Gracenote

- IBM Corporation

- KT Corporation

- Kudelski Group

- Microsoft Corporation

- Nuance Communications Inc.

Recent Developments

-

In August 2024, ACRCloud announced the integration of its automatic content recognition (ACR) technology into major streaming services. This update introduces enhanced fingerprinting algorithms designed to improve content-matching accuracy and deliver a more personalized user experience. By advancing content discovery capabilities, ACRCloud aims to strengthen its position in the evolving digital entertainment landscape.

-

In August 2024, Vobile Group launched a new suite of ACR tools aimed at enhancing brand safety and compliance in digital advertising. These tools utilize advanced recognition techniques to monitor brand mentions across various digital media platforms. By providing advertisers with greater visibility and control over their brand presence, Vobile Group strengthens its role in the digital marketing ecosystem.

-

In July 2024, Audible Magic introduced its latest ACR solution, pushing the boundaries of content management and protection. Leveraging machine learning-based detection, the system offers advanced copyright protection and sophisticated digital media tracking. This technology ensures stricter control against unauthorized content use, making it a powerful tool for safeguarding intellectual property.

Automatic Content Recognition Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.03 billion |

|

Revenue forecast in 2030 |

USD 10.31 billion |

|

Growth rate |

CAGR of 20.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, content, platform, technology, industry vertical, end use, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

ACRCloud; Apple Inc.; Audible Magic Corporation; Clarifai Inc.; Digimarc Corporation; Google LLC (Alphabet Inc.); Gracenote; IBM Corporation; KT Corporation; Kudelski Group; Microsoft Corporation; and Nuance Communications Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automatic Content Recognition Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automatic content recognition market report based on component, content, platform, technology, industry vertical, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Content Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio

-

Video

-

Text

-

Image

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart TVs

-

Linear TVs

-

Over-The-Top (OTT)

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Audio & Video Watermarking

-

Audio & Video Fingerprinting

-

Speech Recognition

-

Optical Character Recognition (OCR)

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Media & Entertainment

-

IT & Telecommunication

-

Automotive

-

Retail & E-commerce

-

Audience Measurement

-

Content Filtering

-

IT & Telecommunication Electronics

-

Government & Defense

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Audience Measurement

-

Content Enhancement

-

Broadcast Monitoring

-

Content Filtering

-

Ad-tracking

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automatic content recognition market size was estimated at USD 3.39 billion in 2024 and is expected to reach USD 4.03 billion in 2025.

b. The global automatic content recognition market is expected to grow at a compound annual growth rate of 20.7% from 2025 to 2030 to reach USD 10.31 billion by 2030.

b. Based on component, the software segment dominated the market in 2024 with a share of over 74%. The rising demand for automatic content recognition software to track and analyze TV viewership data is fueling its adoption across various industries. Broadcasting stations, film production companies, marketing and advertising agencies, and game developers are among the key users leveraging ACR technology for better audience insights and content management.

b. The key players in this industry are ACRCloud, Apple Inc., Audible Magic Corporation, Clarifai Inc., Digimarc Corporation, Google LLC (Alphabet Inc.), Gracenote, IBM Corporation, KT Corporation, Kudelski Group, Microsoft Corporation, and Nuance Communications Inc. among others.

b. Key factors that are driving the automatic content recognition market growth include the increased demand for personalized content and an upsurge in the popularity of digital platforms, including social media, streaming services, and online video-sharing platforms.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."