- Home

- »

- Next Generation Technologies

- »

-

Automated Optical Inspection Systems Market Report, 2030GVR Report cover

![Automated Optical Inspection Systems Market Size, Share & Trends Report]()

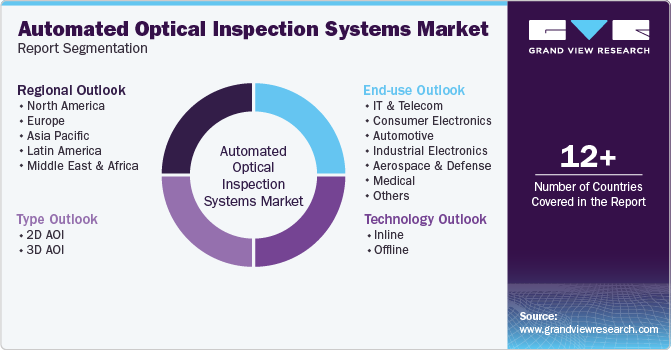

Automated Optical Inspection Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (2D AOI, 3D AOI), By Technology (Inline, Offline), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-751-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Optical Inspection Systems Market Summary

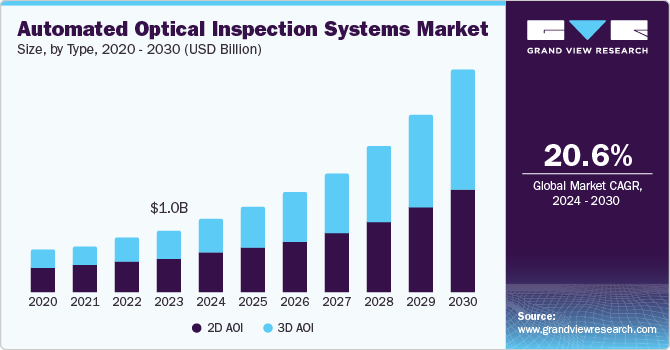

The global automated optical inspection systems market size was estimated at USD 1.01 billion in 2023 and is projected to reach USD 3.64 billion by 2030, growing at a CAGR of 20.6% from 2024 to 2030. Increasing complexity in electronics manufacturing, growing demand for high-quality electronic products, and advancements in AOI technology are the primary factors driving growth for this industry.

Key Market Trends & Insights

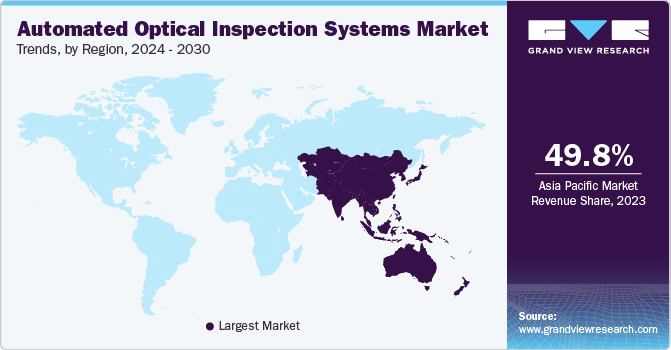

- Asia Pacific dominated the global industry in 2023, accounting for a revenue share of 49.8%.

- The U.S. automated optical inspection systems market dominated the regional industry in 2023.

- By type, the 2D AOI segment dominated the global industry in 2023, accounting for a 54.2% revenue share.

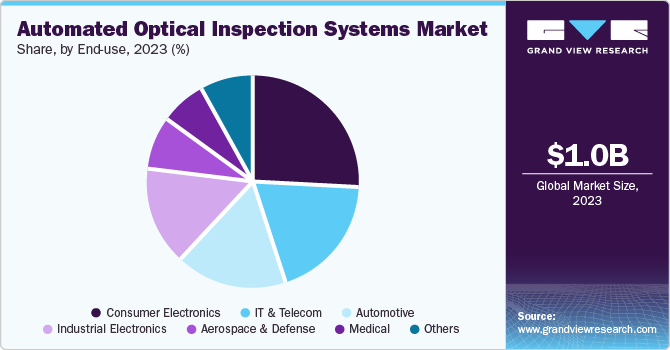

- By end use, the medical segment is expected to register the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1.01 Billion

- 2030 Projected Market Size: USD 3.64 Billion

- CAGR (2024-2030): 20.6%

- Asia Pacific: Largest market in 2023

The increasing adoption of industry 4.0 principles and the growing use of AOI systems in various industries, including automotive and electronics have contributed to the growing demand for this market in recent years.

