Automated Guided Vehicle Market Size, Share & Trends Analysis Report By Vehicle Type, By Navigation Technology, By Application, By Industry, By Component, By Battery Type, By Mode Of Operation, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-153-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Automated Guided Vehicle Market Trends

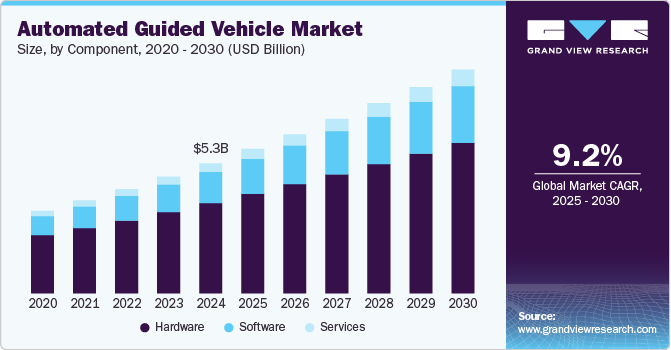

The global automated guided vehicle market size was estimated at USD 5.34 billion in 2024 and is expected to grow at a CAGR of 9.2% from 2025 to 2030. Increased productivity and reduced labor costs are the key factors driving the need for automated guided vehicle (AGV). The demand for AGVs is expected to grow owing to the increasing automation in industries. An increase in innovation and research has led to the development of next-generation AGVs with the integration of AI and ML technologies. The adoption of smart AGVs is expected to rise significantly owing to the growing flexibility of AGVs in adapting to the environment automatically, irrespective of predefined paths. For instance, in September 2024, Toyota Material Handling Europe launched a high-density AGV and pallet shuttle system aimed at expanding storage capacity and enhancing efficiency in warehouse settings.

Advancements in technologies such as LiDAR, machine vision, and AI-based navigation systems are enabling AGVs to perform complex tasks with greater precision and adaptability. The adoption of AGV-as-a-Service (AGVaaS) is also reducing barriers for small and medium enterprises, allowing them to implement automation without substantial upfront capital investments. Furthermore, AGVs are becoming more versatile, with applications ranging from warehouse automation to production line optimization. The demand for AGVs is increasingly supported by the global focus on Industry 4.0 and smart manufacturing practices.

Moreover, innovations in battery technology, such as lithium-ion systems, enhance the runtime and efficiency of AGVs. Integration with advanced software systems, including Warehouse Management Systems (WMS) and IoT platforms, is further expanding the functionality of AGVs, enabling real-time inventory management and predictive maintenance. The use of AGVs in specialized environments, such as cold storage and hazardous material handling, is also on the rise, emphasizing their adaptability to diverse operational needs. Additionally, the rising demand for customized AGV solutions tailored to industry-specific requirements is fostering product innovation among key market players. As organizations prioritize supply chain resilience, AGVs are becoming useful for automation strategies, supporting their projected long-term growth.

Vehicle Type Insights

The tow vehicle segment led the Automated Guided Vehicle (AGV) industry in 2024, accounting for over 38.0% share of the global revenue. The high growth is attributed to the rising demand for efficient material handling solutions in industries like automotive, manufacturing, and logistics, where the need for moving heavy loads seamlessly is critical. Tow vehicles, which pull or push carts and trailers within industrial environments, offer significant advantages in terms of flexibility and load capacity. Their ability to automate the transportation of heavy loads across extensive facilities reduces the need for manual labor and minimizes operational disruptions. In addition, tow vehicles are easily integrated into existing systems and can be customized for various tasks, enhancing their appeal to industries seeking scalable automation solutions.

The forklift truck segment is predicted to foresee significant growth during the forecast period. The growth is attributed to the increasing need for enhanced productivity and operational efficiency. These vehicles are capable of automating complex tasks such as high-level pallet stacking, material handling, and inventory management, which traditionally require considerable manual effort. By automating these functions, businesses can reduce labor costs, minimize human error, and achieve higher throughput. Moreover, the growing emphasis on safety and regulatory compliance in industrial operations is driving the adoption of automated forklifts. Their ability to operate with precision and reduce manual intervention aligns with the industry's focus on minimizing workplace accidents and improving operational standards.

