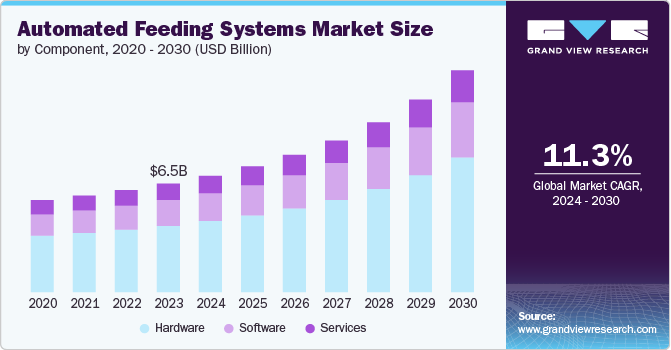

Automated Feeding Systems Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By System, By Livestock (Ruminants, Poultry, Swine, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-345-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Automated Feeding Systems Market Trends

The global automated feeding systems market size was estimated at USD 6.45 billion in 2023 and is projected to grow at a CAGR of 11.3% from 2024 to 2030. The growth of the market is driven by various factors, such as the need to enhance cost efficiency and address labor shortages. Moreover, the need to enhance feed efficiency and nutritional management contributes to the growth in the adoption of automated feeding systems. Automated feeding systems refer to technologies and systems designed to automate the process of feeding livestock or animals in agricultural settings. These systems are used across various sectors, including dairy farming, poultry farming, swine production, and other livestock operations.

Automated systems enable precise control over feed distribution and intake, optimizing feed efficiency and reducing feed wastage. Adopting precision feeding and real-time monitoring allow for customized feeding strategies tailored to individual animal needs, optimizing growth rates and overall productivity. Moreover, automated feeding systems contribute to better animal health and welfare by ensuring consistent and timely feeding schedules.

Livestock farming comes with its share of challenges; one of the major challenges is a shortage of workers. This is driving the need to adopt smart, sustainable, and digital farming techniques. Digital farming combines intelligent and sustainable agricultural methods, promoting connectivity and cooperation within the farming community. It utilizes digital technologies, such as sensors attached to livestock, to improve agricultural techniques. Automated feeding systems reduce the need for manual labor in feeding livestock, which helps farms optimize labor costs and address labor shortages.

The growing adoption of advanced technologies, such as Artificial Intelligence (AI), presents significant growth opportunities for the market. Continuous advancements in technology, including sensors, data analytics, and automation software, enhance the effectiveness and efficiency of automated feeding systems.

In January 2024, Precision Livestock Technologies, a U.S.-based company, Precision Livestock Technologies introduced an AI-driven system that predicts cattle feed intake and recommends feeding schedules based on extensive data from its machine vision Bunk Management System and external sources. This technology mimics expert feeding professionals, enabling Precision Livestock Technologies clients to automate feeding decisions and verify assumptions tailored to specific feeding protocols. This aims to enhance profitability and animal health in the cattle industry.

Component Insights

The hardware segment dominated the target market with a share of over 61.0% in 2023. In terms of component, the market is classified into services, software, and hardware. The segment's growth can be attributed to the scalability and adaptability of modern automated feeding hardware and the rising innovation and launch of new automated feeding systems integrated with advanced technologies.

Moreover, companies are expanding their production capacities to increase their production capacity for feeding equipment. For instance, in June 2022, Lely opened its new business hub and complex, Lely Park, to provide innovative farming solutions that improve the profitability of farming operations and meet the needs of North American farmers. This new campus, which began construction in late 2020, would increase Lely's production capacity for feeding and robotic milking equipment as well as innovative farming solutions.

The software segment is expected to register the fastest CAGR of 12.1% over the forecast period. The segment’s growth can be attributed to the customization and flexibility offered by software solutions and the need for real-time monitoring and control. Software offers customizable features that can be tailored to specific farm needs and protocols, accommodating various livestock types and farming practices. FishFarmFeeder, a Spain-based company, offers software for aquaculture feeding systems.

System Insights

The conveyor feeding systems segment dominated the target market with a share of over 47.0% in 2023. In terms of system, the market is classified into self-propelled feeding systems, rail-guided feeding systems, and conveyor feeding systems. The conveyor feeding systems segment’s growth can be attributed to the scalability and efficiency of conveyor feeding systems. Conveyor feeding systems streamline the feed distribution process, reducing the time and labor required to feed livestock. This efficiency is particularly beneficial for large-scale farming operations. Moreover, these systems ensure consistent and precise delivery of feed, which is crucial for maintaining optimal nutrition and health of the livestock.