The increasing complexity and miniaturization of electronic components are driving the market growth. As electronic devices become smaller and more complex, the need for precise inspection and defect detection has risen, leading to the adoption of advanced tools to detect defects and enhance the production of high-quality electronic components. The growing need for high-quality electronic components in industries like automotive, consumer electronics, and telecommunications is another factor driving the adoption of AOI systems. The automotive industry uses AOI systems to inspect critical components like sensors and cameras, ensuring they meet stringent safety and quality standards. Various companies rely on AOI systems to ensure the quality of their vehicles' electronic systems. Moreover, the increasing adoption of Industry 4.0 principles is driving market growth. Industry 4.0 emphasizes using digital technologies such as automation, robotics, and data analytics to improve manufacturing efficiency and quality.

Furthermore, advancements in AOI technology, such as AI and Machine learning, are enhancing the capabilities of AOI systems. Advancements in technology, such as AI-powered AOI systems, can detect defects with greater accuracy and speed, driving the adoption of AOI systems across various industries. In addition, companies are introducing innovative products to enhance the AOI system portfolios. For instance, in April 2023, Omron introduced two new AOI systems, VT-Z600 and VT-S1040, at the IPC Expo 2023. Omron's latest AOI systems use advanced hardware and software systems designed to improve inspection efficiency and accuracy, enabling manufacturers to reduce production costs and increase customer satisfaction.

Type Insights

The 2D AOI segment dominated the global industry and accounted for the revenue share of 54.2% in 2023. The segment growth is attributed to factors such as ease of use, cost-effectiveness, and efficient speed, making it an ideal solution for high-volume production lines. The growing trend of expanding industries such as automotive, consumer electronics, and telecommunications boosts the adoption of 2D AOI systems to streamline production and reduce errors. 2D AOI systems use cameras and optics to capture images of printed circuit boards (PCBs) and other products, allowing for rapid inspection and detection of defects and irregularities. In addition, 2D AOI systems are relatively simple to implement and require minimal training. Moreover, technological developments in 2D AOI have played a significant role, with continuous improvements in imaging technology, faster processing speeds, and enhanced algorithms, increasing the accuracy and efficiency of 2D AOI systems.

The 3D AOI segment is anticipated to witness the fastest CAGR during the forecast period. The segment growth is driven by the increasing adoption of advanced manufacturing applications to eliminate false alarms and detect defects. To provide precise three-dimensional measurements and inspections, 3D AOI systems are incorporated with advanced technologies such as structured light, angled view cameras, and stereo vision. This enables the detection of complex defects and irregularities that may not be visible through 2D inspection methods. Furthermore, the growing demand for high-precision inspection in aerospace, automotive, and medical devices drives the adoption of 3D AOI systems.

Technology Insights

The inline segment accounted for the largest revenue share in 2023. Inline AOI systems are designed to inspect products as they move through the production line, allowing for immediate identification and removal of defective products, reducing waste, and improving overall product quality. Inline AOI systems are often customized to accommodate specific production line requirements, making them a versatile solution for various industries, including electronics, automotive, and pharmaceuticals. Furthermore, inline AOI systems are the most widely used, due to the ability of seamless insertion as a fixed component in electronics and other production lines. Moreover, inline AOI systems can inspect thousands of PCB and quality defects. For instance, in April 2023, Marantz Electronics launched an advanced inline AOI system named Mek iSpector JDZ. This new system is designed to offer reliable, high-quality inspection capabilities at a more affordable price, targeting smaller or mid-sized companies requiring efficient and accurate quality control for low volume and higher mix of production with budget constraints.

