Automated Container Terminal Market Size, Share & Trends Analysis Report By Type of Automation (Full Automation, Semi-Automation), By Offering (Equipment, Software, Services), By Project, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-336-5

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Automated Container Terminal Market Trends

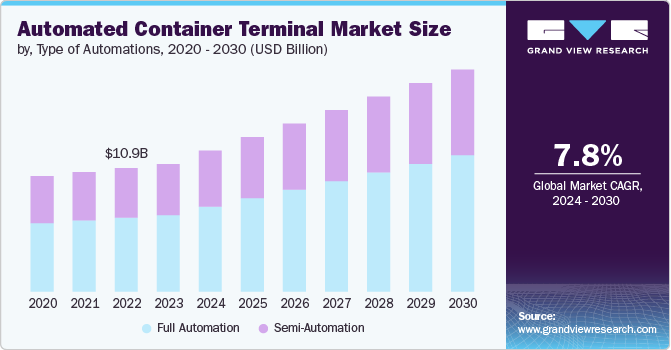

The global automated container terminal market size was estimated at USD 10.89 billion in 2023 and is expected to grow a CAGR of 7.8% from 2024 to 2030. An automated container terminal is a port facility where container handling processes are managed and operated using advanced automation technologies and robotics, minimizing human intervention to enhance efficiency, safety, and productivity. The market is growing significantly due to factors such as increasing demand for efficient port operations, rising container traffic and trade volumes, advancements in automation and robotics technology, and the need to reduce operational costs and increase productivity.

The global increase in maritime trade has put pressure on ports to operate more efficiently. Efficient port operations are crucial to minimize vessel turnaround times, thus reducing waiting periods and improving overall logistics. Automated container terminals enhance operational efficiency by streamlining container handling processes through advanced technology. This demand is driven by the need to manage larger ships and higher cargo volumes effectively. Efficient port operations also help in mitigating congestion, which can lead to significant cost savings and improved service levels. The automation of port operations reduces human intervention, minimizing errors and increasing throughput. Ports that adopt automation technology can gain a competitive advantage by providing faster, more reliable services to shipping companies and other stakeholders.

Globalization and the expansion of international trade have led to a steady increase in container traffic and trade volumes. As economies grow and consumer demand rises, the volume of goods transported via containers continues to escalate. Automated container terminals are essential to handle the growing number of containers efficiently and effectively. The rise in container traffic necessitates the adoption of advanced technologies to maintain smooth operations and avoid bottlenecks. Automation helps in managing the higher workload by enhancing the speed and accuracy of container handling. The increased container traffic also requires better space utilization within ports, which can be achieved through automated storage and retrieval systems. As trade volumes grow, the investment in automated solutions becomes a strategic priority for ports aiming to maintain high performance and service levels.

Type of Automation Insights

The full automation segment held the largest revenue share of 46.2% in 2023 and also registered the fastest CAGR of 8.2% from 2024 to 2030. The growth of full automation can be attributable to its ability to significantly enhance operational efficiency and reduce labor costs by minimizing human intervention. Full automation provides consistent and high-speed container handling, leading to increased throughput and reduced turnaround times for vessels. Additionally, the integration of advanced technologies such as automated guided vehicles (AGVs) and robotic cranes allows for precise and reliable operations, further boosting productivity. The demand for full automation is also driven by the need to improve safety and reduce the risk of human errors in port operations.

The semi-automation segment registered a significant compound annual growth rate of 7.3% over the forecast period primarily because it offers a balance between operational efficiency and cost-effectiveness. Semi-automated terminals utilize technologies such as automated stacking cranes (ASCs) and remote-controlled equipment, which streamline container handling processes while still requiring some level of human supervision and intervention. This approach appeals to ports seeking to upgrade their operations gradually without fully committing to the expense and complexity of full automation. Additionally, semi-automation allows ports to adapt quickly to changing operational demands and scale their automation efforts as needed, making it a flexible and attractive option for modernizing port facilities.

Offering Insights

The equipment segment held the largest market share of 49.4% in 2023 due to the substantial investments made by port operators in upgrading their infrastructure with advanced automation technologies. This segment includes various types of equipment, such as automated stacking cranes (ASCs), automated guided vehicles (AGVs), and robotic arms, which are essential for automating container handling operations. These technologies enable ports to achieve higher efficiency, faster turnaround times, and increased throughput, all of which are critical in meeting the growing demands of global trade and container traffic. Moreover, equipment upgrades are often seen as foundational investments that pave the way for subsequent improvements in software and services to optimize overall terminal performance.

