Automated Visual Field Analyzer Market Size, Share & Trends Analysis Report By Type (Static, Kinetic), By Application (Glaucoma, Age-related Macular Degeneration), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-301-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

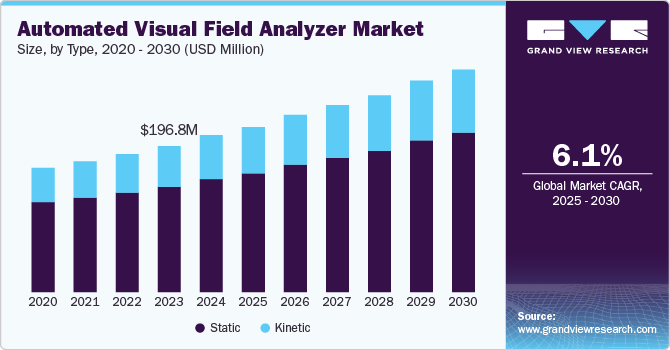

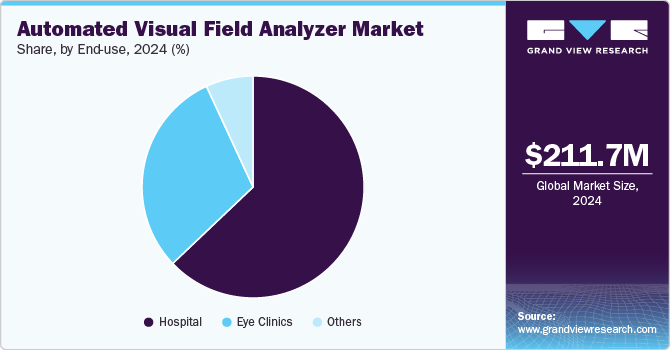

The global automated visual field analyzer market size was valued at USD 211.7 million in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2030. The automated visual field plays a vital role in the prevention and early detection of ocular diseases by assessing the visual field of the human eyes. Aging is the primary risk factor for most eye conditions. Thus, an increase in the prevalence of ocular disorders, such as glaucoma, cataracts, and diabetic retinopathy, a growing geriatric population, and the introduction of a technologically advanced automated visual field analyzer for diagnosis have fueled the market growth.

The number of people with glaucoma, an age-related eye condition, is projected to increase 1.3 times between 2020 (76 million) and 2030 (95.4 million).

The turnaround time for automated visual field analyzers has greatly decreased, and accuracy in visual field testing has increased. New software algorithms have been introduced, which is among those significant advancements. An increase in the frequency of new product launches is one of the main factors projected to fuel the market expansion. Recent technical developments are leading to the creation of novel visual function tests. The examination of the patient population with restricted access to healthcare is now made possible by diagnostic testing employing portable, affordable equipment, which also allows testing to take place outside of a clinical setting or at home.

Technological advancements have also played a crucial role in the market's expansion. Modern automated visual field analyzers incorporate sophisticated algorithms, allowing for faster, more accurate testing with improved patient comfort. For instance, devices like the Humphrey Field Analyzer and the Octopus Visual Field Analyzer utilize advanced technologies that enhance the detection of visual field defects. These innovations not only improve diagnostic accuracy but also facilitate better patient engagement, as the tests can be conducted more efficiently, often requiring less time and resulting in less fatigue for patients.

The aging population is another significant factor contributing to market growth. As life expectancy increases, age-related eye diseases are becoming more prevalent. In fact, a report by the U.S. Census Bureau projects that the number of individuals aged 65 and older will reach over 98 million by 2060 in the U.S. alone. This demographic shift will likely lead to a surge in the demand for regular eye examinations and practical diagnostic tools, further propelling the market for automated visual field analyzers.

Moreover, the high prevalence of ophthalmic diseases in the Asia Pacific is expected to create a high demand for automated visual field analyzers. According to the WHO, three Asian areas alone (containing 51% of the global population) account for 62% of the estimated 216.6 million people worldwide with moderate to severe bilateral exhibiting distance vision impairment: South Asia (61.2 million), East Asia (52.9 million), and South-East Asia (52.9 million) (20.8 million).

Furthermore, to spread awareness regarding eye health and vision care among the general public, optometrists, and ophthalmologists for the diagnosis and treatment of ophthalmic diseases, many organizations are taking several initiatives. Some of these activities include conducting awareness and advertising campaigns and workshops. In addition, several providers offer seminars, tutorials, and workshops that give ophthalmologists and technicians practical training with visual field analyzers. Such initiatives help to increase awareness regarding eye diseases and readily available diagnostic tools like ophthalmic perimeters, which will fuel the industry's growth.