The offline segment is expected to experience a significant CAGR over the forecast period. The growing need for high-precision inspection, increasing adoption of Industry 4.0 technologies, and rising demand for quality control are some factors driving the segment's growth. Offline AOI systems offer greater flexibility and adaptability in manufacturing processes as offline AOI systems inspect products and components outside the production line, making them ideal for various industries where product complexity and variability are high. Furthermore, offline AOI systems are integrated into existing manufacturing environments, enabling manufacturers to upgrade their inspection capabilities without disrupting ongoing production.

End Use Insights

The consumer electronics segment dominated the AOI systems market in 2023. The segment growth is driven by increasing demand for efficient and accurate inspection of PCB and other electronic products. Today, AOI systems have become a standard in multiple electronic manufacturing production lines. Consumer electronics products like smartphones, laptops, and tablets have complex designs and high-density PCBs, requiring precise inspection to detect defects and ensure quality. In addition, AOI systems are extensively used in the electronics segment to inspect components, solder joints, and PCBs for defects, such as cracks, scratches, and incorrect placement. Furthermore, the increasing miniaturization of electronic components and the growing demand for high-quality products have further fueled the segment growth.

The medical segment is expected to register the fastest CAGR during the forecast period. Expanding health infrastructure and increasing demand for precision and advanced medical device quality control are attributed to drive segment growth. As the healthcare industry advances with more complex medical devices and diagnostics, rigorous inspection processes to ensure product safety and efficacy become crucial. Stringent regulatory requirements and a growing emphasis on patient safety further drive the segment. Furthermore, increasing automation and advancements in biotechnology in healthcare manufacturing are likely to propel segment growth over the forecast period.

Regional Insights

North America automated optical inspection systems market held a significant share in 2023. A robust focus on innovation and technological advancements, high per capita consumption, and increasing demand for electrical components primarily drive the region’s growth. The expansion of the automotive and consumer electronics sector has led to the implementation of smart technologies for precise inspection and defect detection, driving the adoption of AOI systems. Moreover, the flourishing electronic industry and the presence of key players in the U.S. and Canada further drive region growth. In addition, the growing 4.0 industry and smart manufacturing in North America have increased demand for AOI systems as manufacturers seek to improve efficiency and quality control.

U.S. Automated Optical Inspection Systems Market Trends

The U.S. automated optical inspection systems market dominated the regional industry in 2023. The rising technological advancements and expanding consumer electronic sector in the region are driving growth for this market. The U.S. is home to some of the largest companies engaged in the AOI systems business, which invest heavily in advanced manufacturing technologies to improve product quality and enhance ease of business. Furthermore, stringent quality regulations and electronic manufacturing processes further drive the region's growth, emphasizing early defect detection.

Asia Pacific Automated Optical Inspection Systems Market Trends

Asia Pacific automated optical inspection systems market dominated the global industry and accounted for a revenue of 49.8% in 2023. This market is primarily driven by increasing demand for consumer electronics and the presence of large numbers of PCB manufacturers. Due to increasing disposable income, the rapid growth of consumer electronics and automobiles in countries such as India and China has led to the adoption of AOI systems. Furthermore, the region is one of the largest producers of automobiles, leading to the need for high-quality electronic components. In addition, various companies and governments are collaborating to meet the growing demand. For instance, in July 2023, Omron Automation launched a new proof-of-concept (PoC) Lab in India to showcase the latest advancements in AOI. Moreover, the region is a hub for semiconductors and advanced printed circuit boards.

India automated optical inspection systems market held significant share of regional industry 2023. The region's growth is driven by rising disposable income and expanding electronic and automotive industries. Over the past few years, India has witnessed rapid economic growth and is projected to become one of the top economies by in approaching years owing to strong domestic demand for consumption and investment. Furthermore, the strong presence of the electronic segment in the country is expected to contribute to the growth of this market in the next few years. For instance, Tata Sons announced the building of the semiconductor fabrication facility in Dholera. With this investment, India is likely to contribute significantly to the growth of the AOI systems industry.