Navigation Technology Insights

The laser guidance segment led the AGV market in 2024. The high growth is attributed to the increasing demand for precise navigation solutions that ensure operational efficiency and safety in industrial environments. Laser guidance technology offers precise, reliable, and adaptable navigation solutions that are crucial for optimizing the performance of AGVs in complex industrial environments. Laser-guided AGVs utilize laser scanners to map and navigate their surroundings with high precision, enabling them to follow predefined paths and avoid obstacles with minimal errors. This high level of accuracy is essential for applications that require intricate maneuvering and consistent performance, such as in large warehouses, manufacturing facilities, and distribution centers.

The natural navigation segment is predicted to foresee significant growth in the forecast years owing to its advanced capabilities in leveraging environmental features for navigation, which significantly enhances operational efficiency and adaptability. Natural navigation technology, which includes techniques such as Simultaneous Localization and Mapping (SLAM) and vision-based systems, allows AGVs to navigate by interpreting and mapping their surroundings in real-time without relying on predefined paths or physical markers. Unlike traditional guidance systems that require physical infrastructure or predefined tracks, natural navigation AGVs use sensors and cameras to analyze and understand their environment dynamically. This capability enables them to operate in highly variable and unstructured environments, such as changing warehouse layouts or evolving production lines, without the need for extensive reconfiguration.

Application Insights

The logistics and warehousing segment led the market in 2024. The increasing need to streamline and optimize material handling processes within warehouses and distribution centers is propelling the demand for this segment. AGVs equipped with advanced technologies can automate repetitive tasks such as transporting goods between storage areas, sorting items, and replenishing stock, leading to significant reductions in manual labor and operational errors. This automation enhances productivity, speeds up order fulfillment, and improves overall warehouse efficiency.

The assembly segment is predicted to foresee significant growth in the forthcoming years, driven by the increasing need for efficiency, precision, and flexibility in manufacturing and assembly processes. AGVs tailored for assembly applications are essential in modern production environments due to their ability to streamline complex workflows, reduce manual labor, and enhance overall operational efficiency. The ability to automate repetitive and labor-intensive tasks, such as transporting parts and components between different stages of the assembly line, is also driving the segment's growth. AGVs equipped with advanced navigation and handling systems can seamlessly integrate with existing assembly lines, improving the flow of materials and optimizing the assembly process.

Industry Insights

The manufacturing sector segment led the market in 2024, owing to the increasing demand for automated solutions that streamline production workflows and reduce manual labor. AGVs automate the transportation of materials, components, and finished products between various stages of the manufacturing process, ensuring timely and accurate delivery. This reduces bottlenecks, minimizes downtime, and optimizes overall production efficiency, which is essential for meeting the growing market demands and maintaining competitive advantage. Additionally, the integration of AGVs with Industry 4.0 technologies, such as IoT and real-time data analytics, enables manufacturers to monitor and enhance operational performance continuously.

The wholesale and distribution sector segment is predicted to foresee significant growth in the forecast years, driven by the increasing need for operational efficiency, accuracy, and scalability in managing large volumes of goods. The surge in e-commerce, global trade, and complex supply chains is fueling the demand for AGVs to enhance the efficiency and effectiveness of wholesale and distribution operations. AGVs automate tasks such as transporting products from receiving docks to storage areas, picking and sorting items for order fulfillment, and moving goods to shipping areas. This automation reduces manual labor, minimizes errors, and accelerates processing times, which is essential in meeting the high-speed demands of modern supply chains.