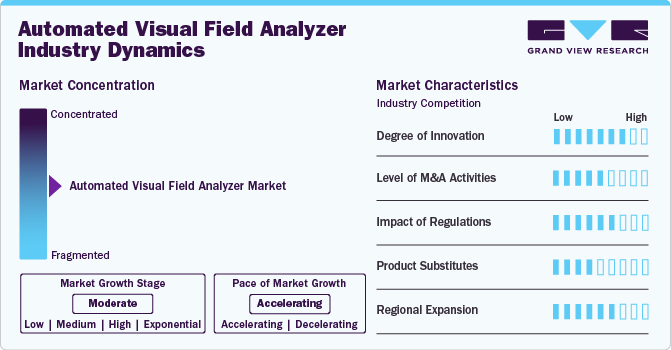

Market Concentration & Characteristics

The automated visual field analyzer industry is characterized by moderate-to-high concentration, with a few major players dominating the market, such as Carl Zeiss Meditec, Haag-Streit, and Topcon. These companies invest significantly in research and development to innovate and enhance their product offerings. The industry features a mix of established brands and emerging companies focusing on advanced technologies, such as artificial intelligence and telemedicine integration. In addition, regulatory compliance and product standardization play critical roles in market dynamics, ensuring safety and effectiveness in diagnostic practices. Overall, the industry is evolving rapidly in response to growing demand for eye care solutions.

The automated visual field analyzer industry is characterized by continuous innovation, demonstrated by the June 2024 launch of the AP-600 Visual Field Analyser by Grafton Optical. This device incorporates state-of-the-art technology, enhancing accuracy and efficiency in visual field testing. Its advanced features and user-friendly software streamline patient data management, showcasing the industry's commitment to improving diagnostic capabilities and patient care through technological advancements. As the demand for precise visual assessments grows, such innovations are crucial in meeting the evolving needs of eye care professionals.

Regulations play a crucial role in the automated visual field analyzer industry, ensuring safety, efficacy, and quality standards for devices. Compliance with guidelines from organizations like the FDA and CE marking in Europe is essential for market entry. Stricter regulations may lead to increased development costs but also drive innovation, as manufacturers must adopt advanced technologies to meet regulatory requirements. In addition, these regulations foster consumer confidence by ensuring that products are reliable and effective, ultimately influencing purchasing decisions in healthcare settings. Adapting to changing regulations can also create opportunities for companies to differentiate their products in a competitive market.

Strategic acquisitions allow firms to integrate advanced technologies and expand product portfolios. Companies may acquire smaller firms specializing in innovative visual field-testing technologies or software solutions to improve data management. For instance, in July 2021, Topcon Corporation announced that it acquired VISIA Imaging SRL, an ophthalmic device manufacturer and headquartered in suburban Florence, Italy. These mergers not only facilitate entry into new markets but also foster collaboration in research and development. As competition intensifies, such M&A activities are expected to continue, driving growth and innovation while allowing firms to leverage combined expertise and resources effectively.

In the automated visual field analyzer industry, product substitutes include manual perimetry devices, which, despite being less efficient, still serve as traditional options for visual field testing. In addition, alternative diagnostic tools, such as optical coherence tomography (OCT) and fundus cameras, offer complementary insights into ocular health but do not specifically measure visual fields. Wearable technologies and smartphone-based applications are emerging as potential substitutes, providing convenience and portability. However, these alternatives may lack the precision and comprehensive data analysis capabilities of advanced automated visual field analyzers, positioning the latter as the preferred choice for many eye care professionals.

The automated visual field analyzer industry is witnessing significant regional expansion, particularly in North America, Europe, and Asia-Pacific. In North America, increasing awareness of eye health and rising incidences of glaucoma drive demand. Notable companies are expanding their presence in emerging markets, offering tailored solutions to meet local needs. For instance, in October 2020, Topcon Corporation announced the completion of work on its new factory, TOPCON OPTONEXUS Co., Ltd, a 100% subsidiary of Topcon Corporation. This factory aimed to expand the production capacity of optical components that support Topcon’s overall growth strategy.

Type Insights

The static automated visual field analyzer segment held the largest share of 72.0% in 2024, driven by its widespread adoption among eye care professionals for diagnosing and monitoring various eye conditions, particularly glaucoma. These devices offer reliable and consistent testing, allowing for precise measurement of visual field loss. Their user-friendly interfaces and advanced features, such as customizable test protocols, further enhance their appeal. In addition, the growing emphasis on early detection of visual impairments and advancements in technology have contributed to increased demand. As a result, static automated visual field analyzers remain a dominant choice in clinical settings globally.

The kinetic automated visual field analyzer devices segment is expected to grow at the fastest CAGR during the forecast period. Serving as an alternative to static devices, these analyzers offer superior spatial resolution, enabling the detection of minor defects, quicker peripheral testing, and enhanced interaction between patients and examiners. These advantages are anticipated to fuel segment growth. In addition, kinetic analyzers are frequently utilized for diagnosing neuro-ophthalmological conditions and peripheral retinal diseases, as well as assessing vision defects in children. However, their demand may be limited due to their semi-automated nature, as individual variations in the hill of vision depend on specific pathologies.