The services segment registered the fastest compound annual growth rate (CAGR) of 8.3% over the forecast period because it encompasses essential offerings such as maintenance, support, and consulting services that complement the adoption of automation technologies. As ports increasingly invest in automation equipment and software, the demand for specialized services to integrate, operate, and maintain these systems has surged. Service providers offer tailored solutions to optimize terminal operations, improve efficiency, and ensure the seamless functioning of automated equipment. Moreover, as automation evolves, there is a growing need for consultancy services to guide ports through the complexities of adopting new technologies and optimizing their operations for maximum efficiency and profitability.

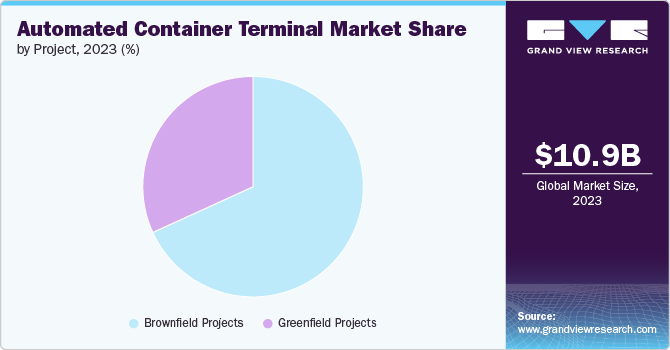

Project Insights

The brownfield projects segment held the largest market share of 68.2% in 2023 because it involves the upgrading and retrofitting of existing terminals with automation technologies, which is often a more practical and cost-effective approach for many established ports. Brownfield projects leverage existing infrastructure, allowing ports to modernize operations while minimizing disruptions to ongoing activities. These projects enable ports to incrementally adopt automation solutions incrementally, starting with key areas such as container handling and logistics, thereby optimizing efficiency and throughput over time. Additionally, brownfield projects benefit from regulatory approvals and established relationships with stakeholders, which can expedite project implementation compared to starting from scratch with greenfield projects.

The greenfield projects segment registered the fastest compound annual growth rate (CAGR) of 9.6% over the forecast period due to the increasing preference for developing new, purpose-built terminals with integrated automation technologies from the ground up. Greenfield projects allow for the implementation of state-of-the-art automation solutions without the constraints of existing infrastructure, facilitating more efficient and optimized terminal operations. These projects often attract significant investments from stakeholders looking to capitalize on the advantages of modern technology and streamline port operations right from inception. Moreover, greenfield terminals are designed to handle growing container traffic and meet future demand projections more effectively compared to retrofitting existing facilities (brownfield projects).

Regional Insights

North America automated container terminal market held a notable 16.5% revenue share in in 2023 due to its extensive network of major ports along the East and West coasts, including key hubs like Los Angeles, New York/New Jersey, and Savannah. These ports handle substantial volumes of container traffic from Asia and Europe, driving the demand for advanced automation solutions to improve efficiency and throughput. Additionally, North America's robust infrastructure, technological innovation, and favorable regulatory environment support the adoption of automated container handling technologies, further solidifying its position in the global market.

U.S. Automated Container Terminal Market Trends

The growth of the automated container terminal market in the U.S. is propelled by increasing trade volumes necessitating efficient port operations, advancements in automation technologies enhancing terminal efficiency, and strategic investments in port infrastructure to handle larger container ships and improve logistics capabilities.

Asia Pacific Automated Container Terminal Market Trends

The Asia Pacific automated container terminal market asserted its dominance in 2023, capturing the largest revenue share at 38.5%. The region is home to some of the busiest ports in the world, particularly in countries like China, Singapore, and South Korea, which have heavily invested in advanced automation technologies to handle large volumes of container traffic efficiently. Secondly, rapid industrialization and urbanization in the Asia Pacific have driven significant growth in maritime trade, necessitating the adoption of automated solutions to enhance port capacities and operational efficiencies. Thirdly, supportive government policies and investments in infrastructure development have encouraged the deployment of automation technologies across ports in the region. Lastly, Asia Pacific's strategic location as a hub for global trade routes has further bolstered its position in the automated container terminal market, attracting continued investments from both local and international stakeholders.