Component Insights

The hardware segment accounted for the largest AGV industry revenue share in 2024. The growth can be attributed to the increasing emphasis on automation technologies that require advanced components to meet industry-specific demands for efficiency and scalability. Sensors, motors, controllers, and batteries are crucial components of AGVs, directly influencing their performance, reliability, and operational efficiency. Innovations in these components, such as the development of more precise sensors and robust battery systems, have substantially enhanced the capabilities of AGVs. Moreover, industries such as manufacturing, logistics, and warehousing are increasingly adopting AGVs to streamline operations and reduce labor costs. This surge in adoption has led to a heightened demand for advanced hardware solutions that can deliver improved accuracy, speed, and durability.

The services segment is expected to showcase significant growth over the forecast period. This growth can be attributed to the rising demand for various services, which include preventive and corrective maintenance, vehicle and software health checks, and training employees directly or indirectly with the operation of AGVs. As AGV systems become increasingly complex and integral to various industrial operations, there is a need for comprehensive services that ensure their optimal performance and longevity. These services include installation, maintenance, repair, and system upgrades, which are vital for maximizing the efficiency and lifespan of AGVs.

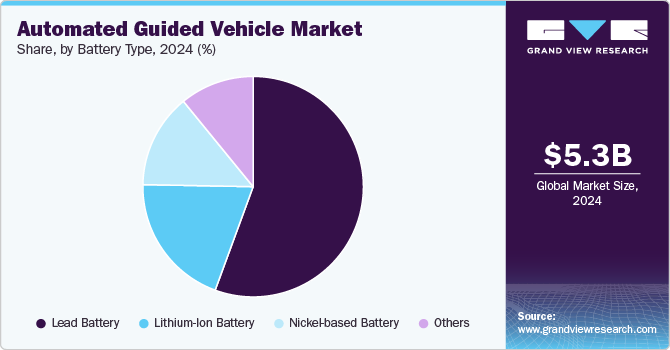

Battery Type Insights

The lead battery segment accounted for the largest market revenue share in 2024. The growth can be attributed to the widespread adoption of AGVs in cost-sensitive industries, where the affordability and reliability of lead-acid batteries align with operational and budgetary priorities. Lead-acid batteries have a stable power source, which is essential for the consistent performance and longevity of AGVs. Their technology ensures robust performance under varying operational conditions, making them useful for industries that rely heavily on AGVs for vital tasks. Moreover, the lower upfront cost of lead-acid batteries, compared to alternative technologies, makes them valuable for businesses seeking to manage capital expenditures while still achieving efficient automation.

The lithium-ion battery segment will witness significant growth in the coming years. The growth can be attributed to the increasing need for advanced energy solutions in industries prioritizing efficiency, sustainability, and high-performance automation. Lithium-ion batteries offer superior energy density, allowing AGVs to operate for longer periods, which is essential for maintaining high productivity and efficiency in automated environments. This extended operational time reduces the frequency of charging cycles and minimizes downtime, which directly enhances operational efficiency. Moreover, lithium-ion batteries have faster charging times compared to other battery types, enabling quicker turnaround and more flexible usage of AGVs in high-demand environments.

Mode of Operation Insights

The indoor segment accounted for the largest market revenue share in 2024. The growth can be attributed to the increasing focus on automation in controlled environments, where precision and efficiency are paramount for streamlining operations. Indoor AGVs are experiencing widespread adoption among industries such as warehousing, manufacturing, and distribution, where space optimization, operational efficiency, and precision are essential. The thriving e-commerce sector and the growing emphasis on streamlined warehouse operations drive the demand for indoor AGVs that handle material transport, sorting, and storage tasks with high accuracy and reliability. The need for reduced human intervention, enhanced safety, and improved inventory management further propels the adoption of indoor AGVs.

The outdoor segment will witness significant growth in the coming years automated guided vehicle industry. This growth is driven by the increasing demand for AGVs capable of handling logistics and material transport in open spaces such as construction sites, ports, and large industrial facilities. Moreover, the expansion of supply chain and logistics operations that require efficient material handling across vast outdoor areas drives the outdoor AGV market. Outdoor AGVs are designed to navigate complex, unstructured environments and handle tasks such as transporting goods between loading docks, managing inventory in outdoor storage yards, and facilitating operations on construction sites.