End Use Insights

The hospitals segment held the largest revenue share of 62.9% in 2024 driven by the increasing number of eye-related disorders and the demand for precise diagnostic tools. Hospitals typically have access to advanced technology and specialized personnel, allowing for comprehensive eye examinations and treatments. The integration of automated visual field analyzers enhances efficiency and accuracy in diagnosing conditions like glaucoma and retinal diseases. In addition, as healthcare facilities continue to invest in cutting-edge medical equipment, the reliance on automated systems in hospitals is expected to grow, further solidifying their dominant position in the market.

The eye clinics segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is driven by an increasing focus on specialized eye care and the rising prevalence of ocular disorders. Eye clinics are adopting advanced diagnostic tools to enhance patient outcomes and streamline workflow. In addition, the demand for quick, accurate visual field testing is propelling clinics to invest in automated analyzers, which offer efficient assessments. As awareness of eye health continues to grow, the eye clinics segment is expected to thrive, catering to a broader patient base.

Regional Insights

North America automated visual field analyzer market dominated the overall global market and accounted for 45.0% revenue share in 2024 owing to the growing geriatric population, rising prevalence of eye disorders, increasing approvals and R&D investments, and inclination towards adopting newer products in the US. In addition, several factors, such as the expansion of hospitals and the presence of well-established healthcare infrastructure along with research facilities, are expected to boost the growth of the overall North America market to a greater extent.

U.S. Automated Visual Field Analyzer Market Trends

The automated visual field analyzer market in the U.S. held a significant share of the North America region in 2024. High awareness of retinal disorders and an established healthcare infrastructure facilitate the adoption of advanced diagnostic technologies. The increasing prevalence of conditions such as diabetic retinopathy and age-related macular degeneration further fuels the demand for automated visual field analyzers. Additionally, significant investments in research and development, along with the presence of key market players, enhance innovation in diagnostic tools.

Europe Automated Visual Field Analyzer Market Trends

The European automated visual field analyzer market is experiencing growth, largely driven by demographic trends. According to Eurostat data released in February 2024, over 21% of Europe's 448.8 million population was aged 65 and older as of January 2023. This aging population often faces vision issues related to age, such as presbyopia, which can be effectively addressed with advanced refractive surgery devices. This trend presents a significant market opportunity for companies in the sector. As the elderly population continues to grow, the demand for innovative and effective refractive treatments is expected to rise, boosting the need for these devices in Europe.

The UK automated visual field analyzer market is experiencing notable growth, driven by increasing screen time among the population. According to data from Independent UK published in June 2024, Brits spend an average of 1 hour and 52 minutes daily on social media. This prolonged exposure to screens raises concerns about digital eye strain and exacerbates existing vision issues. As a result, there is a growing demand for effective diagnostic tools like automated visual field analyzers to assess and address these vision-related problems.

The automated visual field analyzer market in France is expanding, driven by a rising awareness of retinal disorders and the aging population. Increasing incidence of conditions like diabetic retinopathy and macular degeneration is fueling demand for advanced diagnostic tools. Enhanced research initiatives and improved healthcare infrastructure further support market growth in the country. According to World Bank data, France’s healthcare expenditure was around 12.31% of its GDP in 2021.

The automated visual field analyzer market in Germany is experiencing robust growth, primarily driven by increasing awareness of retinal health and a significant rise in eye disorders. Notably, Staar Surgical reports that the EuroEyes clinic group performed the highest number of ICL surgeries in Germany in 2021. The aging population, coupled with a high prevalence of conditions such as diabetic retinopathy and macular degeneration, intensifies the demand for precise diagnostic tools. Germany's well-established healthcare system, supported by advanced research and technological innovations, facilitates the adoption of automated visual field analyzer devices in clinical settings.

Asia Pacific Automated Visual Field Analyzer Market Trends

The Asia Pacific automated visual field analyzer market is witnessing significant growth attributed to various factors, such as the rising prevalence of chronic disorders such as diabetes, high adoption of advanced technologies, and the presence of a large geriatric population. Furthermore, the increasing knowledge regarding eye disorders is further anticipated to propel the growth of the market in the region during the forecast period. Countries like China, India, and Japan are key contributors, with growing adoption of advanced medical technologies and improving healthcare infrastructure. The APAC automated visual field analyzer market is expected to expand due to the region's numerous FDA, TGA, and EMA-approved facilities.

The automated visual field analyzer market in Japan is set for significant growth, primarily driven by the country's aging population. As of 2023, approximately 30% of the population is aged 65 and older, making them more susceptible to eye disorders. This demographic shift is anticipated to boost demand for automated visual field analyzers in the coming years.