The self-propelled feeding systems segment is expected to register the highest CAGR of 12.6% over the forecast period. The segment’s growth is attributed to the flexibility and mobility offered by self-propelled feeding systems. These systems are highly mobile and flexible, allowing them to navigate different parts of the farm and deliver feed to various locations without being restricted to fixed paths or infrastructure. Moreover, advances in robotics, sensors, and AI have enhanced the capabilities of self-propelled feeding systems, making them more reliable, efficient, and user-friendly.

In August 2022, KUHN SAS, a France-based company, introduced a new self-propelled, autonomous diet feeder that can feed up to 280 cows. The AURA operates autonomously using a Global Positioning System (GPS) and Real-time kinematic (RTK) to navigate the farm, collecting and distributing a Total Mixed Ration (TMR). Its integrated loading and weighing modules precisely calculate the mix of forage materials, including grass and maize, along with any necessary supplements and concentrates.

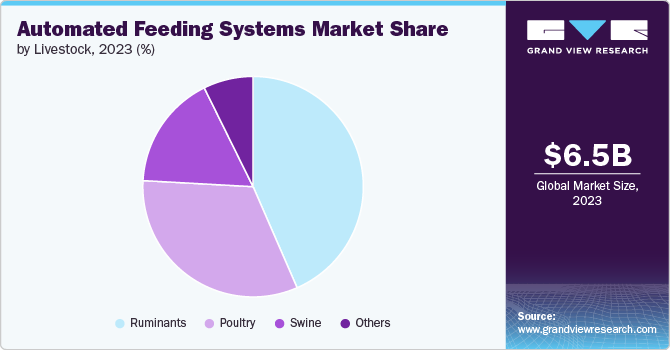

Livestock Insights

Based on livestock, the market has been segmented into ruminants, poultry, swine, and others. The ruminants segment held the largest market share of over 43.0% in 2023. The increased demand for dairy and meat products drives the segment’s growth. According to Global Feedback Ltd, a Netherlands and UK-based environmental group’s 2024 report, between 2015 and 2021, global meat production rose by 9%, and global milk production grew by 13%. Rising global demand for dairy and meat products is pushing farmers to adopt more efficient feeding systems to boost productivity and meet market needs, driving the segment’s growth.

The poultry segment is expected to register the fastest CAGR of 12.0% over the forecast period. The growth of the poultry segment is driven by various factors, including the need for disease control and the need to ensure animal welfare. Automated systems can help minimize human contact with poultry, reducing the risk of disease transmission and improving biosecurity on farms. Moreover, consistent and well-managed feeding schedules improve the health and welfare of poultry by ensuring they receive the right amount of nutrients at the right times. The rising poultry meat consumption is also expected to have a positive impact on the market’s growth.

Regional Insights

The automated feeding systems market of North America is projected to grow at a CAGR of 11.6% from 2024 to 2030. The growth of the market in the region is driven by several key factors, such as the acute labor shortage in the agricultural sector, which has accelerated the adoption of automation and robotics to maintain productivity and efficiency. Moreover, robust poultry production in the region contributes to the demand for automated feeding systems. According to Agriculture and Agri-Food Canada (AAFC), in 2022, over USD 4.0 billion worth of poultry and egg products were produced in Canada.

U.S. Automated Feeding Systems Market Trends

The U.S. automated feeding systems market is projected to grow at a CAGR of 11.2% from 2024 to 2030. The growth of the market in the country can be attributed to the government’s initiatives, such as grants and subsidies for technology adoption in agriculture. Moreover, the presence of prominent automated feeding system providers, such as BouMatic, drives the market’s growth.

Europe Automated Feeding Systems Market Trends

The automated feeding systems market of Europe dominated with a market share of over 34.0% in 2023. The market’s growth is driven high livestock population and meat production in the region. According to Eurostat, at the end of 2022, there were 75 million bovine animals, 70 million sheep and goats, and 134 million pigs in the European Union (EU). Moreover, European consumers have a high demand for quality meat, dairy, and poultry products, which drives farmers to adopt technologies that enhance productivity and consistency.