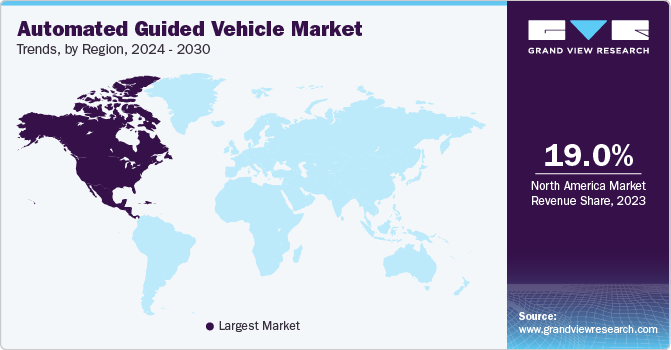

Regional Insights

North America dominated with a revenue share of over 23.0% in 2024 in the automated guided vehicle industry. The North America market is growing primarily due to the e-commerce boom and demand for automation, the increasing need for workplace safety and efficiency, and the growing focus on environmental sustainability. AGVs are being deployed to streamline material handling, improve inventory management, and automate order fulfillment processes. Some of the major e-commerce players, such as Amazon and Walmart, are increasingly adopting AGVs to maintain pace with rising consumer expectations for faster deliveries.

U.S. Automated Guided Vehicle Market Trends

The U.S. automated guided vehicle industry is expected to grow in 2024 due to the increasing adoption of automation across industries to address labor shortages and enhance operational efficiency. The rapid expansion of the e-commerce sector, driven by rising consumer demand for faster deliveries, is a key growth driver, as AGVs are crucial for optimizing warehouse operations, including inventory management and order fulfillment.

Europe Automated Guided Vehicle Market Trends

The automated guided vehicle industry in Europe is expected to witness significant growth over the forecast period. Europe is a hub for the automotive industry, where AGVs are widely used for automated assembly lines, material transport, and parts handling in major manufacturing countries, such as Germany and the UK European companies are also focusing on energy-efficient solutions and reducing their carbon footprint. AGVs are often electric-powered, align with sustainability goals, and help companies achieve greener operations.

Asia Pacific Automated Guided Vehicle Market Trends

The automated guided vehicle industry in Asia Pacific is anticipated to register the highest CAGR over the forecast period. The Asia Pacific region is witnessing significant growth in the e-commerce sector, particularly in countries such as China and India, where online shopping has become a dominant retail channel. AGVs are increasingly used in warehouses and fulfillment centers to handle the high volume of orders and optimize inventory management and order processing.

Key Automated Guided Vehicle Company Insights

Some key players in the automated guided vehicle industry, such as BALYO, Bastian Solutions, LLC, and Daifuku Co., Ltd. are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

BALYO specializes in designing, engineering, and manufacturing autonomous driving forklifts based on standard trucks. The company converts conventional forklift trucks into independent, intelligent robots that can assist human operators. The Balyo model can be guided without the use of reflectors or ground lines. BALYO offers a wide range of Autonomous Guided Vehicles (AGVs) that enable companies to automate their warehouse or factory.

-

Bastian Solutions, LLC is a provider of material handling and automation solutions, specializing in integrated systems such as AGVs, robotics, conveyor systems, and Warehouse Management Systems (WMS). The company focuses on helping businesses streamline operations, improve productivity, and enhance supply chain efficiency through tailored automation solutions. The company’s business is broadly classified into solutions and services.

Key Automated Guided Vehicle Companies:

The following are the leading companies in the automated guided vehicle market. These companies collectively hold the largest market share and dictate industry trends.

- Swisslog Holding AG

- KION GROUP AG

- Bastian Solutions, LLC

- Daifuku Co., Ltd.

- Dematic

- JBT

- Seegrid Corporation

- TOYOTA INDUSTRIES CORPORATION

- Hyster-Yale Materials Handling, Inc.

- BALYO

- E&K Automation GmbH

- Kollmorgen

- KMH Fleet Solutions

- ELETTRIC80 S.P.A.