The automated visual field analyzer market in China is expected to grow in the Asia Pacific in 2023. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the automated visual field analyzer market. The country faces a rising prevalence of chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The automated visual field analyzer market in India is growing rapidly, driven by increasing awareness of eye disorders and advancements in diagnostic technologies. The rising prevalence of conditions like diabetic retinopathy and retinal diseases, combined with a growing healthcare infrastructure, is enhancing demand for automated visual field analyzer devices in clinical settings across the country.

Latin America Automated Visual Field Analyzer Trends

The Latin American automated visual field analyzer market is fueled by the growing elderly demographic. Aging brings about heightened vulnerability to numerous chronic ailments, prompting the need for analyzers as a treatment option. This, coupled with the demand for medications, is propelling market growth in the region.

Middle East & Africa Automated Visual Field Analyzer Trends

In the Middle East and Africa (MEA), the automated visual analyzer market is expanding due to increasing investments in healthcare infrastructure and a rising prevalence of chronic and infectious diseases. Nations such as Saudi Arabia, the UAE, and South Africa are heavily investing in modernizing healthcare systems, which include advanced diagnostic technologies like automated visual analyzers for labs and clinical settings.

The automated visual field analyzer market in Saudi Arabia is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per the Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Automated Visual Field Analyzer Company Insights

The competitive scenario in the automated visual field analyzer industry is highly competitive, with key players such as Carl Zeiss, Haag-Streit AG, and Topcon holding significant positions. The major companies are undertaking various organic as well as inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Automated Visual Field Analyzer Companies:

The following are the leading companies in the automated visual field analyzer market. These companies collectively hold the largest market share and dictate industry trends.

- Carl Zeiss

- Haag-Streit AG

- Elektron Eye Technology

- Heidelberg Engineering

- Kowa Company Ltd.

- Optopol

- OCULUS

- Metrovision

- MEDA Co., Ltd.

- Topcon

Recent Developments

-

In January 2024,OCULUS launched Easyfield VR, a virtual reality visual field analyzer now available in the U.S. ophthalmic market. This innovative device enhances patient autonomy during visual field testing and simplifies data compilation for eye care providers. It offers various screenings and utilizes advanced tracking technology for efficiency.

-

In March 2022 , Heru Inc. announced that its reautomated visual field-testing platform shows a strong correlation with the Zeiss Humphrey Field Analyzer (HFA). Tested on 47 eyes, including healthy and glaucomatous cases, the platform proved significantly faster, enhancing data collection and access for patients in various settings.

Automated Visual Field Analyzer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 222.7 million |

|

Revenue forecast in 2030 |

USD 300.0 million |

|

Growth Rate |

CAGR of 6.1% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Carl Zeiss; Haag-Streit AG; Elektron Eye Technology; Heidelberg Engineering; Kowa Company, Ltd.; Optopol; OCULUS; Metrovision; MEDA Co., Ltd.; Topcon |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automated Visual Field Analyzer Market Report Segmentation

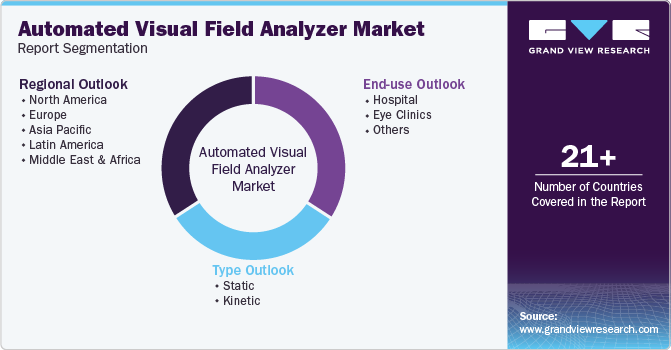

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automated visual field analyzer market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Static

-

Kinetic

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Eye Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global automated visual field analyzer market is expected to grow at a compound annual growth rate of 6.14% from 2025 to 2030 to reach USD 300.0 million by 2030.

b. North America dominated the automated visual field analyzer market with a share of 45.0% in 2024. This is attributable to the high adoption of technologically advanced medical devices and the increasing demand for accurate devices.

b. Some key players operating in the automated visual field analyzer market include Carl Zeiss; Haag-Streit AG; Elektron Eye Technology; Heidelberg Engineering; Kowa Company, Ltd; Optopol; Topcon, and Metrovision.

b. Key factors that are driving the automated visual field analyzer market growth include technological advances and an increase in the frequency of new product launches. Additionally, the rise in the prevalence of ocular disorders such as cataracts and glaucoma is expected to drive the overall growth,

b. The global automated visual field analyzer market size was estimated at USD 211.7 million in 2024 and is expected to reach USD 222.7 million in 2025.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."