Europe Automated Container Terminal Market Trends

The automated container terminal market in Europe held the second largest revenue share in the market primarily due to its well-established ports and logistics infrastructure across major countries such as Germany, Netherlands, and Belgium. These countries have been early adopters of automation technologies in ports, driven by stringent efficiency and environmental regulations. Additionally, Europe's strategic position as a gateway between North America and Asia contributes to its significant role in global trade, further supporting the adoption of advanced container handling technologies.

Key Automated Container Terminal Company Insights

Some key companies operating in the Market include Konecranes, Cargotec Corporation, and among others.

-

Konecranes is a prominent player in the automated container terminal market, offering advanced automation solutions for efficient container handling. The company provides a range of services, including maintenance, modernization, and consulting, bolstering its presence in global port operations. The company's acquisitions and strategic expansions further strengthen its capabilities, positioning Konecranes as a key provider of innovative solutions in the automated container terminal sector.

CyberLogitec (CLT) and Künz GmbH are some emerging market companies in the target market.

-

CyberLogitec (CLT) is a prominent provider of IT solutions specializing in terminal operations for the logistics industry worldwide. The company offers advanced Terminal Operation Systems (TOS) and automation solutions, including the U-Type fully automated terminal. CLT has offices located in Seoul, Singapore, Busan, California, Algeciras, and Ho Chi Minh City, supporting its operations across various regions.

Key Automated Container Terminal Companies:

The following are the leading companies in the automated container terminal market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Cargotec Corporation

- Konecranes

- Liebherr Group

- Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC)

- Künz GmbH

- CLT

- TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation)

- LASE Industrielle Lasertechnik GmbH

- Siemens AG

Recent Developments

-

In July 2024, CLT announced the launch of South Korea's first fully automated terminal at Dongwon Global Terminal (DGT) in Busan. Leveraging advanced technologies like Automated Guided Vehicles (AGVs), Double Trolley Quay Cranes (DTQC), and the OPUS Terminal Enterprise system, CLT's OPUS solutions enabled seamless integration and control of various automation equipment. This initiative not only enhances operational efficiency and safety but also marks CLT's leadership in deploying cutting-edge terminal automation solutions globally, reinforcing its commitment to advancing logistics technology and optimizing port operations.

-

In July 2024, Konecranes announced the expansion of its service capabilities in Germany through the acquisition of Dungs Kran-und Anlagentechnik GmbH. This strategic move expands Konecranes' expertise in crane systems and reinforces its presence in the industrial service sector. It enhances Konecranes' ability to provide comprehensive maintenance solutions and support across a broader network in the region.

Automated Container Terminal Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 12.04 billion |

|

Revenue forecast in 2030 |

USD 18.95 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type of automation, offering, project, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

ABB Ltd.; Cargotec Corporation; Konecranes, Liebherr Group; Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC); Künz GmbH; CyberLogitec; TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation); LASE Industrielle Lasertechnik GmbH; Siemens AG. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Automated Container Terminal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automated container terminal market report based on type of automation, offering, project, and region:

-

Type of Automation Outlook (Revenue, USD Million, 2017 - 2030)

-

Full Automation

-

Semi-Automation

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Equipment

-

Software

-

Services

-

-

Project Outlook (Revenue, USD Million, 2017 - 2030)

-

Greenfield Projects

-

Brownfield Projects

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automated container terminal market size was valued at USD 10.89 billion in 2023 and is expected to reach USD 12.04 billion in 2024.

b. The global automated container terminal market is expected to witness a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 18.95 billion by 2030.

b. The equipment segment held the largest market share of 49.4% in 2023 due to the substantial investments made by port operators in upgrading their infrastructure with advanced automation technologies.

b. Key players in the automated container terminal market include ABB Ltd., Cargotec Corporation, Konecranes, Liebherr Group, Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC), Künz GmbH, CyberLogitec, TMEIC (Toshiba Mitsubishi-Electric Industrial Systems Corporation), LASE Industrielle Lasertechnik GmbH, Siemens AG.

b. The automated container terminal market is growing significantly due to factors such as increasing demand for efficient port operations, rising container traffic and trade volumes, advancements in automation and robotics technology, and the need to reduce operational costs and increase productivity.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."