- inVia Robotics, Inc.

- Locus Robotics

- Schaefer Systems International, Inc.

- System Logistics Spa

- Transbotics (A division of Scott Systems International Incorporated)

- Zebra Technologies Corp.

Recent Developments

-

In July 2024, Bastian Solutions, LLC, opened its new manufacturing and corporate campus in Noblesville, Indiana. The newly established campus, chosen for its strategic location, would become the central hub for Bastian Solutions, LLC's manufacturing processes and corporate activities, consolidating various existing sites into one centralized location.

-

In March 2024, Locus Robotics introduced the LocusHub business intelligence engine. LocusHub, a key element of the LocusOne platform, leverages advanced analytics, AI, and ML to provide predictive and prescriptive insights. These insights aim to enhance productivity, reduce expenses, and reveal new dimensions of intelligence within the warehouse.

-

In February 2024, Swisslog Holding AG expanded its presence in Lyon, France. This expansion broadened its customer base in France and strengthened its market position as an intralogistics automation solutions provider. The Lyon office is set to function as a pivotal center for business growth, client interaction, and fostering partnerships with regional enterprises.

Automated Guided Vehicle Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.93 billion |

|

Revenue forecast in 2030 |

USD 9.18 billion |

|

Growth rate |

CAGR of 9.2% from 2025 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Vehicle type, navigation technology, application, industry, component, battery type, mode of operation, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Swisslog Holding AG; Dematic; Bastian Solutions, Inc.; Daifuku Co., Ltd.; JBT; Seegrid Corporation; TOYOTA INDUSTRIES CORPORATION; Hyster-Yale Materials Handling, Inc.; BALYO; E&K Automation GmbH; Kollmorgen; KMH Fleet Solutions; ELETTRIC80 S.P.A.; Fetch Robotics, Inc.; inVia Robotics, Inc.; Locus Robotics; Schaefer Systems International, Inc.; System Logistics Spa; Scott |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automated Guided Vehicle (AGV) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automated guided vehicle (AGV) market report based on vehicle type, navigation technology, application, industry, component, battery type, mode of operation, and region.

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Tow Vehicle

-

Unit Load Carrier

-

Pallet Truck

-

Forklift Truck

-

Hybrid Vehicles

-

Others

-

-

Navigation Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Laser Guidance

-

Magnetic Guidance

-

Vision Guidance

-

Inductive Guidance

-

Natural Navigation

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Logistics and Warehousing

-

Transportation

-

Cold Storage

-

Wholesale & Distribution

-

Cross-Docking

-

-

Assembly

-

Packaging

-

Trailer Loading and Unloading

-

Raw Material Handling

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Manufacturing Sector

-

Automotive

-

Aerospace

-

Electronics

-

Chemical

-

Pharmaceuticals

-

Plastics

-

Defense

-

FMCG

-

Tissue

-

Others

-

-

Wholesale and Distribution Sector

-

E-commerce

-

Retail Chains/Conveyance Stores

-

Grocery Stores

-

Hotels and Restaurants

-

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Battery Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Lead Battery

-

Lithium-Ion Battery

-

Nickel-based Battery

-

Others

-

-

Mode of Operation Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

Frequently Asked Questions About This Report

b. The global automated guided vehicle market size was estimated at USD 5.34 billion in 2024 and is expected to reach USD 5.93 billion in 2025.

b. The global automated guided vehicle market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030 to reach USD 9.18 billion by 2030.

b. Asia Pacific dominated the automated guided vehicle market in 2024 and accounted for a revenue share of over 36%.

b. Some key players operating in the AGV market include Swisslog Holding AG; Dematic; Bastian Solutions, Inc.; Daifuku Co., Ltd.; JBT; Seegrid Corporation; Hyster-Yale Materials Handling, Inc.; Kollmorgen; and KMH Fleet Solutions.

b. The lead battery segment dominated the AGV market in 2024 and accounted for a revenue share of over 60%.

b. The tow vehicle segment dominated the AGV market in 2024 and accounted for a revenue share of over 38%.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."