Asia Pacific Automated Feeding Systems Market Trends

Asia Pacific automated feeding systems market is expected to witness the fastest CAGR of 12.0% from 2024 to 2030. The target market’s growth in the region can be attributed to increased demand for animal products. Rising populations and improving economic conditions in Asia Pacific are leading to higher demand for meat, dairy, and poultry products, prompting farmers to adopt efficient feeding systems to meet this demand.

Key Automated Feeding Systems Company Insights

Some of the key companies operating in the market include Lely, GEA Group Aktiengesellschaft, DeLaval, and Trioliet, among others.

-

DeLaval is a Sweden-based company that provides advanced milking solutions and equipment for the dairy farming industry. The company offers a wide range of products and services designed to improve dairy farm productivity, animal health, and milk quality. The company's product portfolio includes robotic milking solutions, automated feeding systems, and farm management solutions.

FishFarmFeeder and HETWIN - FÜTTERUNGSTECHNIK are some of the emerging companies in the target market.

- FishFarmFeeder is a Spain-based company in the aquaculture technology sector. It specializes in the design and manufacture of automated feeding systems for fish and shrimp farming. Its products aim to optimize feeding processes, enhance productivity, and improve sustainability in aquaculture operations. The company offers a wide range of automated feeding systems and software solutions.

Key Automated Feeding Systems Companies:

The following are the leading companies in the automated feeding systems market. These companies collectively hold the largest market share and dictate industry trends.

- Lely

- GEA Group Aktiengesellschaft

- DeLaval

- Trioliet

- HETWIN - FÜTTERUNGSTECHNIK

- Schauer Agrotronic GmbH

- Rovibec Agrisolutions

- RNA Automation Limited

- Fullwood JOZ

- BouMatic

- DAIRYMASTER

- FishFarmFeeder

Recent Developments

-

In March 2023, DeLaval announced the launch of the autonomous feed distribution robot OptiWagon as part of its DeLaval Optimat automated feeding solution. This system, integrated with the DeLaval DelPro farm management system, provides efficient and flexible feeding for various animal groups up to twelve times per day, optimizing feed conversion into milk and reducing labor and energy costs on dairy farms.

-

In October 2022, FishFarmFeeder announced the development and installation of the first individual automated feeding systems for fingerlings in saltwater ponds. After successful validation in real production environments, these feeders, designed to handle pellets up to 3 mm for fingerlings up to 50 grams, are now in serial production and serve as a complement to existing boat and barge feeding systems in offshore farming, with a capacity of feeding for an extra 6 to 10 hours per day and dispensing 20 to 30 kg of feed per hour.

Automated Feeding Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.91 billion |

|

Revenue forecast in 2030 |

USD 13.17 billion |

|

Growth rate |

CAGR of 11.3% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, system, livestock, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Lely; GEA Group Aktiengesellschaft; DeLaval; Trioliet; HETWIN - FÜTTERUNGSTECHNIK; Schauer Agrotronic GmbH; Rovibec Agrisolutions; RNA Automation Limited; Fullwood JOZ; BouMatic; DAIRYMASTER; FishFarmFeeder |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automated Feeding Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automated feeding systems market report based on component, system, livestock, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

System Outlook (Revenue, USD Million, 2017 - 2030)

-

Rail-Guided Feeding Systems

-

Conveyor Feeding Systems

-

Self-Propelled Feeding Systems

-

-

Livestock Outlook (Revenue, USD Million, 2017 - 2030)

-

Ruminants

-

Poultry

-

Swine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automated feeding systems market size was estimated at USD 6.45 billion in 2023 and is expected to reach USD 6.91 billion in 2024.

b. The global automated feeding systems market is expected to grow at a compound annual growth rate of 11.3% from 2024 to 2030 to reach USD 13.17 billion by 2030.

b. Europe dominated the automated feeding systems market with a share of over 34.0% in 2023. This is attributable to the developed technological infrastructure and the need to enhance efficiency in livestock farming.

b. Some key players operating in the automated feeding systems market include Lely, GEA Group Aktiengesellschaft, DeLaval, Trioliet, HETWIN – FÜTTERUNGSTECHNIK, Schauer Agrotronic GmbH, Rovibec Agrisolutions, RNA Automation Limited, Fullwood JOZ, BouMatic, DAIRYMASTER, and FishFarmFeeder.

b. Key factors driving market growth include the growing need to ensure animal welfare and address labor shortages.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."