Latin America Automated Optical Inspection Systems Market Trends

Latin America automated optical inspection systems market is anticipated to witness the fastest CAGR during the forecast period. The rapidly growing industrial sector, driven by government initiatives and investments in manufacturing, is a key factor in the region's growth. The growing electronics and automotive industries in countries such as Brazil and Argentina are driving demand for advanced AOI systems to ensure high-quality products. Furthermore, the region's increasing focus on quality control, defect detection, and advancements in technology is driving the adoption of AOI systems in various industries. Moreover, the increasing adoption of Industry 4.0 aims to promote the adoption of advanced technologies, including AOI systems, to boost manufacturing competitiveness, which is likely to accelerate region growth.

Brazil automated optical inspection systems market is expected to experience significant growth during forecast period. This is attributed to multiple factors such as entry of various industry leaders and innovators in the country, growing demand for effective electronics solutions and products in automotive industry, rising involvement of advanced technologies in the manufacturing processes, and others. Growing need of superior quality control and enhanced productivity has been contributing to the growth of this industry in recent years.

Key Automated Optical Inspection Systems Company Insights

Some key companies involved in the automated optical inspection systems market include OMRON Corporation, Test Research, Inc., and GÖPEL electronic GmbH., among others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key Payers are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

OMRON Corporation is a multinational Japanese company specializing in automation technology and electronic components. OMRON provides a diverse range of products and solutions that cater to various industries including, industrial automation, electronic components, automotive, and healthcare among others. The company offers a wide range of AOI systems under OMRON Automation, a subsidiary of OMRON Global, to various industries to meet their needs and requirements.

-

GÖPEL electronic GmbH, a German company specializing in the development and production of innovative test and inspection systems for the electronic industry. The key areas of business are automated optical inspection, boundary scan technology, embedded JTAG solutions, and others. GÖPEL Electronic GmbH provides a wide range of products and services, including electrical test equipment and inspection systems.

Key Automated Optical Inspection Systems Companies:

The following are the leading companies in the automated optical inspection systems market. These companies collectively hold the largest market share and dictate industry trends.

- Maxim SMT Pvt. Ltd.

- Daiichi Jitsugyo Asia Pte. Ltd.

- GÖPEL electronic GmbH.

- Koh Young Technology, Inc.

- MIRTEC CO., LTD.

- Nordson Corporation

- OMRON Corporation

- SAKI CORPORATION

- Test Research, Inc.

- Viscom SE

Recent Developments

-

In May 2024, TRI announced the opening of a new manufacturing facility for the development of advanced technologies and inspection solutions for developing markets. This expansion aligns with TRI's focus on increasing efficiency, scalability, and innovation in its manufacturing processes.

-

In April 2024, Omron Corporation introduced VT-X850, a significant advancement in 3D X-ray inspection technology for electronic vehicle (EV) surface mount technology (SMT) manufacturing lines. The VT-X850 is a next-generation computed tomography (CT) X-ray inspection system specifically designed to address the growing complexity and precision requirements of modern SMT assemblies used in electric vehicles.

Automated Optical Inspection Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.18 billion

Revenue Forecast in 2030

USD 3.64 billion

Growth rate

CAGR of 20.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Maxim SMT Pvt. Ltd.; Daiichi Jitsugyo Asia Pte. Ltd.; GÖPEL electronic GmbH.; Koh Young Technology, Inc.; MIRTEC CO., LTD.; Nordson Corporation; OMRON Corporation; SAKI CORPORATION; Test Research, Inc.; Viscom SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Optical Inspection Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automated optical inspection systems market report based on type, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2D AOI

-

3D AOI

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Inline

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

Consumer Electronics

-

Automotive

-

Industrial Electronics

-

Aerospace & Defense

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.